Accomplished banker with 8 years of experience in retail and corporate banking at Lloyds Banking Group and Barclays. Skilled in building client relationships, risk assessment, and financial analysis. Proven track record of achieving sales targets and driving revenue growth. Recognised for strong leadership and mentoring skills. Holds a BSc in Finance from the University of Edinburgh. Committed to delivering exceptional customer service and contributing to the success of the organisation.

06/2018 - present, Relationship Manager, Barclays, Glasgow

- Manage a portfolio of high-net-worth clients, providing personalised banking solutions

- Consistently achieve sales targets, contributing to a 15% increase in branch revenue

- Collaborate with cross-functional teams to develop and implement client acquisition strategies

05/2015 - 05/2018, Assistant Manager, Lloyds Banking Group, Aberdeen

- Supervised a team of 10 customer service representatives, ensuring high-quality service delivery

- Implemented operational improvements, reducing average customer wait times by 20%

- Conducted regular training sessions to enhance team performance and product knowledge

09/2011 - 06/2015, BSc in Finance, University of Edinburgh, Edinburgh

- First Class Honours

- Awarded the Edinburgh Finance Award for outstanding academic achievement

- Client Relationship Management

- Risk Assesment

- Financial Analysis

- Sales and Negotiation

- Team Leadership and Mentoring

- Microsoft Office and CRM software

With 260 banks spread across the country boasting a cumulative 358,570 employees, there are plenty of opportunities in the financial sector. If you have your sights set on a job in this ever-growing industry, you need to show the hiring manager that you have what it takes. Writing a well-positioned banking CV is the first step on the pathway towards success.

Since this is a highly competitive career, you need to set yourself apart from the competition. Sending off a generic CV won’t cut it. Instead, you need a document that positions you as a leading application with the brains to excel. Luckily, you’ve come to the right place.

CV guide for a banking CV

Let Resume.io propel you toward success. We have 150+ CV examples and writing guides backed by experts. Use our CV builder to effortlessly create a banking CV in minutes.

This CV guide and corresponding banking CV example will cover the following:

- How to write a banker CV

- Choosing the right CV format for the banking sector

- How to add your contact information

- Using summaries

- Adding your financial work experience

- Listing education and relevant experience

- Picking the right CV design/layout

- What the banking job market looks like, and what salary you can expect

How to write a banking CV

The very first step in writing your banking CV is understanding the necessary sections to include. Make sure your CV contains the following elements:

- The CV header

- The CV summary (aka profile or personal statement)

- The employment history section

- The CV skills section

- The education section

Your banking CV is likely the first thing a hiring manager will see. It’s your opportunity to hook their attention and show them that you have what it takes to succeed. As you already know, it takes a diverse skill set and high level of expertise to work in this field. For that reason, you need to make sure that you show off your range of talents and experience in the best light. Here are some of the approaches you can use.

- Highlight your career accomplishments. One of the major mistakes many applicants make is simply listing the experience they have. Recounting your prior duties on your CV will not win over the hiring manager. You need to showcase your value to them. You can do this by hinging your CV on the results you have achieved.

- Avoid sending the same banking CV to every employer. While it may be tempting to write your application once and use it every time, this is an error. To increase your chances of success, ensure that you tailor your CV to meet the needs of the company. That means doing some research and tweaking your CV to suit the role.

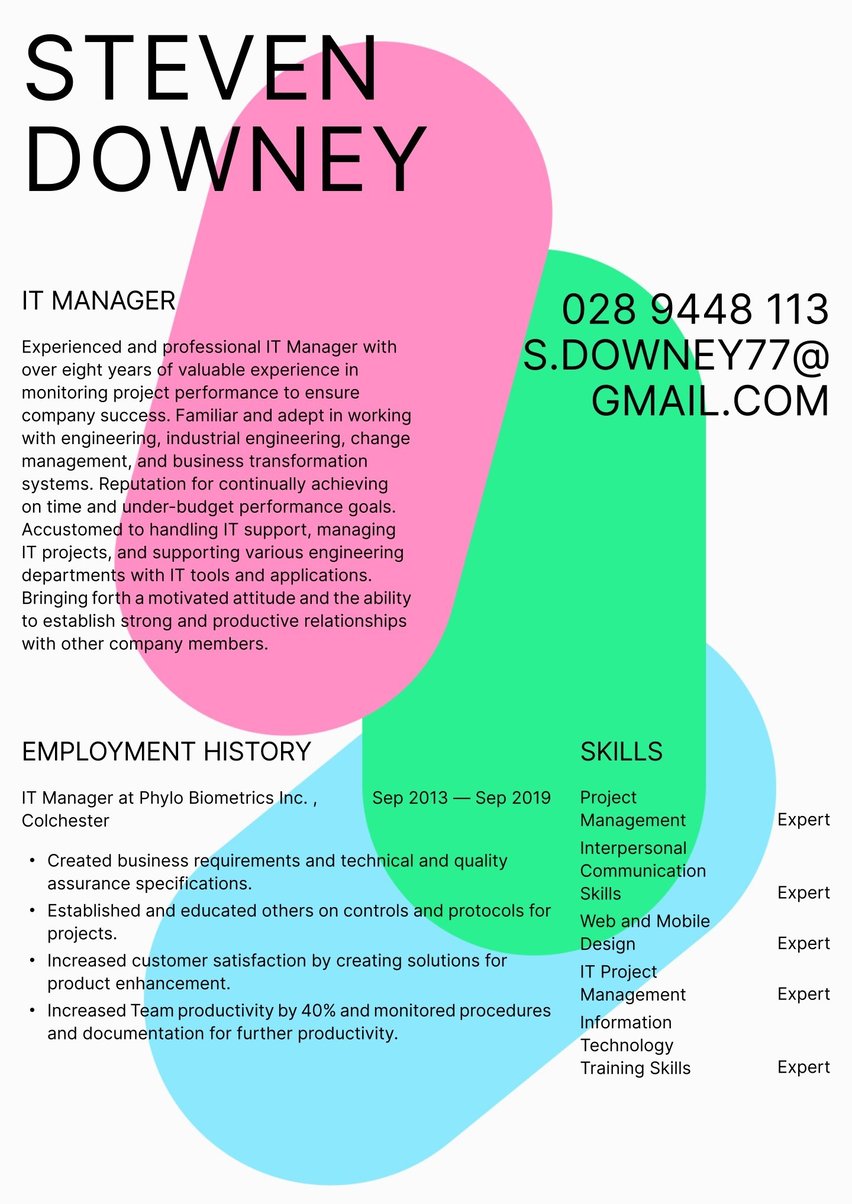

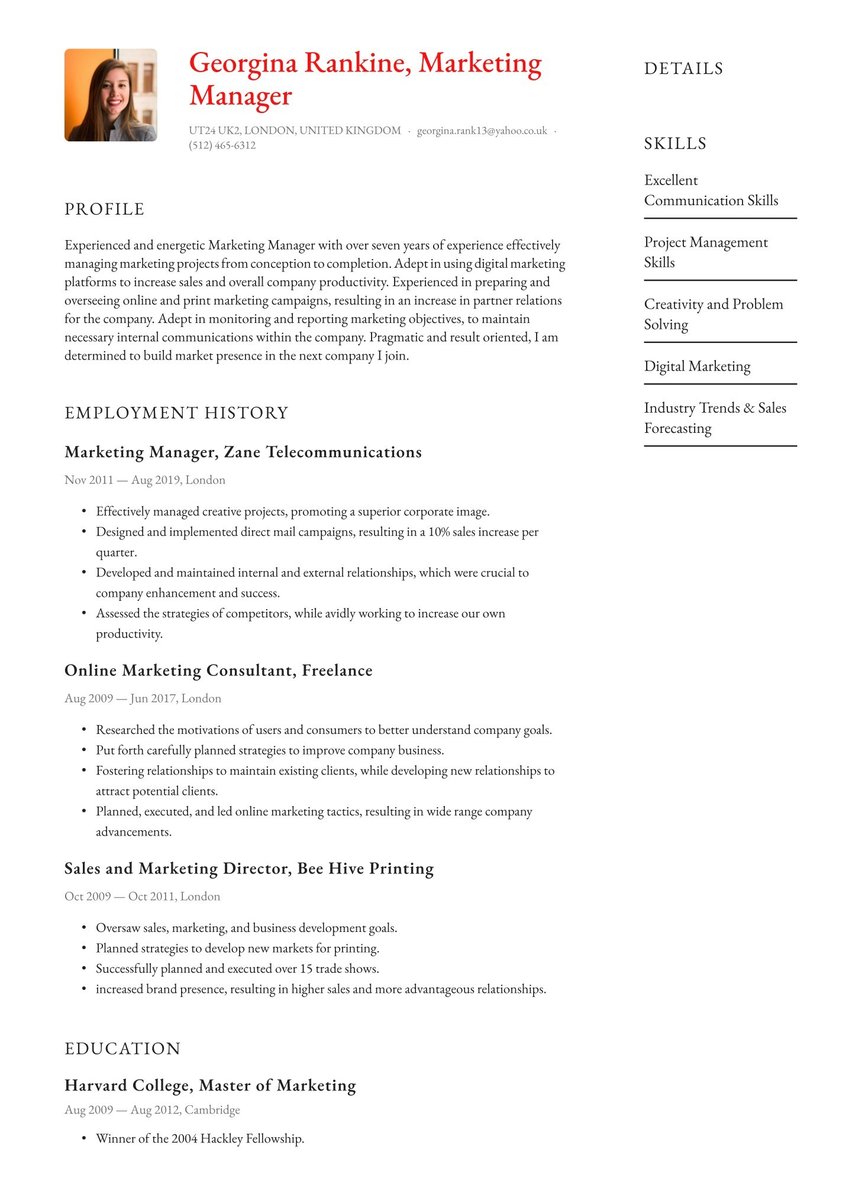

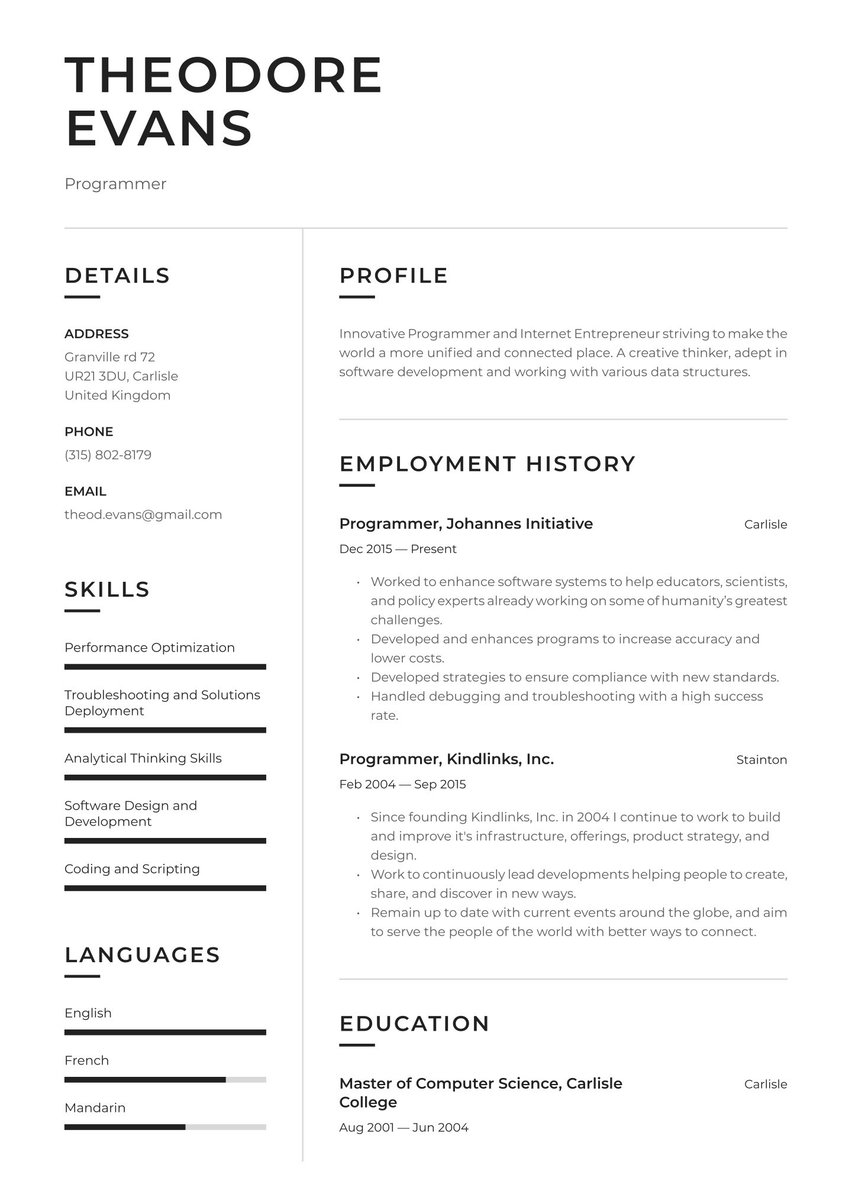

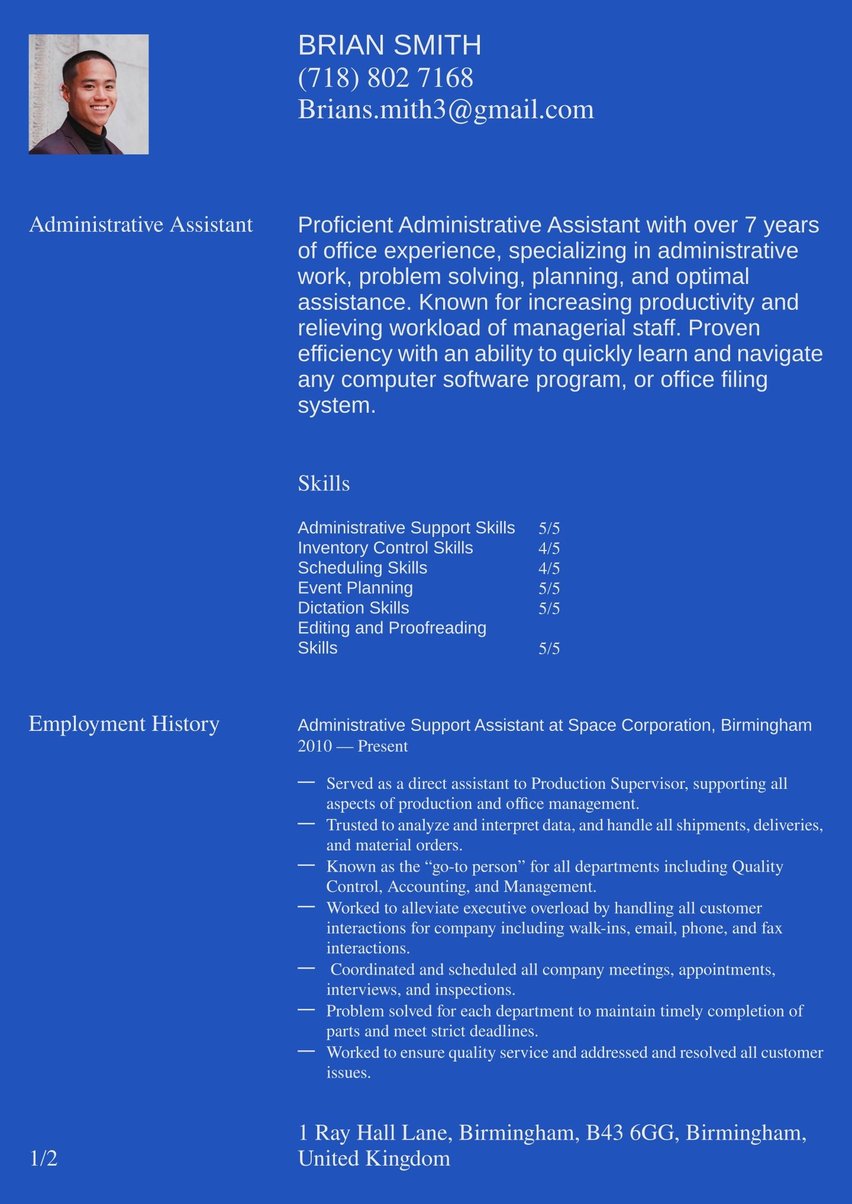

- Keep the design simple. Using flashy or over-the-top design elements could actually work against you. If your banking CV is hard to read, the hiring manager may not bother. Take a look at our selection of tried and tested CV templates now.

- Always be sure to optimise your banking CV to help you get past CV scanning software. You can do this by including specific keywords and phrases in the body of the content. You should also ensure that you use an ATS-friendly design.

Optimise for the ATS

An applicant tracking system, or ATS, is a system companies use to collect and manage applications. Advanced systems may use algorithms to help screen resumes for keywords that are aligned with the job description, and then pass the highest-ranking CVs along.

For example, a job posting for a banking role may include the following requirements:

- “Banking assistant”

- “Private Banking experience”

- “Financial knowledge”

- “Microsoft Office proficiency”

Your CV profile summary, when integrating the keywords, could read:

“Banking assistant with 5+ years of experience in the private banking sector. Boasts a wealth of financial knowledge to support clients in reaching their goals. Proficient in Microsoft Office software and Google Suite.”

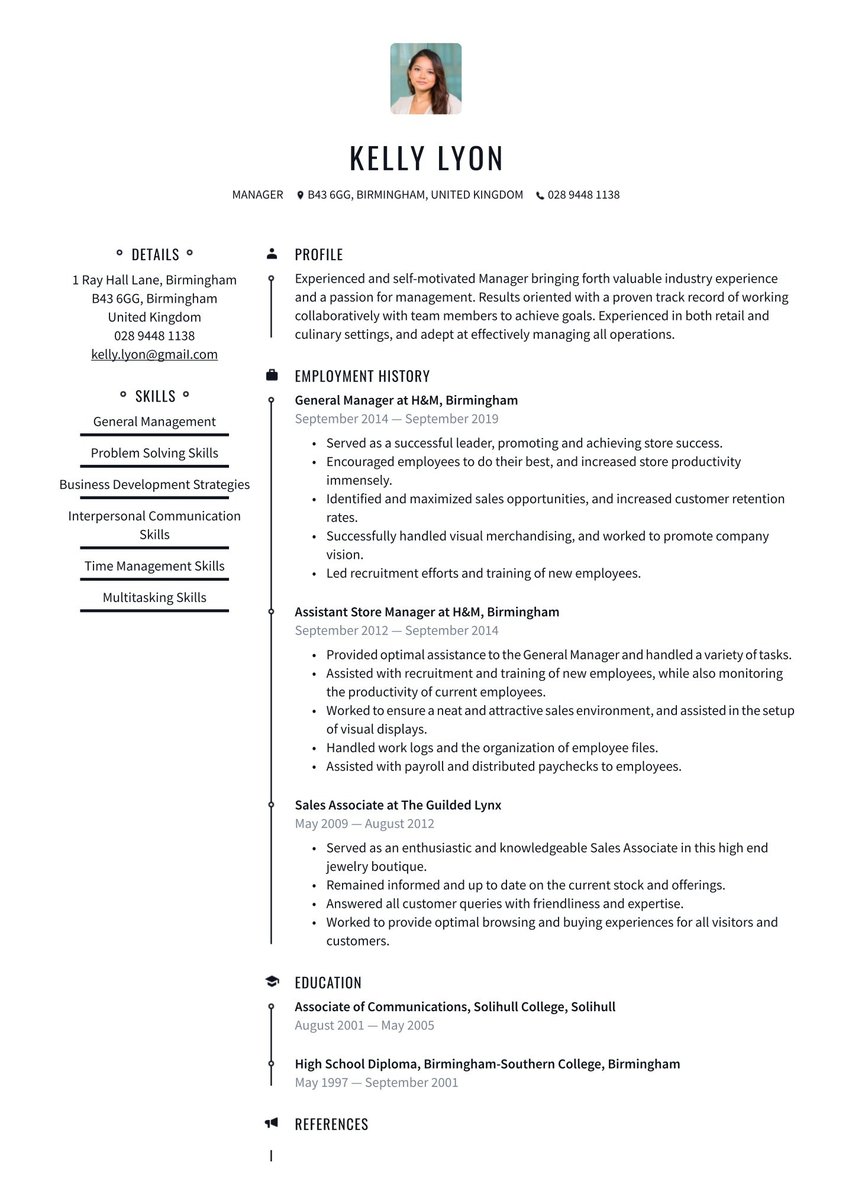

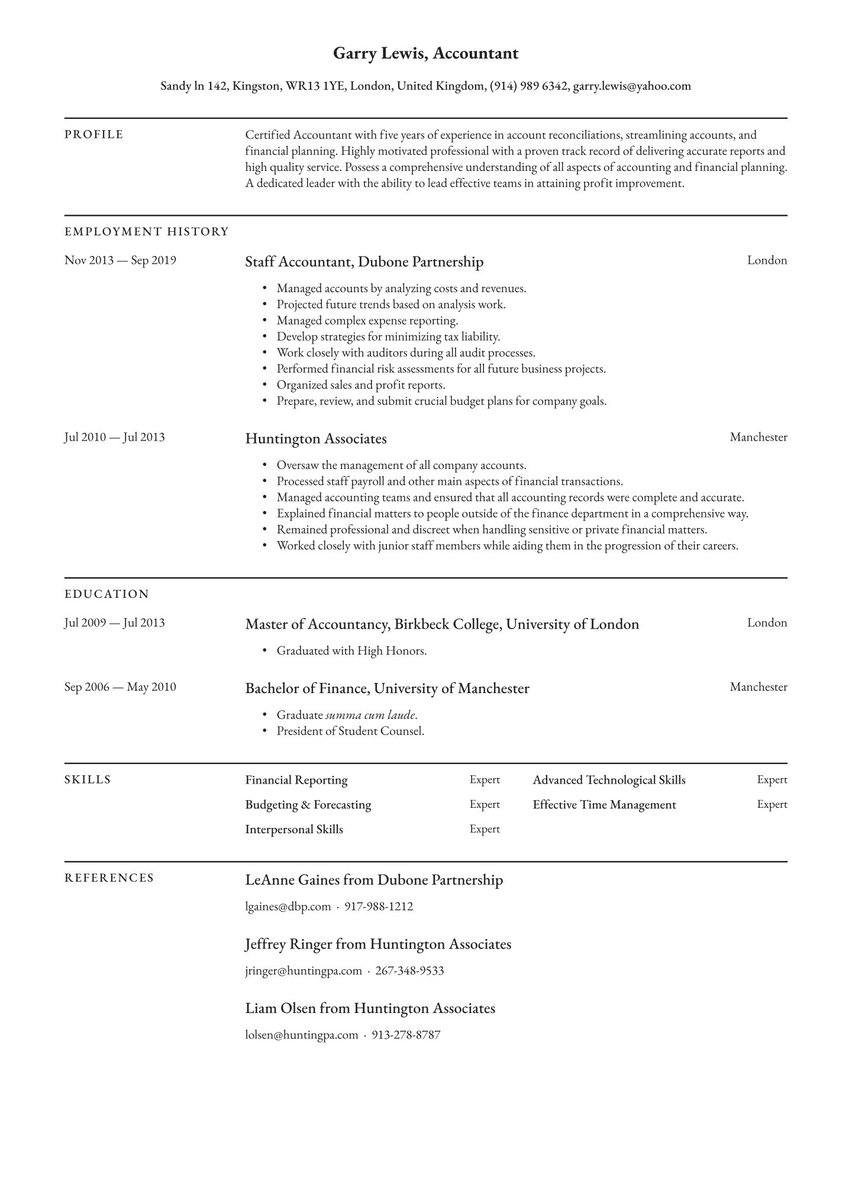

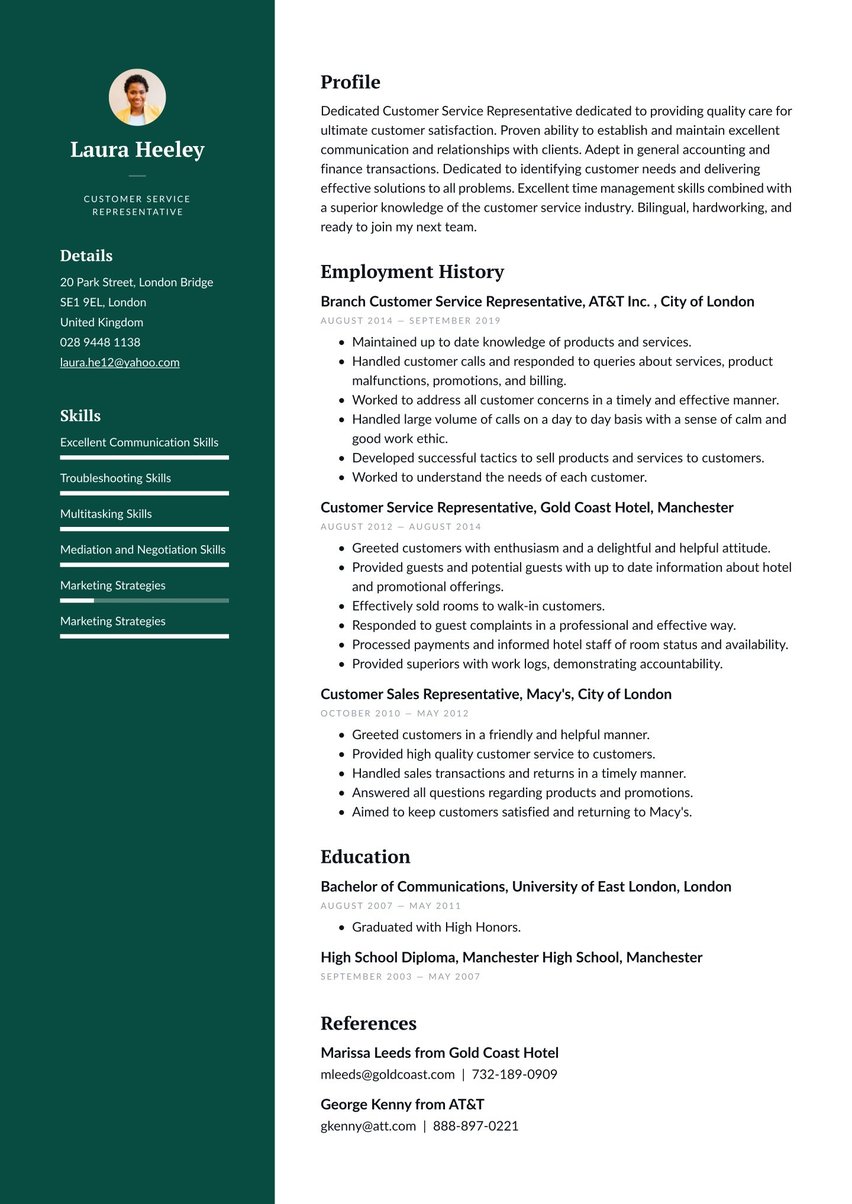

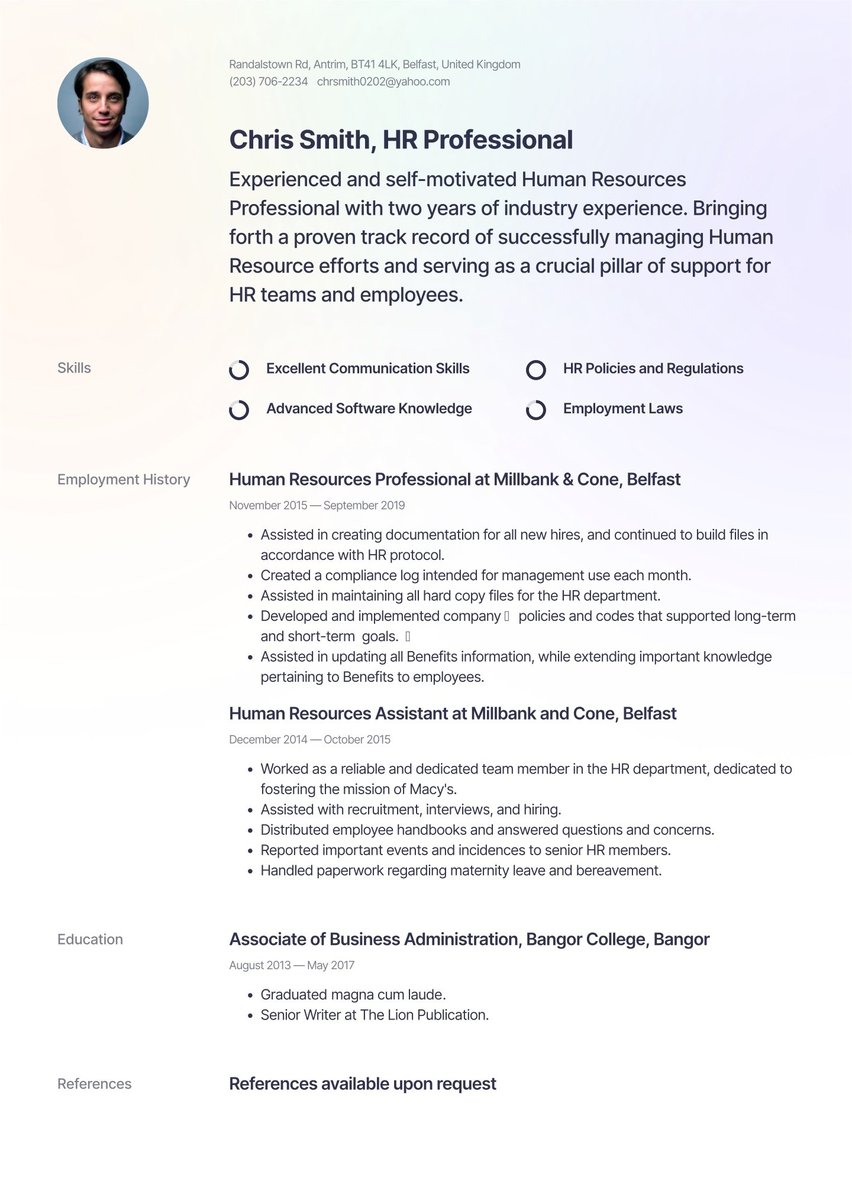

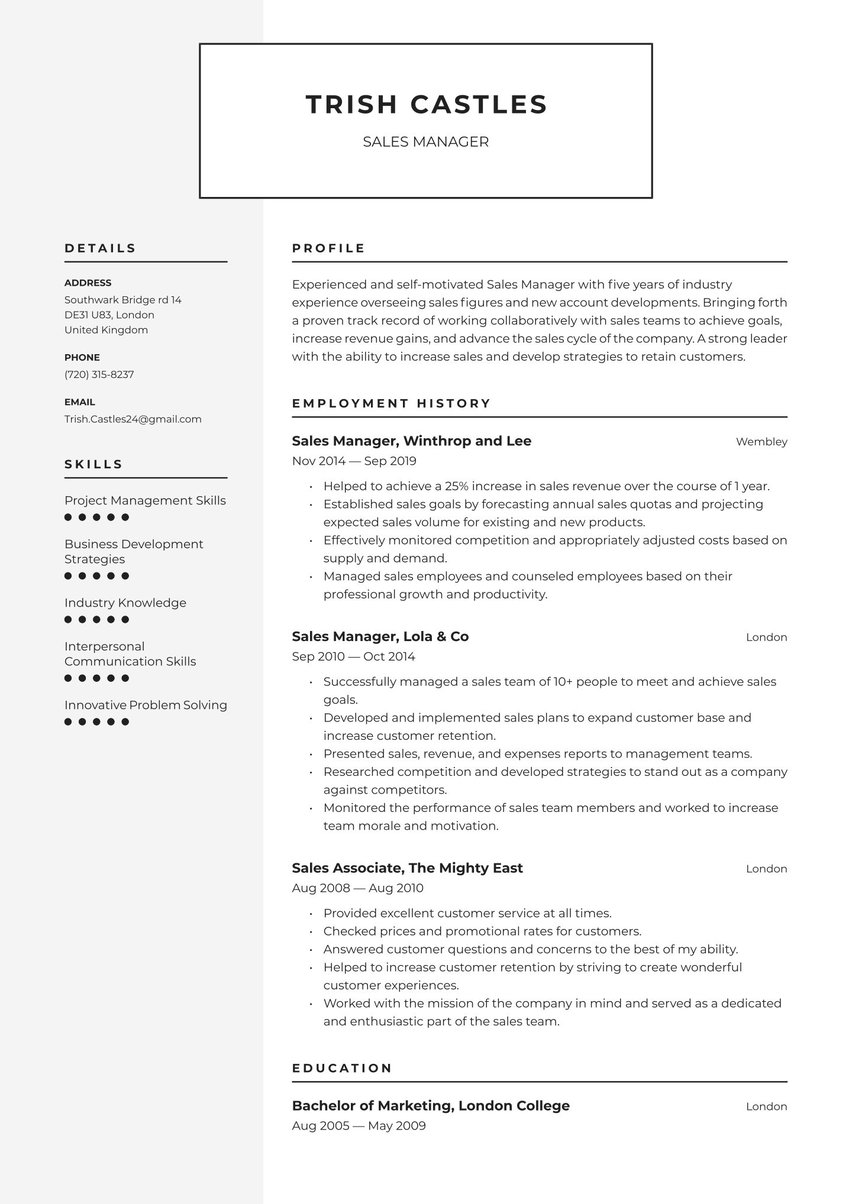

Choosing the right CV format for a banking CV

Next up, you need to choose the right CV format for your banking application. As a general rule, we recommend using the reverse chronological order to best present your career story. This is the traditional format that hiring managers expect to see. Start with your most recent accomplishments at the top of each CV section and then work your way back in time.

However, there are times when you may choose to use a different CV format. For example, if you’re moving into banking from a different sector, you may opt for a skills-based CV format instead. This emphasises the talents that you have over your work experience. Read more about various CV formats in our complete guide.

Whichever format you choose, ensure that it accurately conveys your professional prowess. Check out the many CV templates in our CV builder and choose one that suits you. We also have a wide range of CV examples using various formats as well.

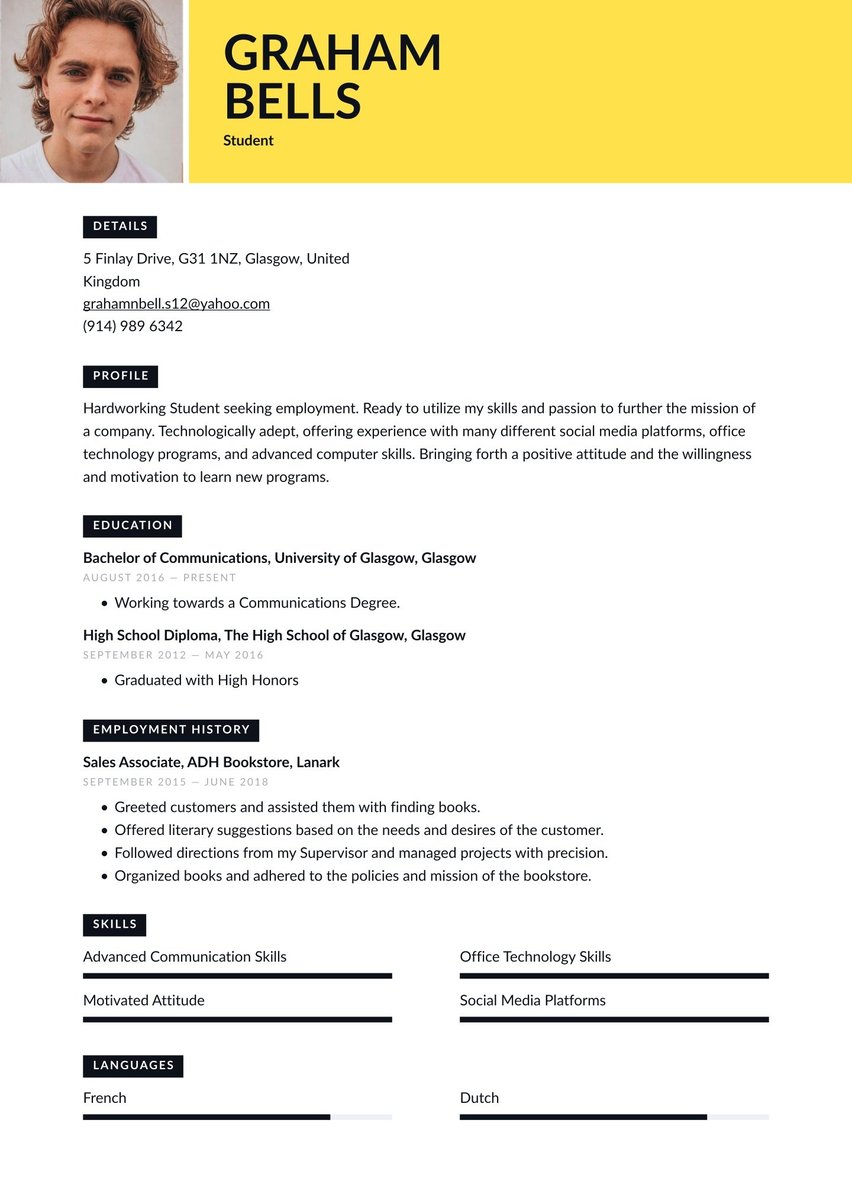

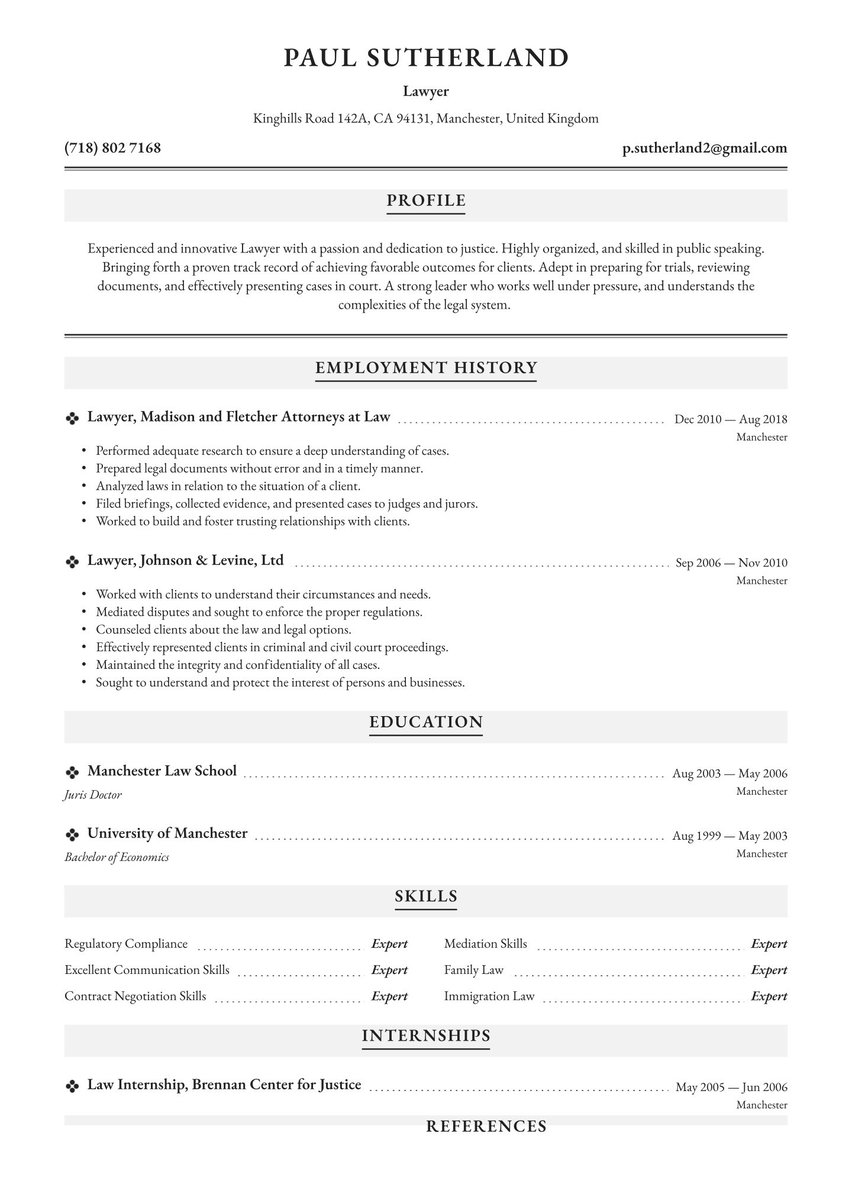

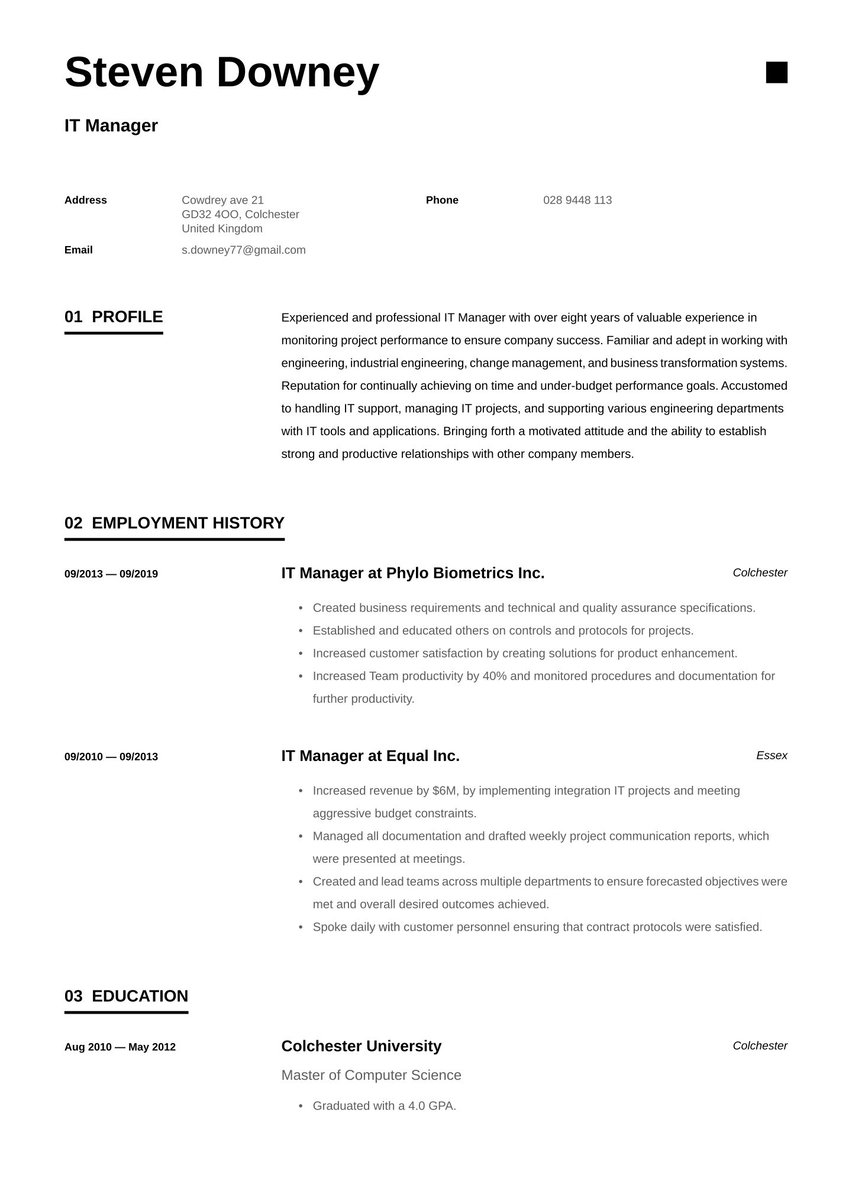

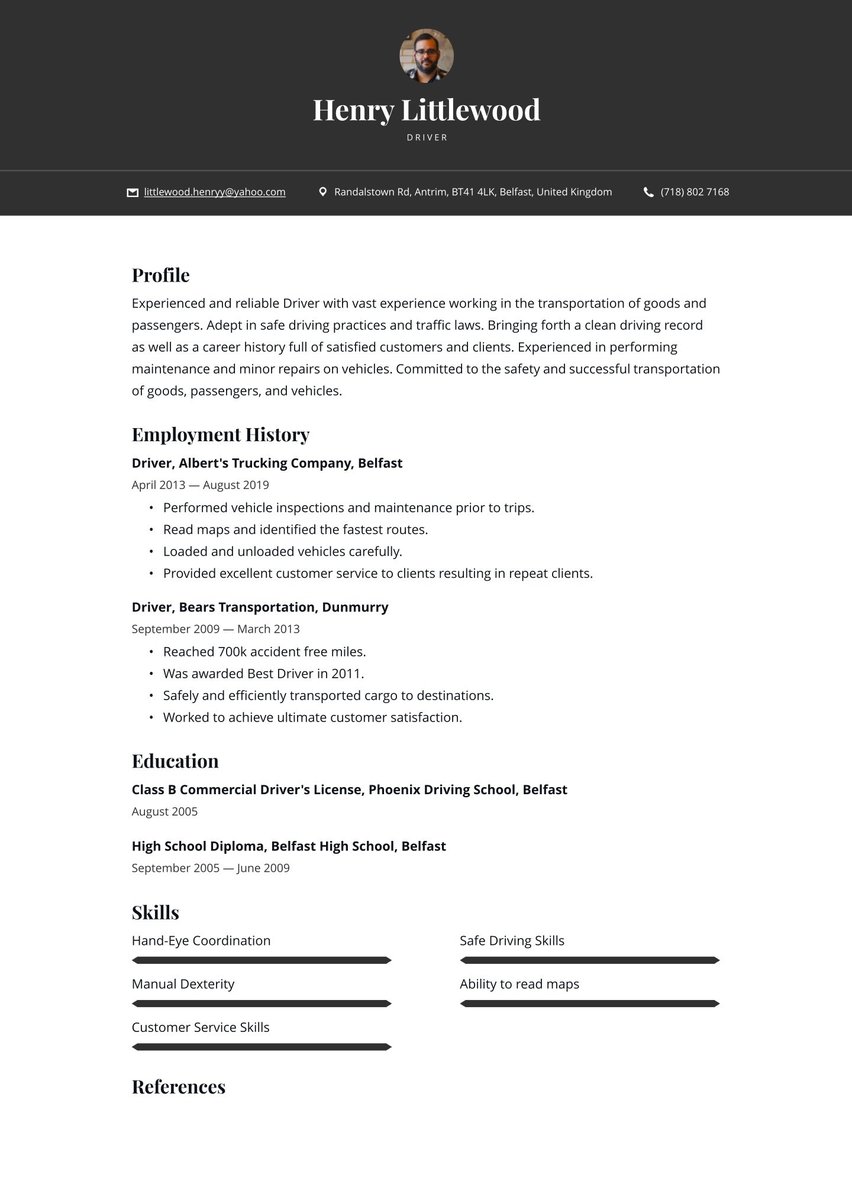

When it comes to the design of your banking CV, go for a classic look. Choosing either a simple layout or a professional setup is the way to go.

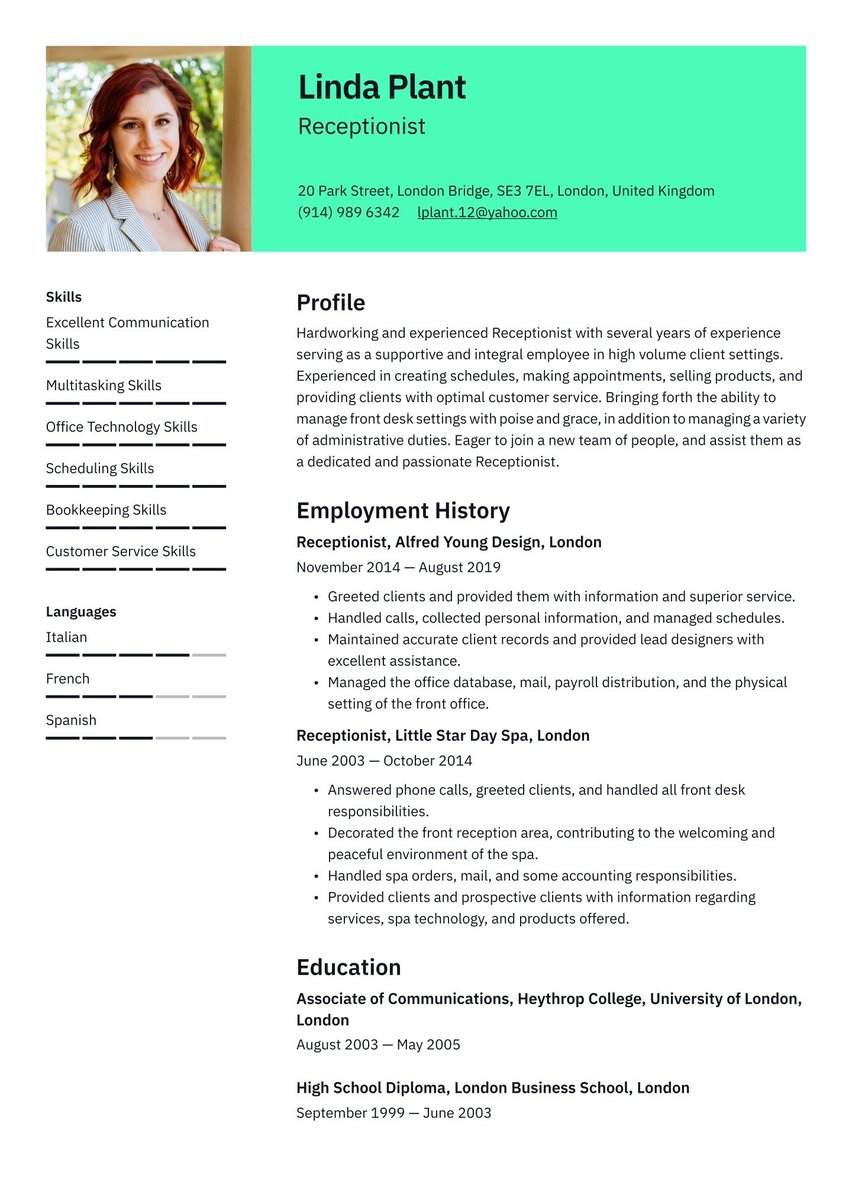

Include your contact information

If you impress the hiring manager with your banking CV, they will want to reach out. That’s where your header plays a role.

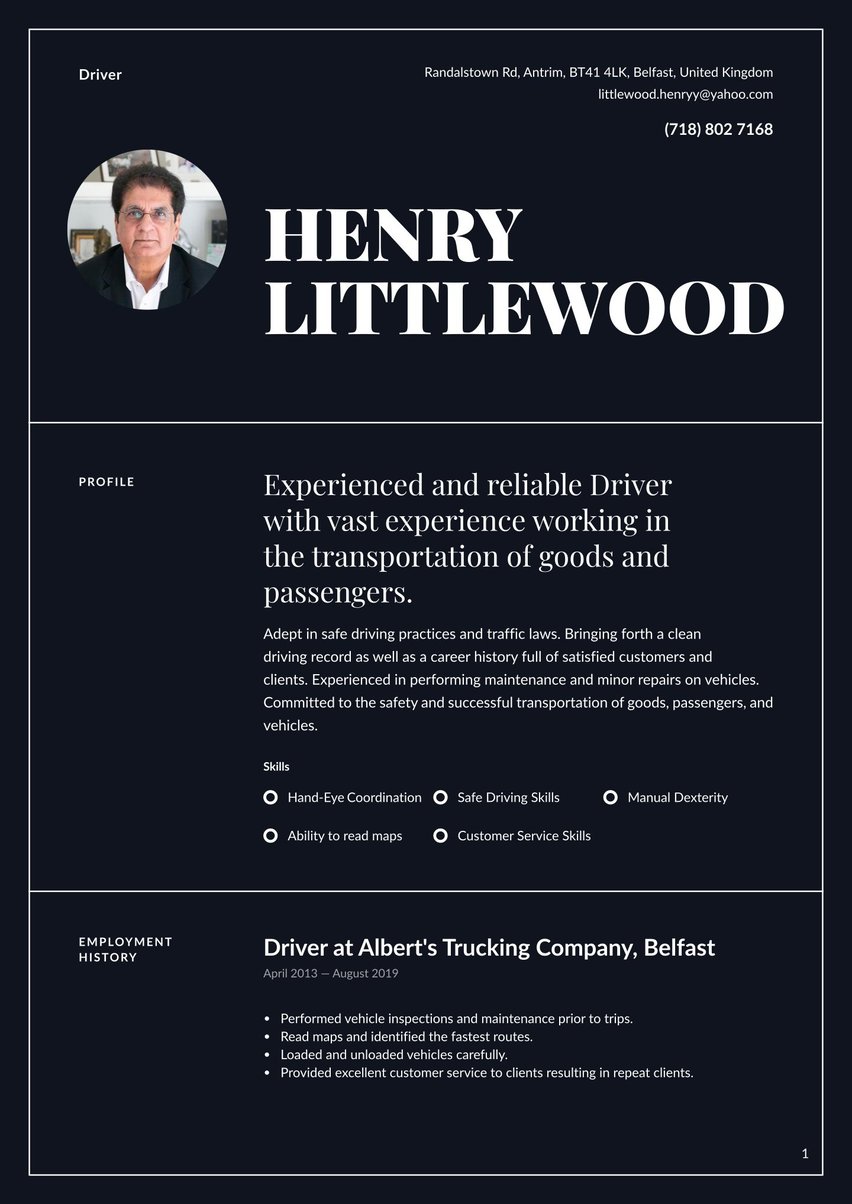

This CV section works like a business card, featuring your contact information front and centre. Here’s what you need to include in this part of the document.

- Full name & title. List your first name and surname as well as the position title.

- Professional email address. Opt for a basic email address. For example, you could use one that includes your name, like: firstname.lastname@gmail.com.

- Phone number. Add a number, such as your mobile number. Make sure that the answer phone message is suitable for a professional setting.

- Location. Include your city and country. You do not need to write your street address or postcode as this is outdated and potentially unsafe.

- LinkedIn. Make sure your LinkedIn page is up-to-date and active. If it is, you should include a hyperlink to it as part of your CV header.

Don’t include:

- Date of birth: If the hiring manager knows your exact age that could lead to age discrimination.

- Personal details: You don’t need to include your marital status, passport number, NI number etc. on a CV.

Lydia Jones

Banking Assistant

Birmingham, UK

0787230912

l.jones@email.co.uk

Lydia Jones

Financial Guru

DOB: 22/3/88

Married with children

56 Rosebud Drive, Birmingham, B12 FJH, UK

0787230912

moneytalkz@email.co.uk

Make use of a summary

If you have ever drafted an elevator pitch, your CV summary follows the same formula. This 2-4 sentence paragraph should encapsulate what makes you a unique candidate. What qualities do you have that others lack? This should be the starting point of your professional summary.

You can use action verbs throughout this section to highlight your abilities. These work well in either simple past or present tense. Examples include executed, excelled, oversaw, orchestrated, managed, increased, boosted, and transformed. Consider how these words could make a huge difference to the bio that you write as part of your banking CV.

The last thing you want to do is simply regurgitate information that can be found elsewhere on your CV. That simply will not do. Instead, you should add value to the information that you share. For example, you might write “Experienced banker with expertise in performing financial analysis and driving business growth by 15% each year.” By being specific about the results that you can offer, you let the hiring manager know what they can expect from you.

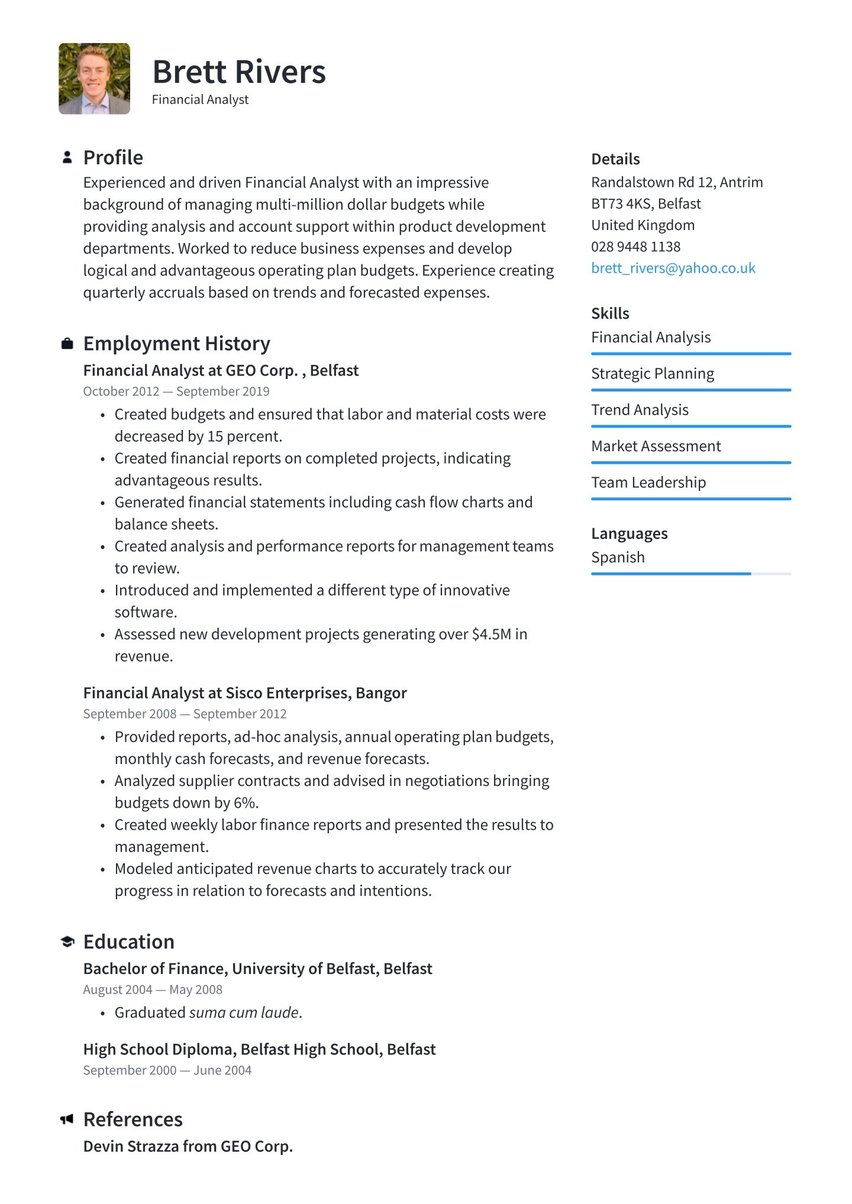

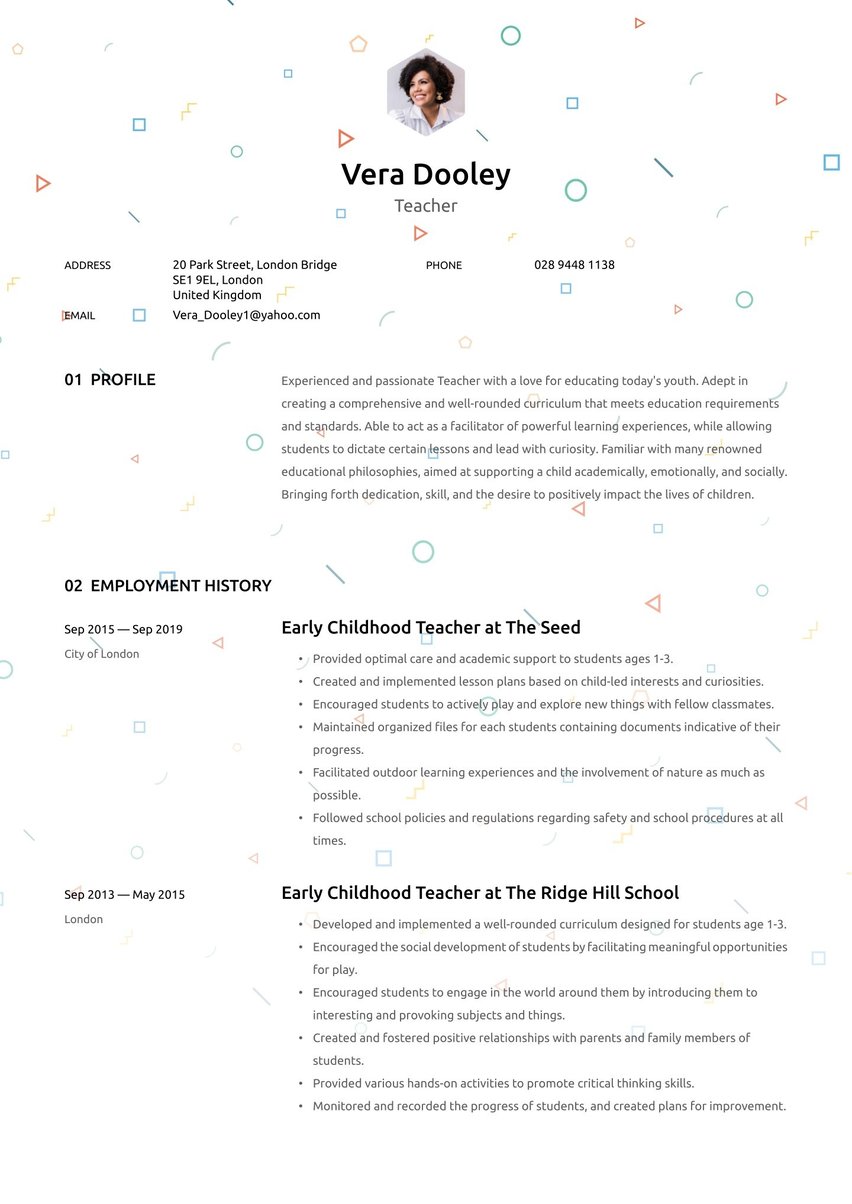

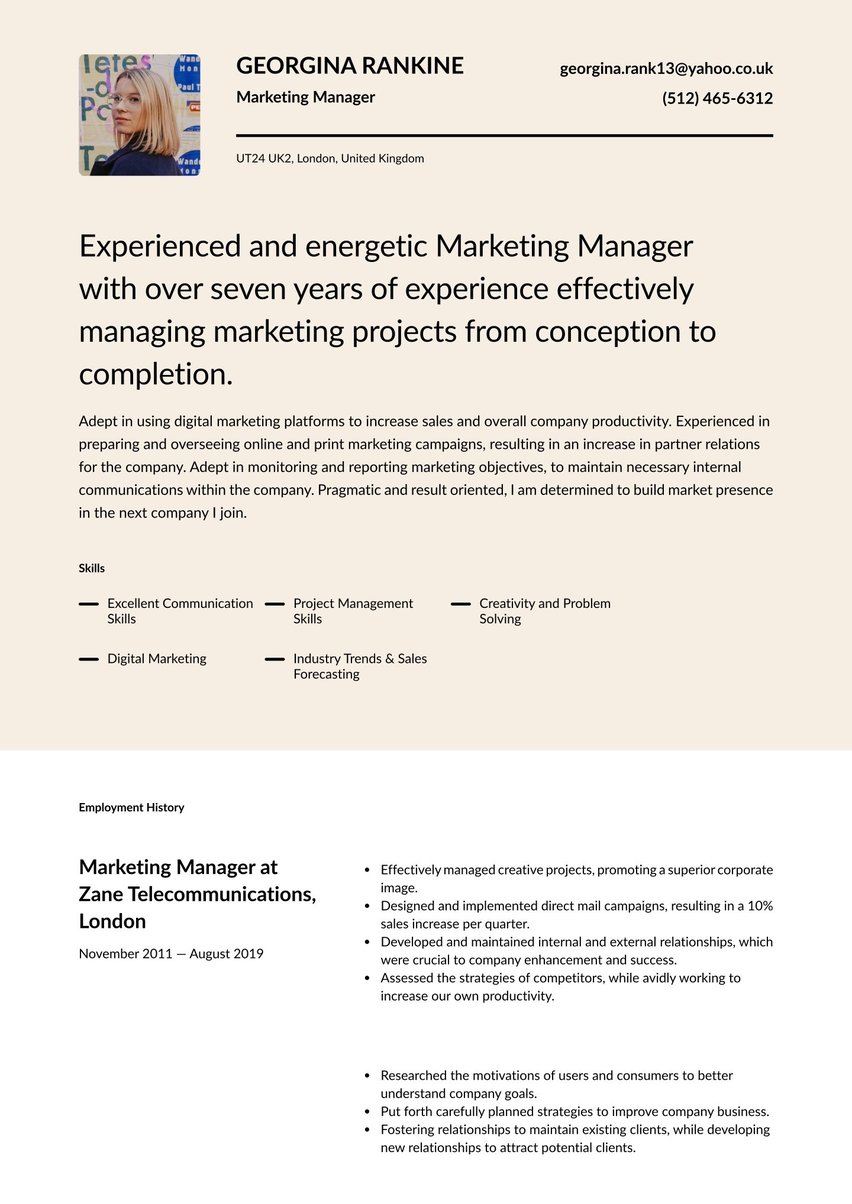

Need inspiration for your CV summary? Here are some associated banker CV templates:

You can find adaptable banking example summaries below:

Driven graduate with a firm foundation in financial principles and banking operations. Boasts a Bachelor's degree in Finance and internship experience in customer service and financial analysis. Confident in handling a wide selection of financial transactions, customer enquiries, and providing exceptional service.

Experienced banking professional with over 5 years in the financial services industry and relationship management. Confident in managing high-value client portfolios, assessing credit risk, and providing strategic financial solutions. Proven track record of driving revenue growth by at least 5% for clients.

Senior financial advisor with 10+ years of experience in financial analysis, revenue growth, and regulatory compliance. Confident in navigating complex regulatory systems while implementing innovative financial solutions to meet strategic goals. Excellent communication and problem-solving skills, with a commitment to delivering exceptional service and fostering long-term client loyalty.

Outline your banking work experience: a long-term investment

Experience is everything in the financial sector. For this section of your CV, we recommend using the reverse chronological order. Start by listing your most recent — or current — work title at the top of the section. Include your work history from the last 10-15 years or around three job positions. If you have had a long career, avoid adding every job you have ever had to your CV.

For each position, list the company, location, job title, and dates of employment. Below that, you should use a bullet point structure to list your accomplishments. Don’t simply talk about the tasks that you did during that experience. Instead, you need to add results-based points. That means adding evidence of how your actions impacted the company as a whole.

For example, here’s what you should not write:

- “Managed client portfolios.”

- “Supervised a team.”

- “Complied with regulations.”

While these statements may be accurate, they are not original. You might as well have taken them directly from the job advertisement. Instead, you want to add results to each point. You should also quantify your experiences using data and statistics, as follows:

- “Managed 150+ client portfolios and boasted a 97% client retention rate.”

- “Supervised a team of 10 bankers and 15 banking assistants.”

- “Maintained 100% compliance with financial regulations consistently.”

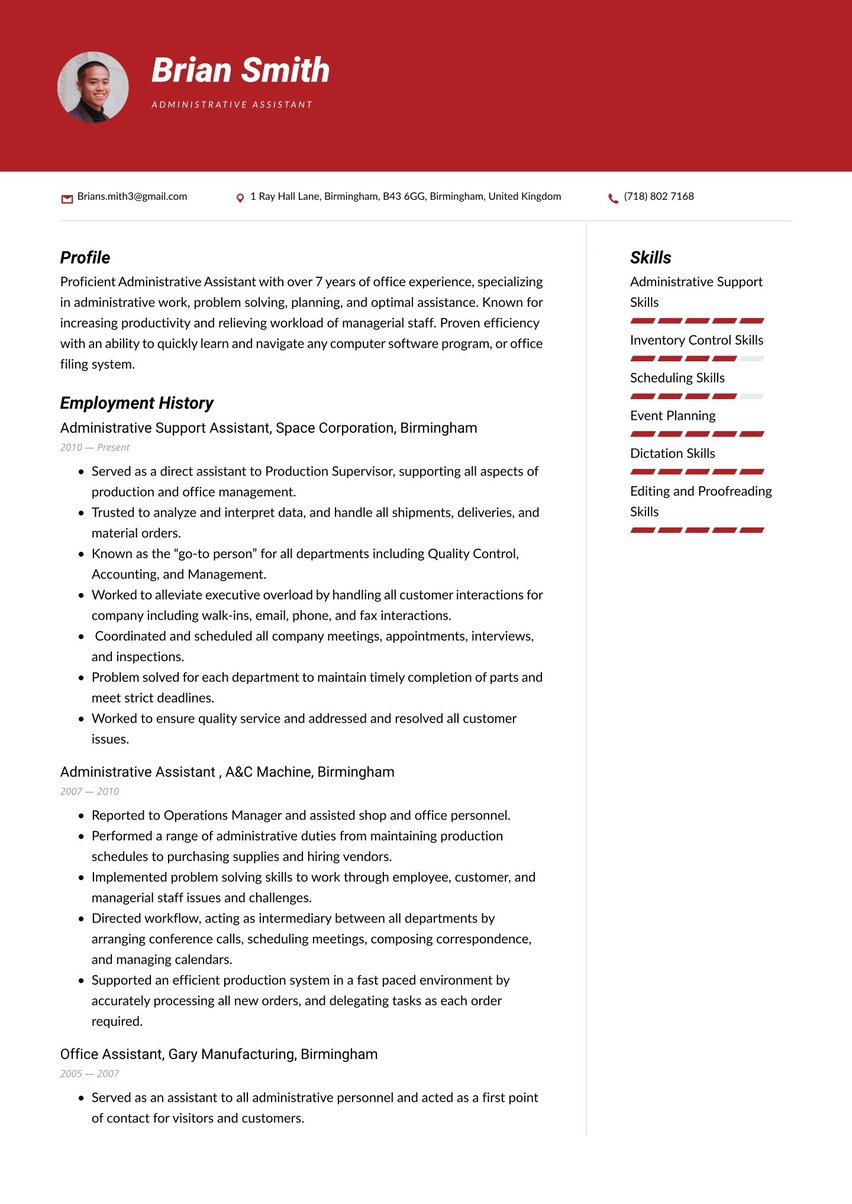

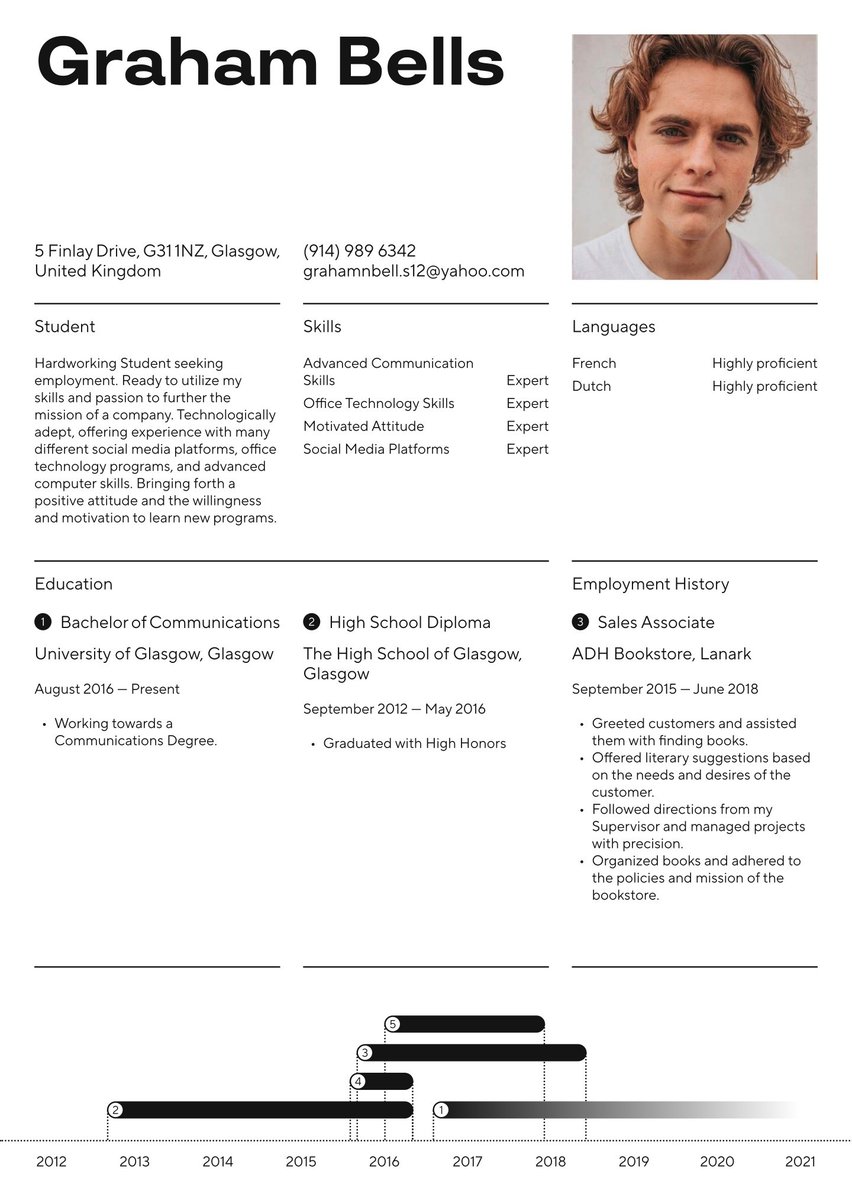

Take a look at the banking employment history CV sample below:

Relationship Manager at Barclays, Glasgow

June 2018 - Present

- Manage a portfolio of high-net-worth clients, providing personalised banking solutions

- Consistently achieve sales targets, contributing to a 15% increase in branch revenue

- Collaborate with cross-functional teams to develop and implement client acquisition strategies

Assistant Manager at Lloyds Banking Group, Aberdeen

May 2015 - May 2018

- Supervised a team of 10 customer service representatives, ensuring high-quality service delivery

- Implemented operational improvements, reducing average customer wait times by 20%

- Conducted regular training sessions to enhance team performance and product knowledge

How to write a banking CV with no experience

If you are a recent graduate or new to the banking sector, you may lack direct experience of the industry. However, remember that everyone has to start somewhere. When applying for an entry-level job, you should look for ways to make your CV stand out from the crowd.

One approach is to rely heavily on your transferable skills. These are talents that you have honed during your time either at university or in other roles. For example, if you previously worked in customer services, you might have great communication and interpersonal skills. Drawing attention to these on your banking CV is a simple way to boost your chances.

Never had a full-time job before now? Look at other ways that you have contributed to the community. That may be via voluntary work, projects at university, or societies. Show the hiring manager that you are a team player, despite not having worked in a formal setting before.

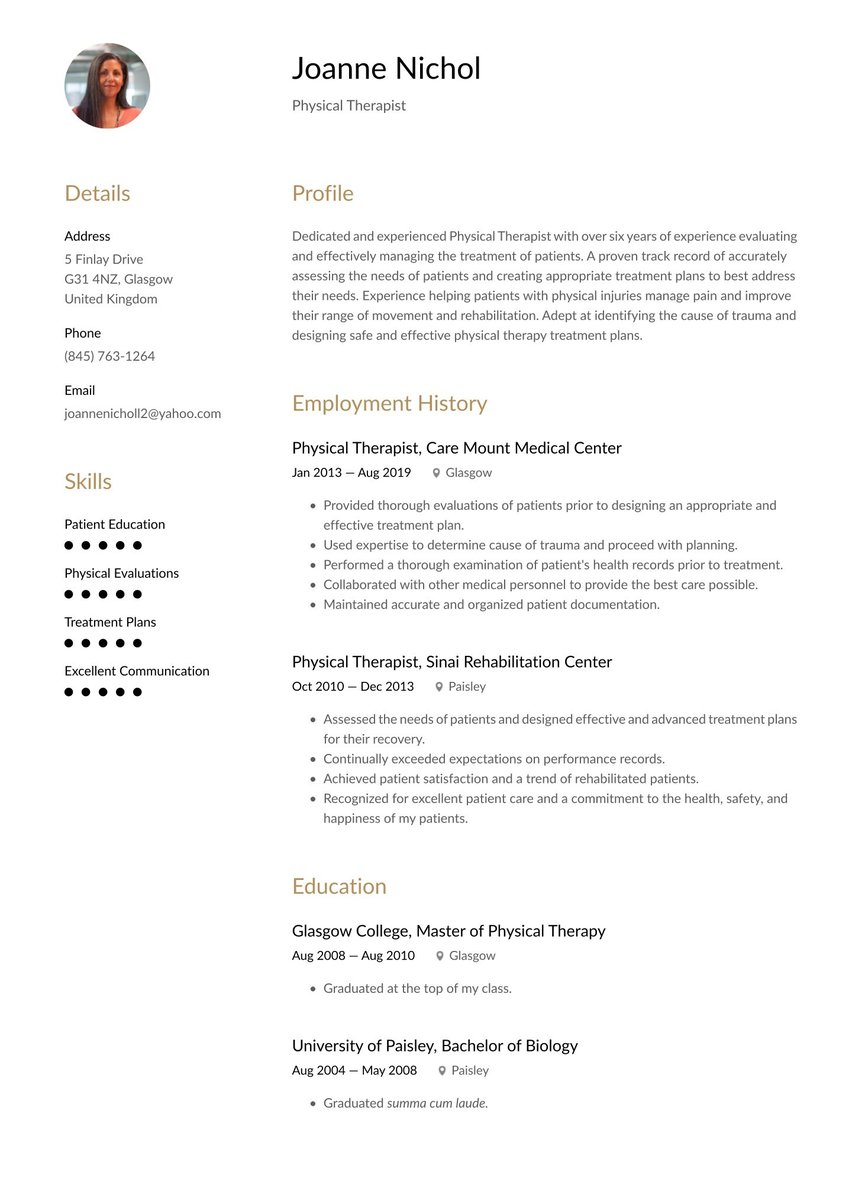

Include the relevant key skills that make you a great banking worker

Next up, let’s talk about your skills section. To pique the hiring manager’s interest, you need to make sure that you have a healthy mixture of both soft and hard skills.

Hard skills are aligned directly with the financial sector and are often called technical skills. They may include regulatory compliance, financial analysis, portfolio management, and financial transactions. Consider what hard skills you have and the value that they add.

Soft skills are also known as transferable skills and span sectors. That is to say that they are not unique to the banking industry. These may include communication, interpersonal skills, time management, organisation, and adaptability.

When you’re trying to decide which skills to include on your banking CV, there’s a handy trick to keep in mind. Return to the job advert and see which skills the hiring manager has listed.

Our CV builder offers pre-selected skills to choose from when creating your application. You will also have the chance to upload your own skills.

Here’s what the skills box looks like in our CV template for banking.

- Client Relationship Management

- Risk Assesment

- Financial Analysis

- Sales and Negotiation

- Team Leadership and Mentoring

- Microsoft Office and CRM software

Always adopt a “show don’t tell” approach. You can list your main skills in this dedicated section. However, you should add context to each of them in the rest of your banking CV. For example, you can mention them when it comes to your summary or work experience sections, too.

For example, you may choose to highlight these skills, as follows:

- Client relationship management: Include a statistic about your client retention rates, which proves that you build lasting relationships.

- Sales and negotiation: Boast about your sales statistics and let the numbers speak for themselves.

- Regulatory compliance: Talk about the regulations you follow and include information about your compliance scores.

Detail your education & relevant banking certifications

When you have completed the above sections, it’s time to tackle your education section. This is where you share the training and education you have completed. As this is a professional sector, the hiring manager will expect you to have a wealth of certificates under your belt.

Once again, you should use the reverse chronological order when listing your education. That way, the hiring manager can quickly see your most recent achievements. Here’s what you may include in the education section of a banking CV:

- Bachelor’s degrees: In most cases, the hiring manager will expect you to have a degree in finance, mathematics, or a similar field.

- Master's degrees: You may have completed a master’s degree, such as a Master of Business Administration (MBA).

- Banking certificates: For example, you may have gained certificates from the Chartered Banker Institute or the London Institute of Banking & Finance.

- Professional development: Include any on-the-job or evening school training, such as completing an Advanced Financial Modelling Workshop or a Leadership in Financial Services Program.

Whatever certificates you have, now is the time to show them off. Including professional training shows that you are dedicated to furthering your banking career.

BSc in Finance, University of Edinburgh, Edinburgh

September 2011 - June 2015

- First Class Honours

- Awarded the Edinburgh Finance Award for outstanding academic achievement

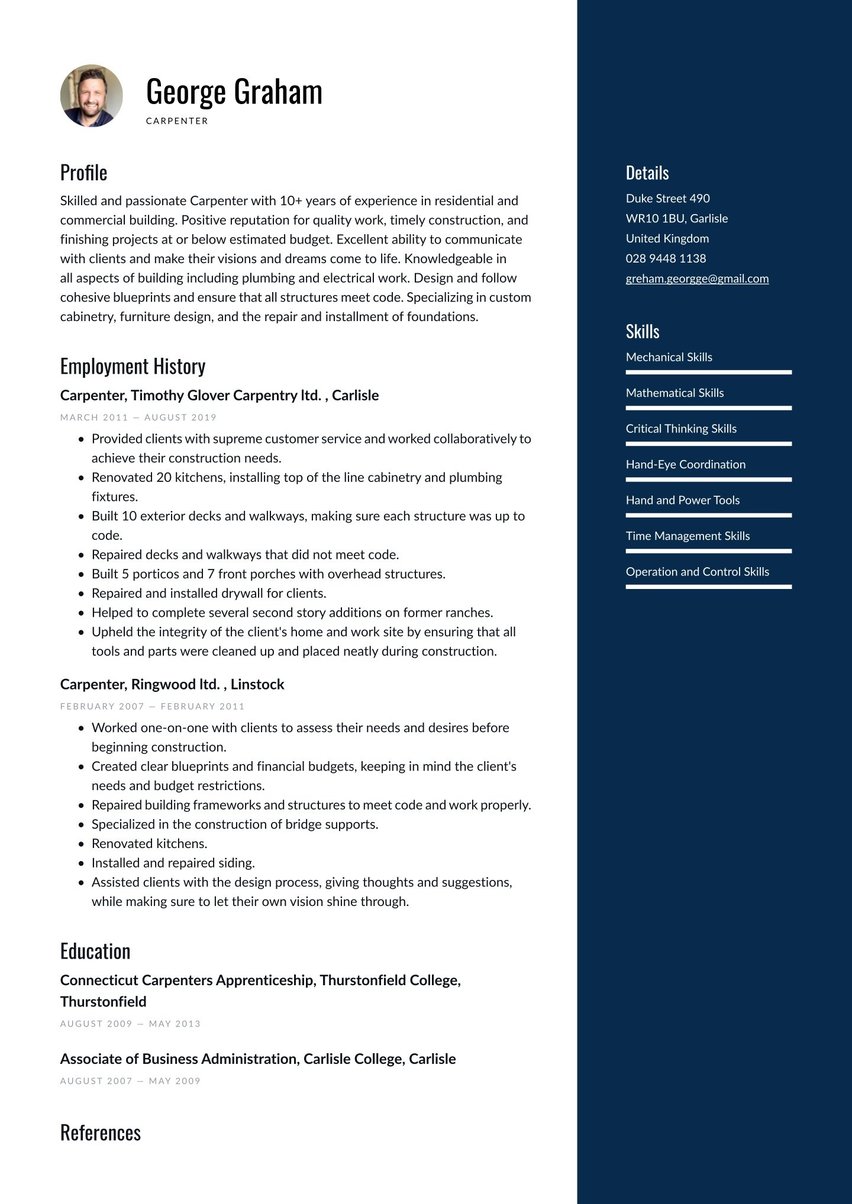

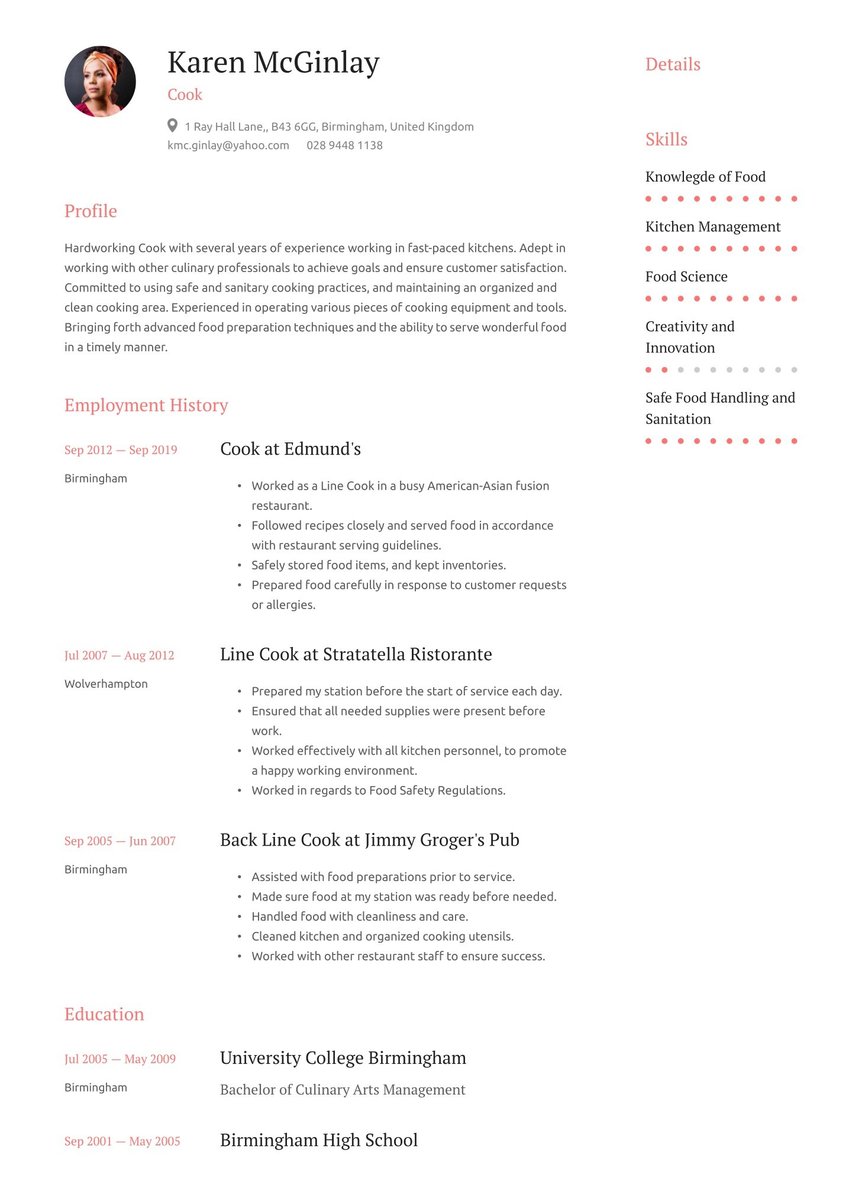

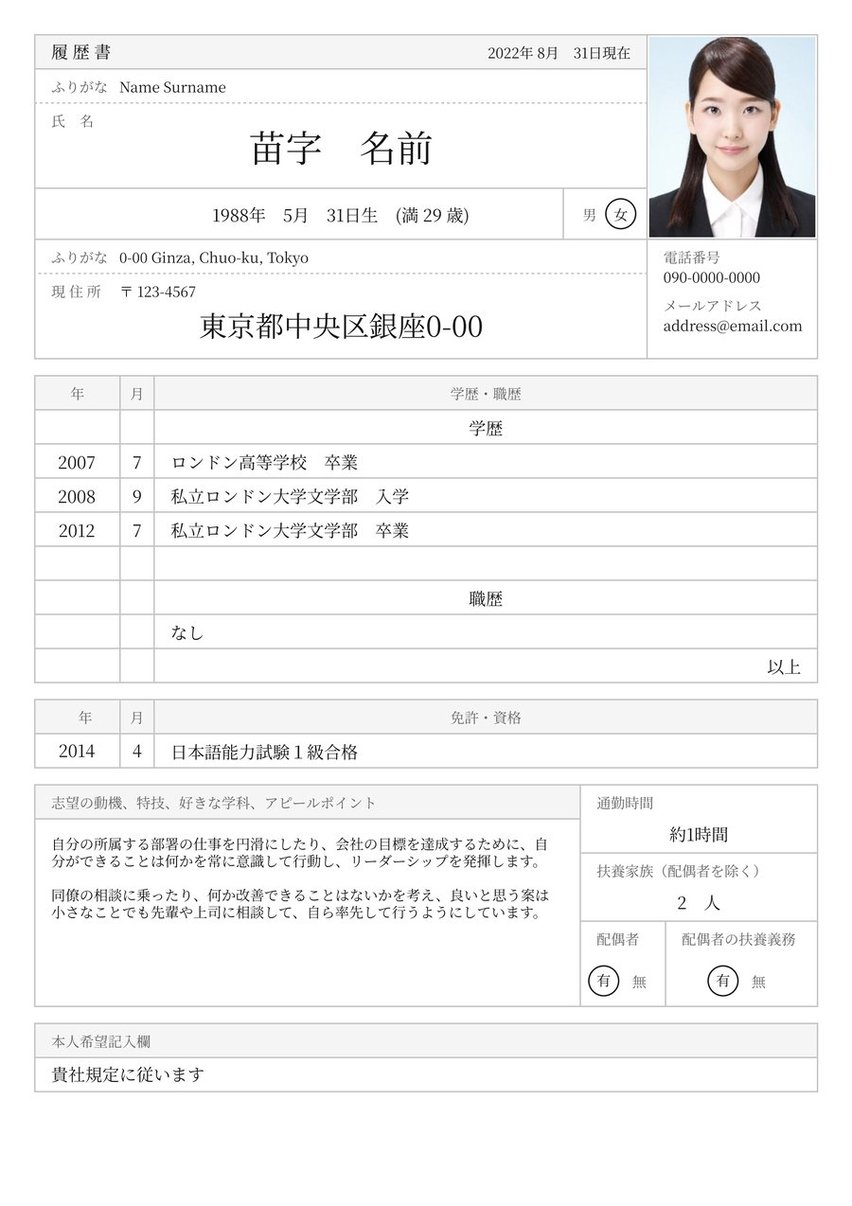

Pick the right CV layout and design for a banking CV

The content of your banking CV should be the star of the show. Choose a design that doesn’t threaten to overshadow it. Here are some of the rules that you should follow:

- Include plenty of white space. This means space around the sections and margins of your CV. Allowing the design to have more space makes it easier to read.

- Pick an appropriate font style. Make sure the CV font you choose is easily legible and fit for purpose. Only pick one or two typefaces to use throughout the document.

- Avoid flashy designs. You need to make sure that your banking CV looks professional. For that reason, you want to avoid any over-the-top or flashy design elements.

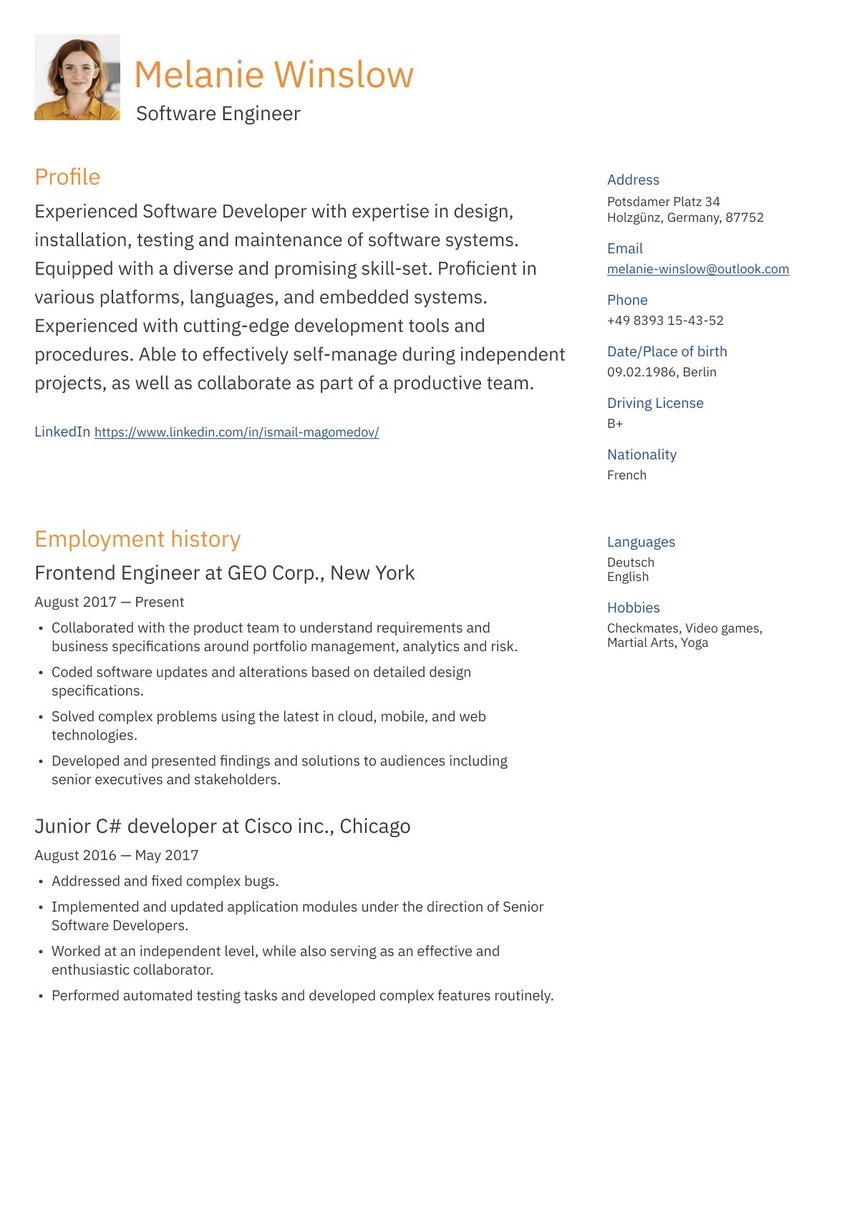

- Don’t include pictures. There is no need for imagery on a banking CV.

- Limit your use of colour. While it may be tempting to opt for a colourful CV, that is not the way to go. Only use one or two CV colours at the most.

If you want some guidance and inspiration, we’ve got you covered. Take the time to look at our selection of CV templates. Choose a professional option that helps you put your professional story in the right light. Using a template is a quick way to streamline this process.

Banking text-only CV example

Profile

Accomplished banker with 8 years of experience in retail and corporate banking at Lloyds Banking Group and Barclays. Skilled in building client relationships, risk assessment, and financial analysis. Proven track record of achieving sales targets and driving revenue growth. Recognised for strong leadership and mentoring skills. Holds a BSc in Finance from the University of Edinburgh. Committed to delivering exceptional customer service and contributing to the success of the organisation.

Employment history

Relationship Manager at Barclays, Glasgow

June 2018 - Present

- Manage a portfolio of high-net-worth clients, providing personalised banking solutions

- Consistently achieve sales targets, contributing to a 15% increase in branch revenue

- Collaborate with cross-functional teams to develop and implement client acquisition strategies

Assistant Manager at Lloyds Banking Group, Aberdeen

May 2015 - May 2018

- Supervised a team of 10 customer service representatives, ensuring high-quality service delivery

- Implemented operational improvements, reducing average customer wait times by 20%

- Conducted regular training sessions to enhance team performance and product knowledge

Skills

- Client Relationship Management

- Risk Assesment

- Financial Analysis

- Sales and Negotiation

- Team Leadership and Mentoring

- Microsoft Office and CRM software

Education

BSc in Finance, University of Edinburgh, Edinburgh

September 2011 - June 2015

- First Class Honours

- Awarded the Edinburgh Finance Award for outstanding academic achievement

Banking job market and outlook

The finance sector is still recovering from the impact of the pandemic. According to figures from Morgan McKinley, the number of London banking jobs in quarter one of 2024 was 80% lower than the same quarter in 2017. Morgan McKinley’s COO, David Leithead, suggested that this may be due to a “continued global economic unease”.

Moreover, a recent report found that 22% of Banking & Financial Services outlined 'No budget to hire’ as one of the biggest challenges they will face in 2024.

Despite the unstable market, you can still land a banking job in the UK. However, you will need to work hard to make a lasting impression on discerning hiring managers. It has never been more important to craft a banking CV that stands out from the competition.

What type of salary you can expect in UK banking

How much will you make in this industry? The average banker salary in the UK is £27,500 per year. However, specialists and those working in London may make much more.

How much do different finance professionals make?

Many different professionals work in the banking sector. Let’s take a look at a mid-level (3-5 years of experience) salary for various finance-related roles, according to Morgan McKinley:

- Data analyst – £40,000 - £45,000

- Fund accounting manager – £65,000 - £75,000

- Fund administrator – £40,000 - £45,000

- Head of operations – £100,000 - £150,000

- Loan operations – £45,000 - £50,000

- Portfolio analyst – £45,000 - £50,000

Key takeaways for building a banking CV

The finance sector is highly competitive. If you want to land your next job, you will need to create a stellar banking CV. Follow the advice we have shared and always tailor your CV to meet the needs of the bank or firm. If you want to make the process easy, use our CV builder to create a winning application in no time.