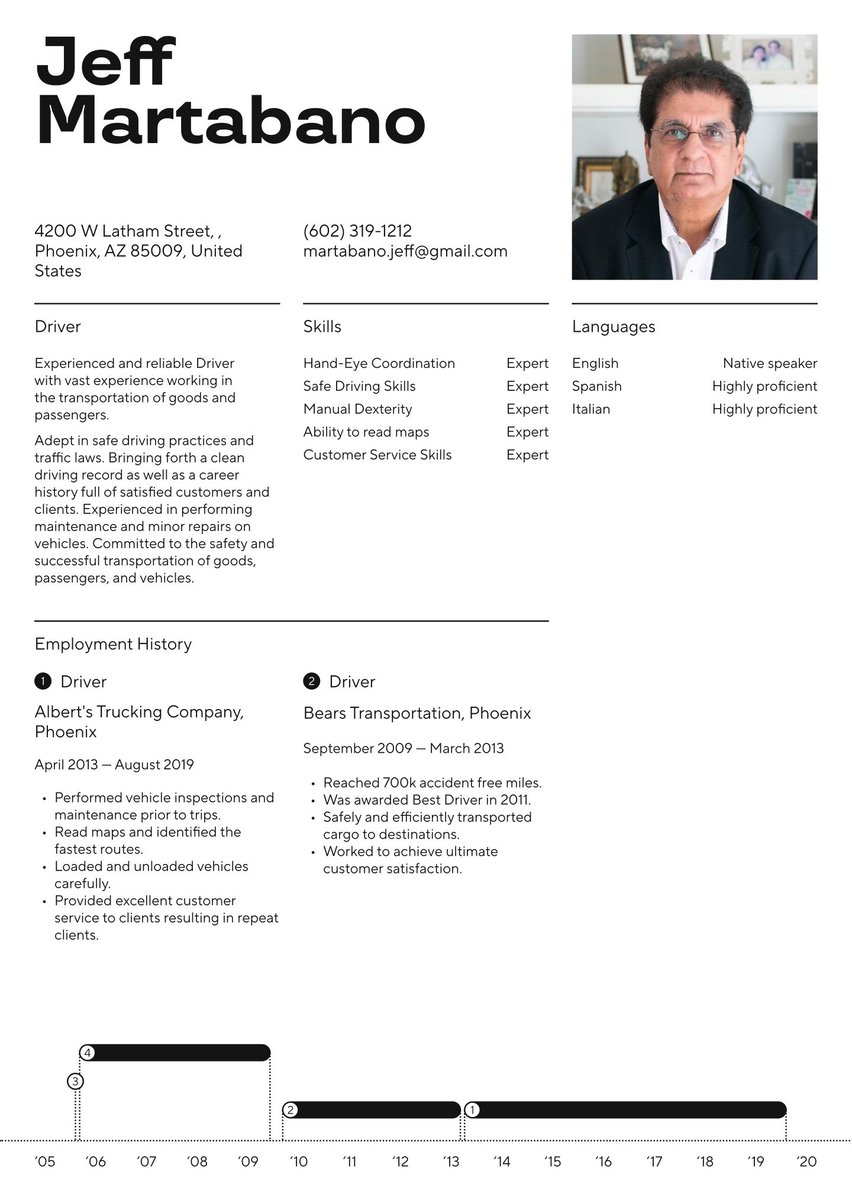

Dedicated Title Insurance Coordinator with exceptional skills communicating and working with realtors, lenders, buyers, and sellers. Over 10 years’ experience in title reports and closing procedures, with in-depth knowledge of all real estate procedures, laws, and markets. Committed to ensuring every closing transaction is smooth and stress-free for buyers, sellers, and real estate agents.

06/2015 - 12/2022, Title Insurance Coordinator , Judicial Title, White Plains

- Assisted 220+ clients and about 140 real estate professionals with resolving clearance of all files prior to closing.

- Provided timely assurance of a clear title, and secured lien payoffs, mortgages, real estate tax balances, and more.

- Consistently efficient in preparing legal documents for clients and proceedings, as well as input applications, recorded documents, and completed final title policies.

- Received eight Employee of the Month awards, recognizing customer service skills dealing with realtors, lenders, investors, buyers, sellers, attorneys, and underwriters.

- Remained up to date about relevant laws and regulations.

07/2012 - 05/2015, Title Insurance Coordinator , Realrise, New York

- Communicated in a professional, personable manner with lenders, real estate offices, and service companies to obtain the information needed for the closing.

- Prepared settlement sheets and all documents for closings.

- Verified accuracy of lender packages.

- Prepared and amended closing policies, and finalized title bill to reflect any changes or updates.

- Scheduled and assisted with all closing processes.

09/2010 - 05/2019, Associate of Communications, Marymount College, White Plains

09/2006 - 06/2010, High School Diploma, Rockville High School, Rockville

- English

- Chinese

- Knowledge of Clearing Title Processes

- Real Estate Procedures

- Commercial Transactions

- Coordinating Skills

- Computer Based Research Programs

- Knowledge of Relevant Laws and Regulations

Title insurance is a key part of any real estate transaction. You help give peace of mind to new property owners. Now Resume.io can help give you peace of mind in your job search for a new title insurance coordinator position.

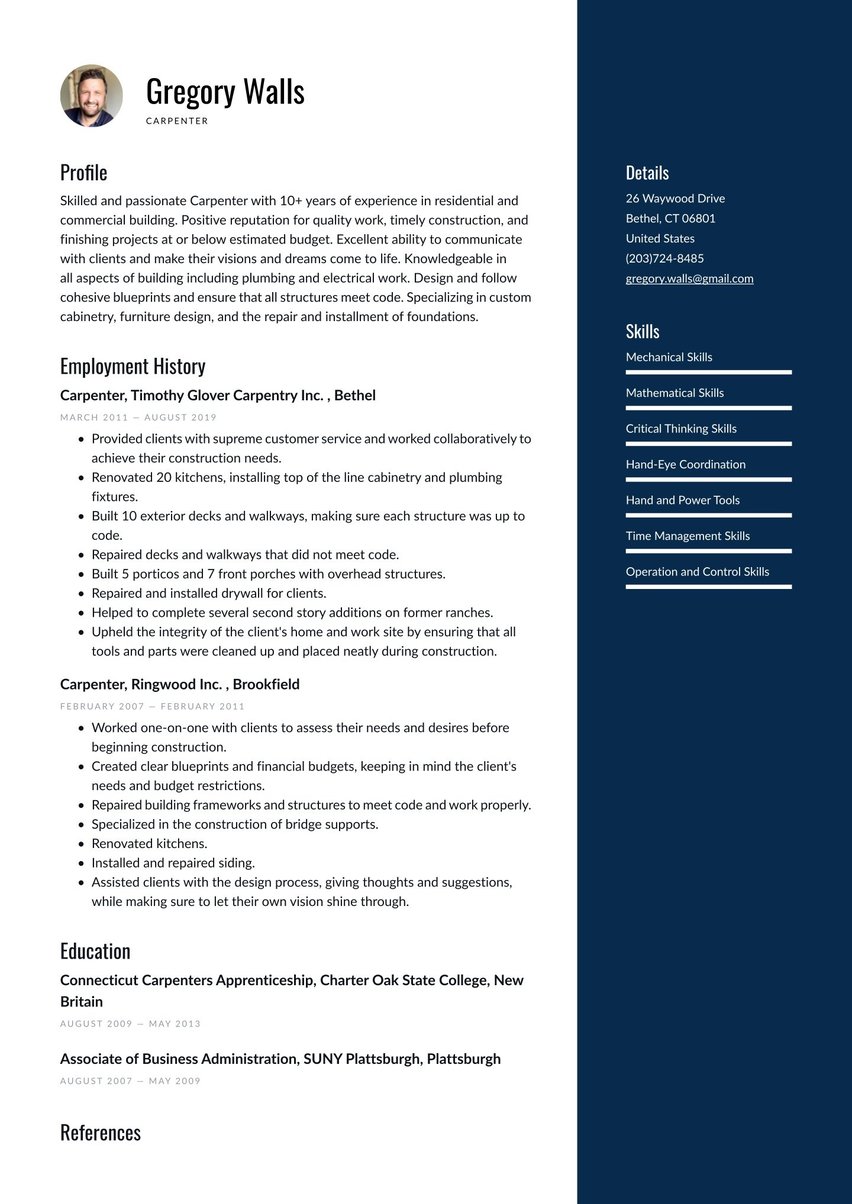

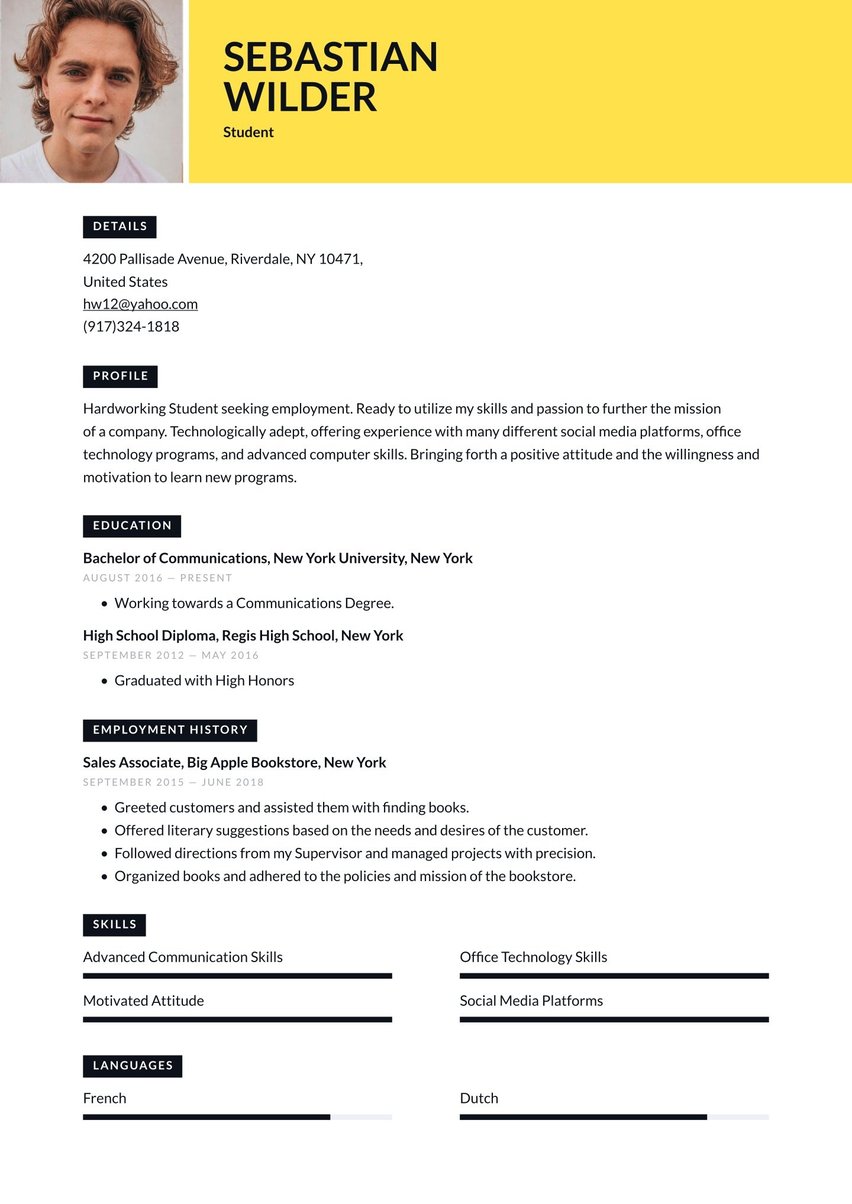

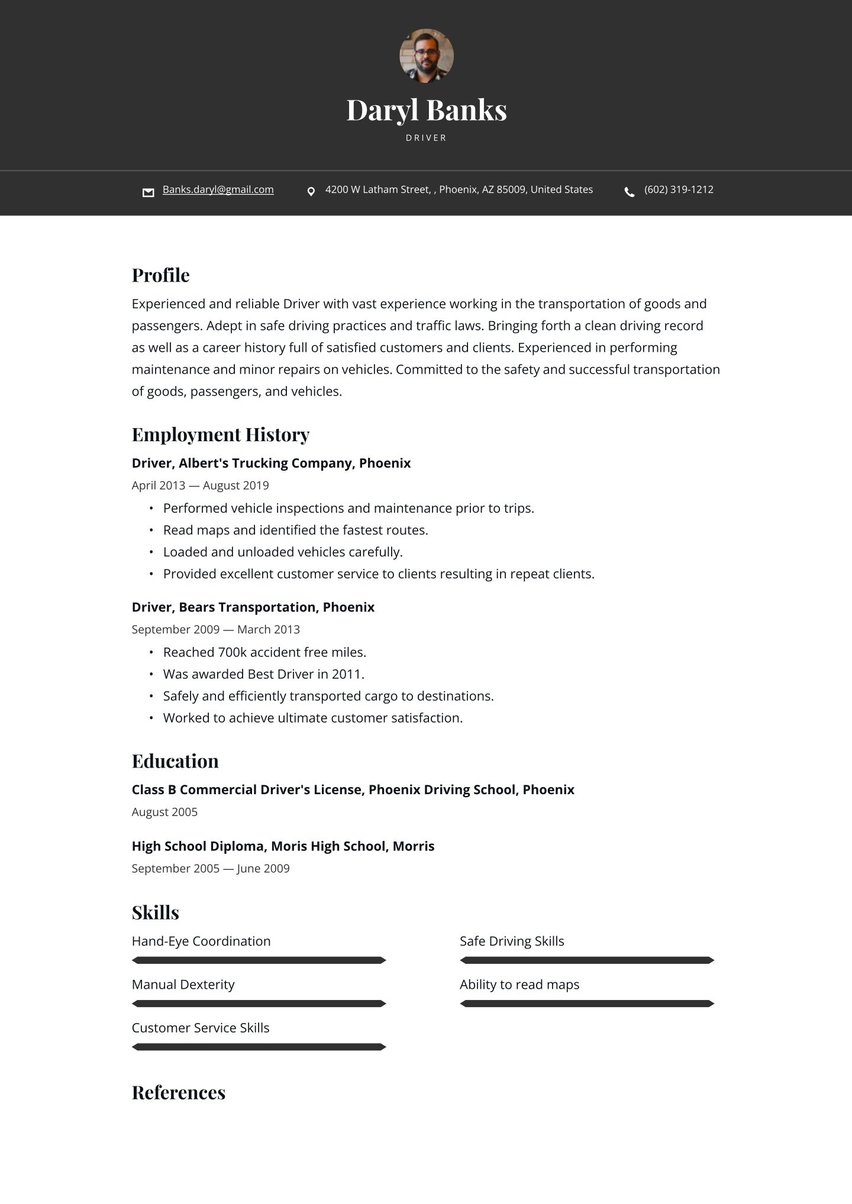

Title Insurance Coordinator resume examples by experience level

Resume.io’s job search resources include more than 300 occupation-specific resume examples, with corresponding writing guides.

By following the helpful tips in this guide on creating a title insurance coordinator resume, you will be on your way to landing that position you have been looking for.

Keep reading as we discuss:

- A snapshot of what title insurance coordinators do

- The proper resume framework and best resume format for title insurance coordinators

- Having the strongest impact each resume section: header, profile, employment history, education and skills

- Layout and design tips for an eye-pleasing, reader-friendly resume document

Let’s get started!

What does a title insurance coordinator do?

Title insurance coordinators provide a valuable service that lessens the stress on property buyers at the time of closing. They are responsible for managing the process of searching, obtaining or releasing titles, and related legal and insurance documents, to ensure everything is in order for the new homeowner to take possession.

Job requirements for a title insurance coordinator generally include the following:

- You need an understanding of public research programs, real estate proceedings, and closing processes.

- You also need to be familiar with regulatory requirements, researching and analyzing important documents such as mortgages, liens, easements, maps, contracts, and agreements in relation to the ownership and use of property.

- You may also be required to offer administrative support, work the front desk, or complete data entry for the insurance policies you are processing.

Title insurance coordinators may work for title insurance companies, real estate firms, or legal firms and your duties may shift depending on your place of employment.

According to the U.S. Bureau of Labor Statistics (BLS), $47,310 was the median average income in 2021 for these professionals, categorized as “title examiners, abstractors, and searchers.” Average annual income data from these two sources is in the same ballpark: talent.com — $49,751 and glassdoor.com — $46,904.

How to Write a Title Insurance Coordinator Resume

Since job descriptions for a title insurance coordinator vary from one employer to the next, it’s crucial that your resume be customized to fit the hiring circumstance. That means for every job you apply for, you need a different version that targets the specific position and employer.

However, the basic framework for your insurance title coordinator resume should be the same as it would be for all other occupation-specific resumes. These are the essential components, ideally fitting on one page:

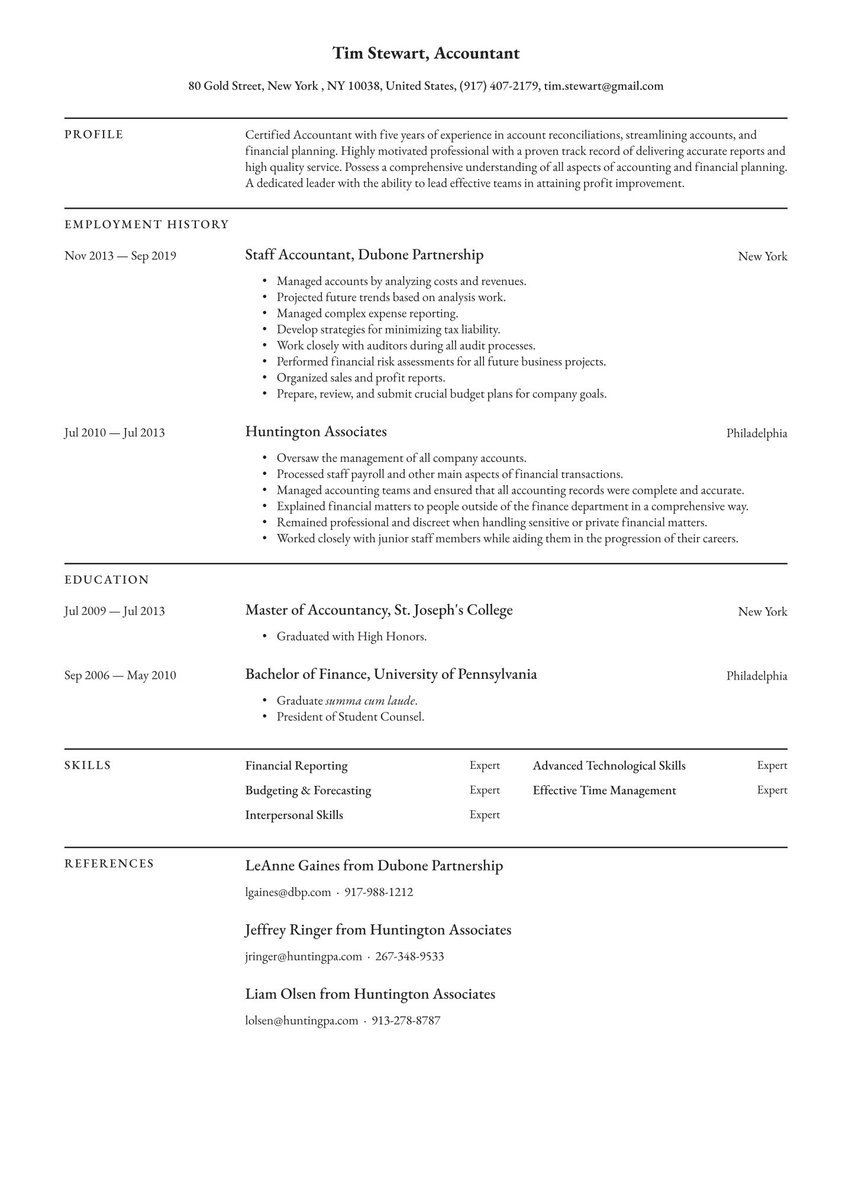

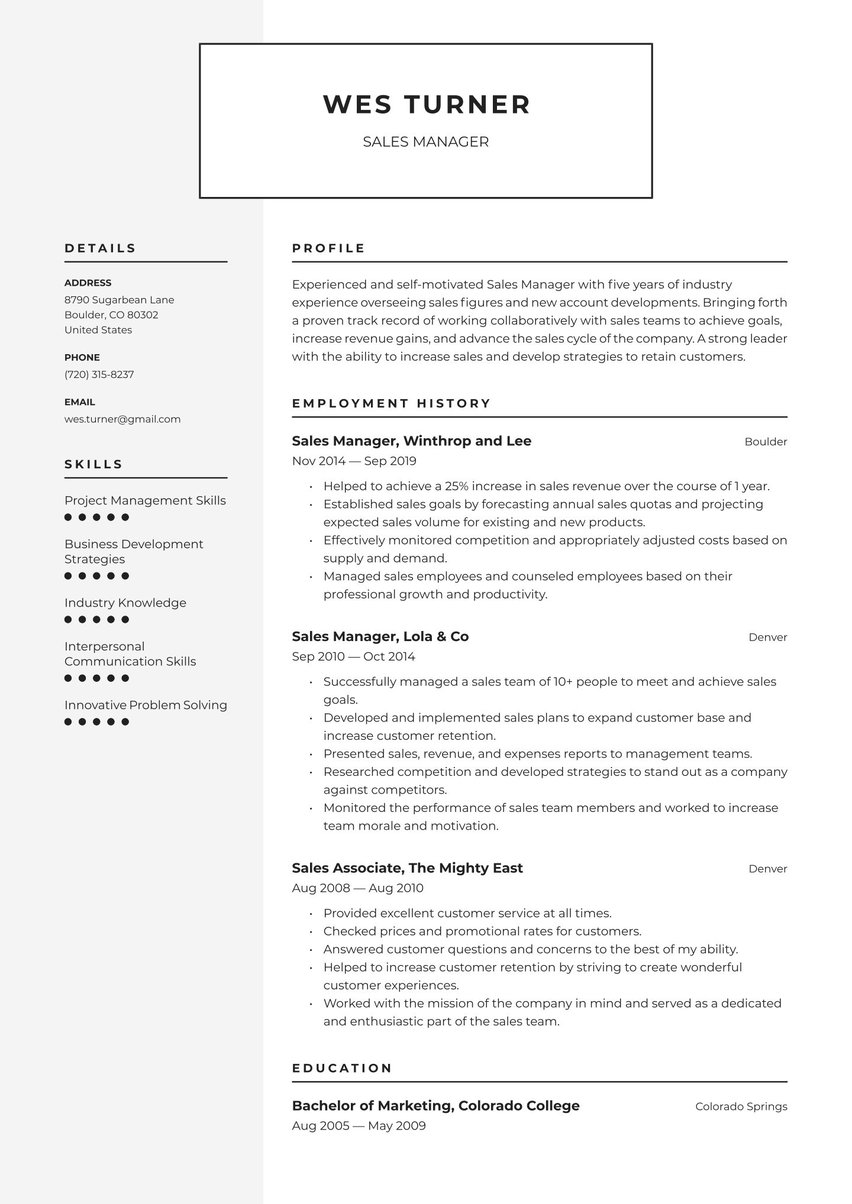

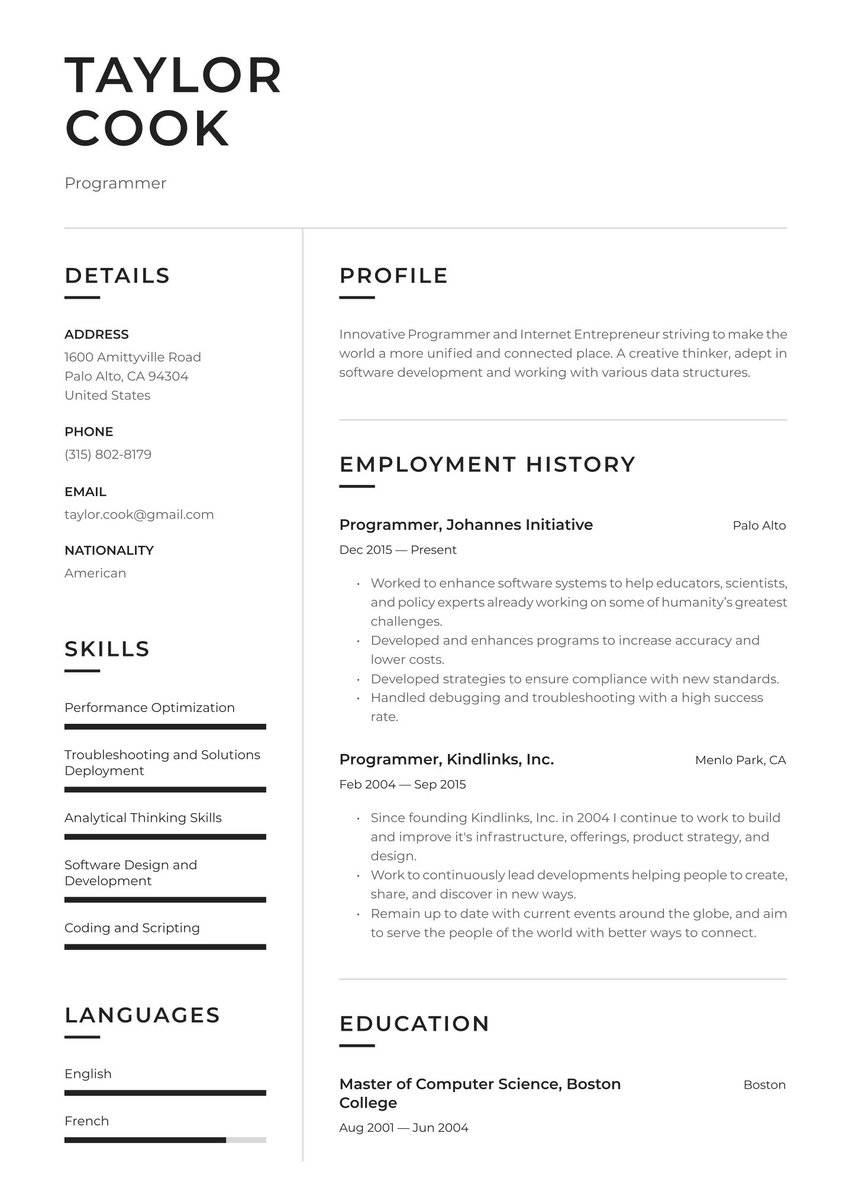

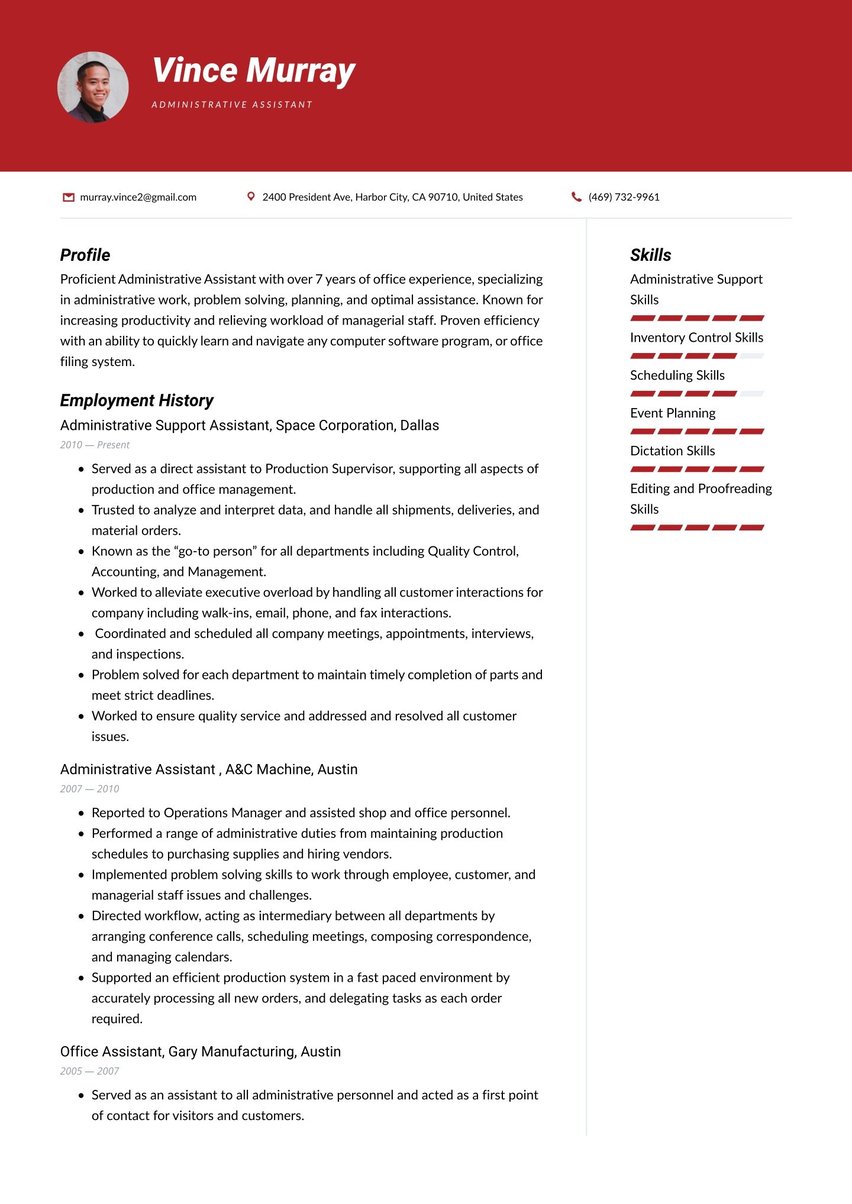

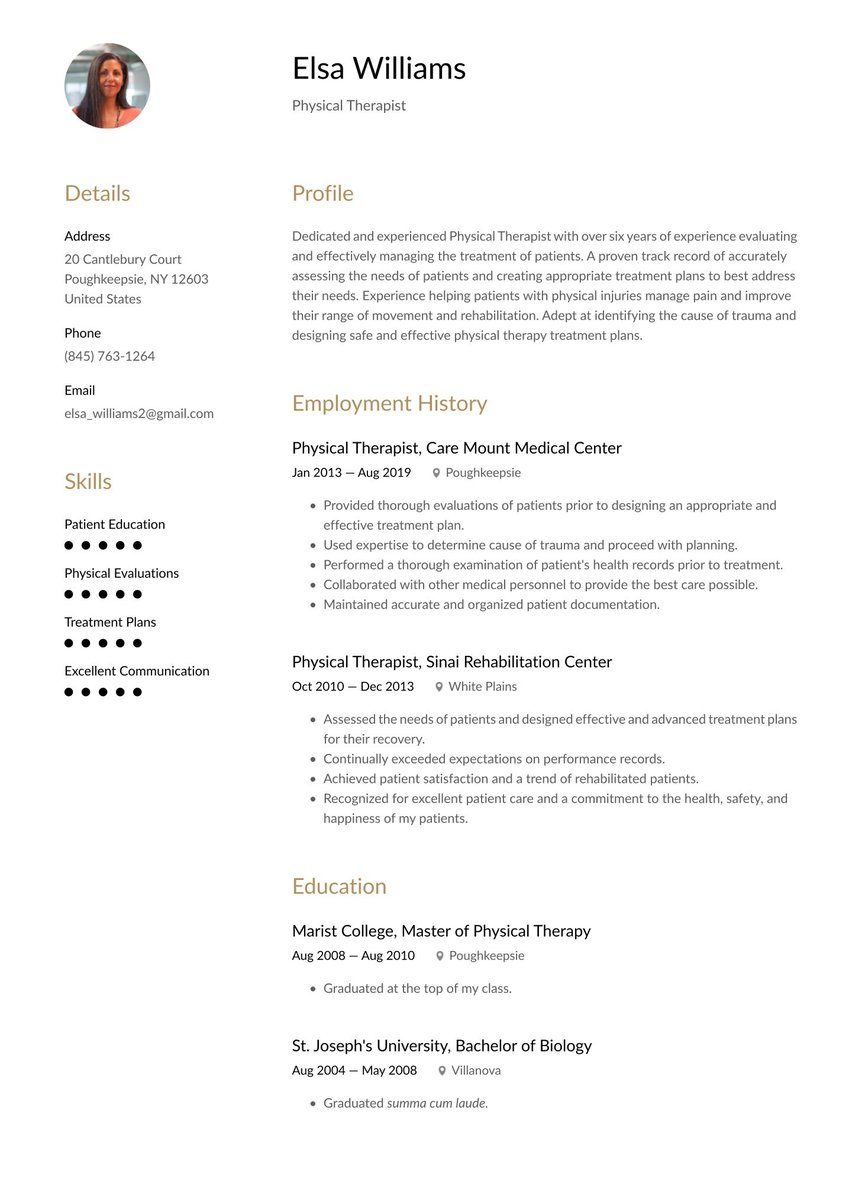

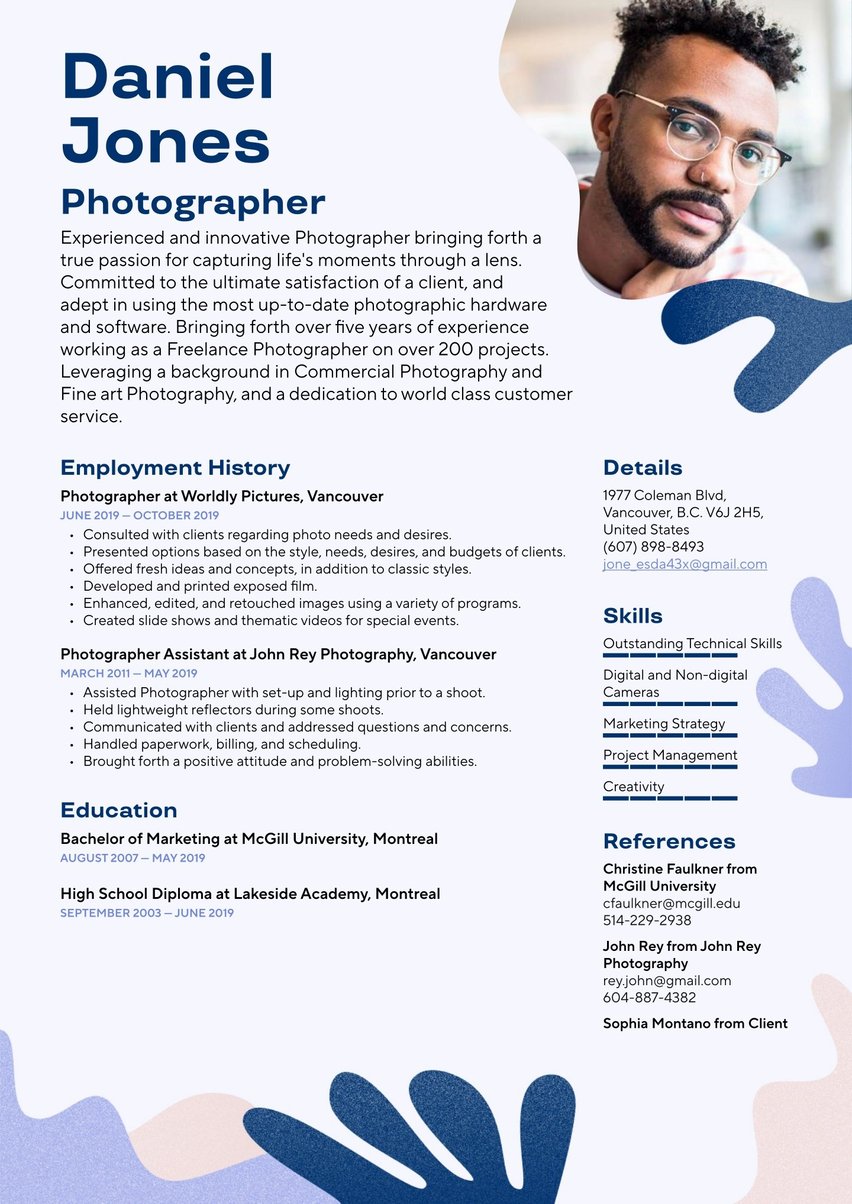

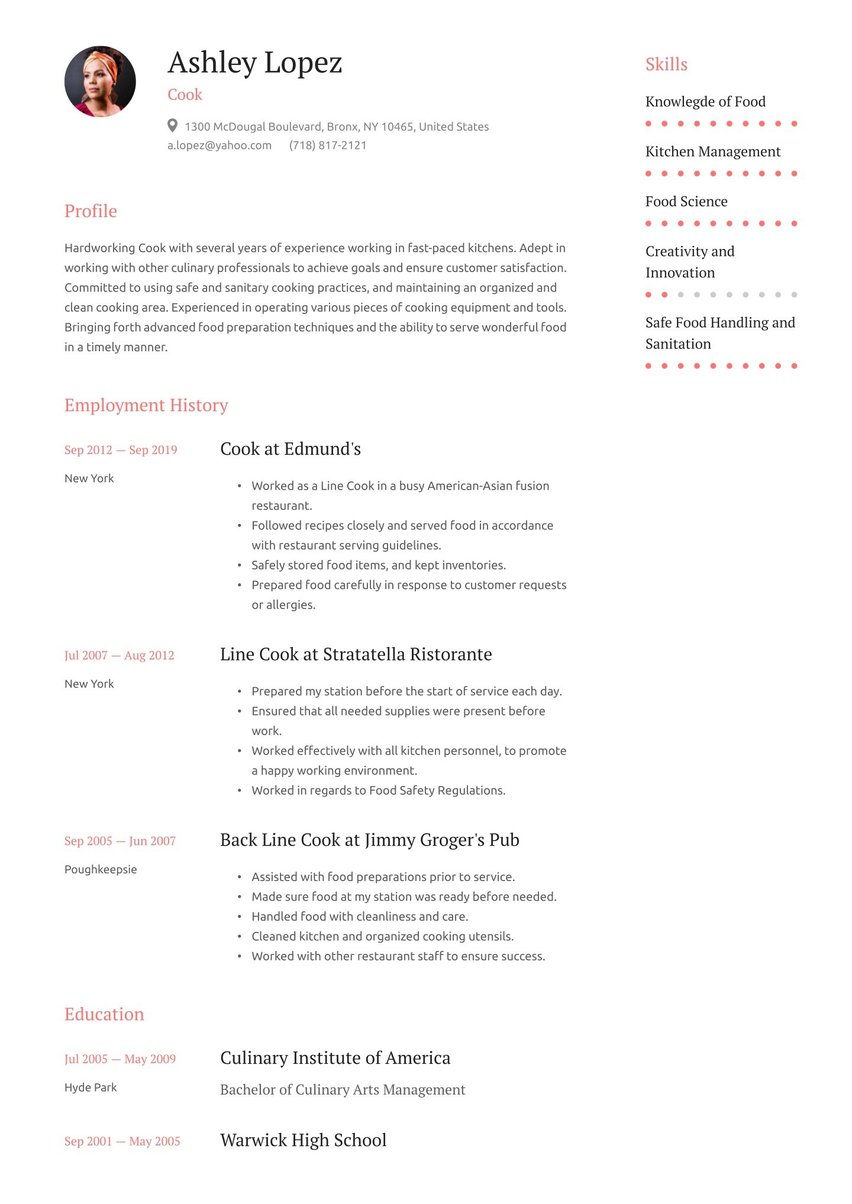

Choosing the best resume format for a title insurance coordinator

If your career path has been straightforward, comprising a series of employee positions, then the most commonly used chronological format is the best way to organize your resume information. It’s also preferred by recruiters for ease of review, with your previous jobs listed by employer from most recent to earliest dates.

The functional resume format, emphasizing transferable skills, and the hybrid (combination) resume format, sometimes work well for job candidates who are new to the workforce, making a career change, or self-employed.

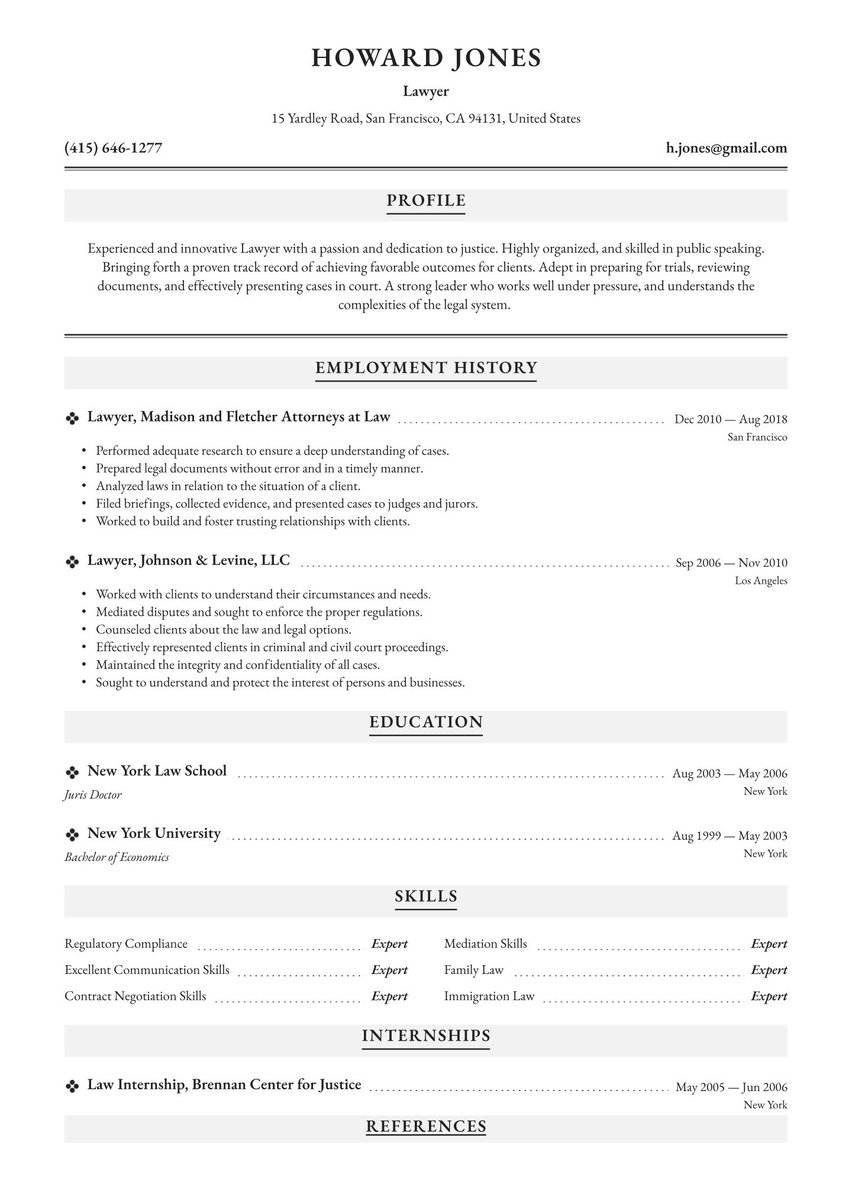

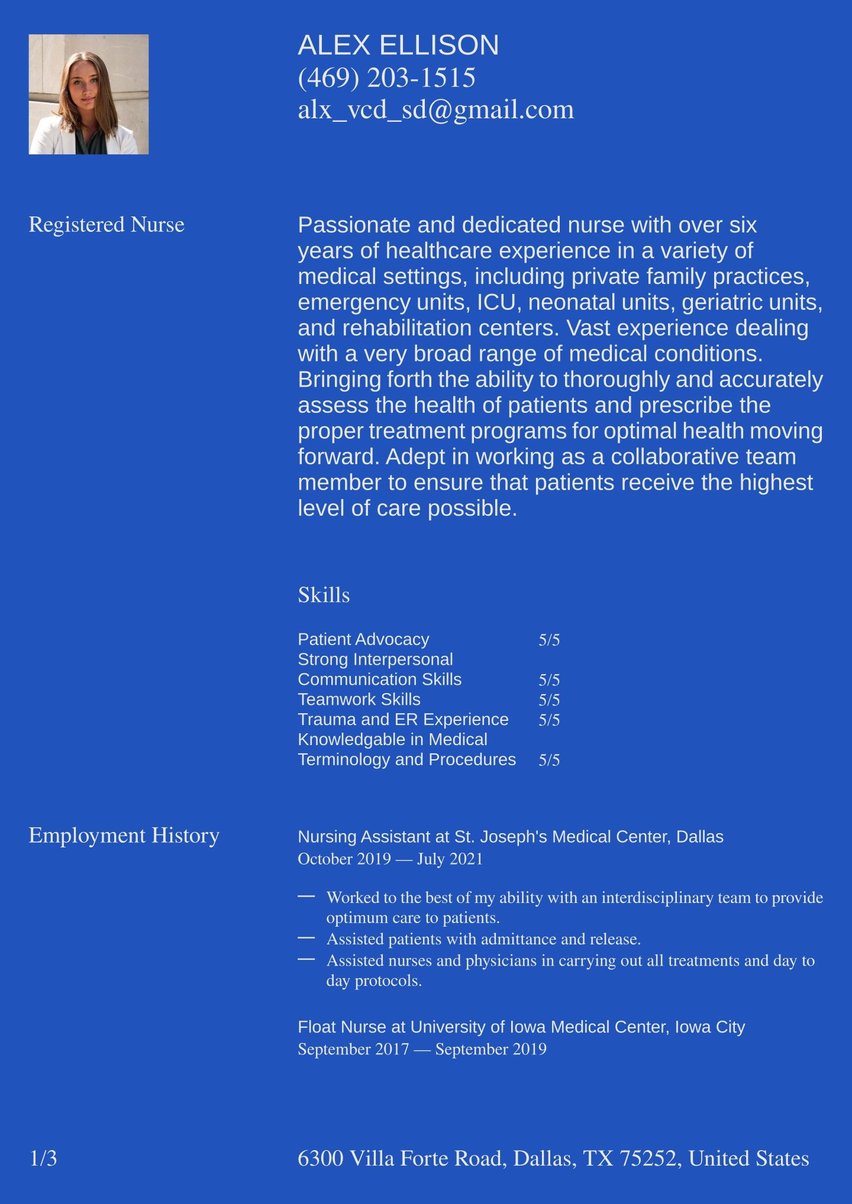

Resume header

The resume header is where your identifying information is prominently displayed: name, job title, phone number and email address. Hiring managers are likely to notice this vital information first, and be able to spot it easily again when they want to contact you for an interview.

From an esthetic standpoint, an attractive header design not only distinguishes your job application from all the rest, but also makes everything on the page look more inviting to read. The impact is reinforced if you make your cover letter and resume documents a matching pair, with identical headers and other design elements.

Now let's take a closer look at each of the sections that your title insurance coordinator resume will include. We'll start with the profile, sometimes called the summary or personal statement.

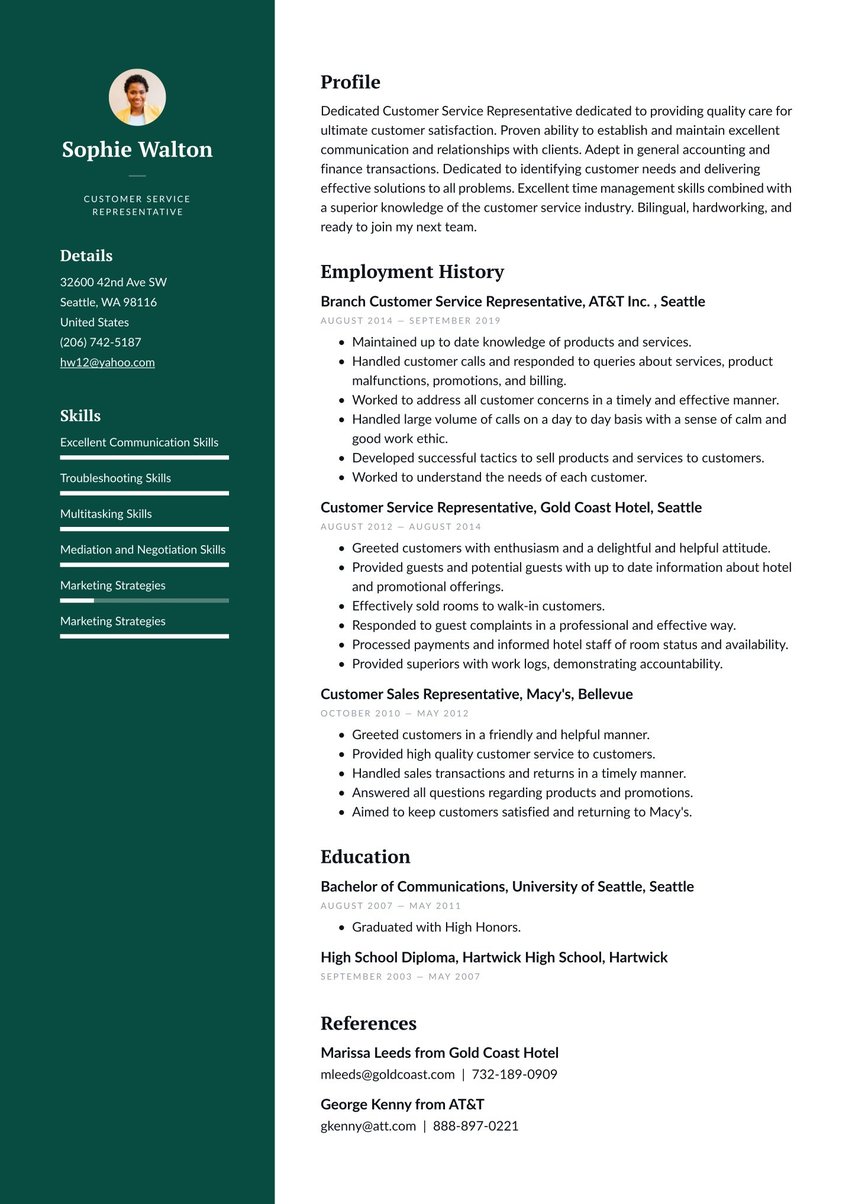

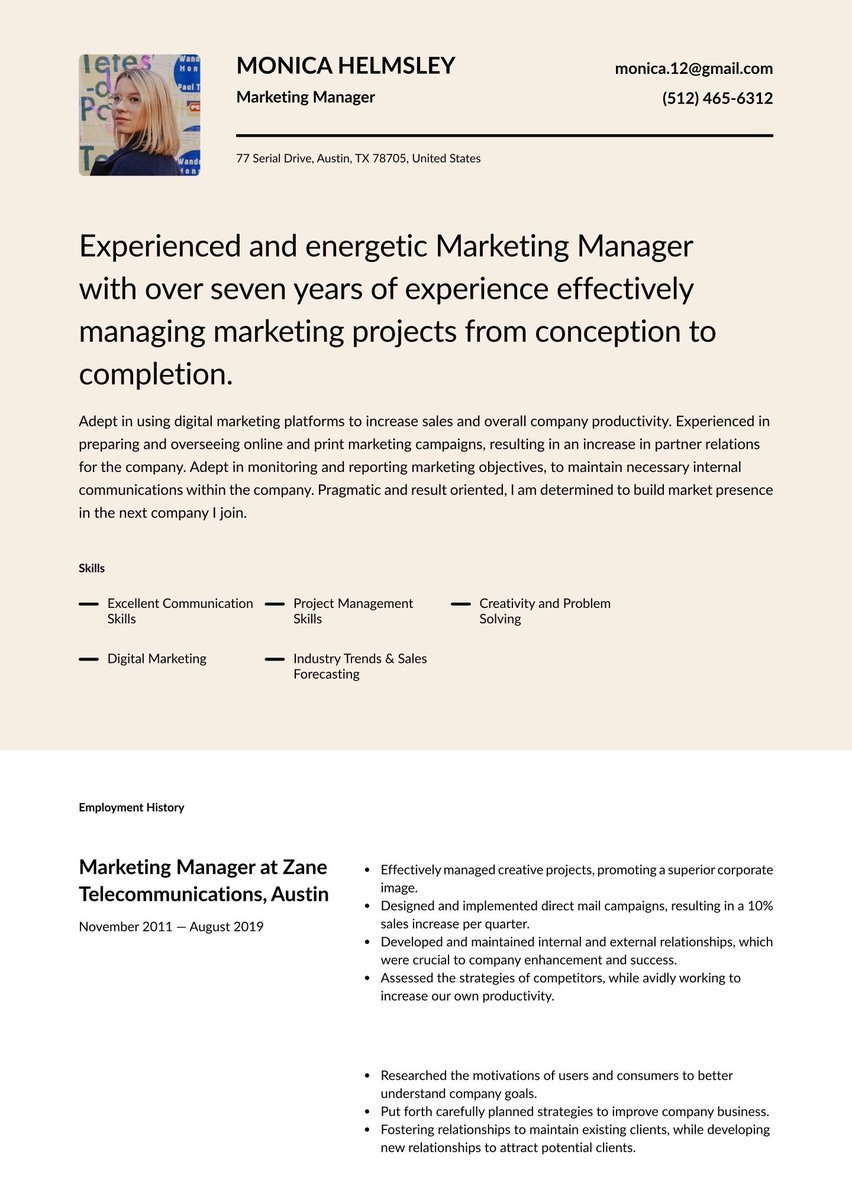

Title insurance coordinator resume profile example

As a title insurance coordinator, you communicate and work with all concerned parties during real estate closing transactions. Therefore, it’s important to show off your ability to express yourself. The profile is the main place to do so in your resume, enabling your achievements to stand out on the page.

Your profile should contain two or three sentences describing your biggest career accomplishments. State these with pride without crossing the line into exaggeration. Strong action verbs will show that you are a person who can get the job done. Use details and data to back up your claims. Also try to call attention to your ability to ensure that all legal requirements are honored throughout the closing process.

Because you are expected to communicate well and consult with clients — learn their needs and desires, confirm escrow and loan details, confirm required insurance, and schedule with all parties — you should also include a sentence or two about your interpersonal skills and ability to get work done in a timely manner. Hiring managers are looking for a good work style fit as well as proficiency in insurance claims and policies.

Check out our sample of a resume profile below.

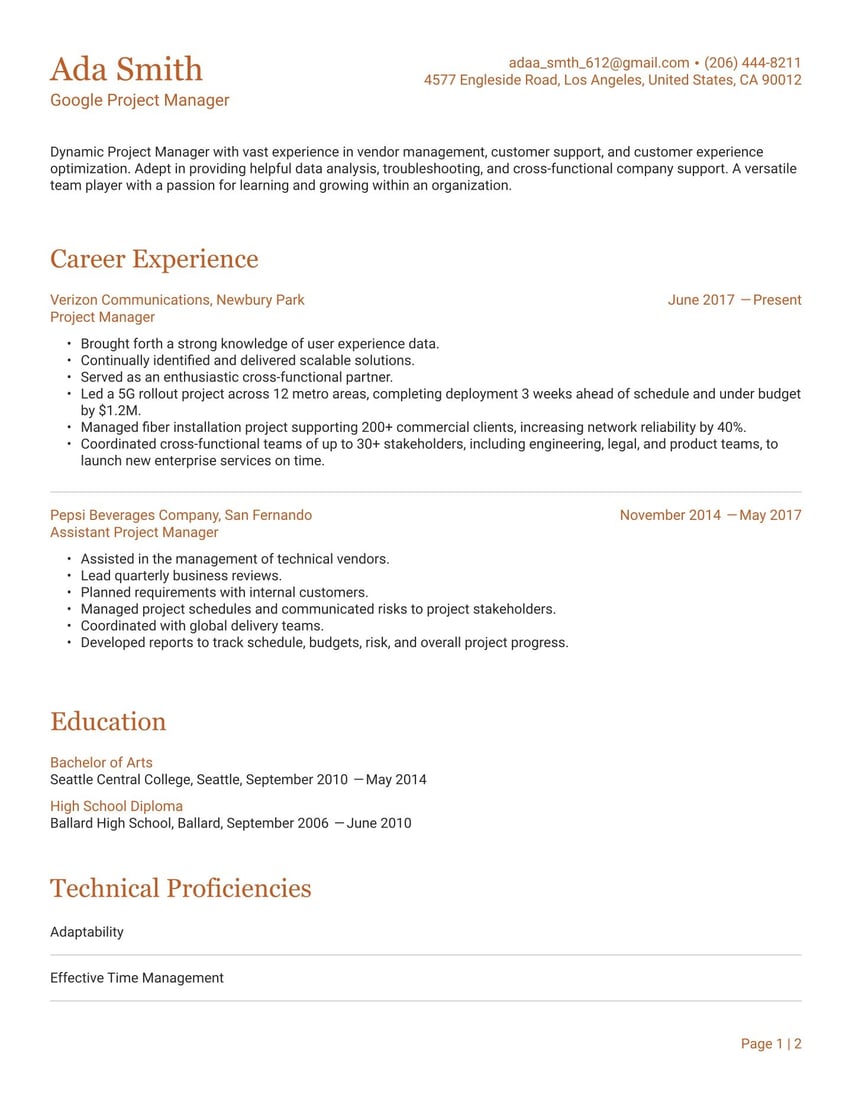

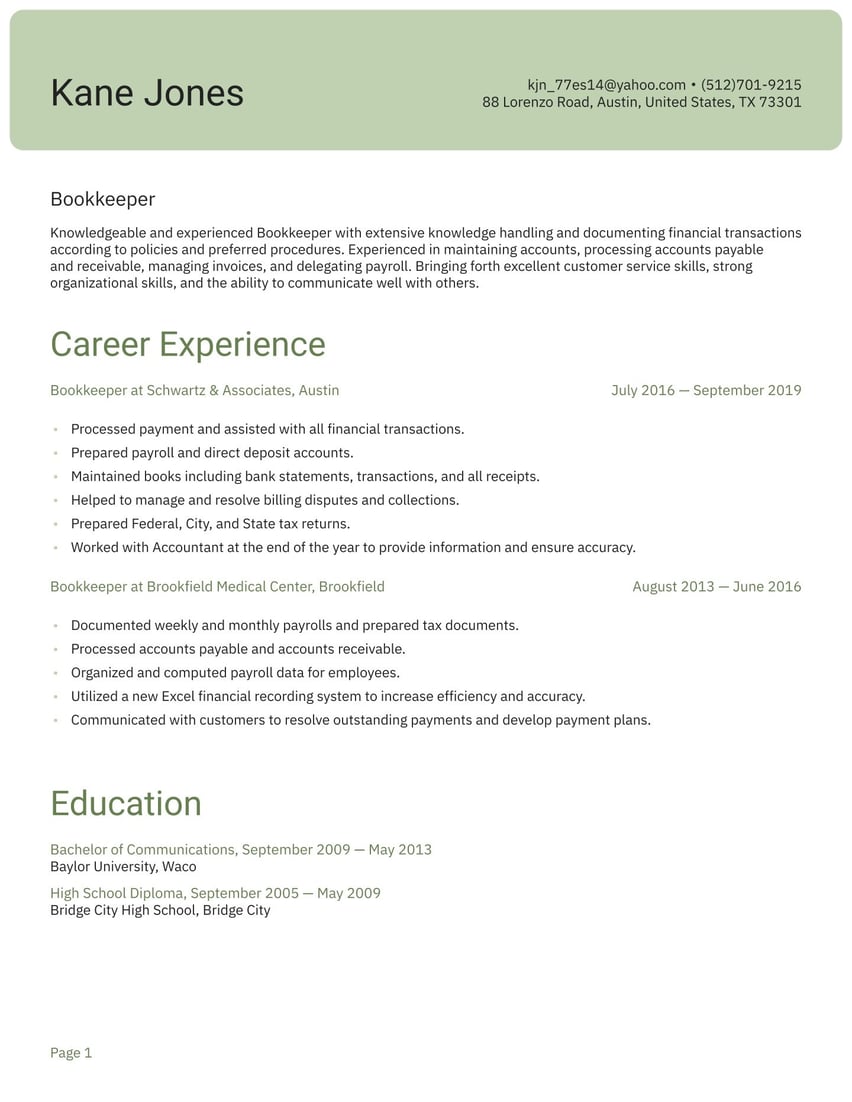

Dedicated Title Insurance Coordinator with exceptional skills communicating and working with realtors, lenders, buyers, and sellers. Over 10 years’ experience in title reports and closing procedures, with in-depth knowledge of all real estate procedures, laws, and markets. Committed to ensuring every closing transaction is smooth and stress-free for buyers, sellers, and real estate agents.

Writing a winning title insurance coordinator resume can make all the difference. Get inspired by other related resumes examples listed here below:

- Realtor resume sample

- Property manager resume sample

- New home sales consultant resume sample

- Title examiner resume sample

- Interior designer resume sample

- Real estate agent resume sample

- Real estate coordinator resume sample

- Architect resume sample

- Real estate assistant resume sample

- Interior decorator resume sample

- Real estate resume sample

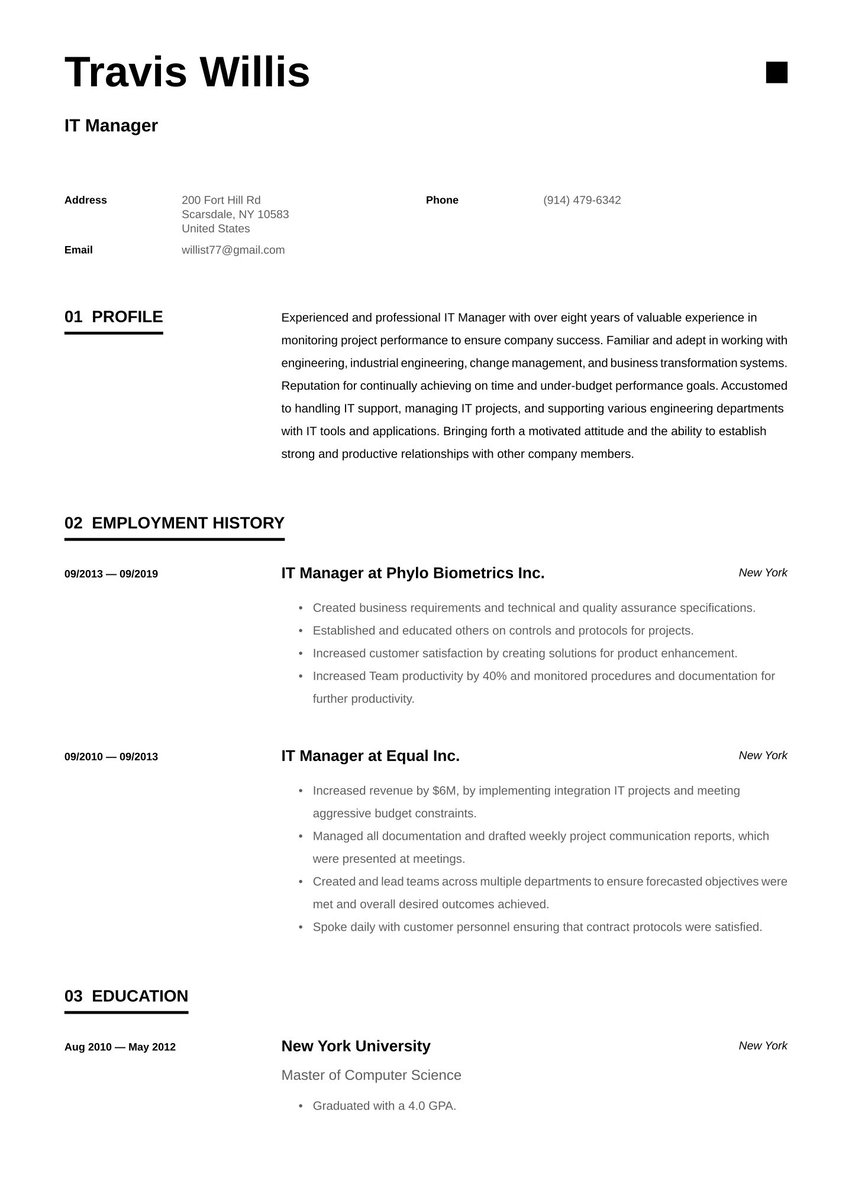

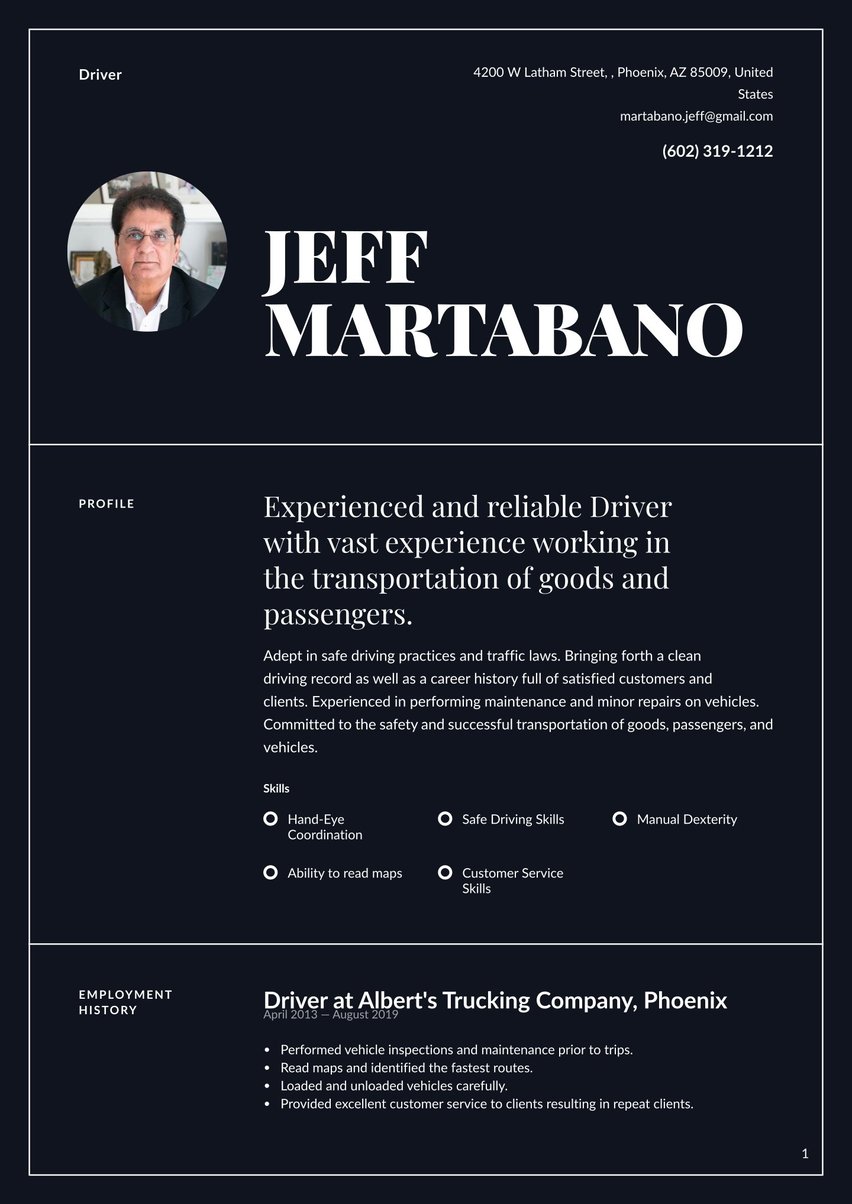

Employment history sample

All the knowledge you need to be a successful title insurance coordinator should be reflected in your resume. Another consideration is your exposure to different work environments. How do you convey all that in your employment history section?

Think about your years of experience as the story of your growth as a professional. Perhaps you started out working the front desk and doing data entry in Excel. Then you moved into investigating liens and judgments against properties. Maybe then you began to communicate and coordinate with lenders and prepare all documentation in closing packages.

Under each job title in your work experience listing, in reverse chronological order as noted previously, show how you advanced in skills. Instead of listing each responsibility, describe how you took charge of a problem, created an action plan, and detail the results you achieved. This method will make your work experience section much stronger.

If you are just entering the job market, you may consider any experience that equipped you with transferable skills, including volunteer work.

The employment history example below can be adapted to fit your situation.

Title Insurance Coordinator at Judicial Title, White Plains

June 2015 - December 2022

- Assisted 220+ clients and about 140 real estate professionals with resolving clearance of all files prior to closing.

- Provided timely assurance of a clear title, and secured lien payoffs, mortgages, real estate tax balances, and more.

- Consistently efficient in preparing legal documents for clients and proceedings, as well as input applications, recorded documents, and completed final title policies.

- Received eight Employee of the Month awards, recognizing customer service skills dealing with realtors, lenders, investors, buyers, sellers, attorneys, and underwriters.

- Remained up to date about relevant laws and regulations.

Title Insurance Coordinator at Realrise, New York

July 2012 - May 2015

- Communicated in a professional, personable manner with lenders, real estate offices, and service companies to obtain the information needed for the closing.

- Prepared settlement sheets and all documents for closings.

- Verified accuracy of lender packages.

- Prepared and amended closing policies, and finalized title bill to reflect any changes or updates.

- Scheduled and assisted with all closing processes.

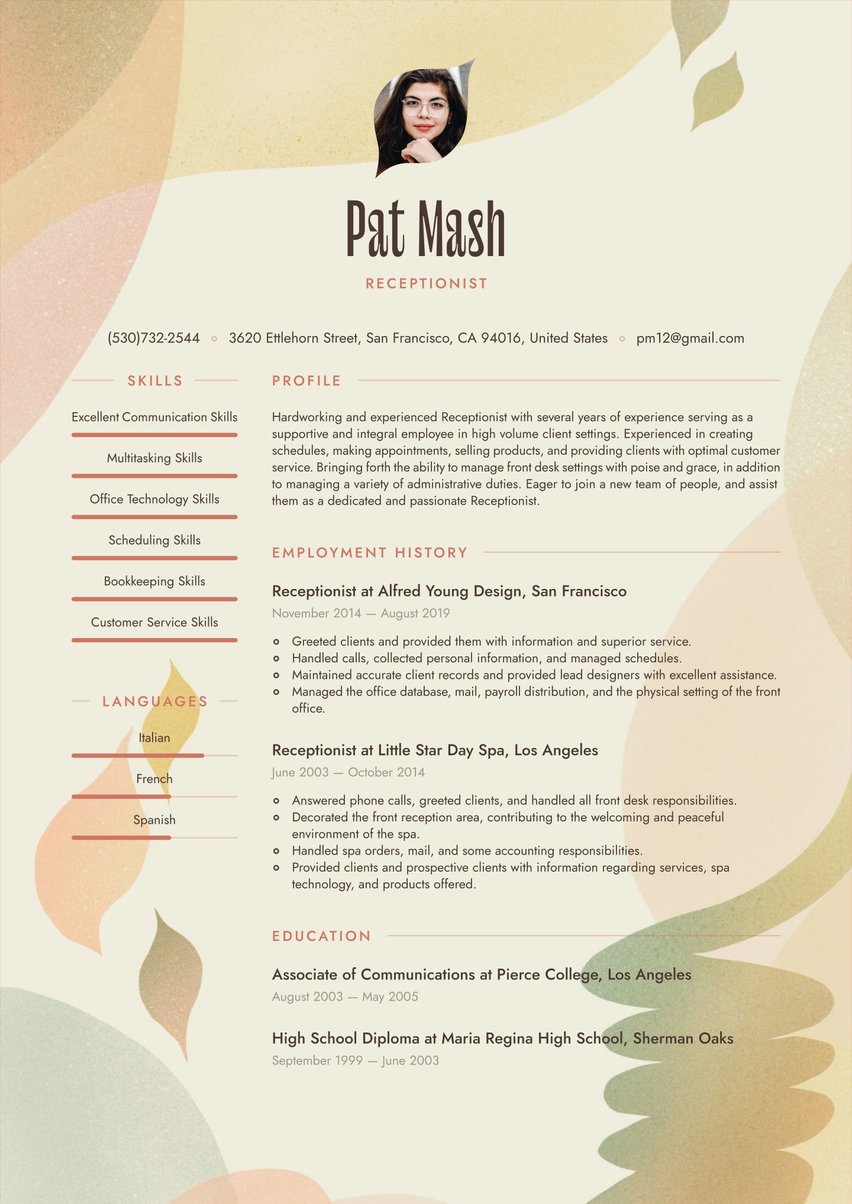

Title insurance coordinator resume education example

Title insurance coordinators can start their careers with a high school education, although some employers may prefer that you have a bachelor’s degree. Your education section is simply a listing of your degrees and where you received them. They should appear in reverse chronological order, from highest to lowest level. In addition, if you have taken any real estate courses or have earned any certifications, you should also list them here as they add to your desirability as a candidate.

Use this resume education section example to guide you.

Associate of Communications, Marymount College, White Plains

September 2010 - May 2019

High School Diploma, Rockville High School, Rockville

September 2006 - June 2010

CV skills example

We haven’t yet mentioned Applicant Tracking Systems (ATS), but they are important gatekeepers in the job search process. ATS software uses algorithms to rank your resume based partly on keywords and phrases that match those in the job listing. That is why your CV skills section — and the rest of your resume — should be customized to match each job for which you apply.

To develop this section, we suggest you make a “master list” of all your skills and attributes. You can sort them into categories such as hard skills — the hands-on knowledge specific to real estate that you have acquired in classes or on the job — and soft skills, or the interpersonal and organizational skills that make you a good employee.

Examples of some impressive soft skills you may consider are excellent time management, strong organizational ability, and advanced communication skills. Some impressive hard skills you might list are expertise in Microsoft Office and computer research programs, knowledge of insurance policies and closing procedures, and the escrow process.

Use your master list to choose the hard and soft skills that best match the job listing and swap them out when necessary to better fit the needs of each prospective employer..

Below is an example of what you might put in your CV skills section.

- Knowledge of Clearing Title Processes

- Real Estate Procedures

- Commercial Transactions

- Coordinating Skills

- Computer Based Research Programs

- Knowledge of Relevant Laws and Regulations

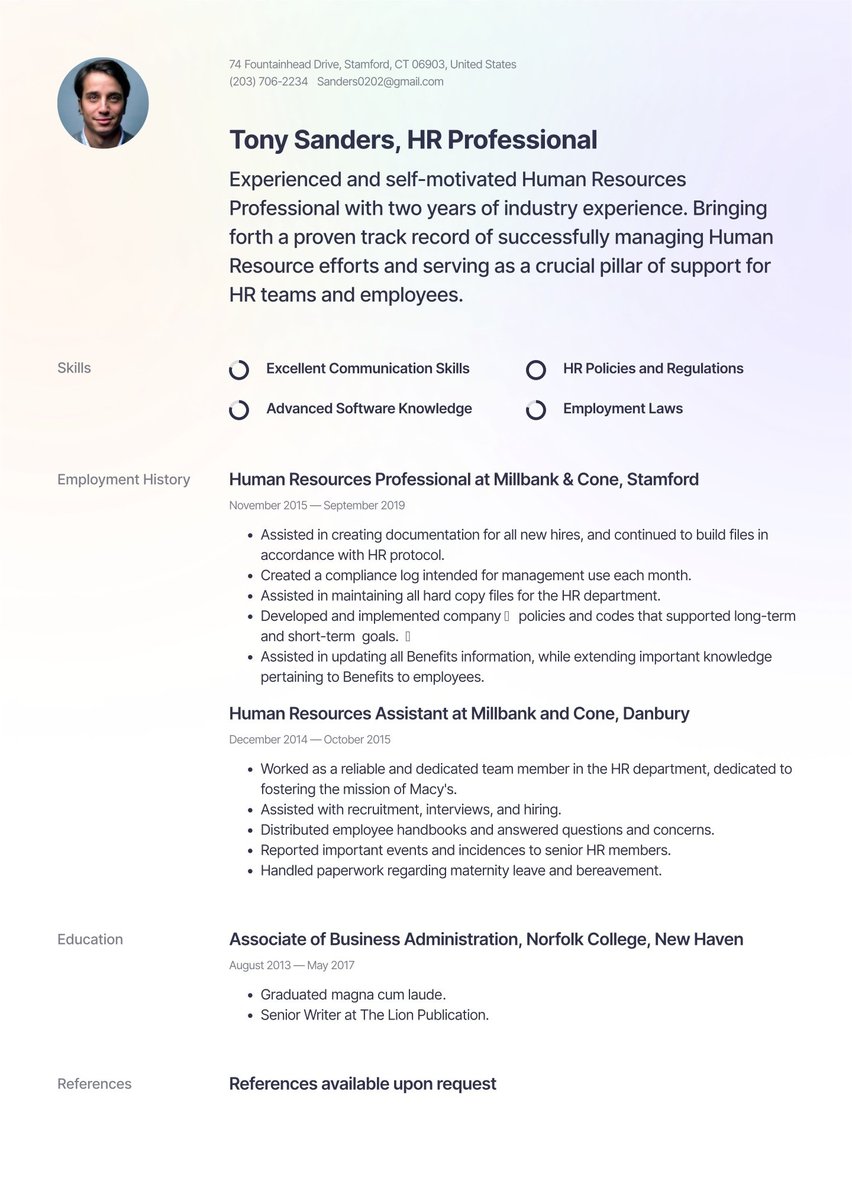

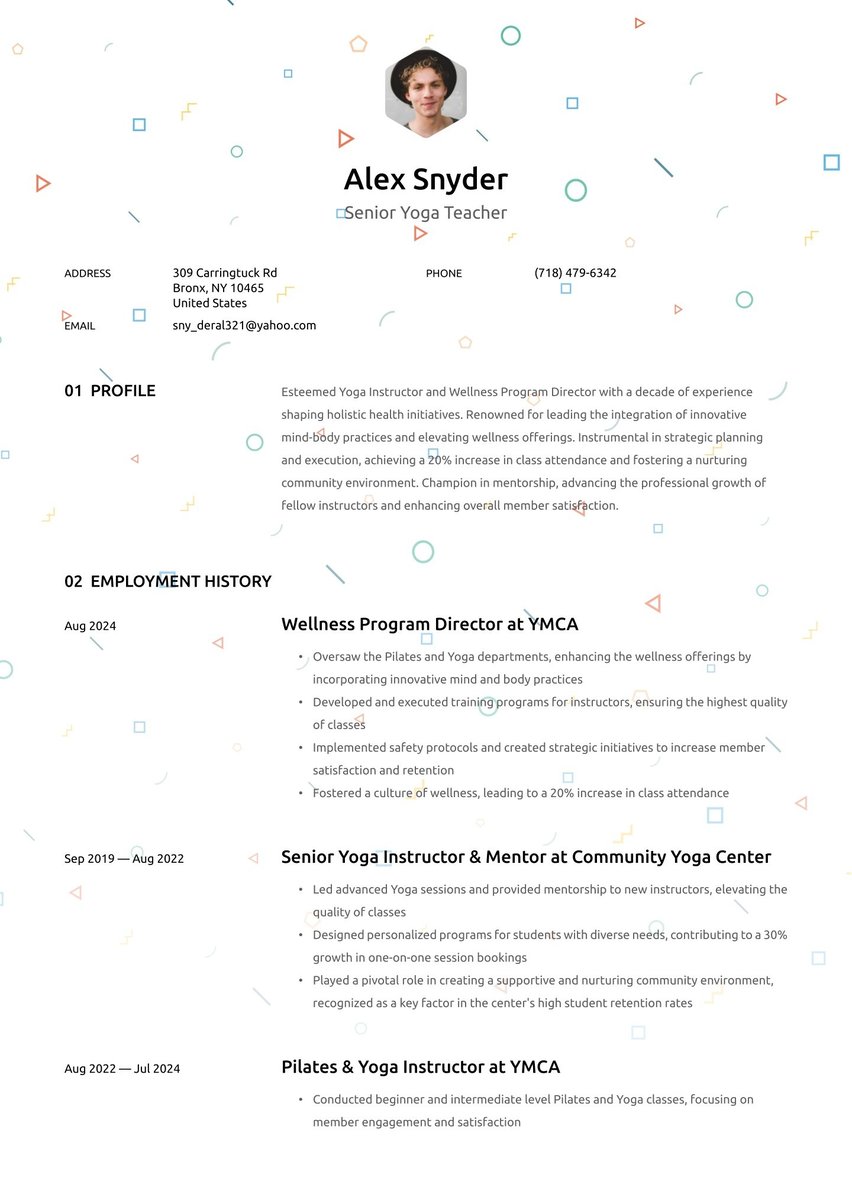

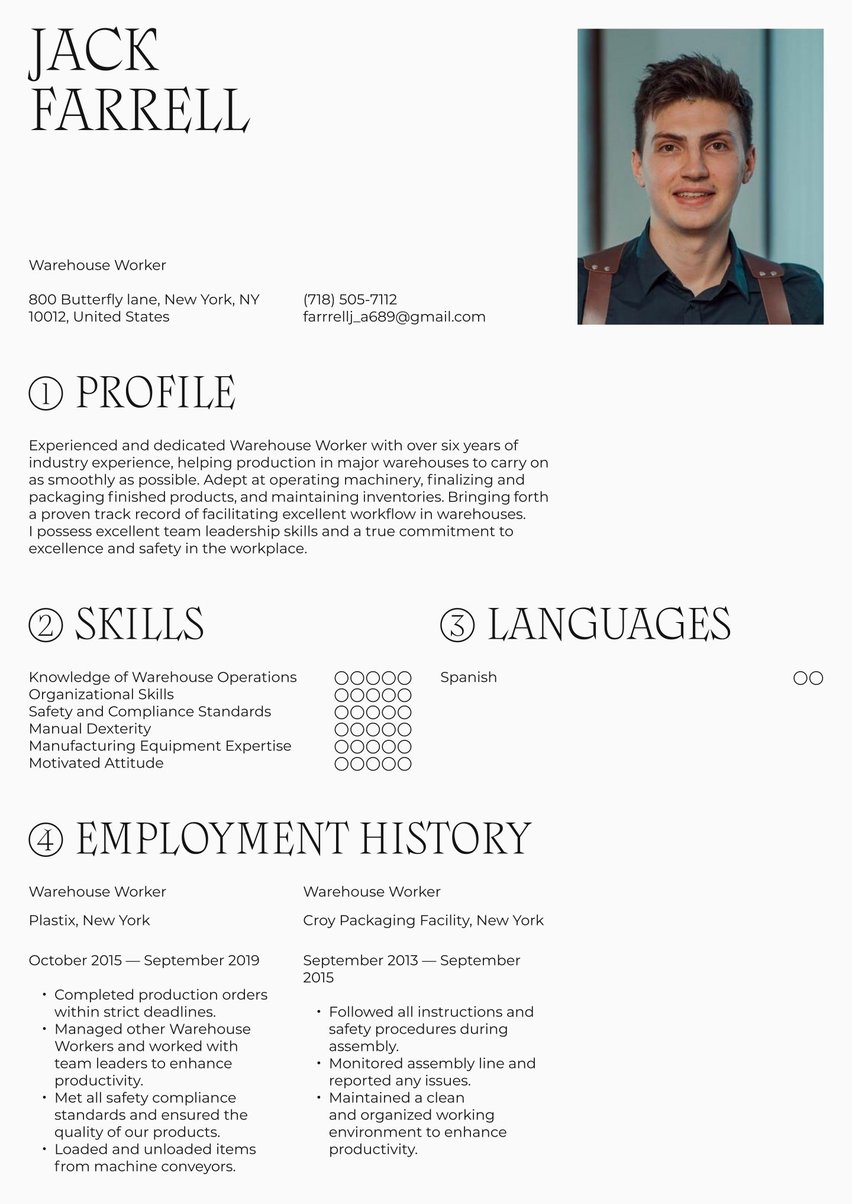

Resume layout, design and formatting

A crisp, professional design is just as important as what you say in your resume, because if you don’t make a good first impression, you may not get a second chance.

You should aim for a design that first-and-foremost is easy to read. Recruiters see dozens, if not hundreds, of resumes for each job and if they have a hard time scanning one, it’s unlikely to make it to the next step: that coveted interview.

Make sure the following items stand out:

- Contact information in your resume header (and, by the way, use a professional email address, not the cute one you still have from high school)

- Job titles

- Section headings.

The best way to eliminate design and formatting errors, while saving yourself time and hassle, is to use a dedicated resume builder tool, such as Resume.io’s, along with one of our field-tested resume templates. You can choose from one of our modern layout templates, or go more classic with a simple or professional design).

Key takeaways for a title insurance coordinator resume

- An impressive title insurance coordinator resume can give you an edge when the competition for jobs is tight.

- Make sure each section of your resume is custom-tailored to fit the specific hiring situation — not only the job itself but the employer and work environment. Each new job application requires a new version of your resume.

- For the most professional looking results, take advantage of Resume.io’s easy-to-use resume builder tool and ready-made resume templates.

You have the tools. Now go and land that new job!

.jpg)

.jpg)