06/2007 - 09/2019, Loan Processor, Wells Fargo, Bellevue

- Developed trustworthy relationships with clients seeking loans.

- Ran thorough credit reports and advised clients on their financial situations.

- Helped client to understand the terms of the best loan suited for them and their lifestyle.

- Worked quickly and efficiently to have loans processed as quickly as possible.

- Increased the rate of return clients with unparalleled customer service and a commitment to satisfaction.

04/2001 - 05/2007, Loan Processor, ABC Bank, Seattle

- Reviewed loan applications and assist home buyers seeking mortgage loans.

- Assisted home buyers with gathering the proper documentation for loan approval.

- Ordered credit and title reports.

- Ensured the privacy and security of a customer's files every step of the way.

- Communicated with attorneys, county clerks, and title companies.

- Made recommendations for alternate actions as needed.

- Processed hundreds of loan applications in a timely and effective manner.

04/2000 - 04/2001, Executive Assistant to Loan Processor, ABC Bank, Seattle

- Assisted Loan Processor with any clerical and administrative duties necessary.

- Became very familiar with the loan process and cultivated positive relationships with those involved in the process.

- Supported managing partners of the company by assisting with duties as needed.

08/2001 - 08/2004, Master of Finance, Ohio State University, Columbus

- Graduated with Distinction.

08/1997 - 05/2001, Bachelor of Economics, University of Washington, Seattle

- Customer Service Skills

- Risk Analysis Skills

- Strong Organizational Skills

- Knowledge of Banking Computer Software

- Advanced Mathematical Skills

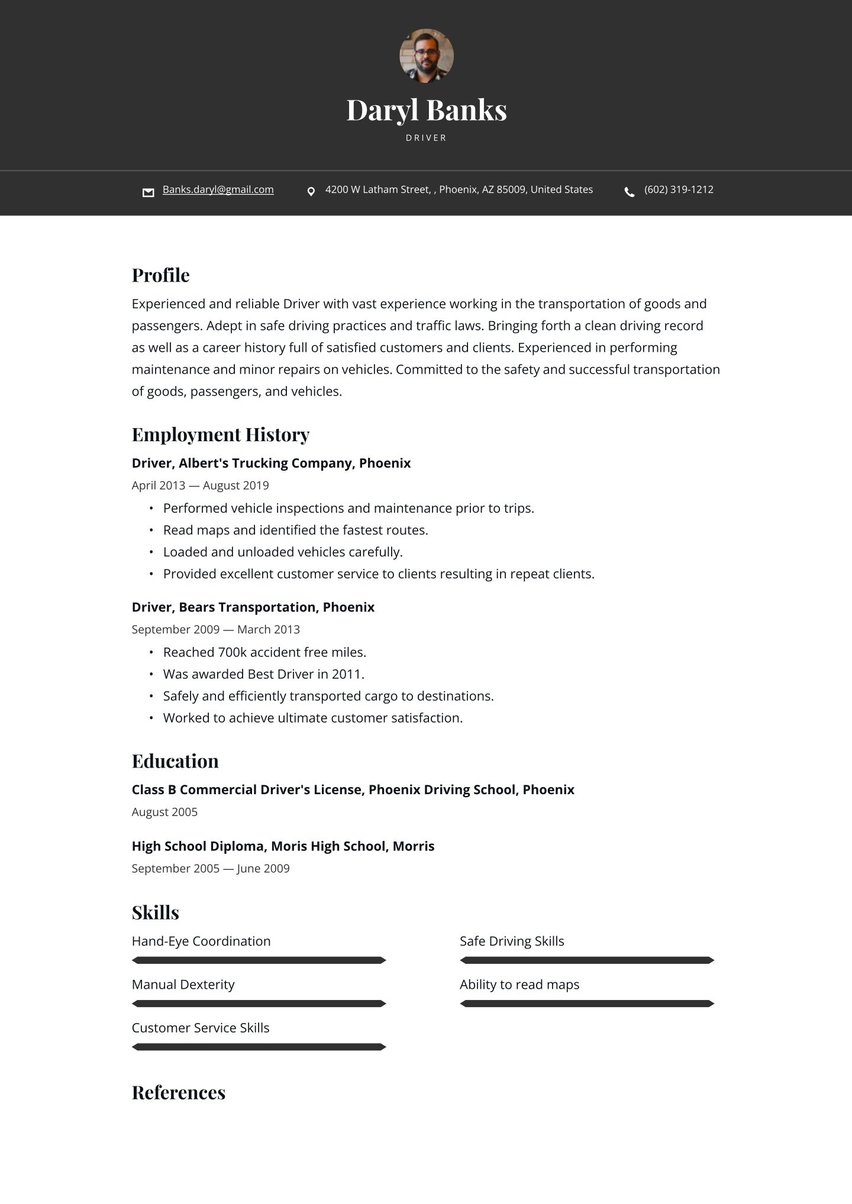

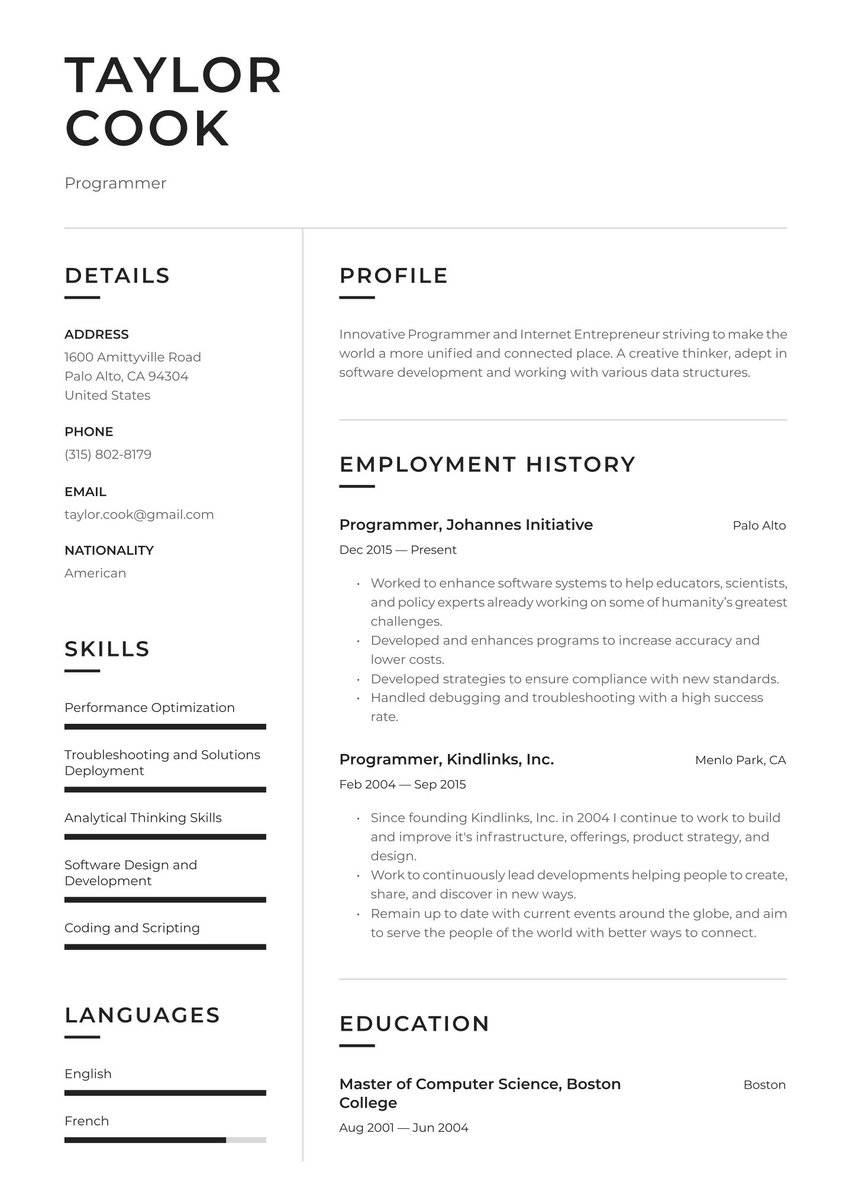

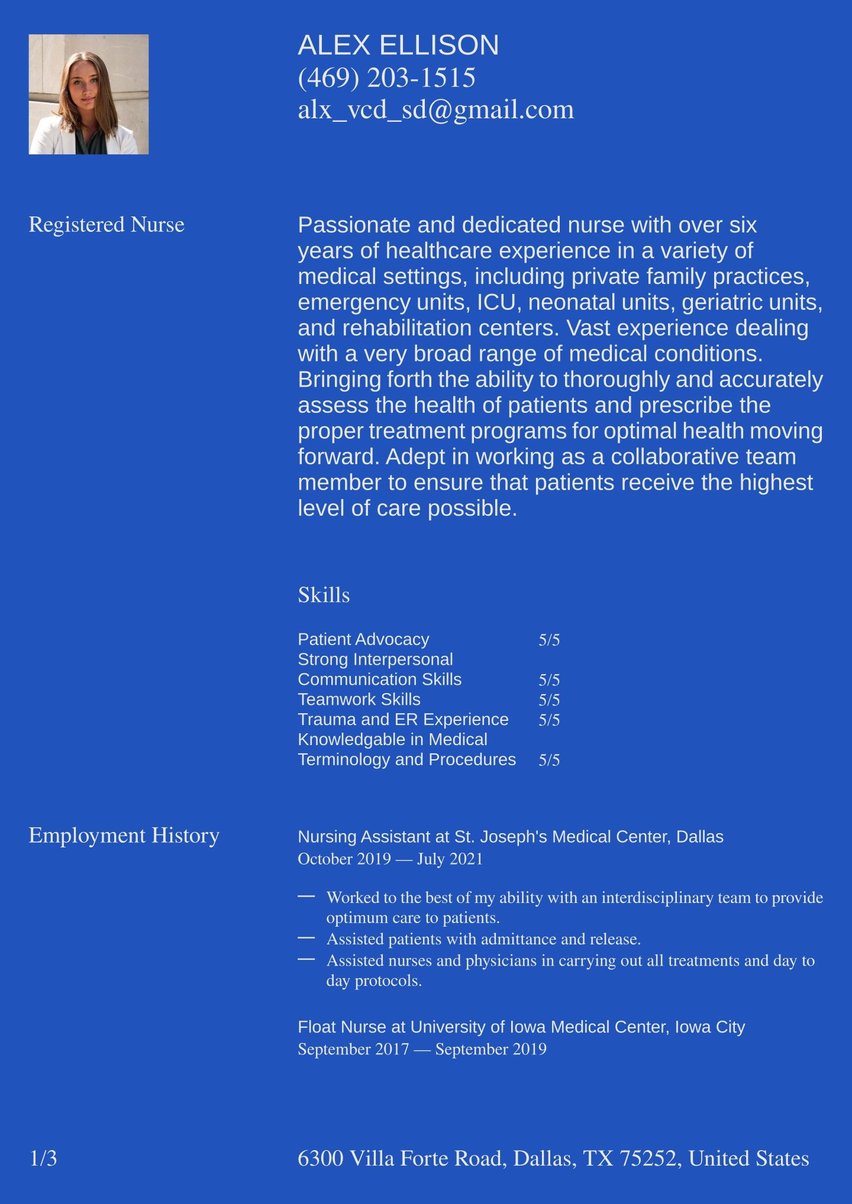

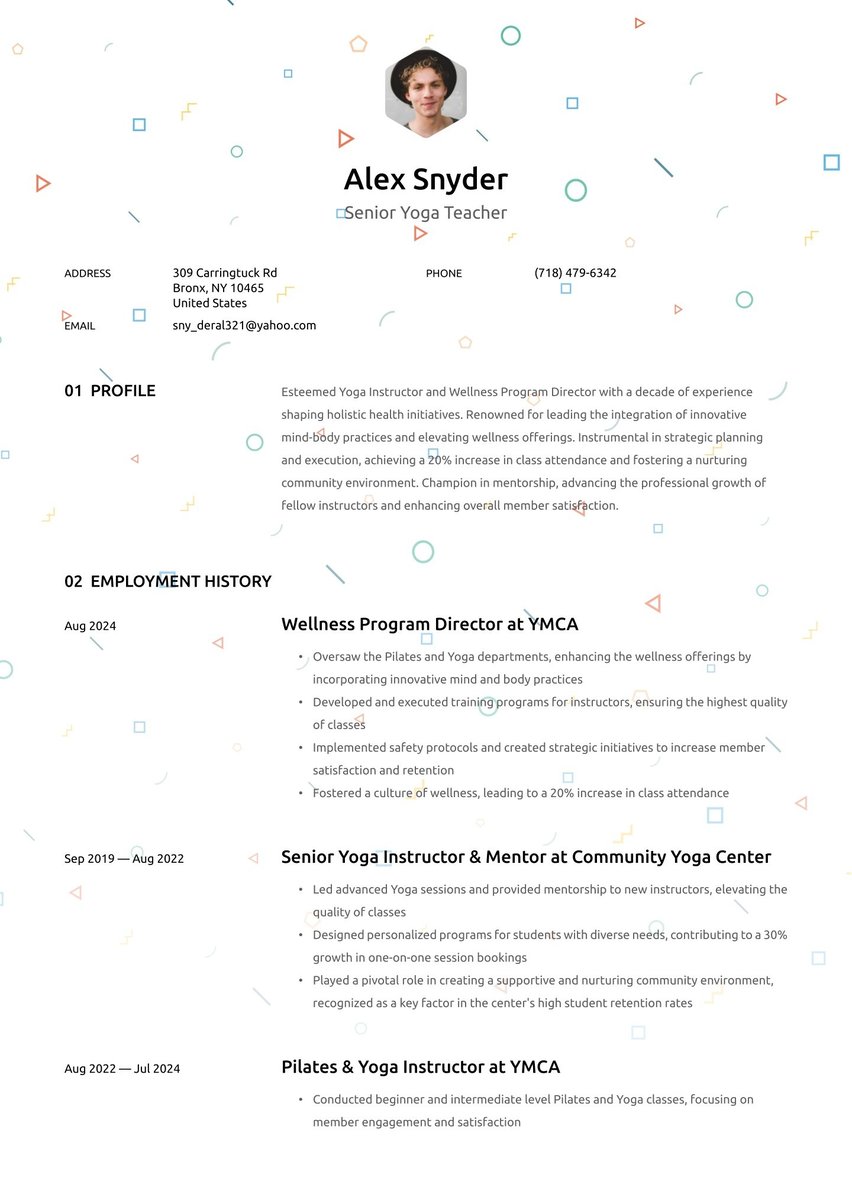

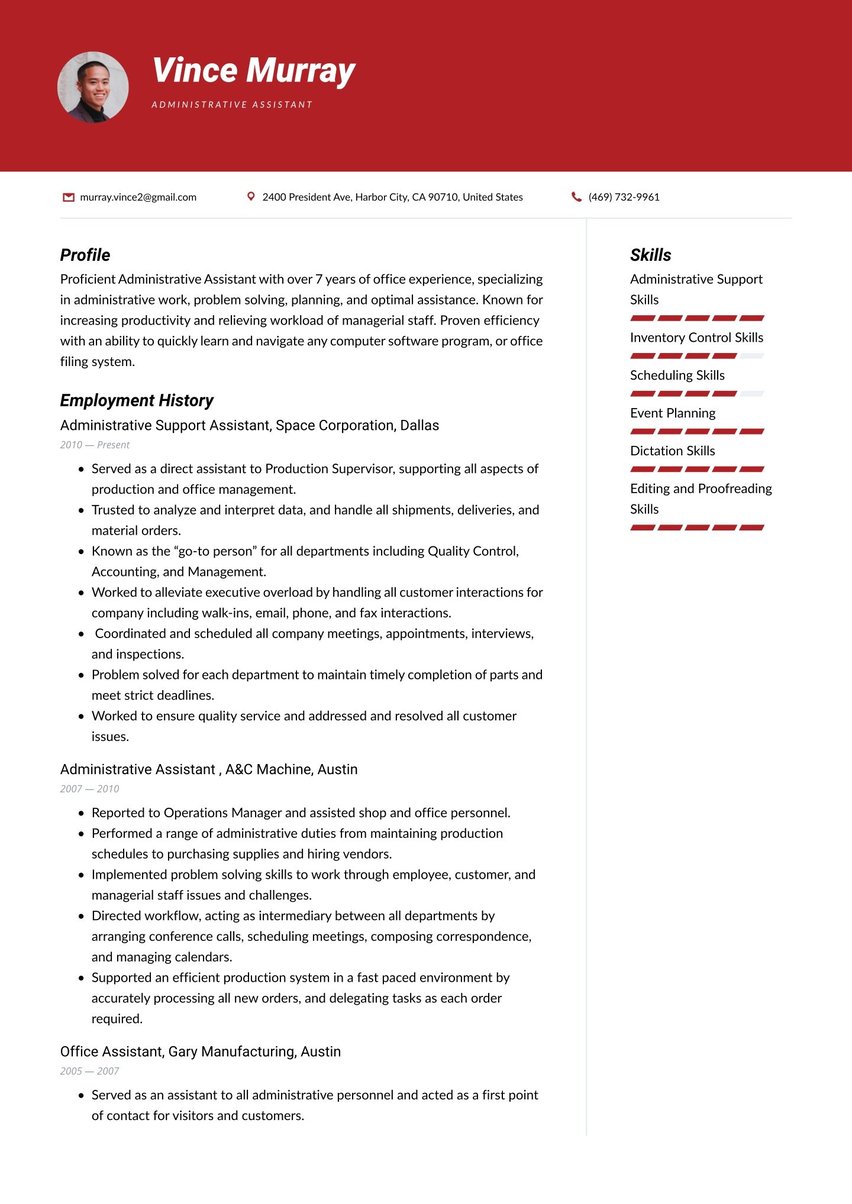

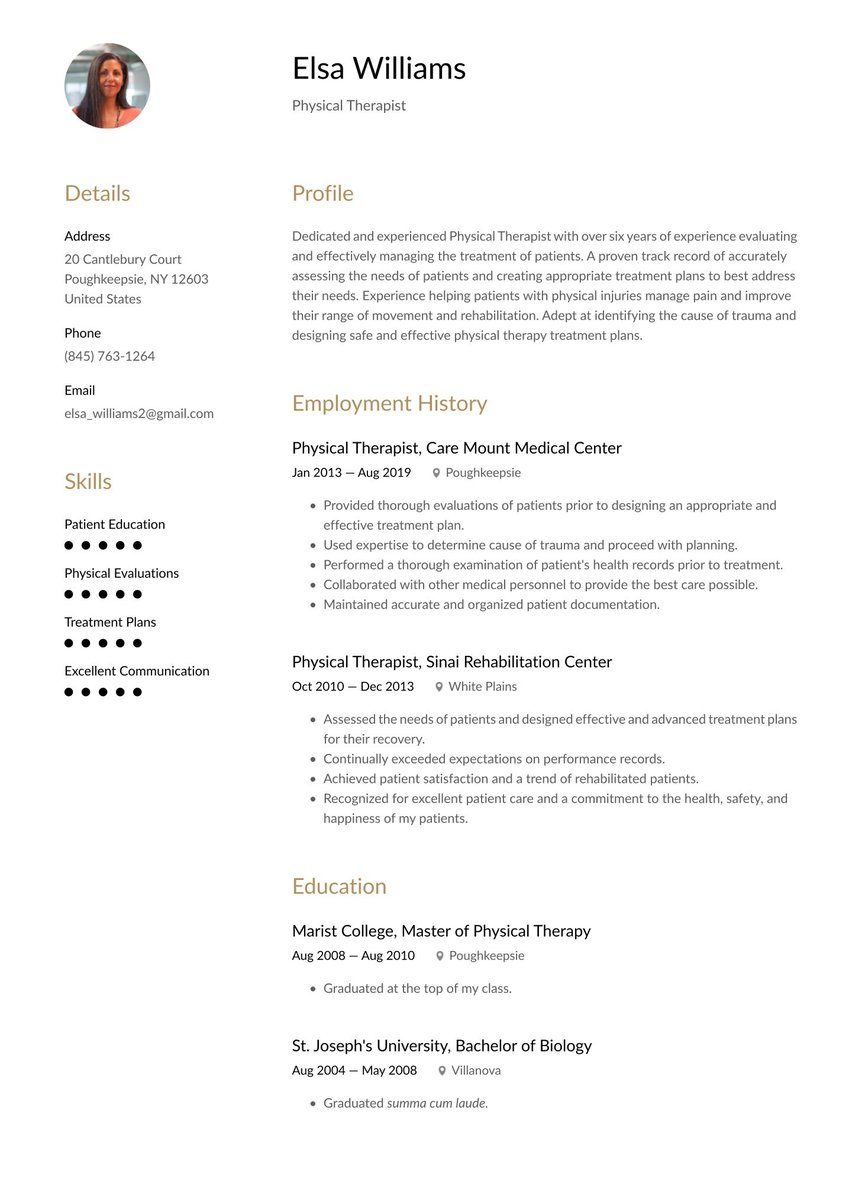

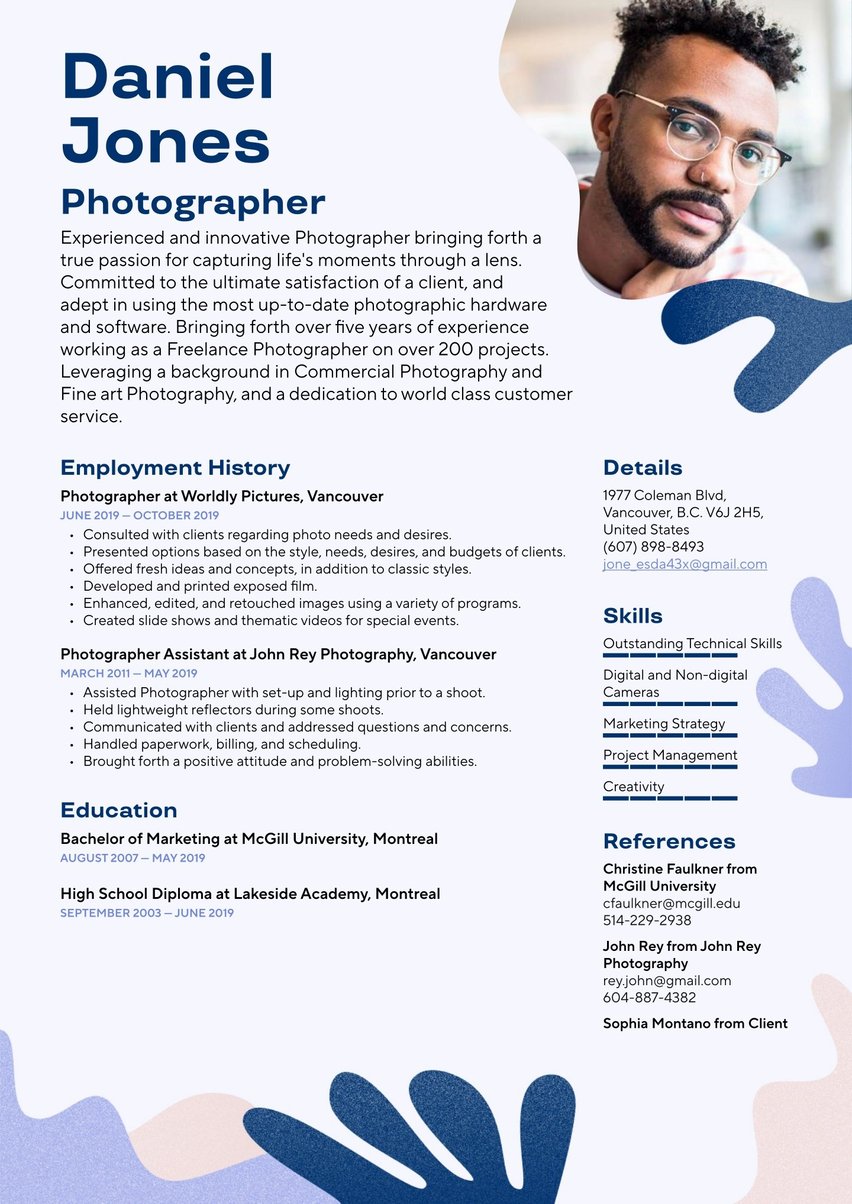

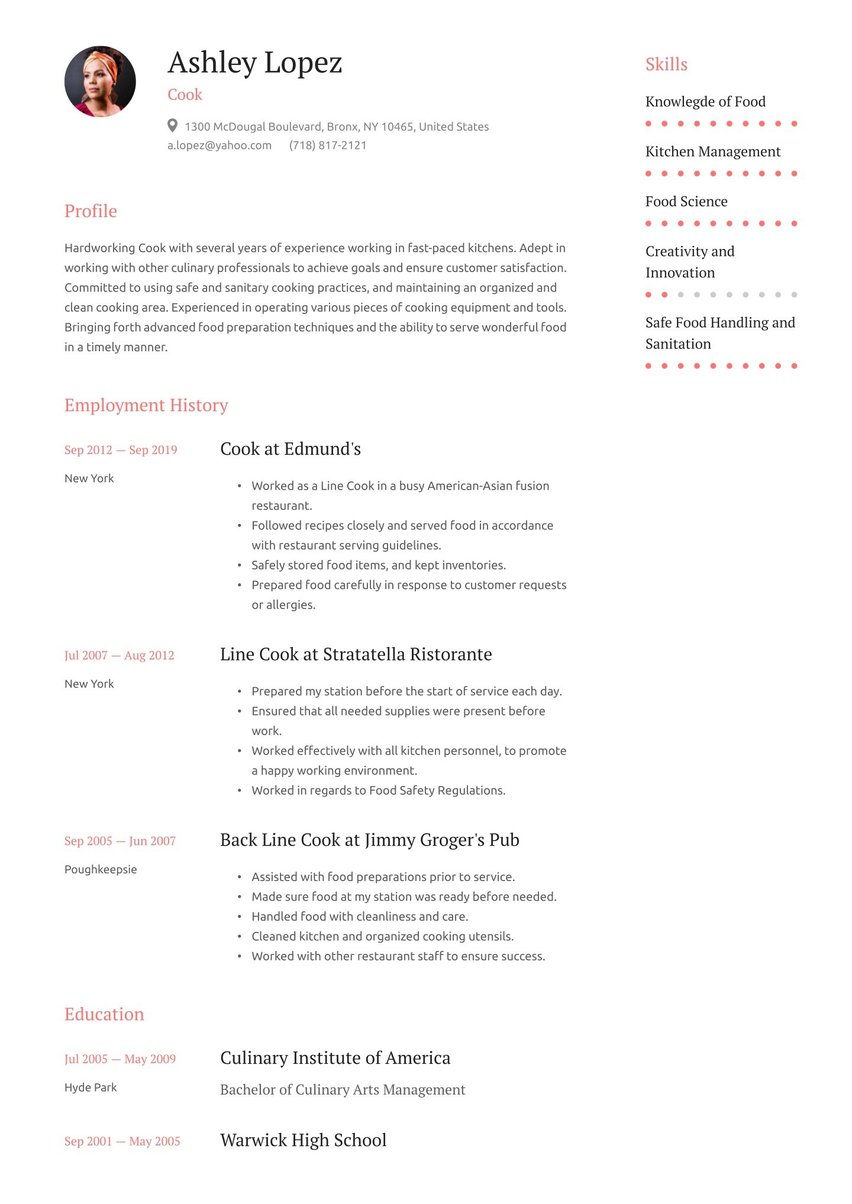

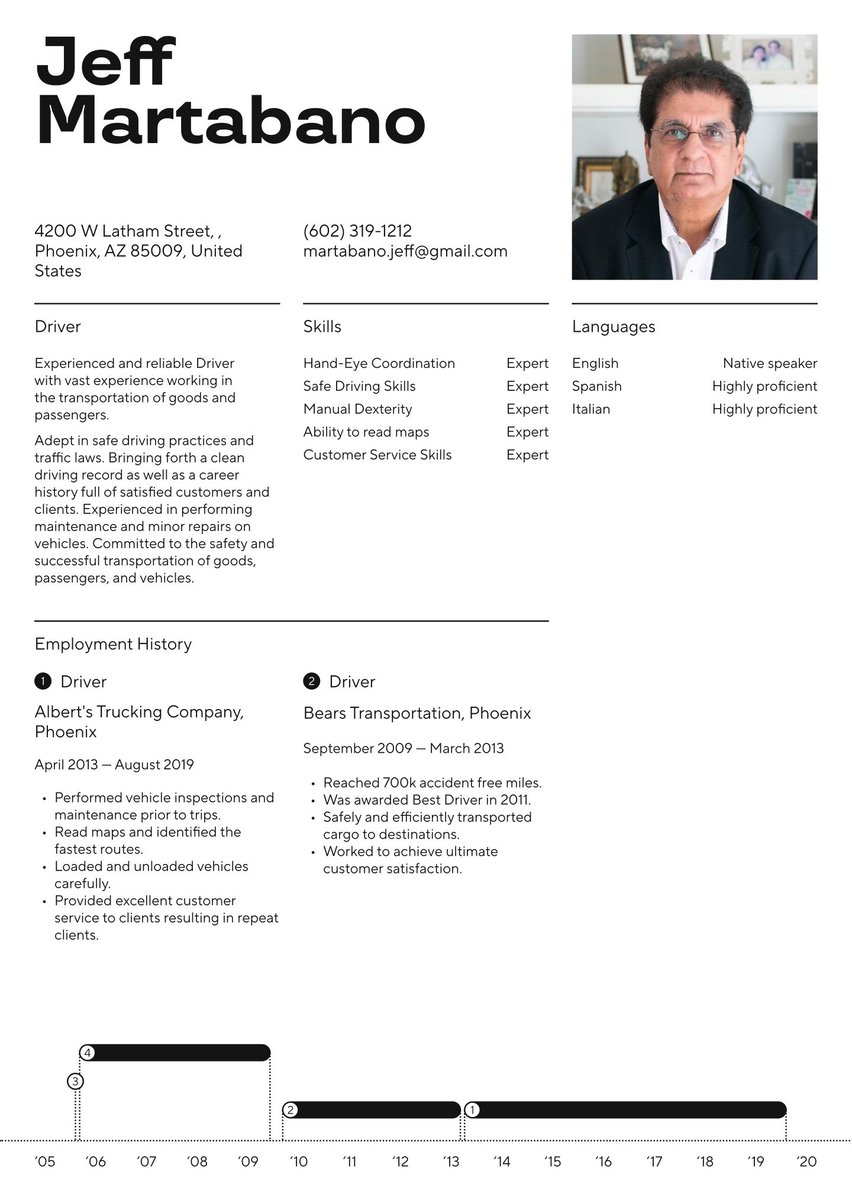

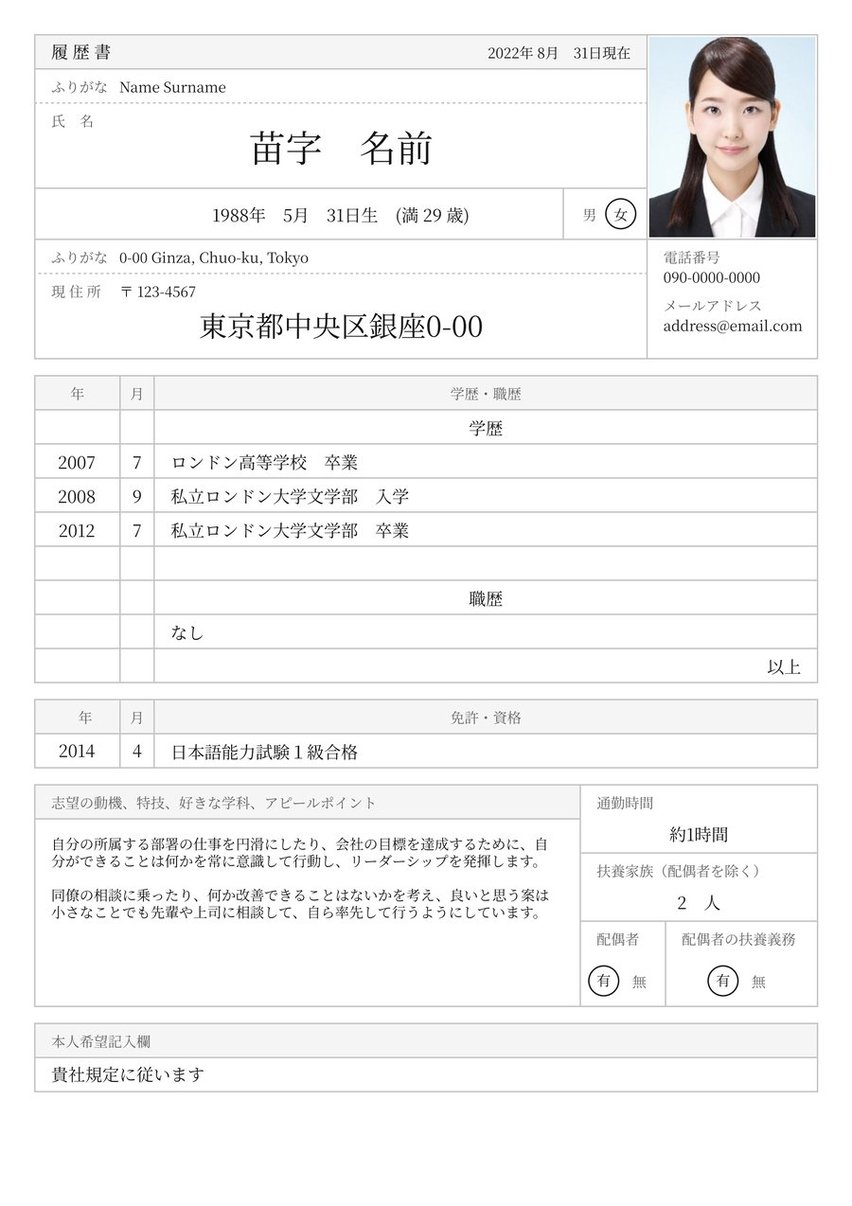

If you're ready for your next position as a loan processor, you'll need a loan processor resume that makes the case for your employment. Convincing the hiring manager that you have what it takes to review and organize other people's applications may seem daunting, but Resume.io is here to help. With 350+ resume examples and writing guides, we're an expert resource for job seekers at all stages of their careers.

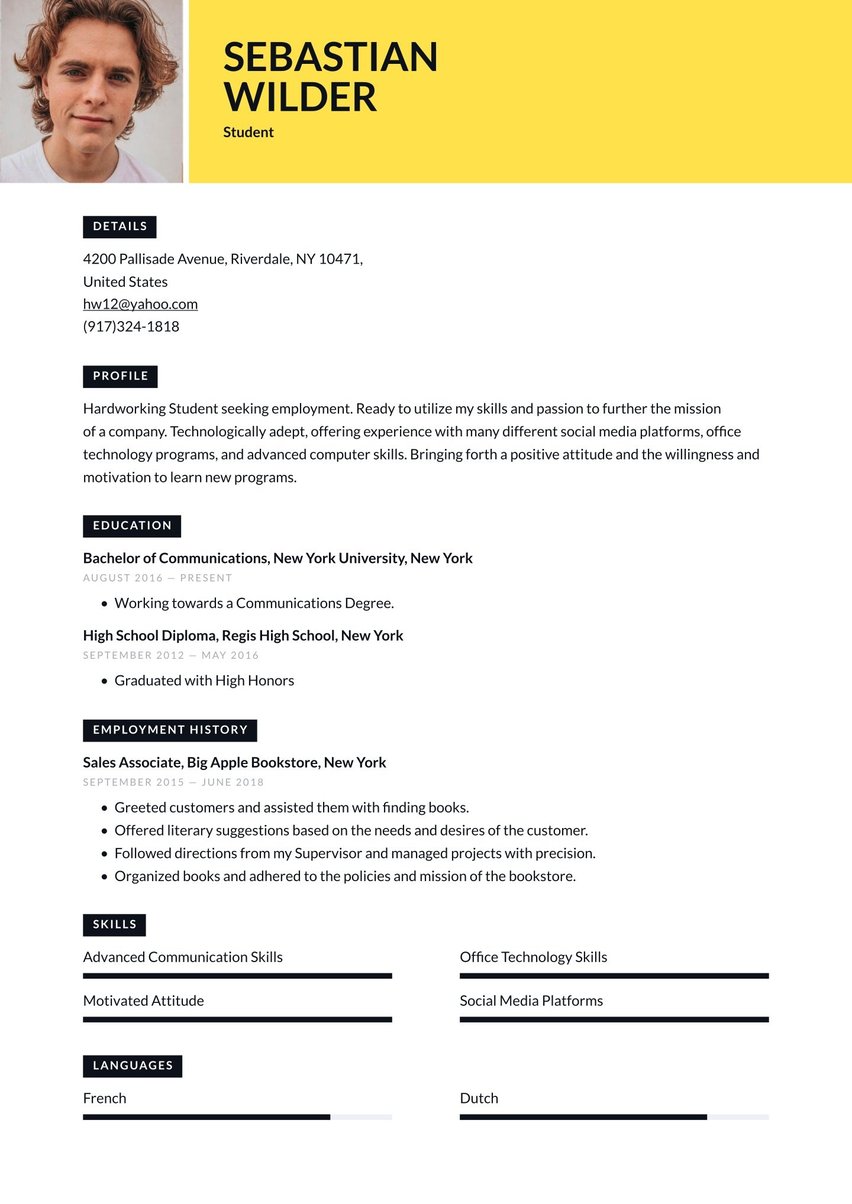

Loan Processor resume examples by experience level

Here's what we'll cover in this writing guide along with the loan processor resume example:

- What does a loan processor do?

- How to write a loan processor resume (tips and tricks)

- The best format for a loan processor resume

- Advice on each section of your resume (summary, work history, education, skills)

- Professional resume layout and design hints.

What does a loan processor do?

Loan processors are responsible for performing the initial assessment and appraisal of loan borrowers by examining their applications. Ultimately the loan processor decides if the applicant is a good candidate for a loan. Loan processors might perform appraisals or individuals or of businesses.

At the forefront of a loan processor’s duties, is the goal of helping qualified applicants obtain loans in a timely manner, while protecting an organization’s credibility. In addition to analyzing and appraising applications, loan processors also write and finalize contracts. Loan processors should have excellent communications and sales skills, as well as a strong working knowledge of banking procedures and computer software.

An ideal candidate holds a bachelor’s degree in a related field such as finance or economics, and has experience working in a loan processor role or in a banking or financial setting.

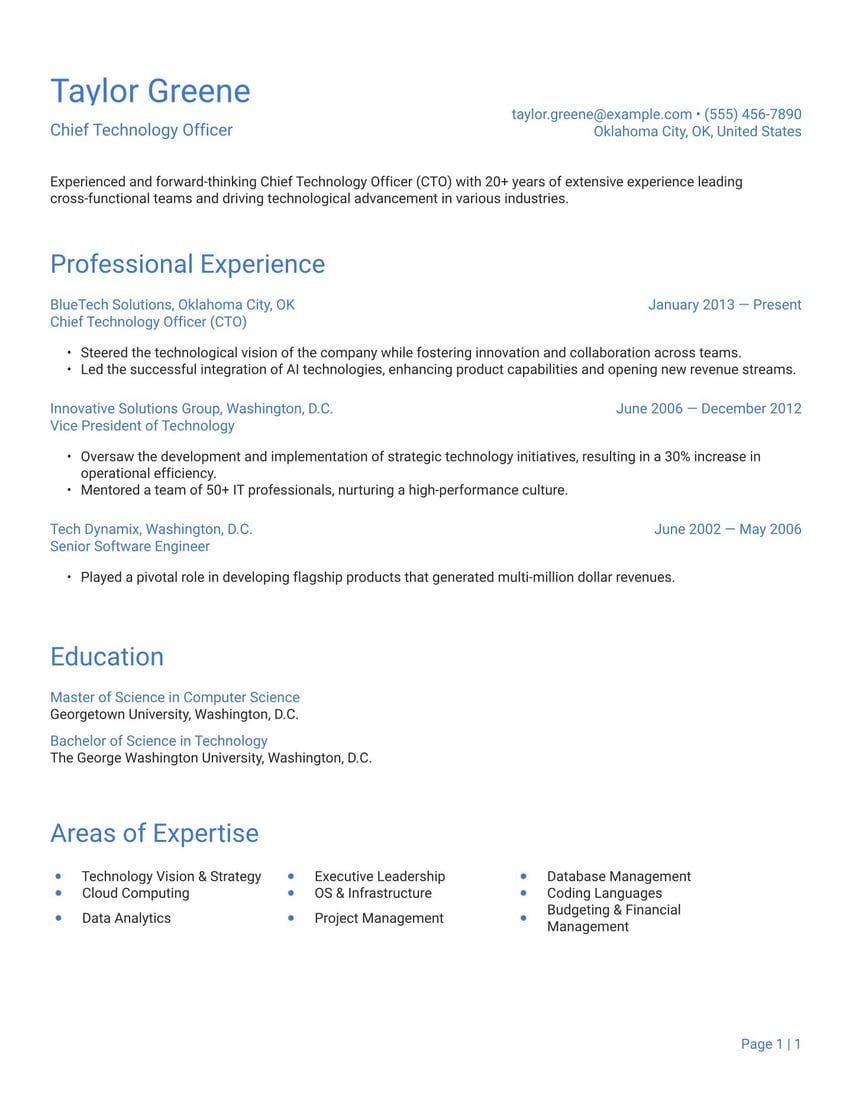

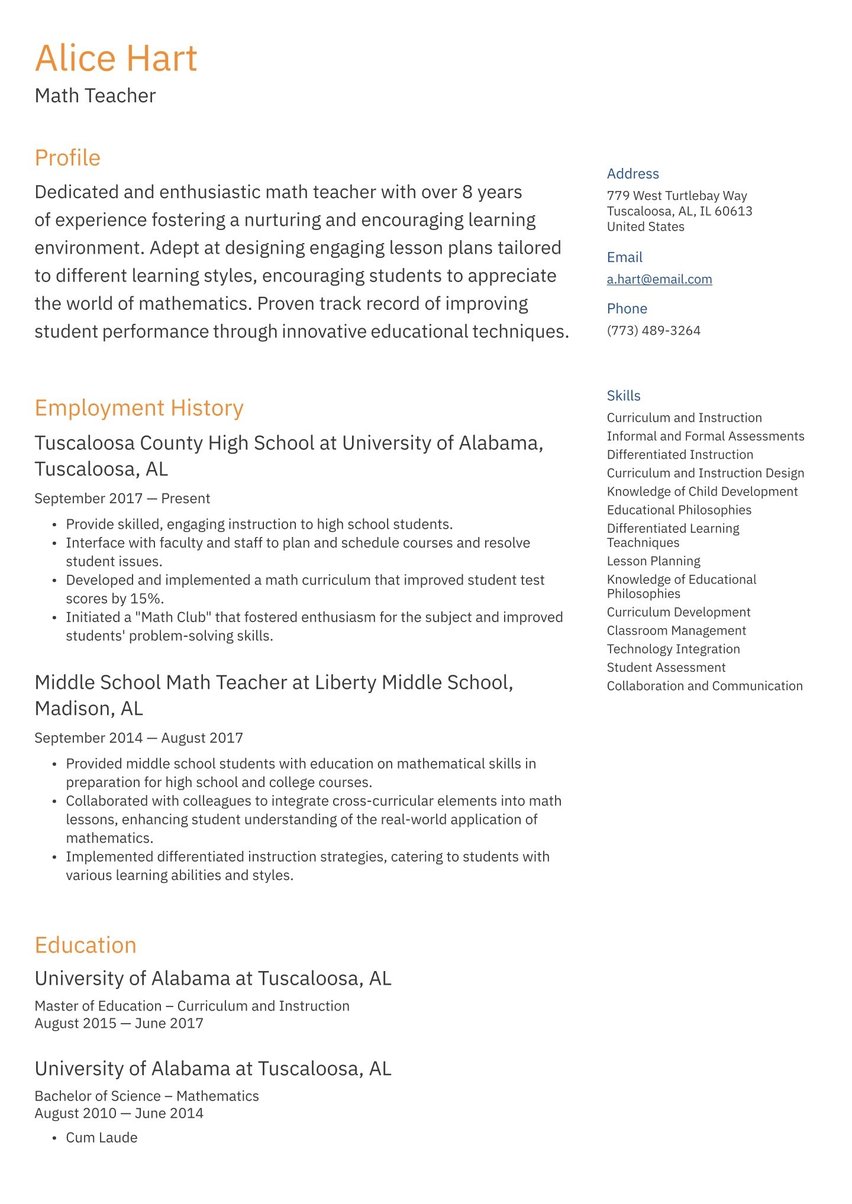

How to write a loan processor resume

A great loan processor resume starts with an organized structure that allows the hiring manager to find the information they are looking for. Your CV should contain the following elements:

- The resume header

- The resume summary (aka profile or personal statement)

- The employment history section

- The resume skills section

- The education section

A loan processor should be adept at accurately analyzing loan applications, while providing the best possible customer service to clients. It is important to demonstrate strong communication skills on your resume, while also highlighting great attention to detail. Loan processors should be knowledgable about lending procedures, and able to protect the credibility of the institution they work for.

A loan processor resume should effectively highlight one’s ability to work well with others, while following relevant rules and regulations. A winning loan processor resume should demonstrate one’s ability to effectively network and cultivate positive relationships.

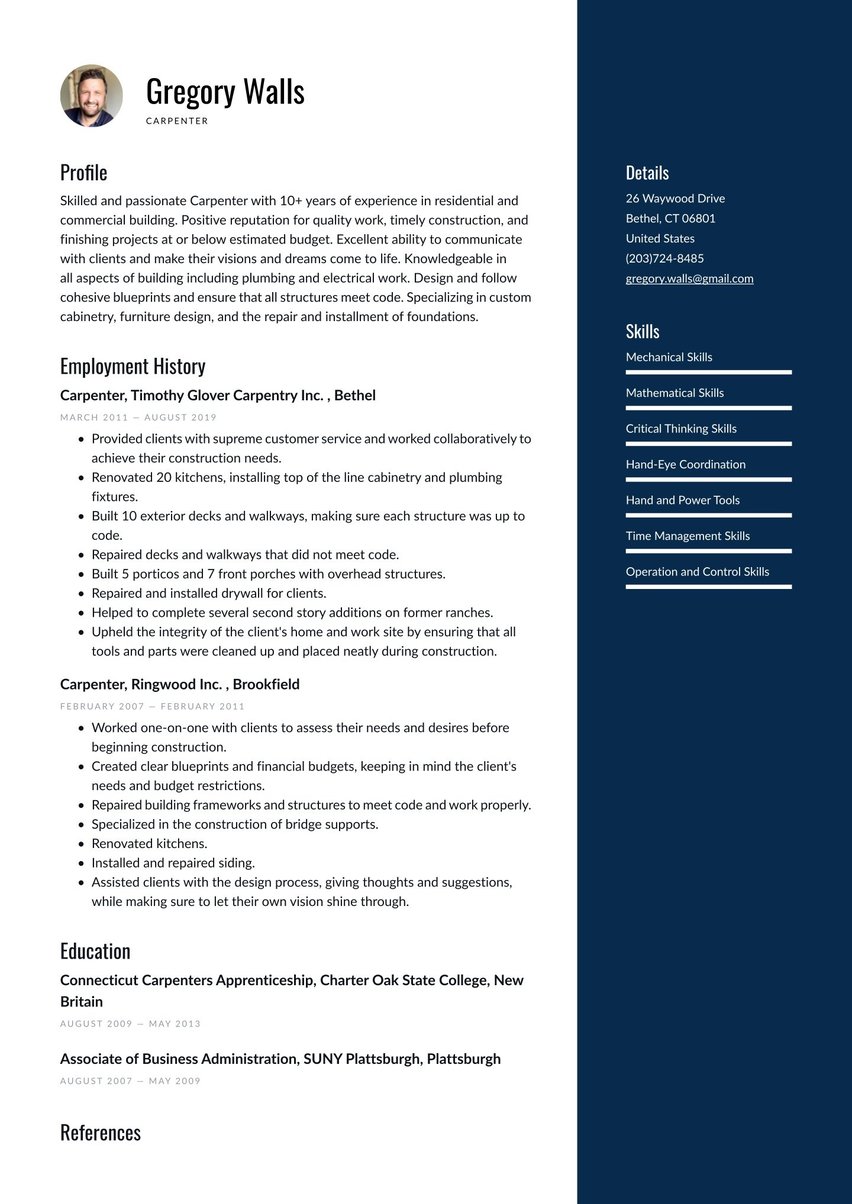

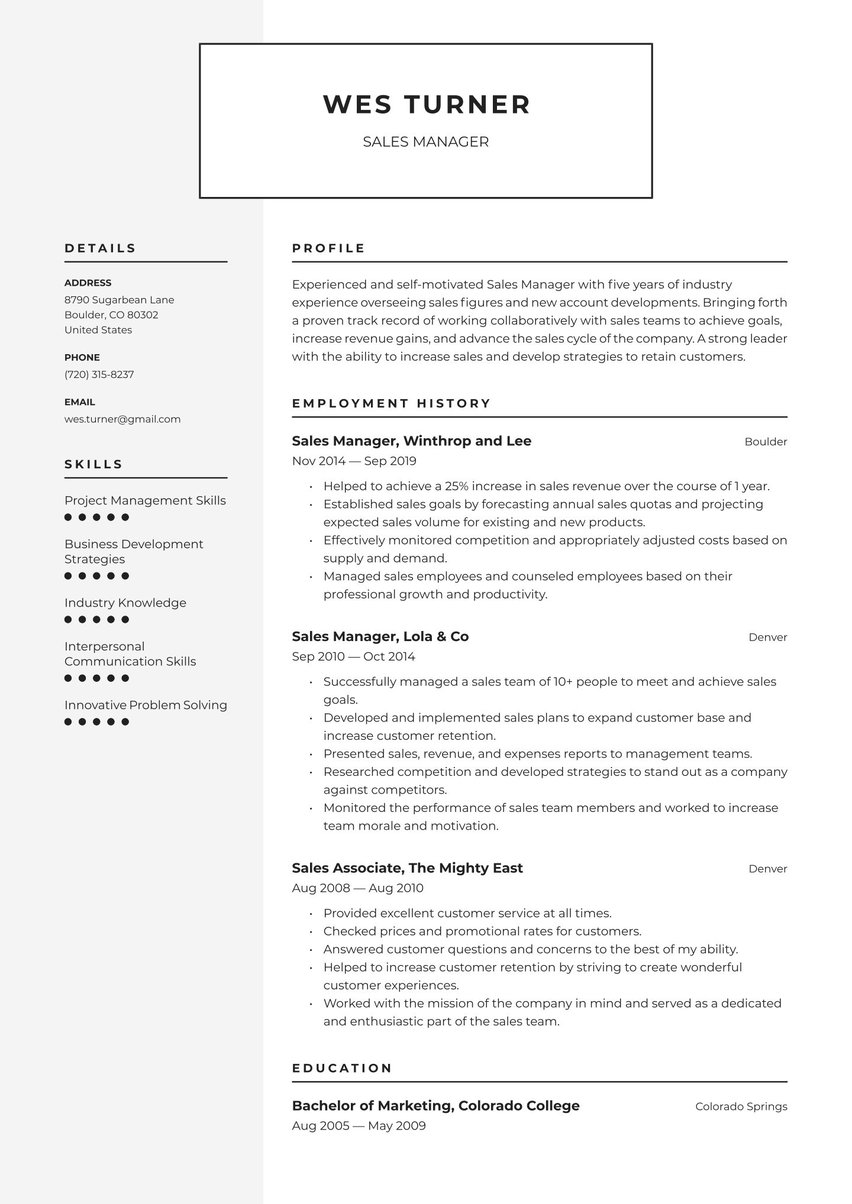

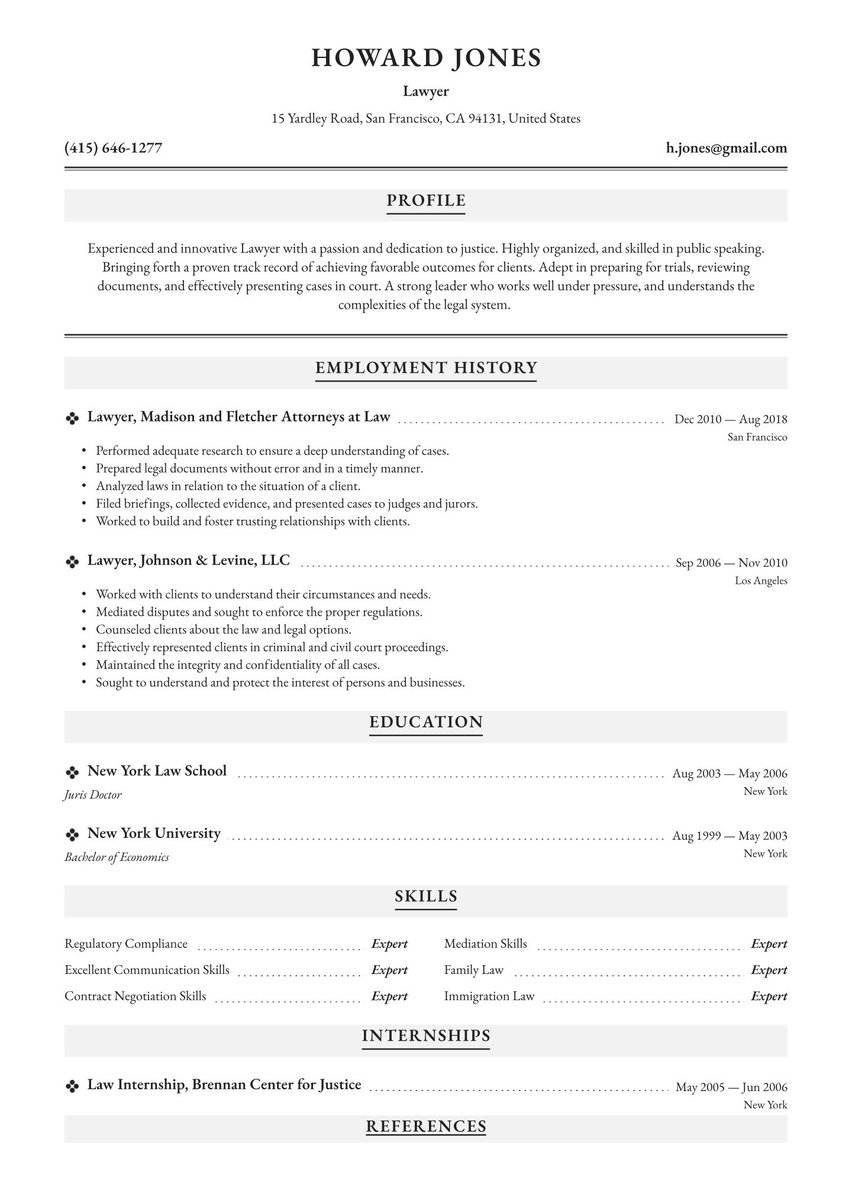

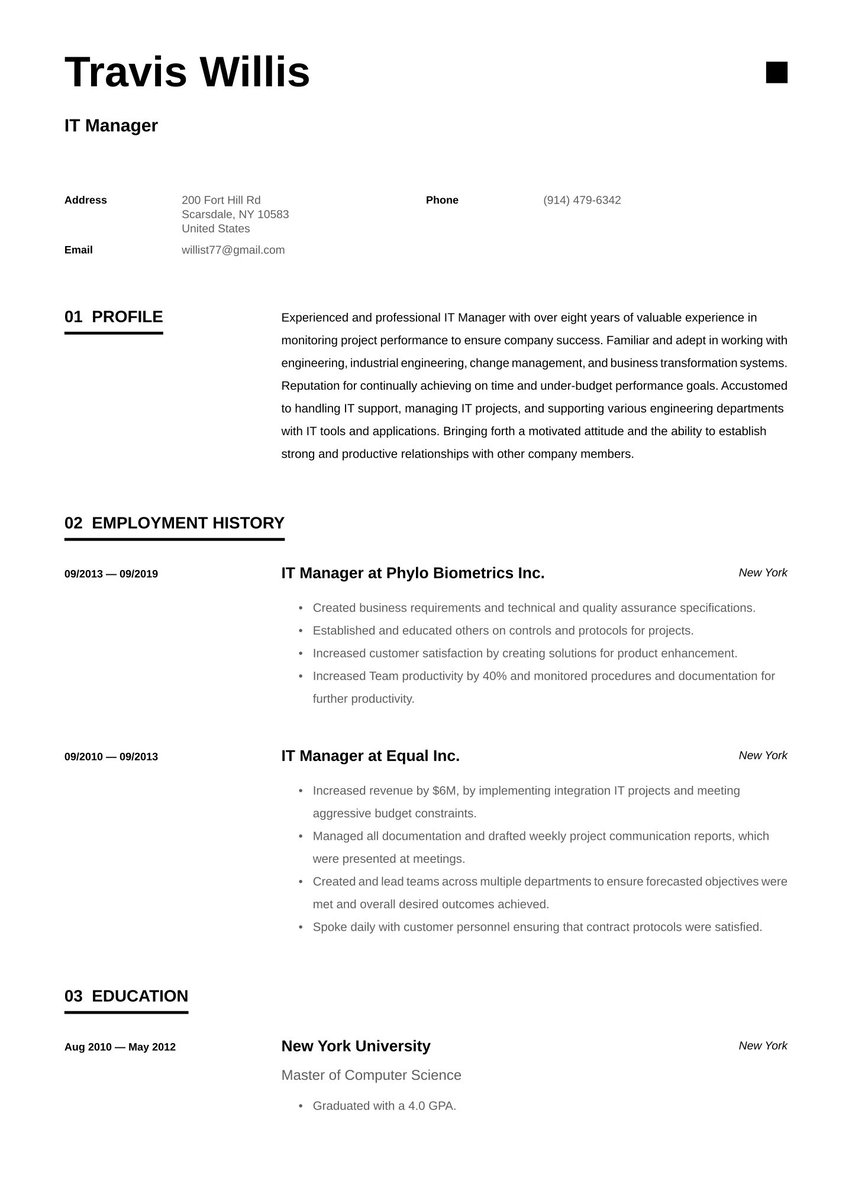

Choosing the best resume format for a loan processor

Loan processors should opt for the reverse chronological resume format is this structure focuses on the employment history section where hiring managers can evaluate your previous experience. This format is also preferred by employers and the Applicant Tracking Systems (ATS) in use at most medium and large companies. The reverse chronological resume format gets its name from the fact that your previous roles will be listed starting with the most recent (or current) and working backwards up to ten years.

While other types of resume formats exist, we don't recommend them for applicants in structured industries like banking and finance because they can make you come across as inexperienced or as if you have something to hide in your previous positions. Our guide to resume formatting will walk you through the different structures in more detail.

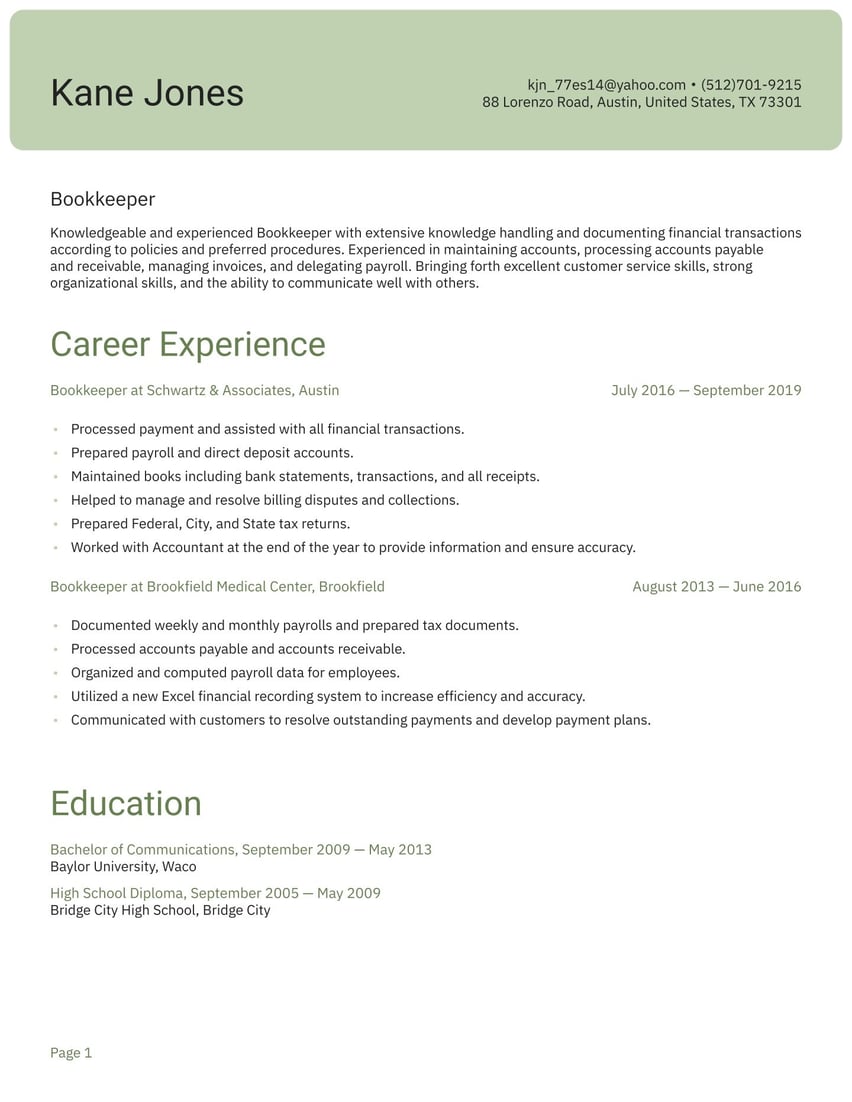

Find more inspiration and writing advice in our related accounting and finance resume examples including our loan officer resume sample, auditing clerk resume example, personal banker resume sample, and bookkeeper resume sample.

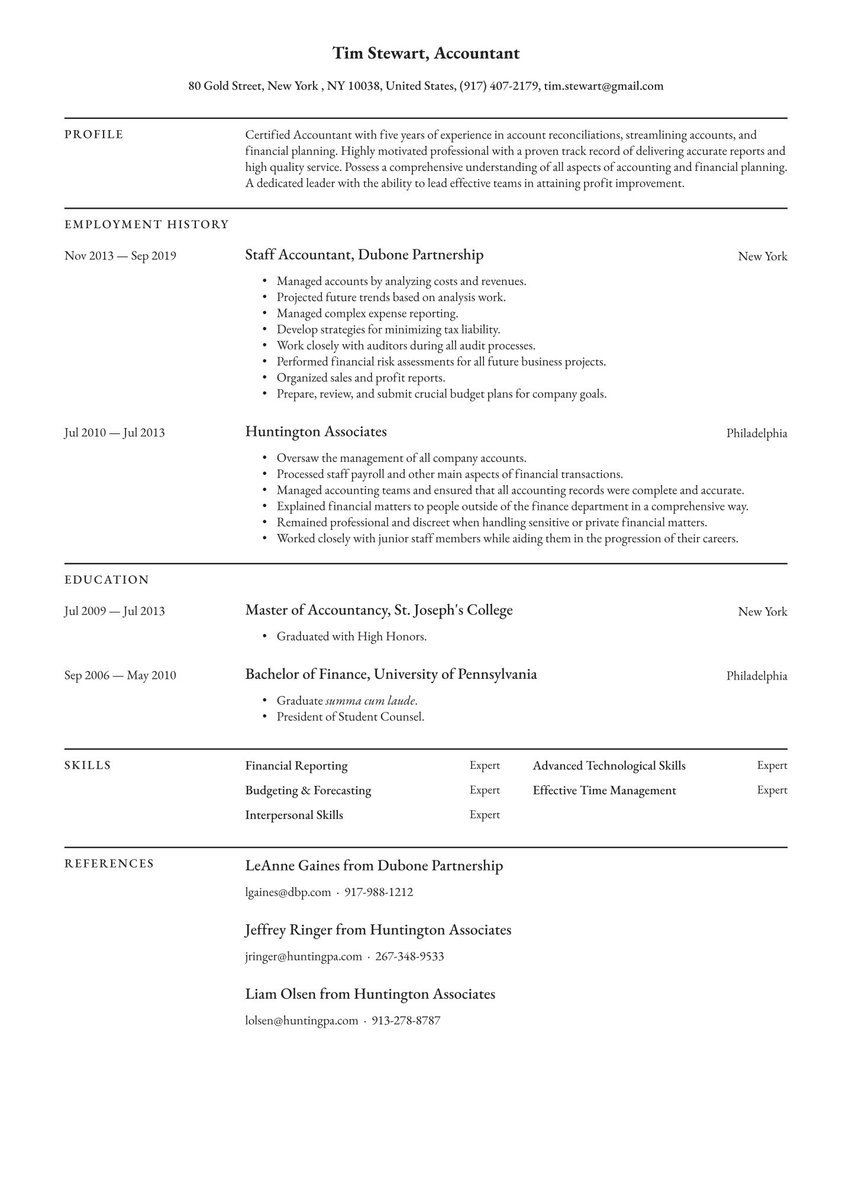

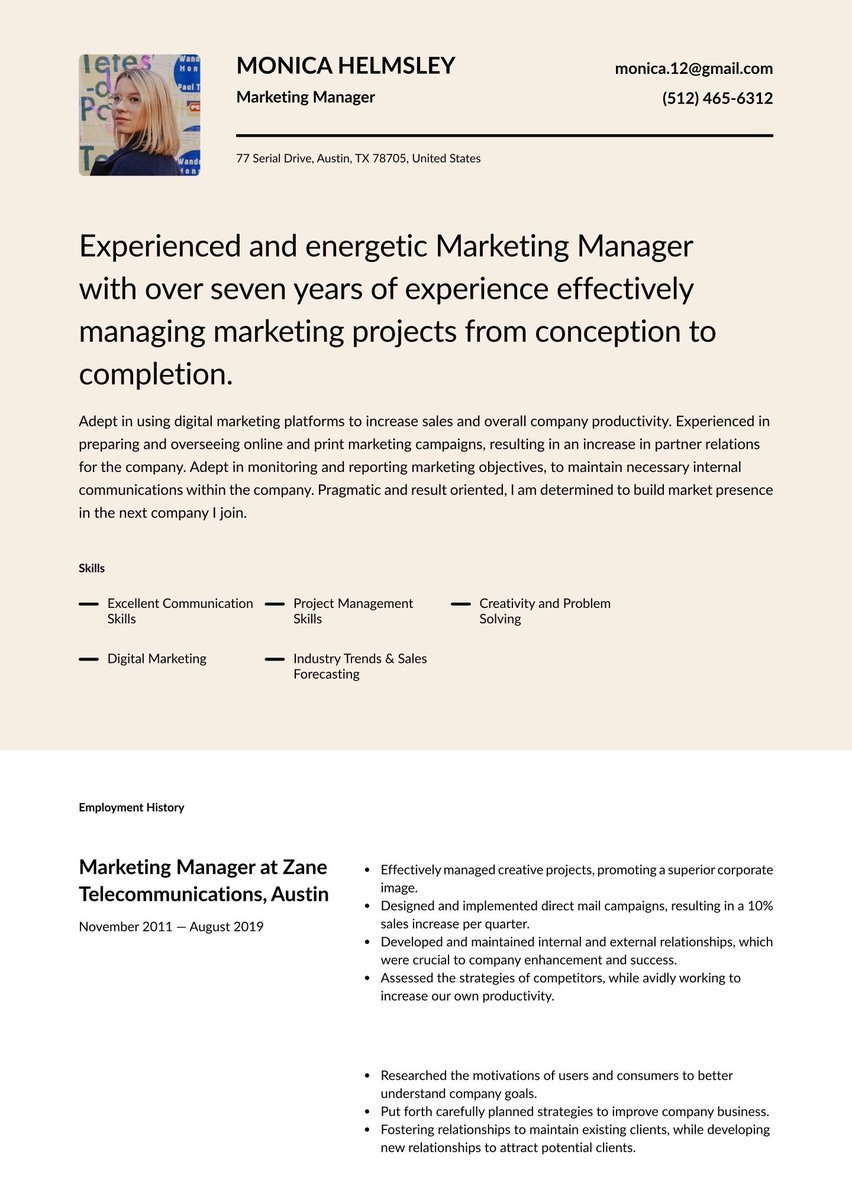

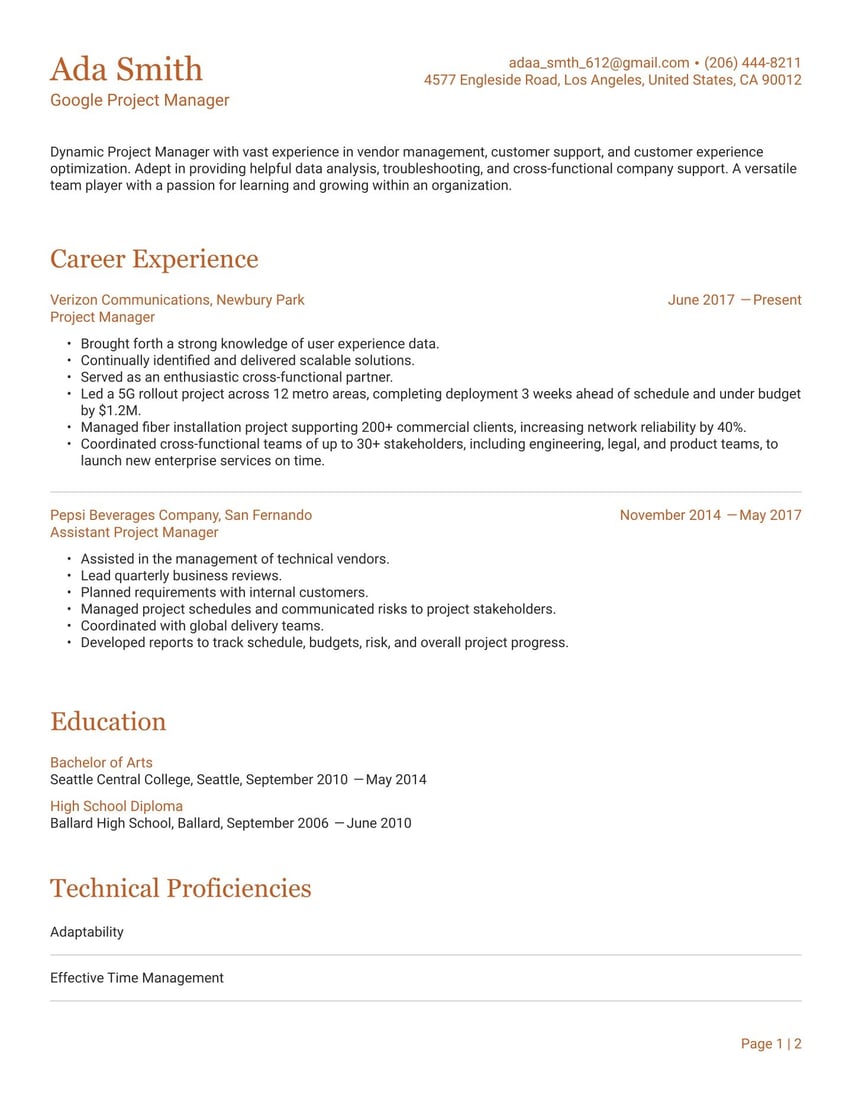

Resume summary example

The resume summary offers 3-5 sentences where you can highlight your biggest accomplishments and attributes. Remember to use as many powerful action verbs and job specific information as you can. Loan processors must be able to successfully identify customer needs, while maintaining a balance between excellent customer service and adherence to lending policies. Highlighting your key attributes that effectively showcase your qualifications and accomplishments for this position is crucial. See our adaptable resume summary below.

Experienced and goal-oriented Loan Processor with over six years of experiencing protecting the credibility of organizations while providing quality assistance to persons seeking loans. Adept in assisting qualified applicants with obtaining loans in a timely manner. Able to successfully analyze and evaluate loan applications and write final contracts. Proven track record of addressing customer needs while presenting and exploring all of their financial options. The ability to cultivate trustworthy relationships, provide assistance, and abide by all regulations and laws.

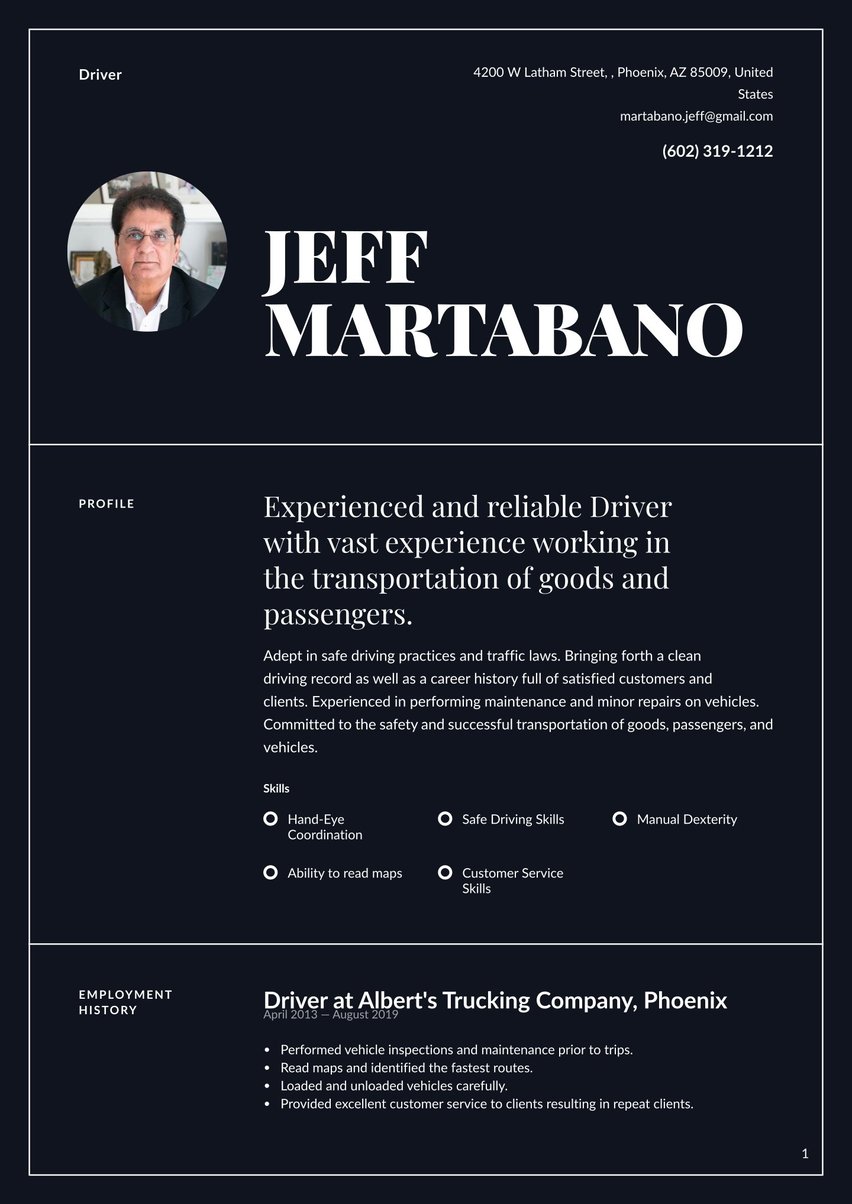

Employment history sample

The employment history section is likely the place the hiring manager's eyes will jump to as they try to assess your experience and qualifications. List all positions relevant to a loan processor role here. Make sure to include the job title, employer name, dates worked, and location. Underneath, add 4-5 bullet points that capture your main duties and skills. Remember to use powerful action verbs and mention job specific accomplishments that prove you are an excellent candidate. See our adaptable resume sample below.

Loan Processor, Wells Fargo

Jun 2007 - Sep 2019, Bellevue

- Developed trustworthy relationships with clients seeking loans.

- Ran thorough credit reports and advised clients on their financial situations.

- Helped client to understand the terms of the best loan suited for them and their lifestyle.

- Worked quickly and efficiently to have loans processed as quickly as possible.

- Increased the rate of return clients with unparalleled customer service and a commitment to satisfaction.

Loan Processor, ABC Bank

Apr 2001 - May 2007, Seattle

- Reviewed loan applications and assist home buyers seeking mortgage loans.

- Assisted home buyers with gathering the proper documentation for loan approval.

- Ordered credit and title reports.

- Ensured the privacy and security of a customer's files every step of the way.

- Communicated with attorneys, county clerks, and title companies.

- Made recommendations for alternate actions as needed.

- Processed hundreds of loan applications in a timely and effective manner.

Executive Assistant to Loan Processor, ABC Bank

Apr 2000 - Apr 2001, Seattle

- Assisted Loan Processor with any clerical and administrative duties necessary.

- Became very familiar with the loan process and cultivated positive relationships with those involved in the process.

- Supported managing partners of the company by assisting with duties as needed.

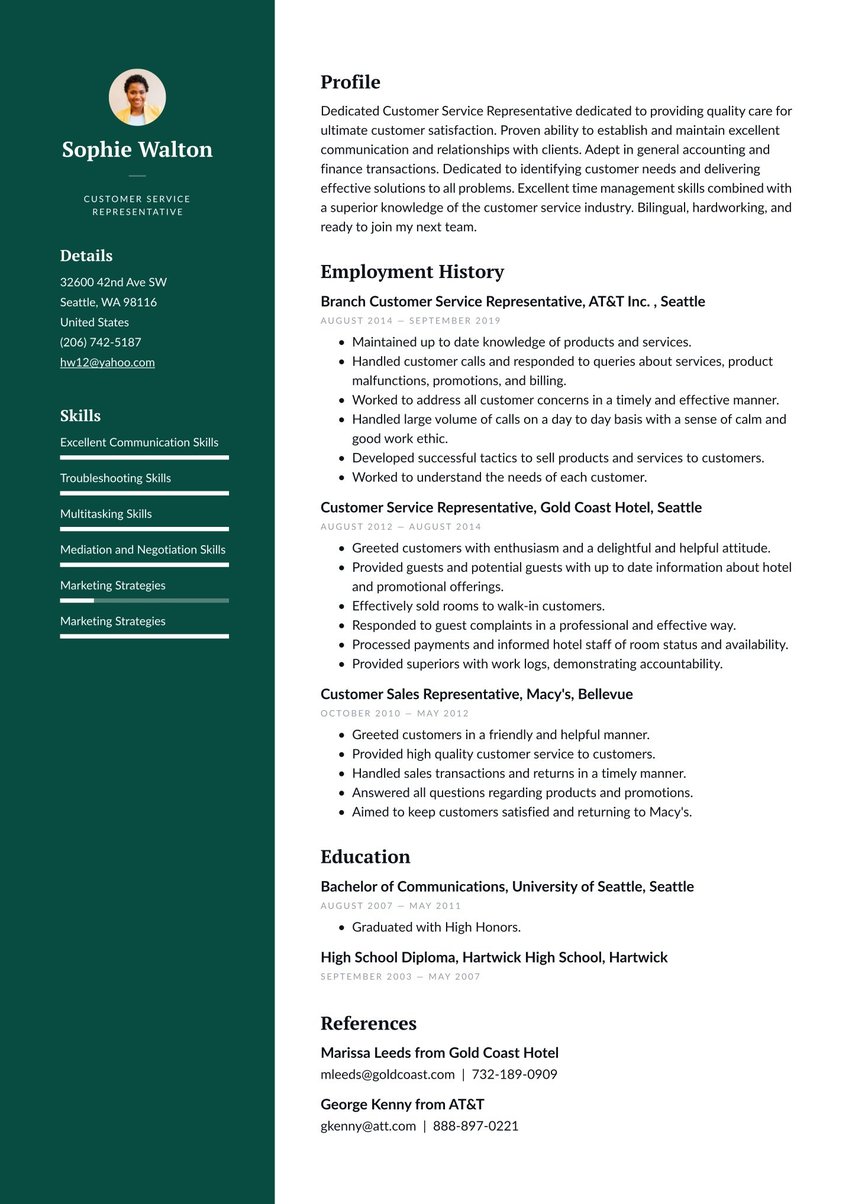

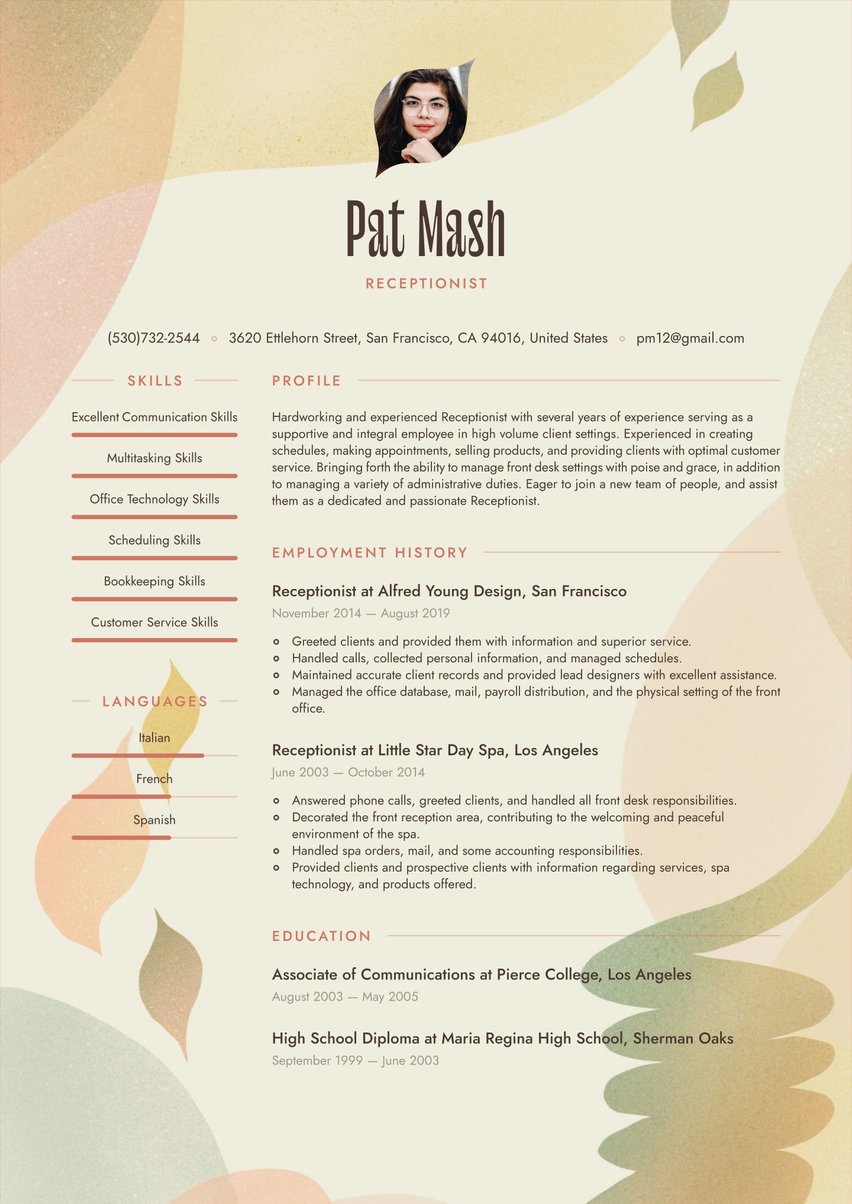

CV skills example

The CV skills section is the place to call the hiring manager's attention to your top qualities and attributes. You'll want to include a mix of soft skills, like attention to detail or organization skills, along with your hard skills, or technical abilities, like any loan processing software you know how to use. Make sure to read the job description closely and pull out any particular skills the employer is looking for. Place them on this section of your CV to increase your chances of passing the automated resume scanners in use at many large and medium financial institutions. In order to be considered a strong candidate you must present yourself as a highly capable and detail oriented individual, who has superior knowledge of lending procedures and policies. See our adaptable resume example below.

- Customer Service Skills

- Risk Analysis Skills

- Strong Organizational Skills

- Knowledge of Banking Computer Software

- Advanced Mathematical Skills

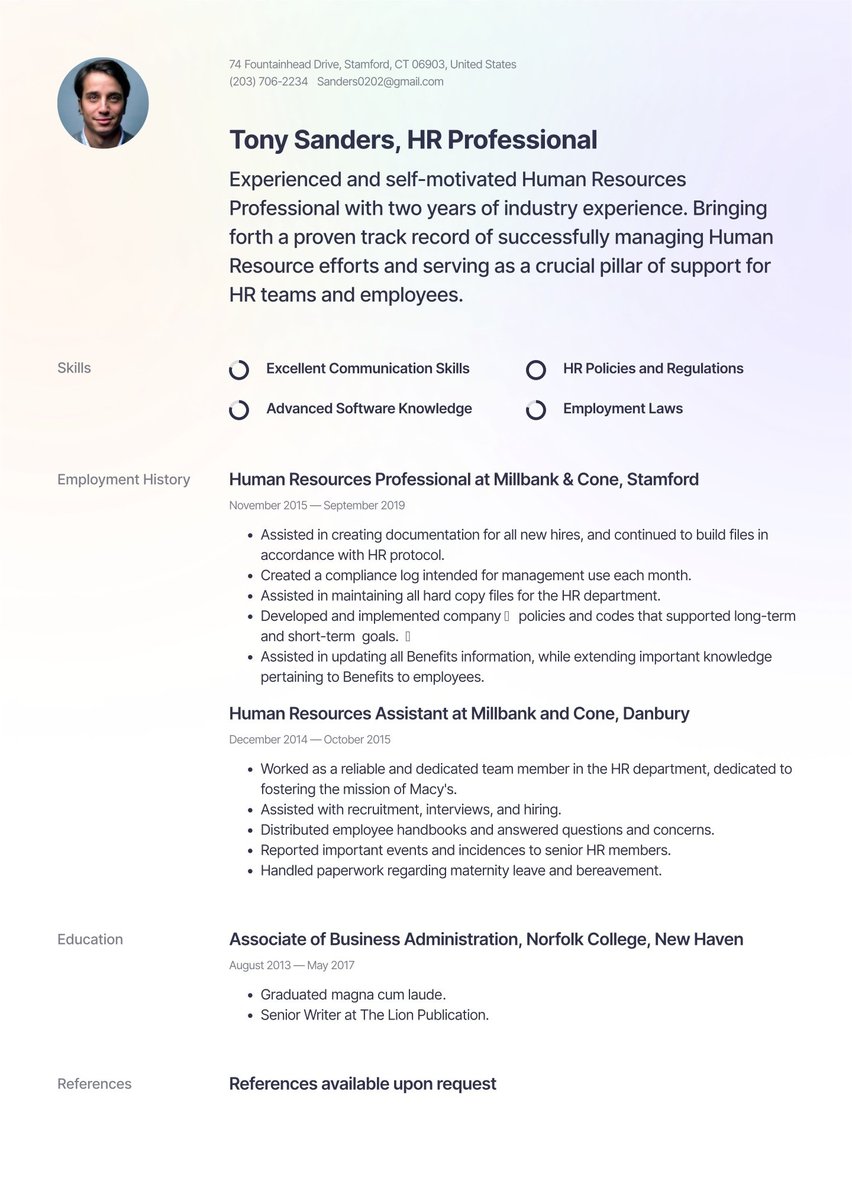

Loan processor resume education example

While loan processors aren't required to have higher education, most banks and financial institutions prefer to hire candidates with at least a bachelor's degree in finance, accounting, or a related field. The education section is the place to list all degrees and certifications here. Any honors or distinctions should be noted here as well. If you hold a degree higher than a bachelor's degree, you may leave out your high school. See our adaptable resume sample below.

Ohio State University, Master of Finance

Aug 2001 - Aug 2004, Columbus

- Graduated with Distinction.

University of Washington, Bachelor of Economics

Aug 1997 - May 2001, Seattle

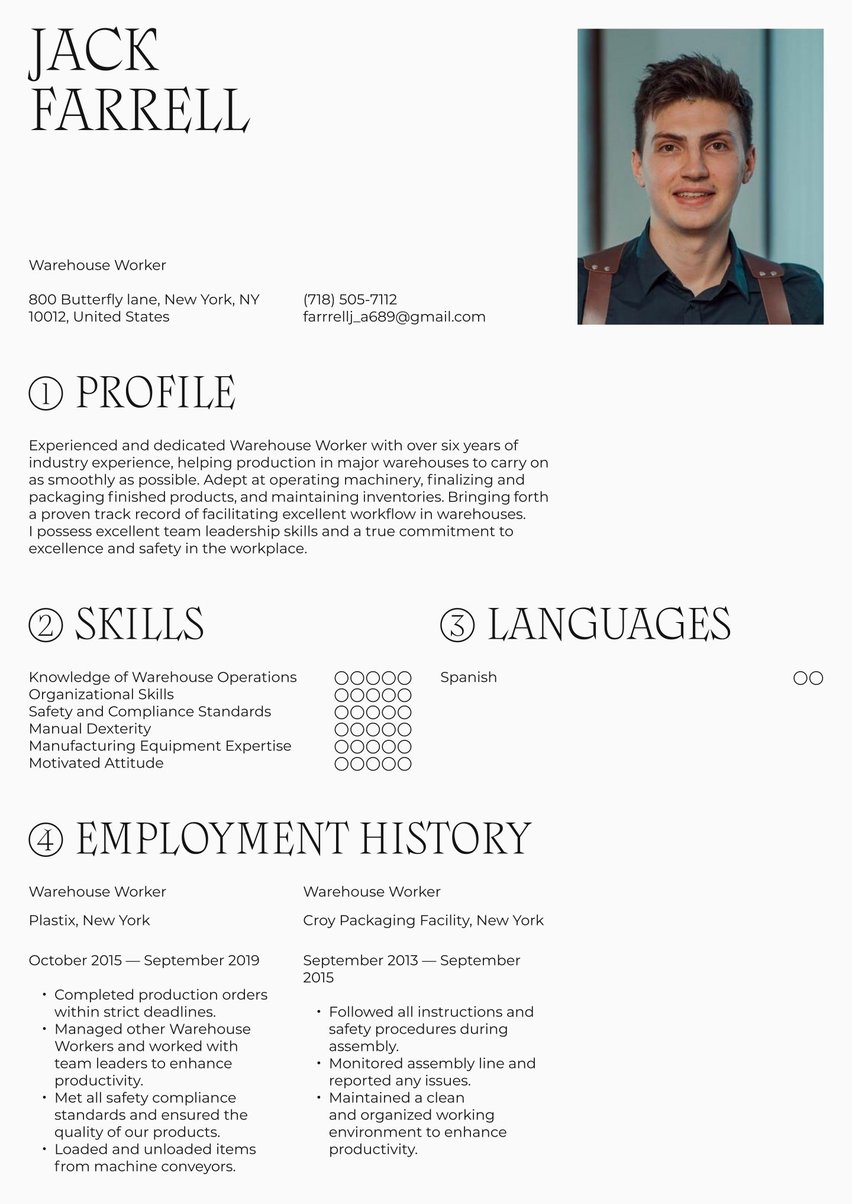

Resume layout and design

The layout and design of your loan processor resume speaks volumes about your professionalism and experience before the hiring manager ever reads a word on the page. In a formal field like finance, it's important not to go overboard with color or eccentric page design. However, a neutral color scheme and an attractive header will help your name and contact information stand out and leave a lasting impression on the hiring manager. Here are some more tips for creating a great resume layout:

- Keep a balance of white space to text to avoid visual fatigue for the reader

- Use consistent font styles and sizes throughout your resume

- Choose a professional resume template to quickly create an attractive layout.

- Use creative section heading titles which may throw off the ATS

- Go overboard with color or images

- Forget to proofread for spelling and grammar mistakes

Key takeaways for a loan processor resume

- You should exude the qualities needed to be a successful loan processor both in the content and the layout of your resume

- The reverse chronological resume format is the best choice for finance professionals and the structure hiring managers expect to see

- Don't forget to place keywords from the job description throughout your resume, especially in the summary and skills sections

- Create a great header in a few clicks by using our adaptable loan processor resume sample

.jpg)

.jpg)