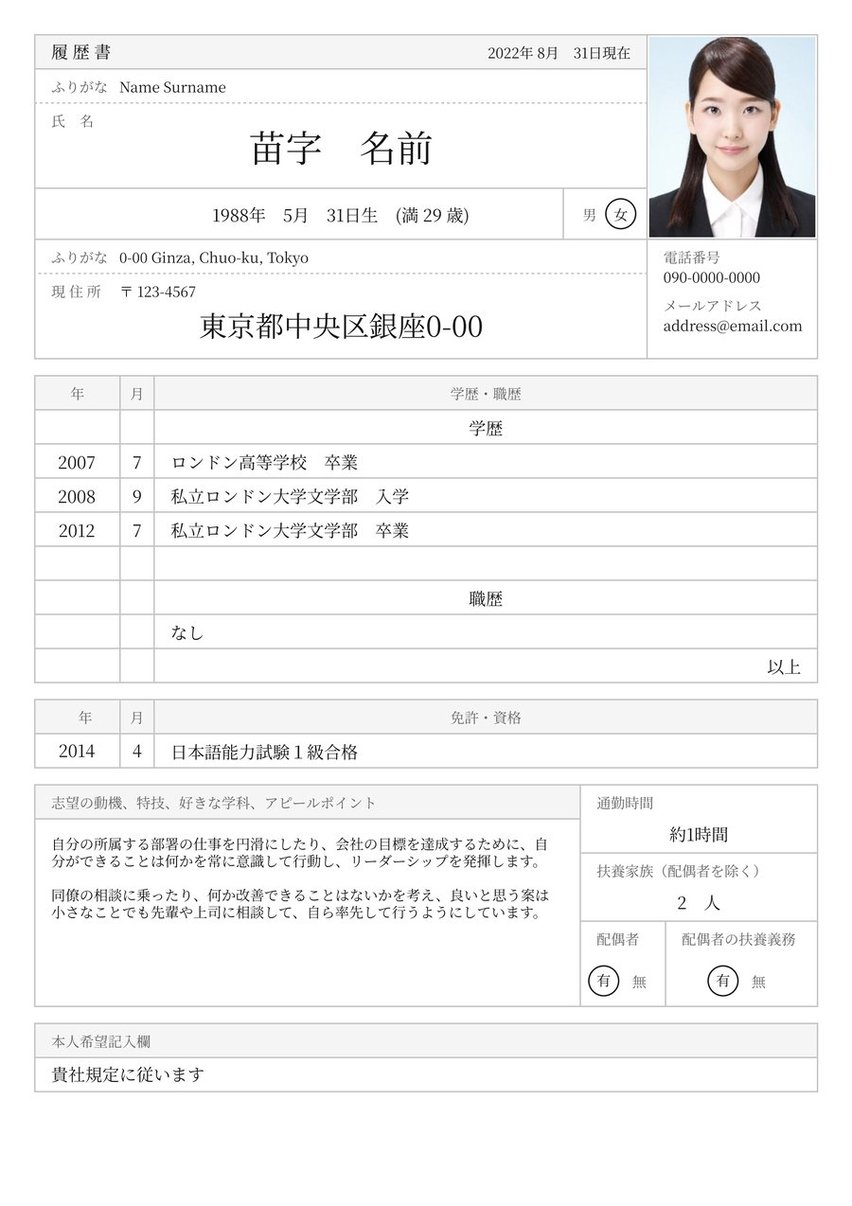

Experienced Bank Teller seeking to fill a full-time or part-time position. Adept in providing fast and efficient banking services to customers, while helping them to successfully complete desired transactions. Skilled in performing routine and complex banking transactions, while complying with all rules and regulations.

07/2018 - 02/2021, Bank Teller, Citibank, New York

- Successfully performed a full range of Teller duties.

- Fostered a welcoming and friendly customer environment.

- Provided prompt and courteous services to all customers.

- Utilized banking knowledge to recognize customer needs and suggested appropriate banking services.

- Worked as an enthusiastic and cooperative team member.

06/2015 - 06/2018, Bank Teller, Walden Savings Bank, Montgomery

- Provided exceptional customer service and basic product information to customers.

- Ensured the accurate processing of customer transactions.

- Assisted customers with account maintenance questions and procedures.

- Promoted bank products and services by referring customers to appropriate business partners as necessary.

- Assisted supervisors in daily branch operations.

09/2010 - 05/2015, Associate of Communications, University at Albany , Albany

09/2006 - 06/2010, High School Diploma, Academy of the Holy Names, Albany

- English

- Polish

- Time Management

- Ability to Multitask

- Adaptability

- Customer Service

- Advanced Banking Knowledge

Working as a bank teller isn’t just about counting cash. Nor should your bank teller resume focus only on that side of the coin. Bank tellers also need great interpersonal skills since this job is all about relationships with local patrons and helping them with a variety of financial planning services.

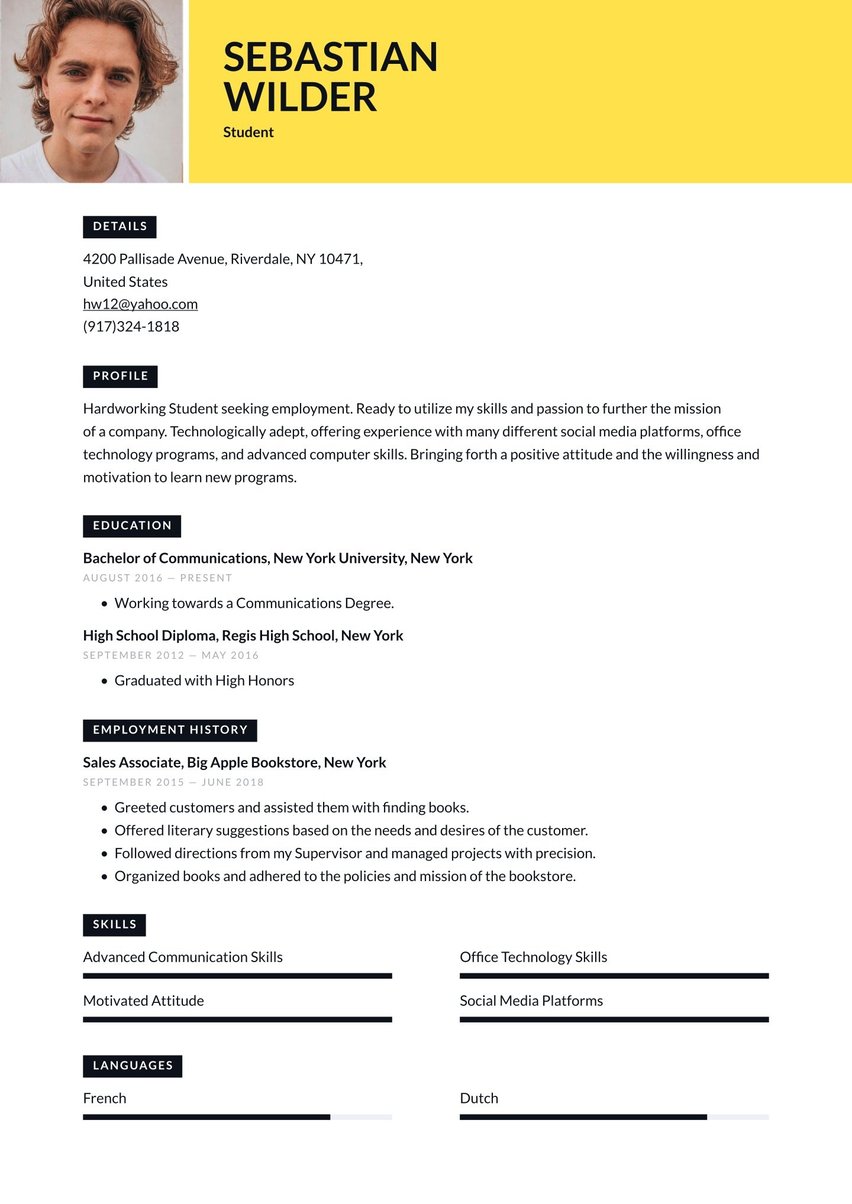

Bank Teller resume examples by experience level

To stand out from other bank teller candidates in a shrinking job market, you’ll need a resume that highlights your unique skills and motivations. Even with no prior experience, you can land a bank teller position by showing the right disposition and a willingness to learn. Resume.io can help you create a job-winning application that takes all of your attributes into account. Thousands of job seekers have found the online resources they were looking for, including 350+ occupation-specific resume examples and writing guides.

The guide you are reading now is designed specifically for bank tellers. Our step-by-step advice corresponds to wording you are welcome to adapt from a bank teller resume example.

Here's what we'll discuss:

- An overview of what bank tellers do and the job outlook

- The proper resume framework and best resume format for bank tellers

- Optimizing the impact of each resume section: header, profile, employment history, education and skills

- Beating the ATS algorithms with the keywords hiring managers are looking for

- Craft an experience section that highlights your strongest skills

- Choose formatting that makes a great first impression

- Layout and design tips for making a great first impression

Before we start building your bank teller resume, let’s first gain a better understanding of the current industry and your role within it.

What does a bank teller do?

Bank tellers are on the front line of a bank’s customer service experience. Responsible for helping clients with a variety of financial transactions, bank tellers and bankers ensure that all exchanges are completed accurately and fairly for both the bank and the clientele.

Bank tellers handle a wide variety of customer needs in local bank branches, including but not limited to:

- Processing deposits and loan payments

- Cashing checks and issuing withdrawals

- Opening and closing accounts, selling cashiers and travelers checks

- Exchanging currencies, counting and packaging bills and coins

- Answering customer questions, cross-selling other products and services

For more ideas and inspiration, check out these other resume examples and writing guides from our accounting & finance category:

- Finance-director resume example

- Senior-accountant resume example

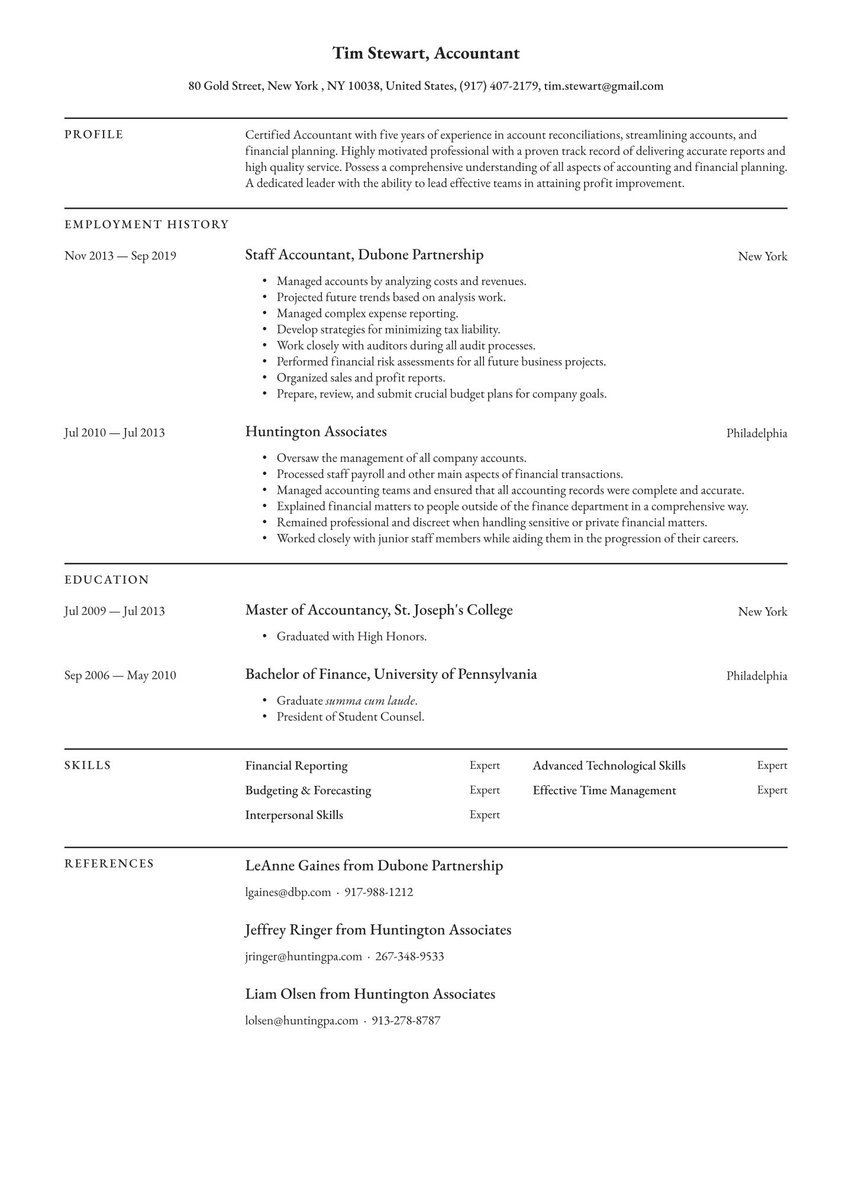

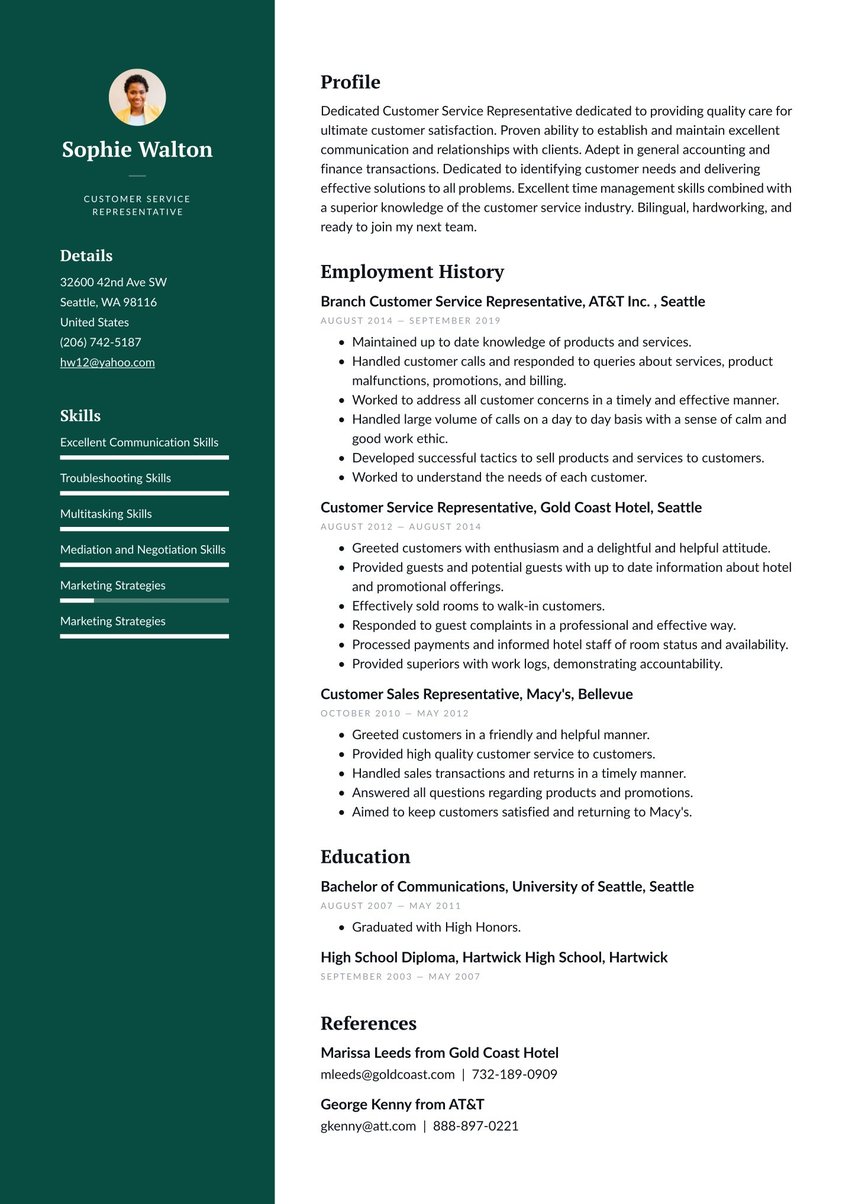

- Accountant resume example

- Loan-officer resume example

- Loan-processor resume example

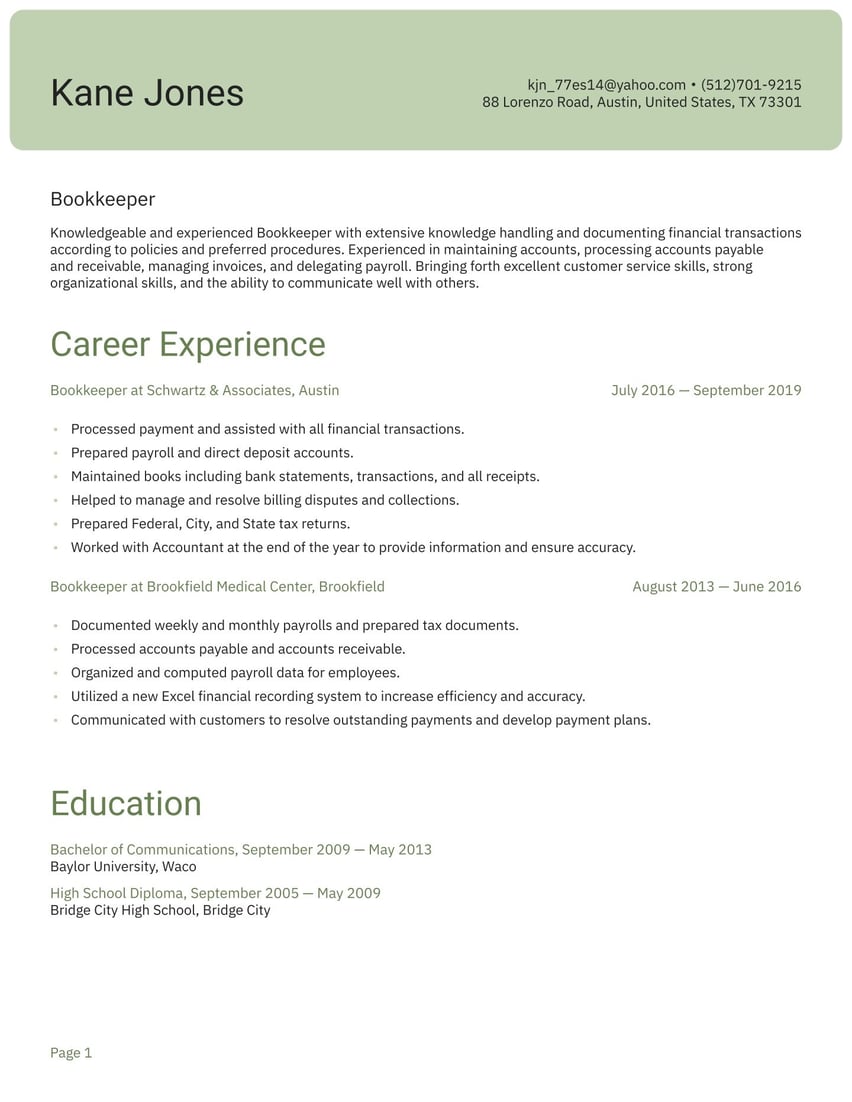

- Bookkeeper resume example

- Auditing-clerk resume example

- Compliance-officer resume example

- Investment-banker resume example

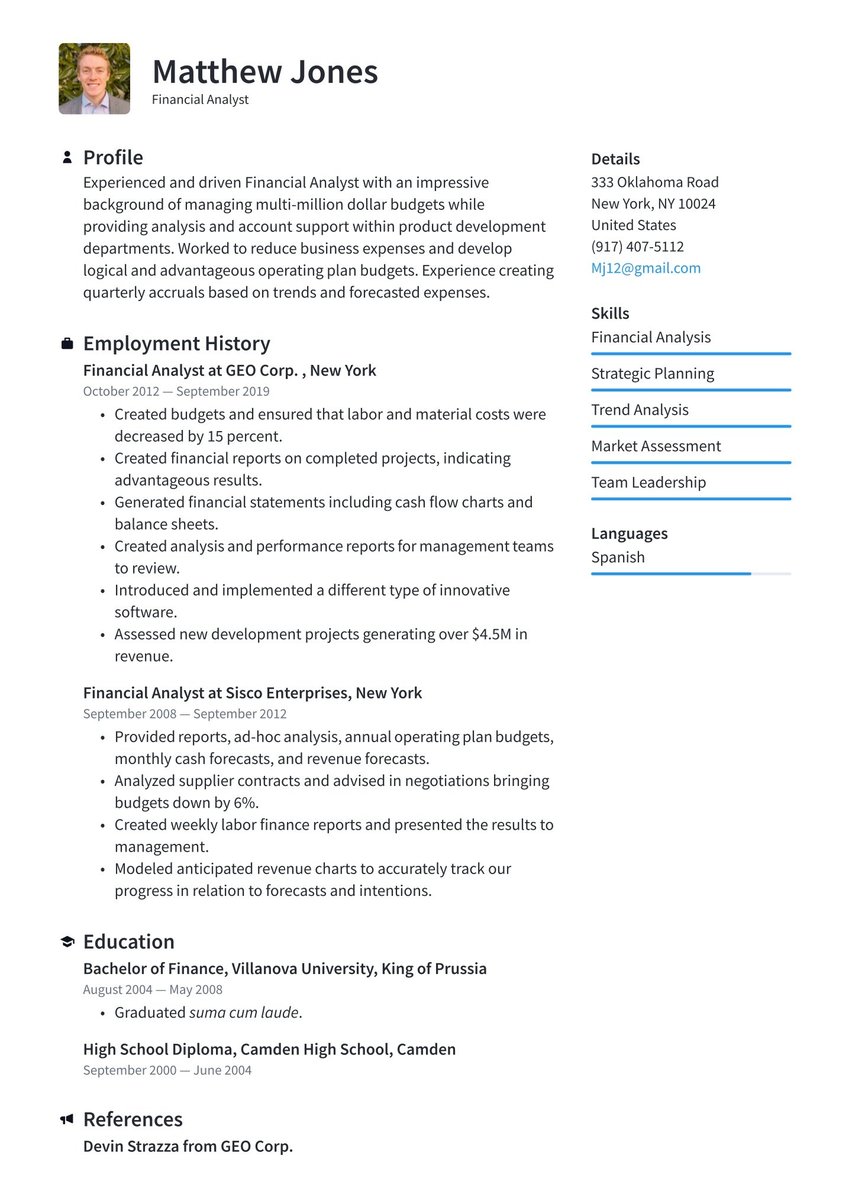

- Financial-analyst resume example

- Financial-advisor resume example

The job market for tellers

The best teller positions are growing increasingly competitive. As ATMs and online banking allow customers to have greater control over their own finances, bank tellers are increasingly responsible for more advanced operations.

It’s time to face the facts: the job market for bank tellers is in decline. The U.S. Bureau of Labor Statistics estimates that the need for bank tellers will decrease by 12% from 2021 to 2031.

But before you slam your laptop closed in despair – there’s hope! While long term growth is projected to be slow, there are still many bank branches in need of tellers. According to Statista, in 2021 there were 72,534 bank branches in the United States.

Banking is not going away anytime soon. The role of the teller is shifting, however. Bank tellers now handle more complex tasks like assisting customers with investment banking and loans. A new job as a bank teller is within your reach – if you know how to use your resume to position yourself. Later on, we’ll cover each section of the resume needed to put your best foot forward as a bank teller who is prepared for the future of the industry.

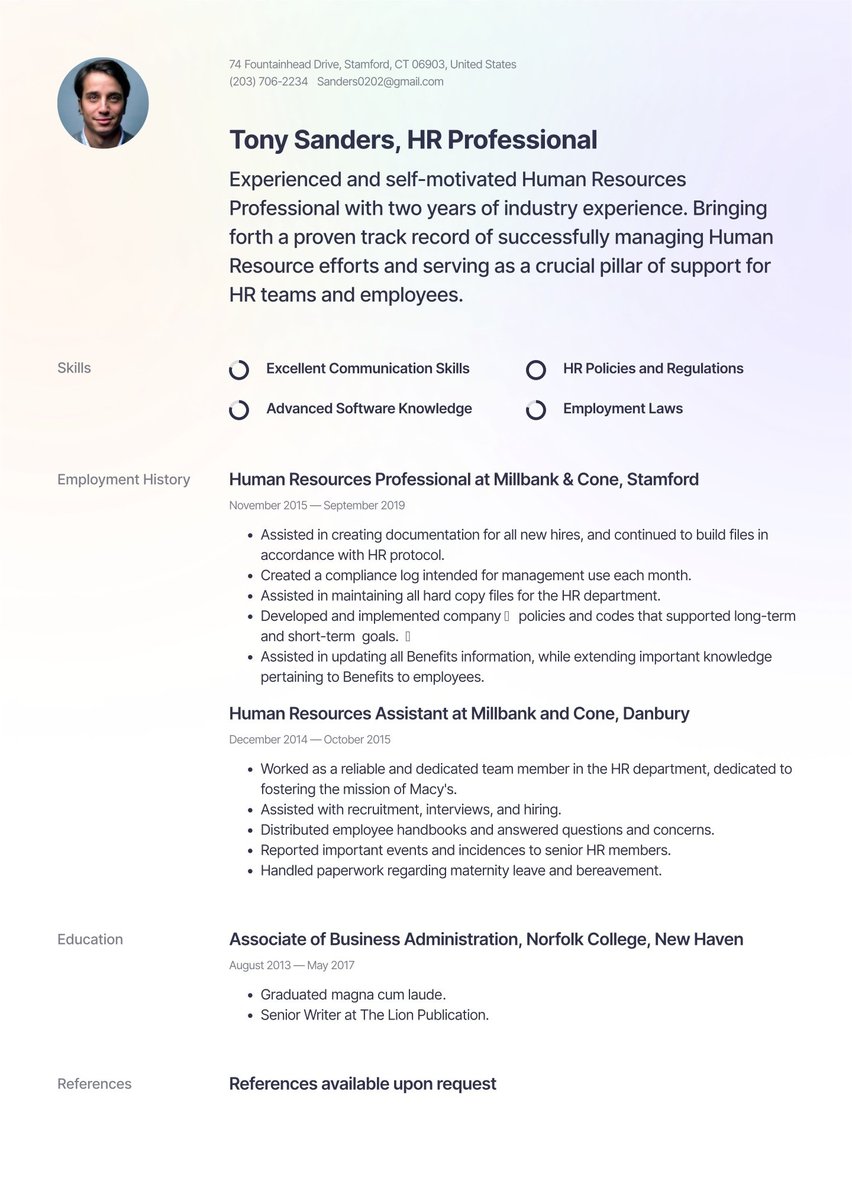

How to write a bank teller resume

A resume for a bank teller is a delicate balance. On one hand, you’ll want to show off hard skills like cash counting, mental math and banking systems. On the other, you’ll need a variety of customer service abilities plus a strong sense of ethics and responsibility. All of your resume content should be organized to include these essential components:

- The resume header

- The resume summary

- The employment history section

- The education section

- The skills section

Each section on a resume is designed to serve a certain purpose. The summary, for example, is the best place to show off your friendly disposition and create a personal connection with the hiring manager. You’ll want to use your employment history to demonstrate clear skills that are related to the industry or the duties of a bank teller.

Before digging deeper, one resume section at a time, there's one vital consideration.

Acing the ATS

Before your resume ever makes to the hands of a hiring manager, it must first pass — *drumroll please* — the ATS challenge!

ATS stands for applicant tracking systems and you’re probably more familiar with these types of software than you think. They’re often built into online application portals like iCIMS, Taleo and Greenhouse.

This type of software contains algorithms that scan your resume for keywords (usually from the job ad description) and rank them against other candidates’ resumes. Only the top ranking resumes are passed on to be read by a human hiring manager.

Getting past the ATS may seem daunting, but there are simple guidelines that will greatly improve your resume’s chances of success.

- Understand the banking industry’s hiring practices and the needs of your branch

- Use a word cloud service to pick out keywords from the job description

- Create clean formatting that can be easily scanned by the algorithm

When discussing each part of your bank teller resume, one at a time, we’ll show you how to address certain aspects that hiring managers look for when evaluating top candidates.

The job description is your best friend when it comes to determining which keywords are essential for beating the ATS. If you’re not quite sure what to include after a few read-throughs, a word cloud service might be able to help. Websites like worditout.com allow you to paste in the job description and the program will create a visualization of the most commonly used words. The biggest words in the cloud are can’t miss keywords for your resume – it’s that easy!

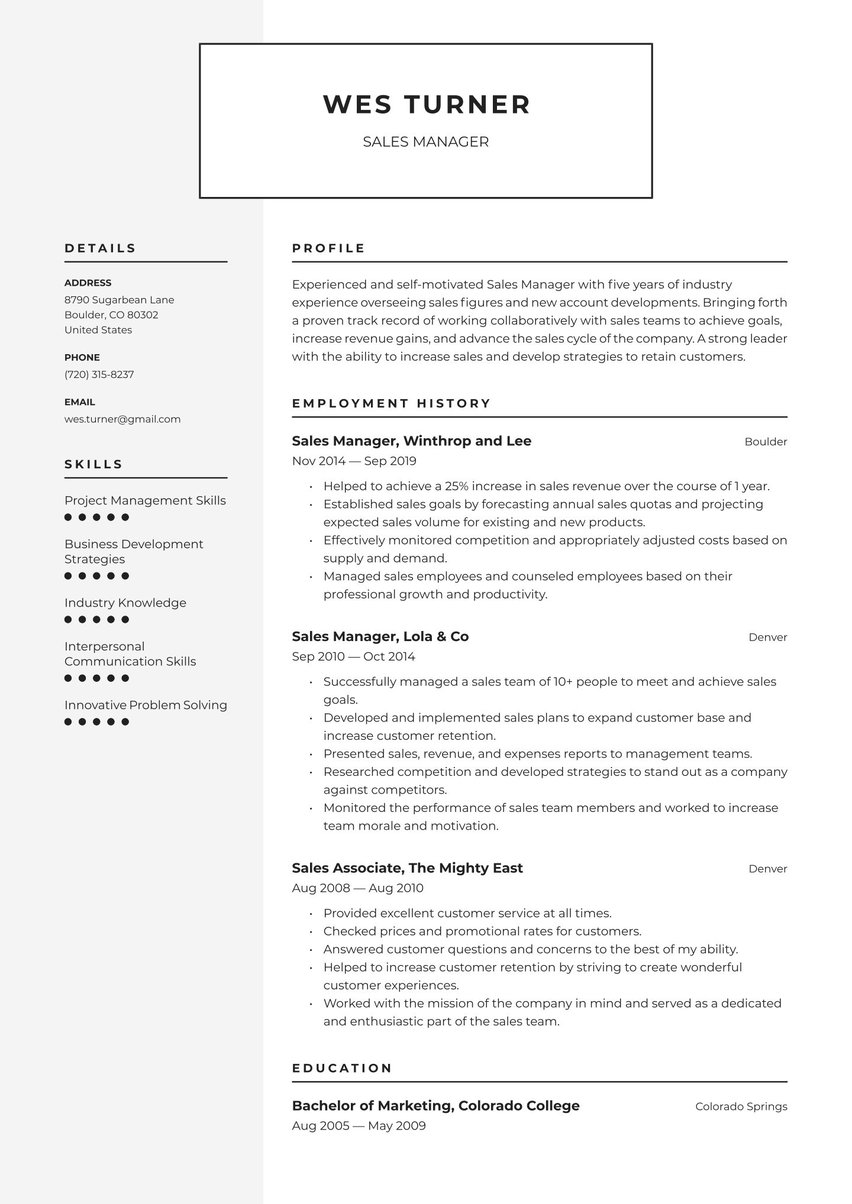

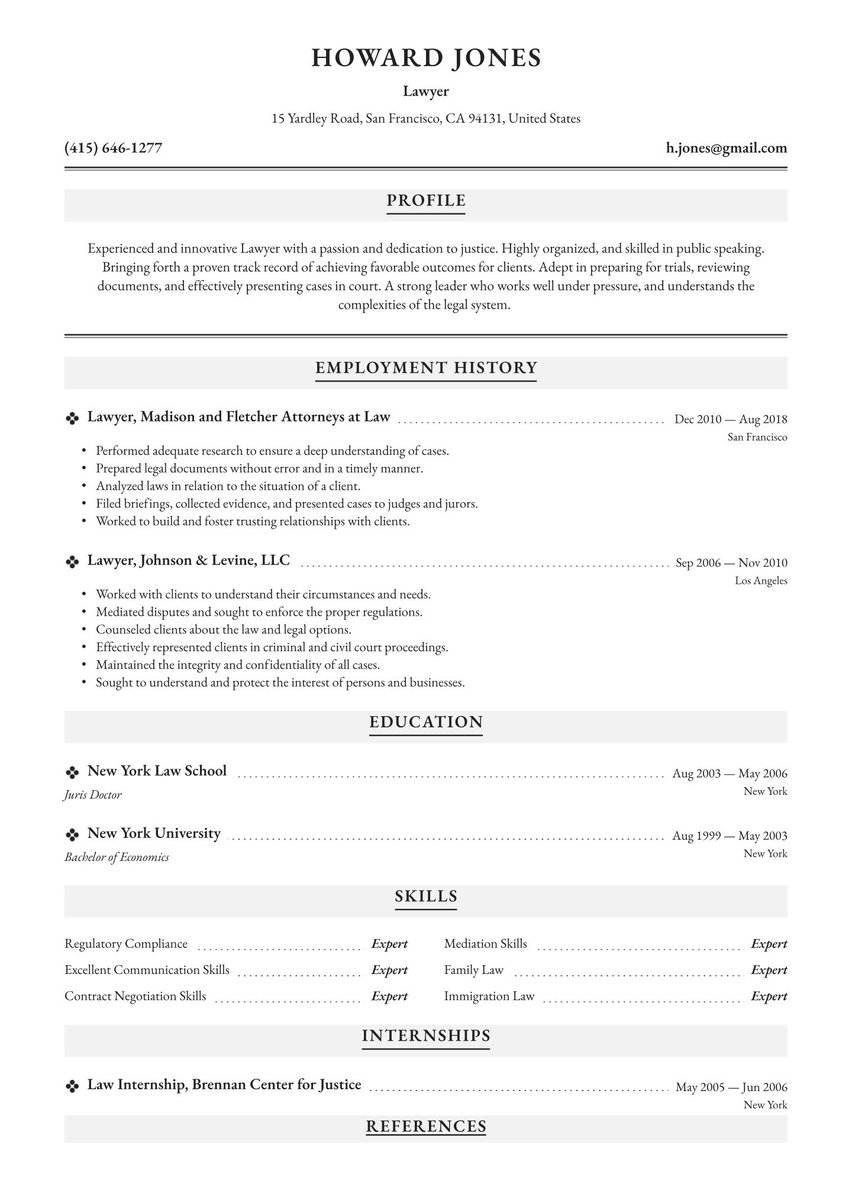

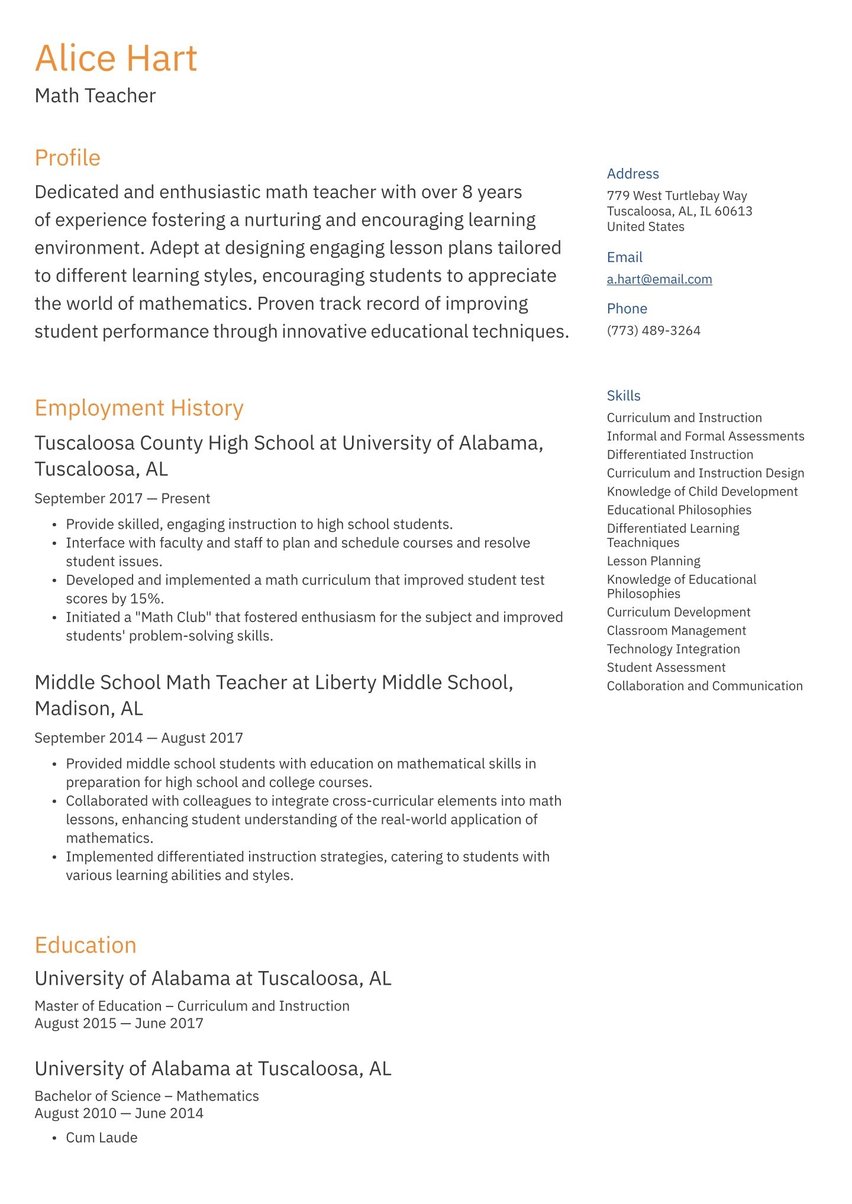

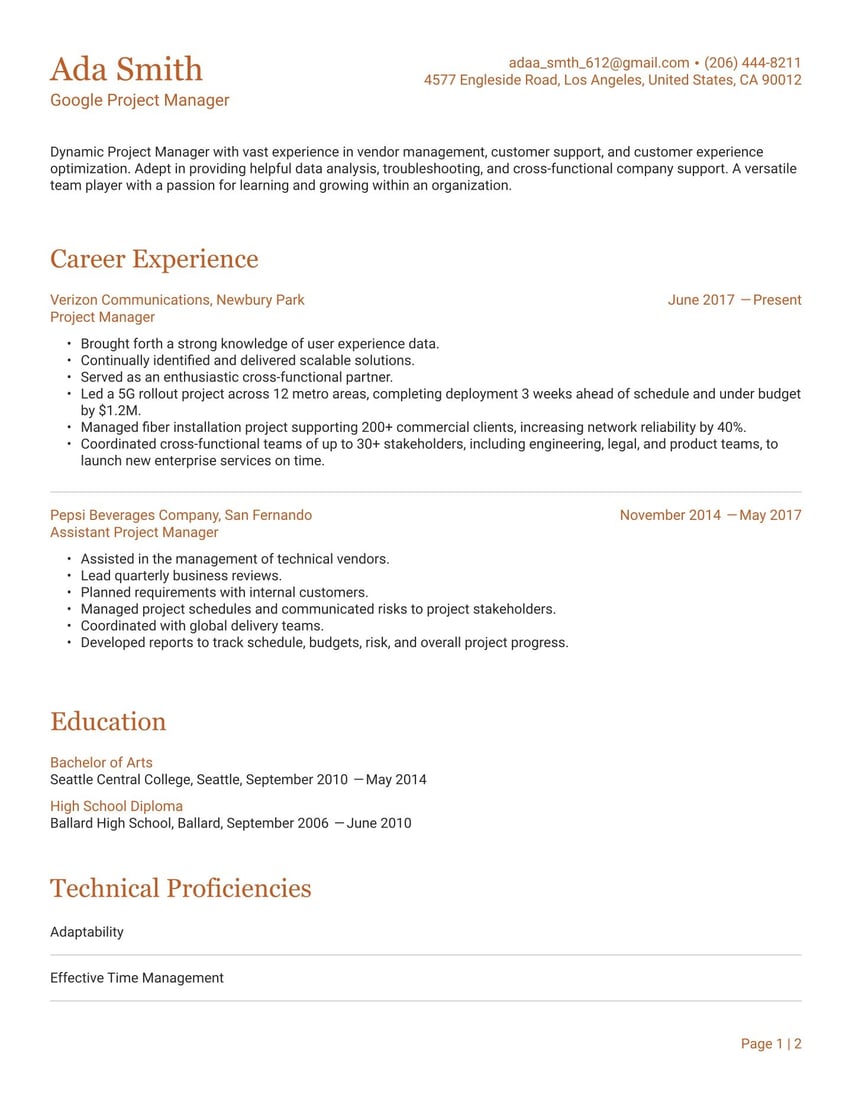

Choosing the best resume format for bank tellers

If your career path has followed a series of employee positions, then the most commonly used chronological resume format is your best option. It’s also preferred by recruiters for ease of review, with your current and previous jobs listed by employer from most recent to earliest dates.

The functional resume format, emphasizing transferable skills, and the hybrid (combination) resume format, are sometimes suitable for job candidates who are new to the workforce, making a career change, or have been self-employed.

Resume header

First things first — the resume header is what hiring managers are likely to notice off the top, and where you also hope they will return later to arrange an interview. It’s the place where your identifying information is prominently displayed: name, job title, phone number and email address.

An attractive header design not only distinguishes your job application from all the rest, but also offsets everything else on the page in a balanced, reader-friendly manner. The impact is stronger if you make your cover letter and resume documents a matching pair, with identical headers and other design elements.

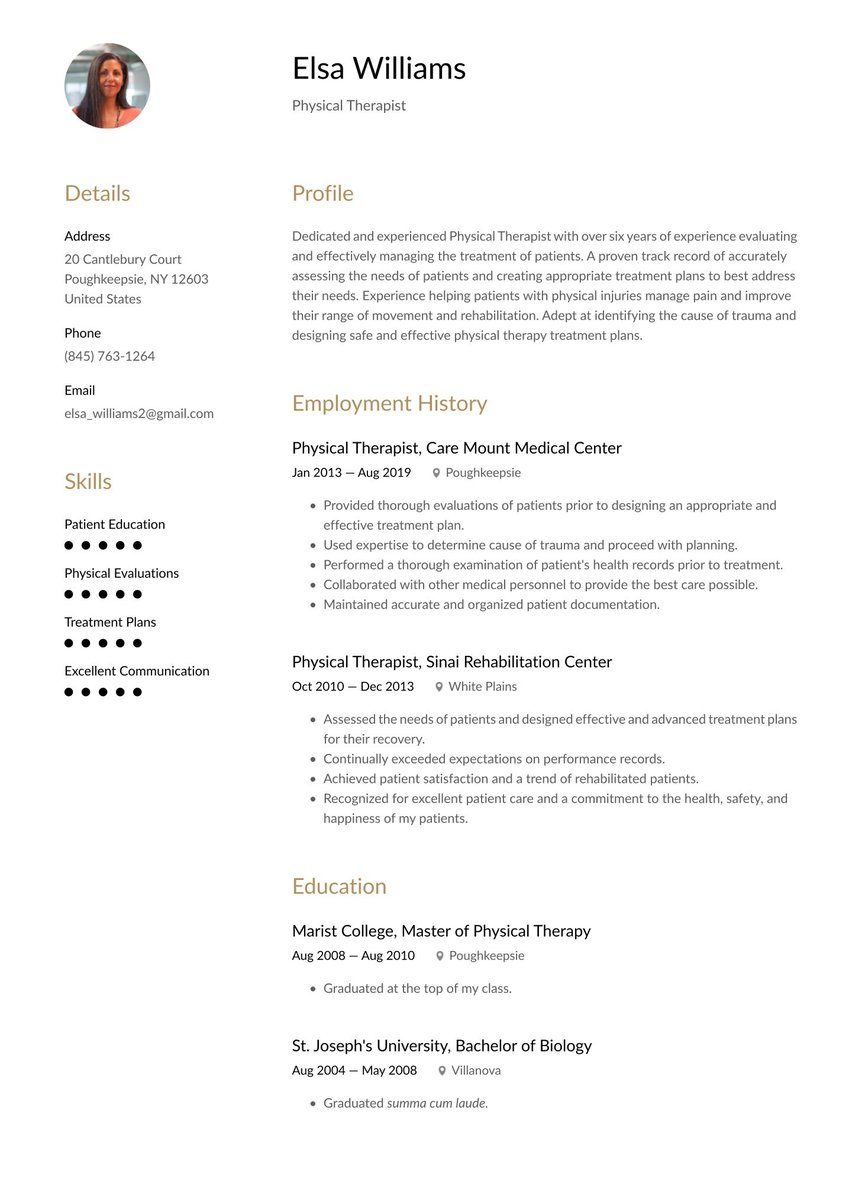

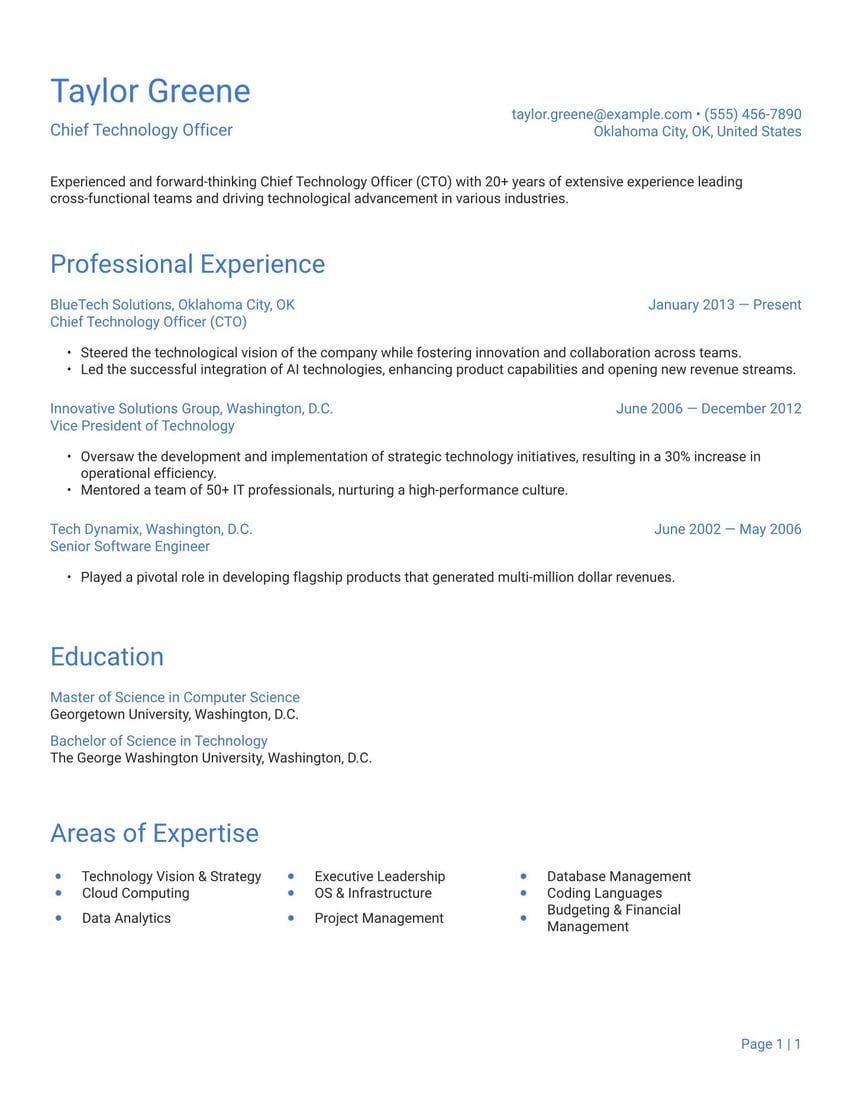

Bank teller resume summary example: professional perfection

Your resume summary (sometimes called profile or personal statement) is a three or four-line description of your previous experience, skills and motivations for applying to the bank branch. It’s also virtually the only place on your resume where you’ll get to show off your personality and human side — deceptively important qualities for bank tellers.

A bank teller role might seem like a very serious position but much of the job is built on positive interactions with customers and other staff members. A bank teller should be trustworthy and ethical when it comes to handling money while still being friendly and helpful towards clientele.

Begin your resume summary with two key traits that define you as a bank teller, then add an example of your most relevant professional experience. Since bank tellers often aren’t required to have advanced degrees, add a line about your education only if you feel it helps differentiate you for the position. Above all, make sure your professional and polite personality shines through – a hiring manager can read all the other details later in your resume.

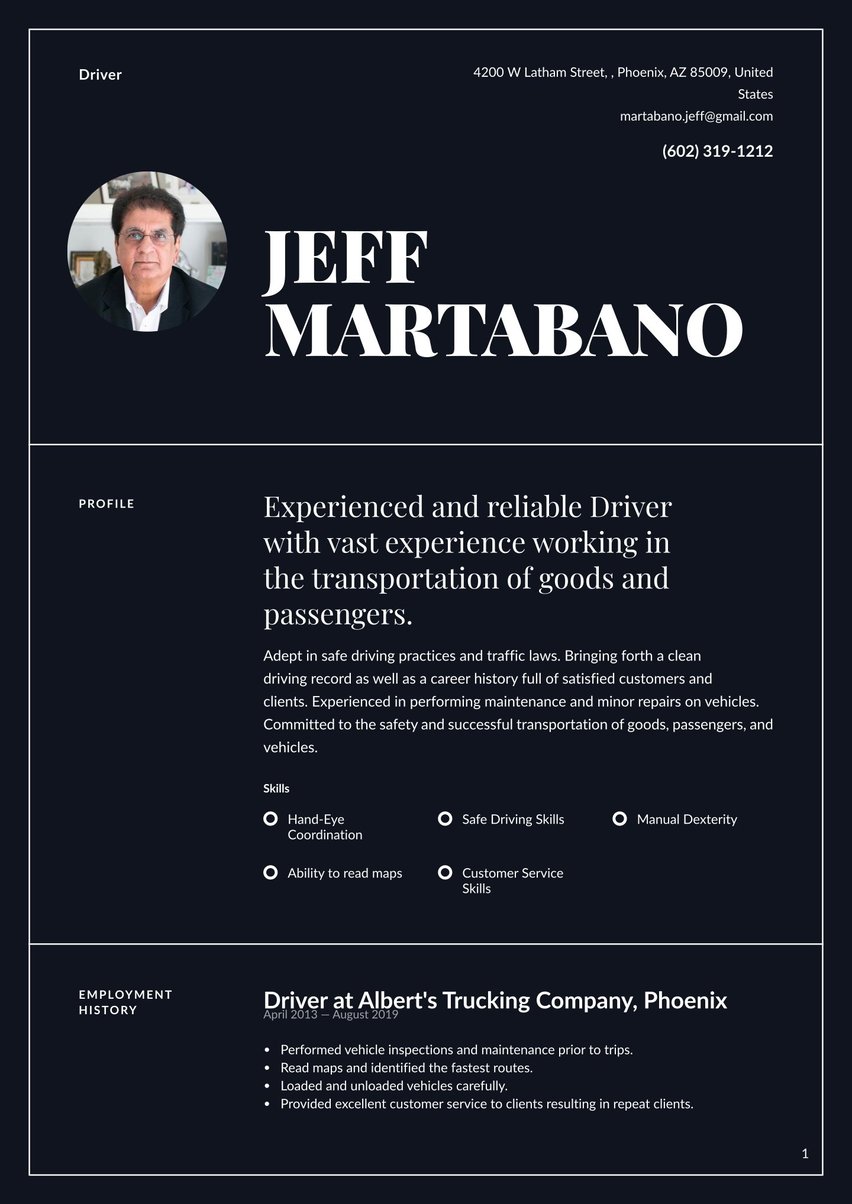

Below is a bank teller resume summary example that you can modify.

Dedicated Bank Teller with over 7 years of experience, seeking to fill a full-time or part-time position. Exemplary record of providing fast and efficient banking services to customers, eagerly helping them to complete desired transactions. Proficient in performing routine and complex banking transactions, with superior knowledge of bank products and pertinent regulations. Excellent customer service skills and helpful, collegial attitude towards coworkers.

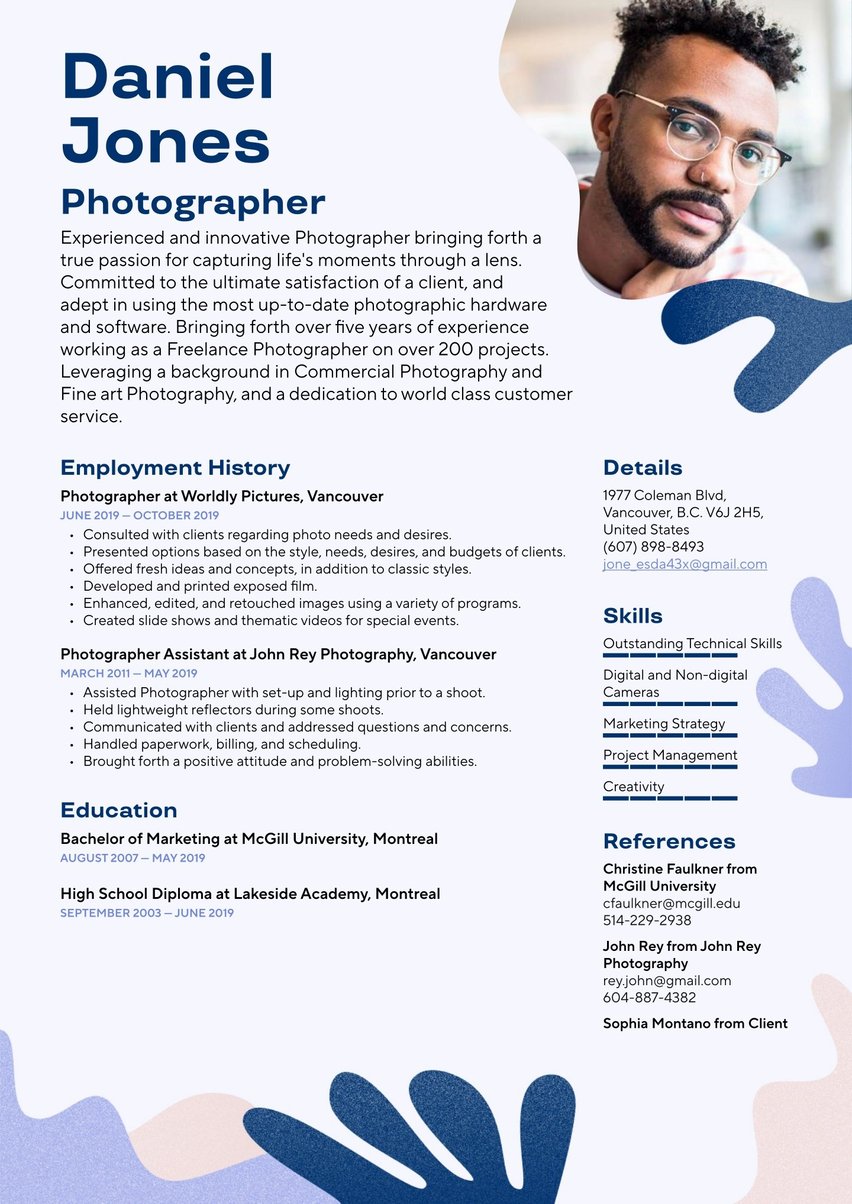

Employment history sample: format to impress

The employment history section is where you’ll break down the details of your previous positions, tasks and achievements. As discussed earlier, for most career professionals with at least some work experience, we recommend the reverse chronological order. Start with your most recent place of employment and work backwards until you’ve listed your most recent four or five positions.

Each job listed on your resume should contain four or five bullet points describing your most impressive duties and any significant results you achieved. Here are some tips for developing each description:

- Use action verbs to inject energy and mastery into each task.

- Offer numbers and statistics that illustrate your contributions.

- Choose roles that most closely align with the tasks of your potential position based on the job description.

Following these tips will help you make the most of your limited resume space and increase your chances of catching a recruiter’s attention as they scan your application.

The sample below illustrates what a bank teller employment history section might look like.

Bank Teller, Citibank, New York

July 2018 - December 2022

- Successfully performed a full range of teller duties, averaging 140 customer transactions per shift.

- Fostered a welcoming and friendly customer environment.

- Provided prompt and courteous services to all customers.

- Utilized banking knowledge to recognize customer needs and suggested appropriate banking services.

- Worked as an enthusiastic and cooperative team member, recognized five times as employee of the month.

Bank Teller, Walden Savings Bank, Montgomery

June 2015 - June 2018

- Provided exceptional service and basic product information to customers.

- Ensured the accurate processing of customer transactions, averaging 125 per shift.

- Assisted customers with account maintenance questions and procedures, improving efficiency when referrals to other staff were unnecessary.

- Promoted bank products and services by referring customers to appropriate business partners as necessary.

- Assisted supervisors in daily branch operations.

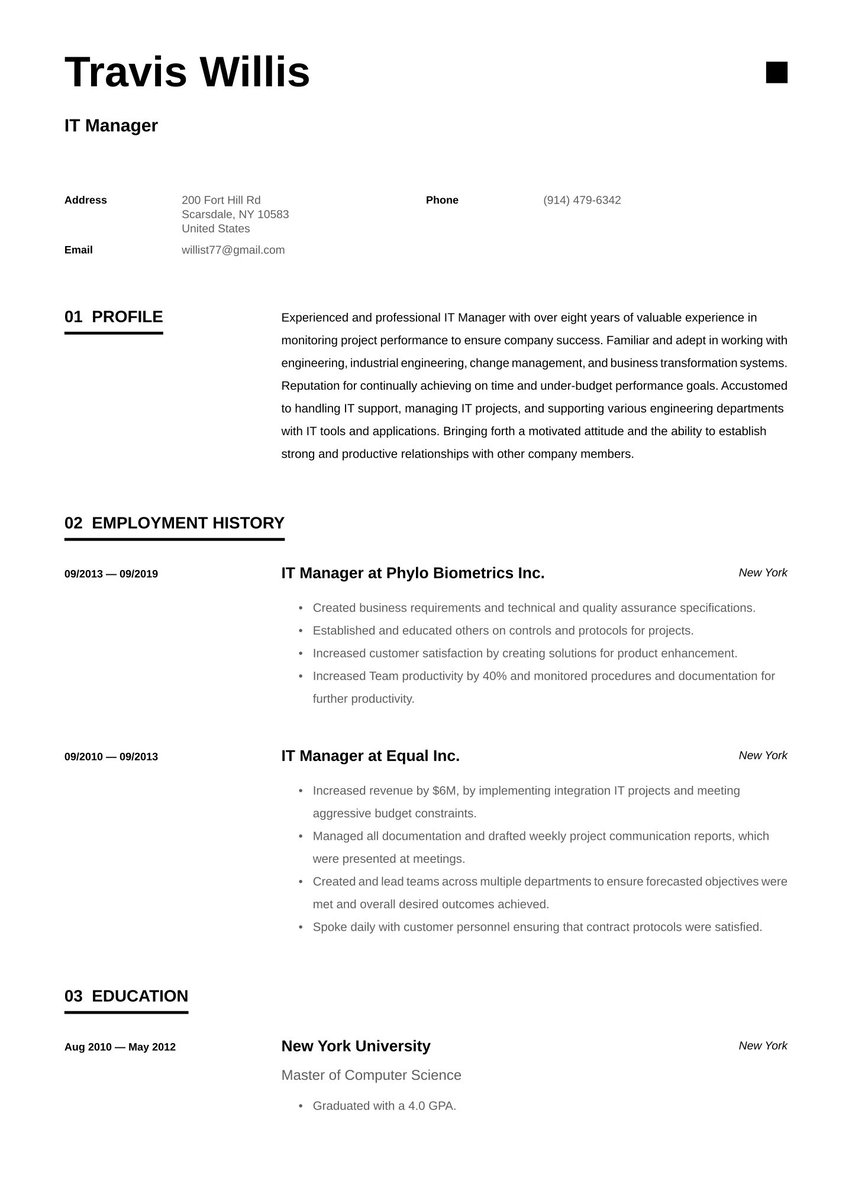

Resume education example: a foundation for success

Bank teller positions are great entry level jobs and launching points into the finance and banking industries because they often require little more than a high school diploma or GED. Candidates for bank teller jobs should also be prepared to pass a background and/or a credit report check.

If you do possess a college degree, it doesn’t hurt to include it on your resume, especially if you want to position yourself for more specialized duties within the bank or if you have an educational background in a banking-related field.

Your resume education section listings should be organized as follows, in reverse chronological order from highest to lowest level.

University at Albany , Associate of Communications, Albany

September 2010 - May 2015

Academy of the Holy Names, High School Diploma, Albany

September 2006 - June 2010

Do bank tellers need college degrees?

Working as a bank teller is one of the best positions available to people who have not completed college education. According to the U.S. Bureau of Labor Statistics, only about 34% of bank tellers have completed some college courses or a degree.

Conversely, if you do possess an educational background in tech, math or business adding it to your resume may help you stand out and position yourself to take on more specialized tasks.

Certifications

Some tellers receive certification through an on-the-job training program after they are hired, while others possess national credentials like the Certified Bank Teller designation from the American Bankers Association. If you have completed additional courses, training, certifications related to work as a bank teller, you should include these either within or following the education section on your resume.

Achievements

If you’ve worked as a bank teller before, you may have earned some recognition or achievements in your previous roles. You can create a short section to show these off if resume space allows. If possible, try to add a one-line description of your achievement that explains what you accomplished. For example, follow up “Teller of the Month” with a description of the number of customers you served or a notable transaction you helped complete.

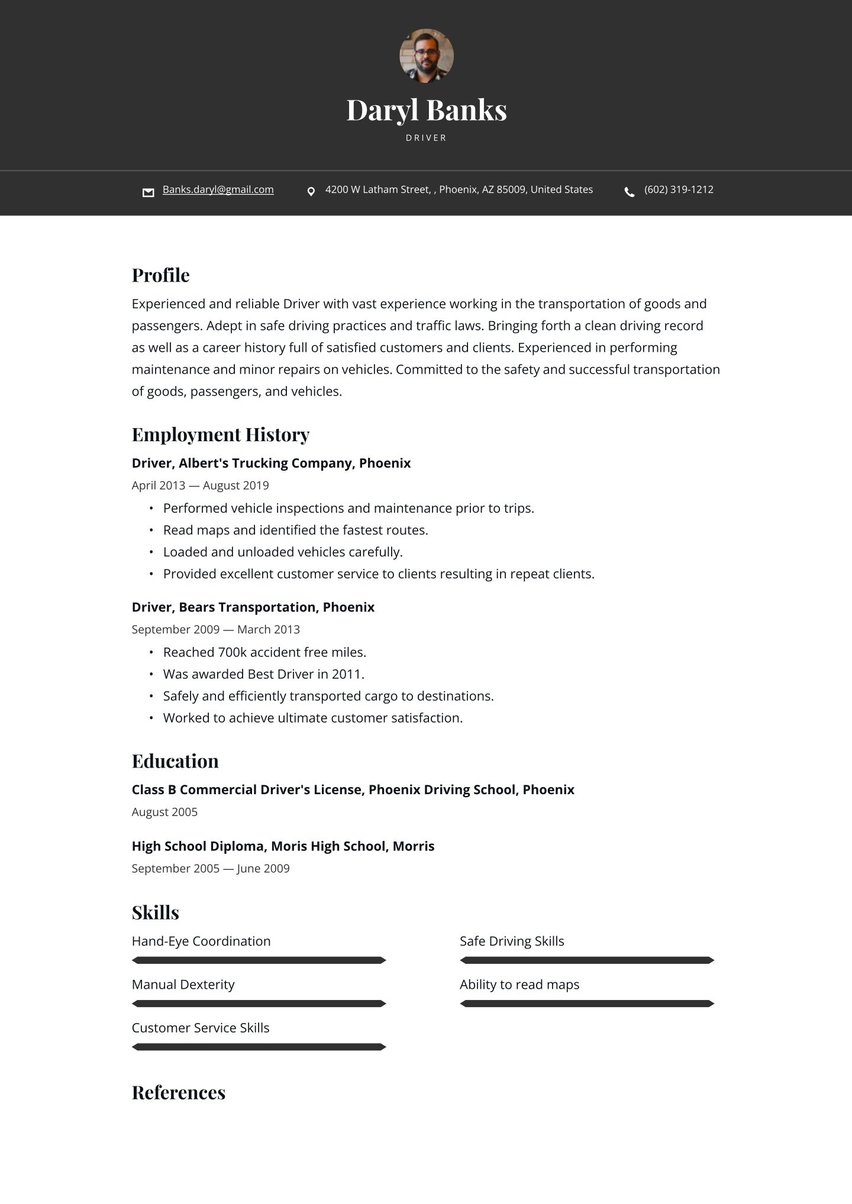

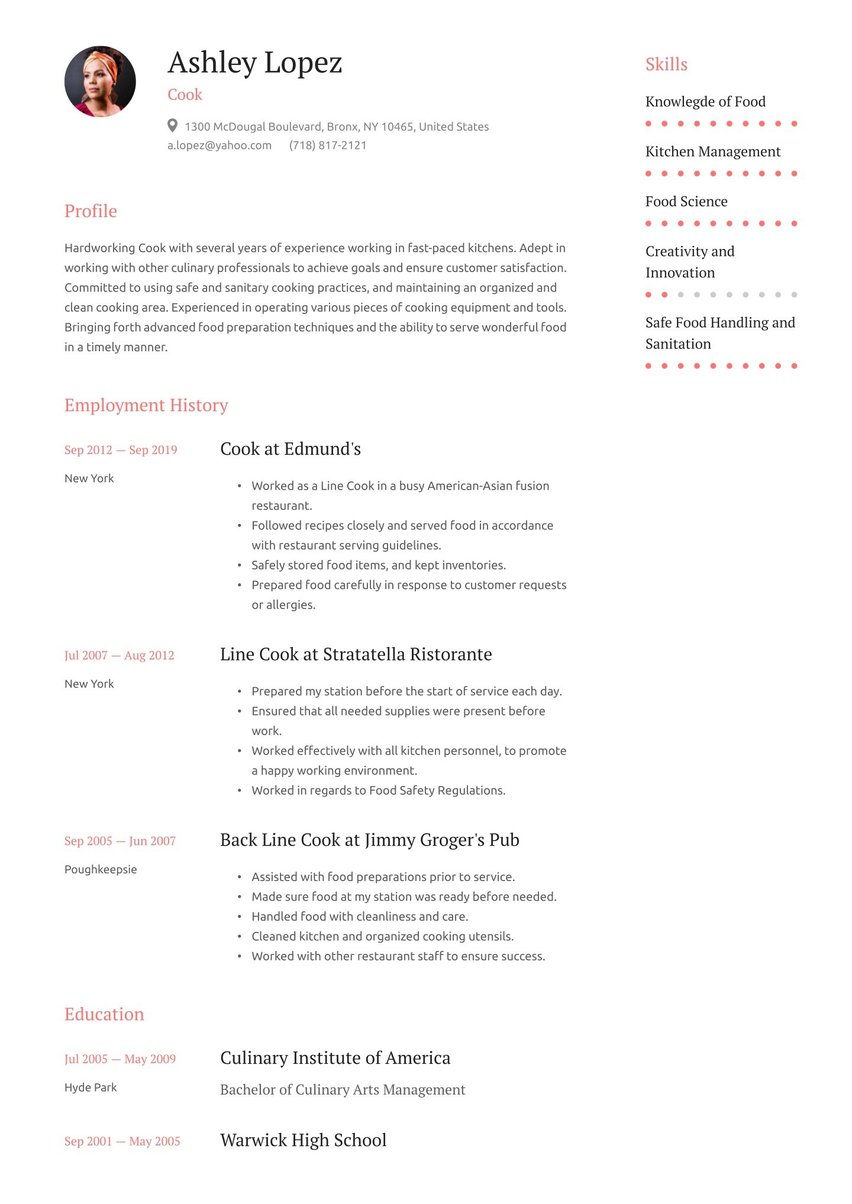

CV skills example: show off your strengths

A bank teller’s skills are the essence of the role, but that doesn’t mean they need to be showcased in a laundry list on the bottom of your resume. Save space by incorporating the most important ones into the bullet points of your work experience section. Your skills section can then be saved for a selection of the most important/specialized abilities.

The skills section is also one of the most important places to optimize your resume for the ATS. Use those word clouds and a careful reading of the advertised job description to place technical skills as well as personality traits into this section.

- Time Management

- Ability to Multitask

- Adaptability

- Customer Service

- Advanced Banking Knowledge

Hard skills

As discussed in the beginning of this example, the role of a bank teller is changing. For candidates with previous teller experience, banks may be looking for more technical abilities (also known as hard skills). If key software programs, investing or loan-related knowledge is mentioned in the job description, make sure to mention the same specific keywords in your skills section if they apply to you.

- Time Management

- Ability to Multitask

- Adaptability

- Customer Service

- Advanced Banking Knowledge

Soft skills

Your temperament and commitment to customer service make all the difference in a bank’s reputation and rapport with its clientele. Make sure to add two or three soft skills into your skills section, highlighting the most relevant based on the job description.

Check out a bank teller CV sample for the skills section below.

- Problem-solving skills

- Multitasking

- Patience

- Attention to detail

- Responsible

- Focused

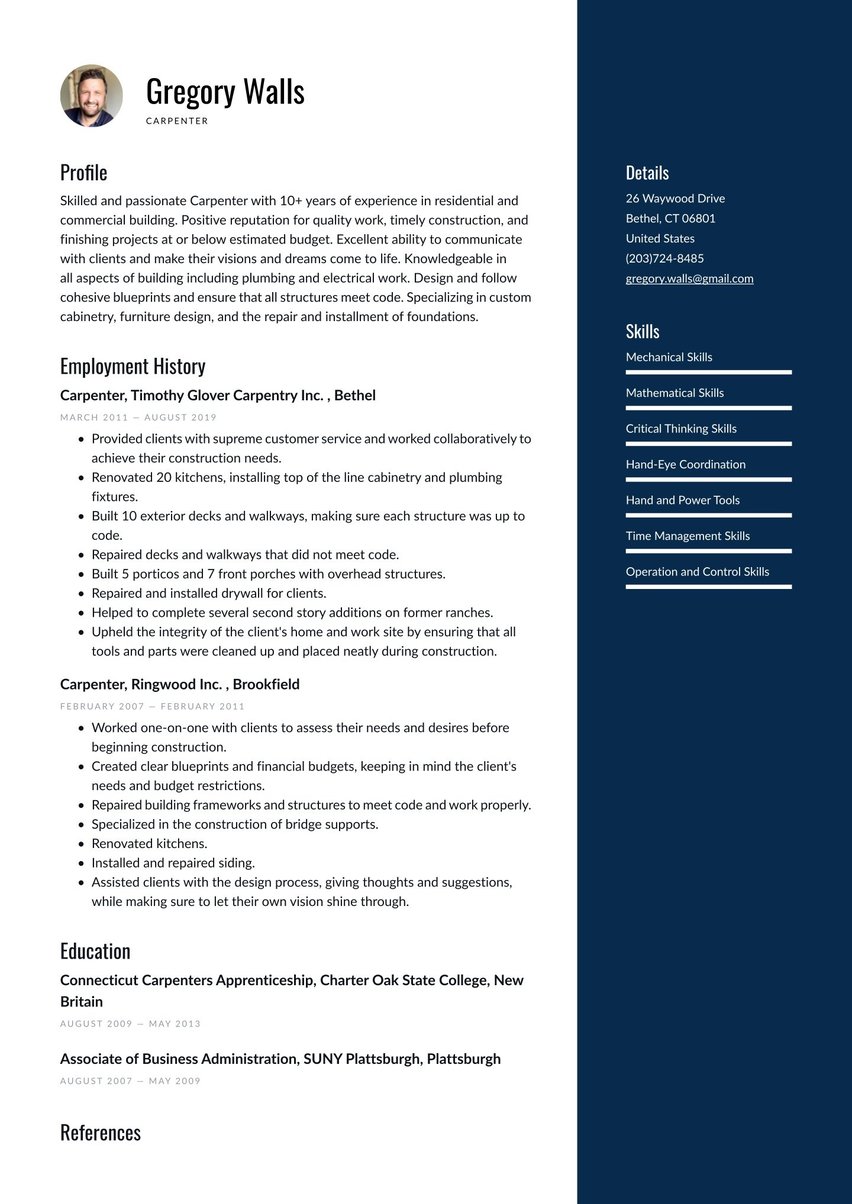

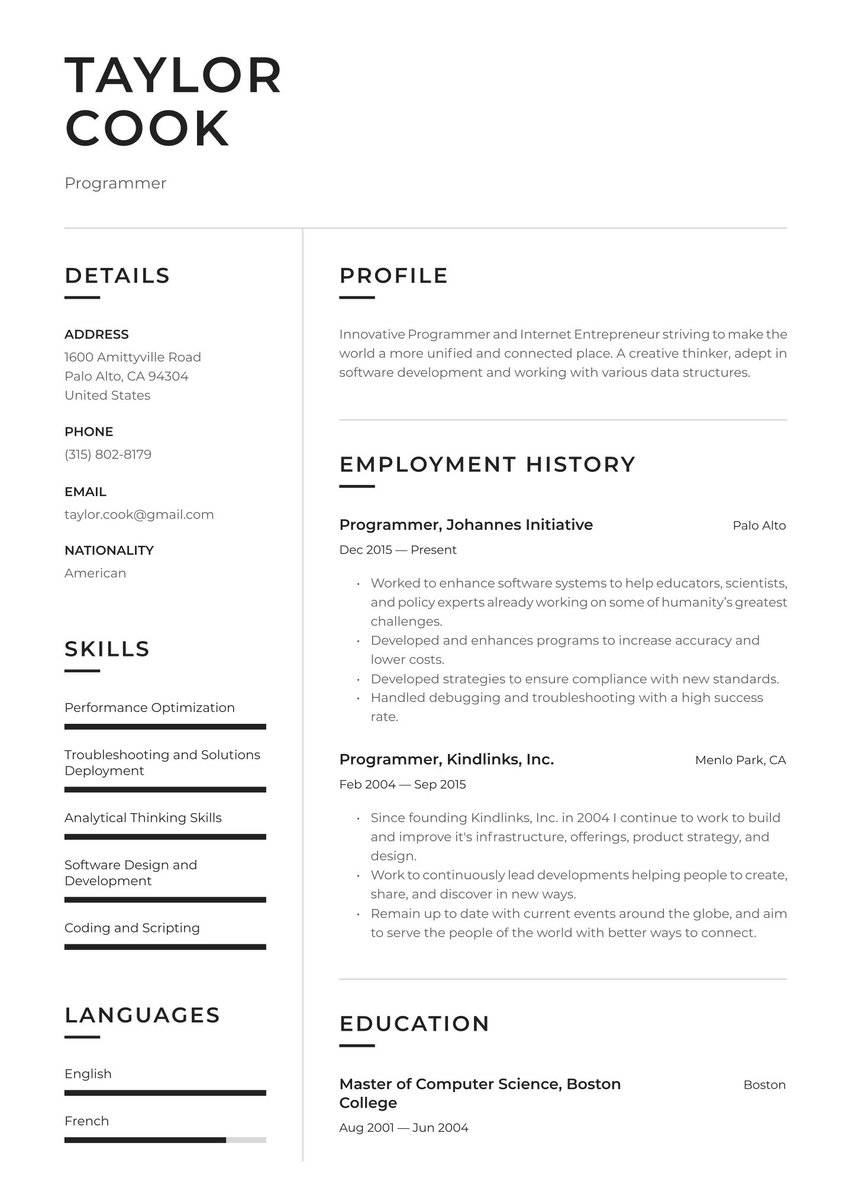

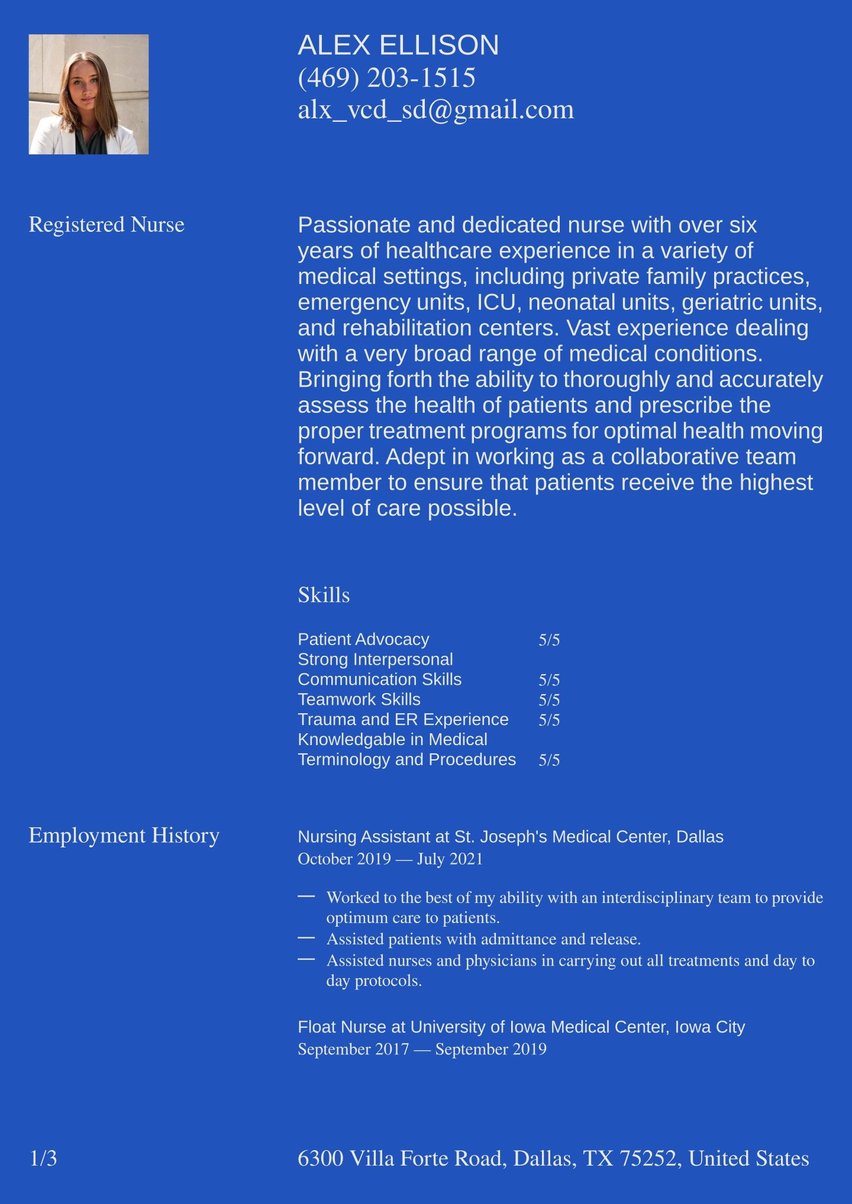

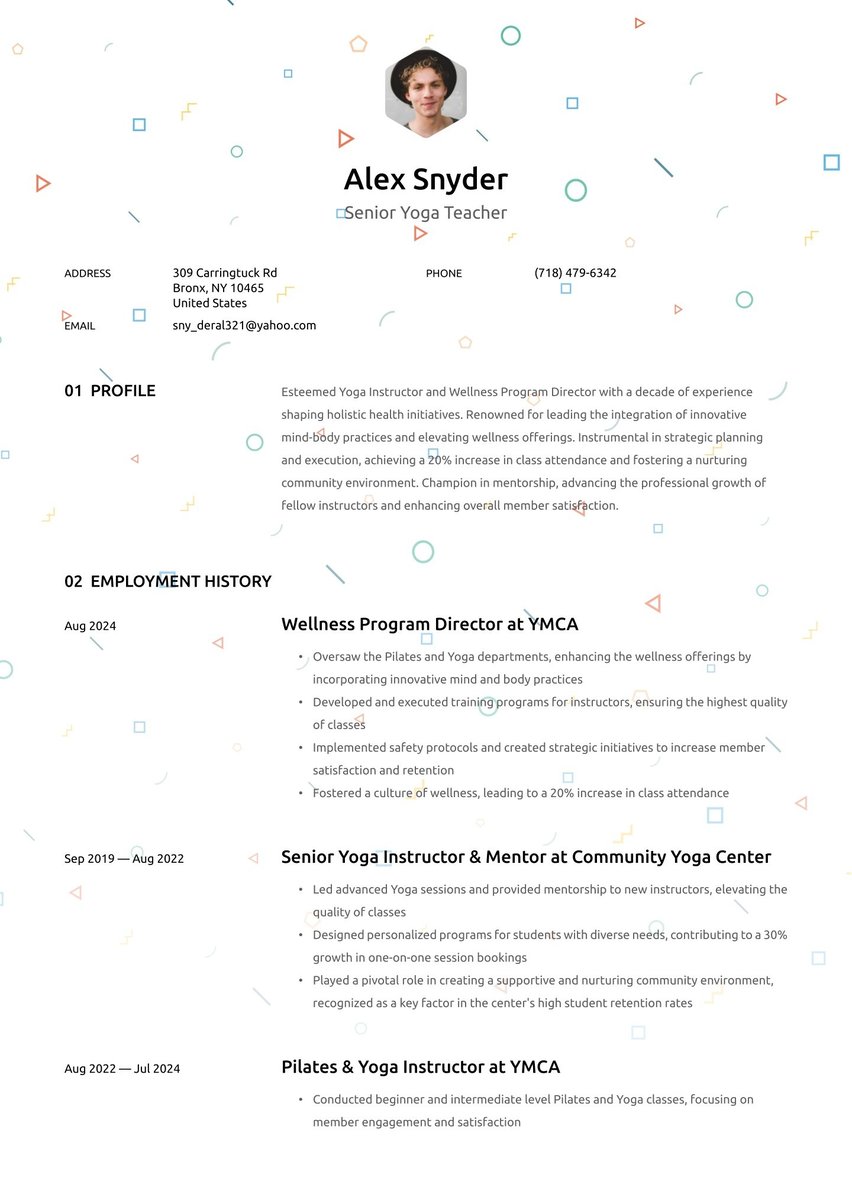

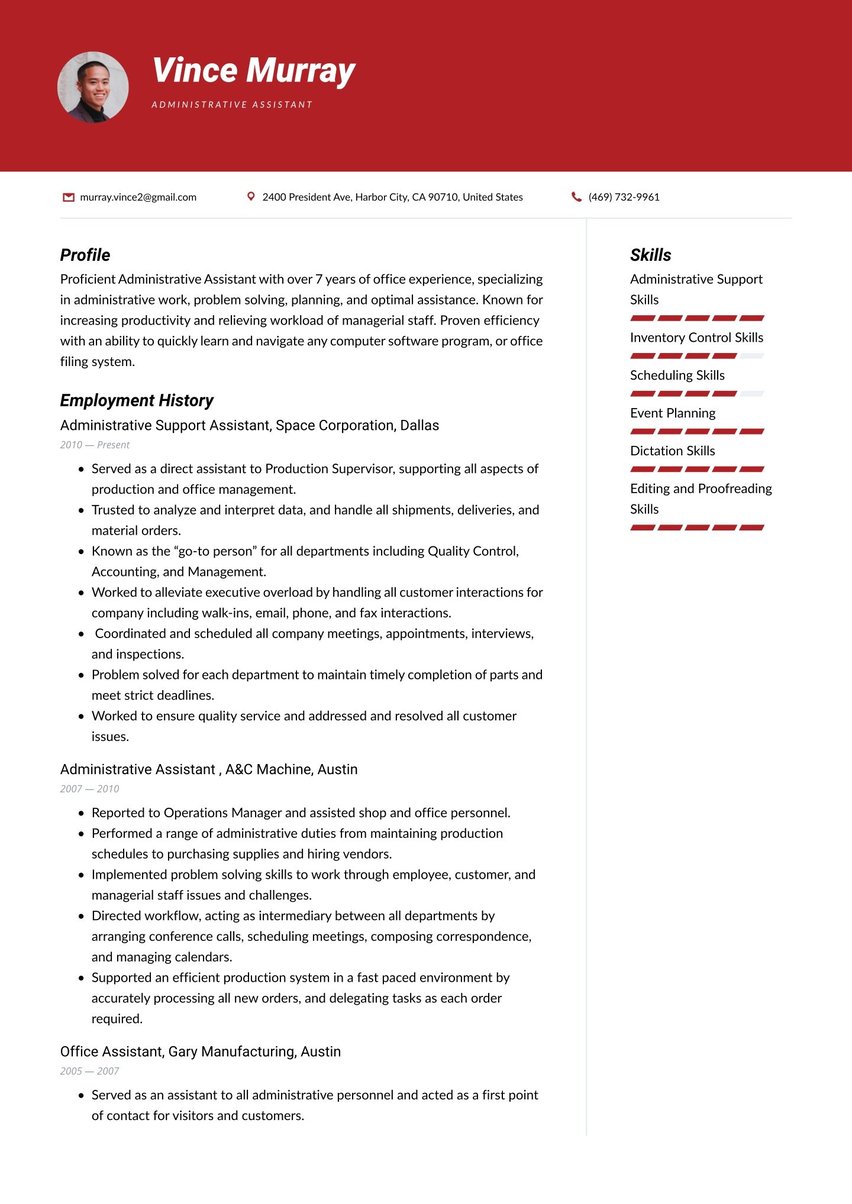

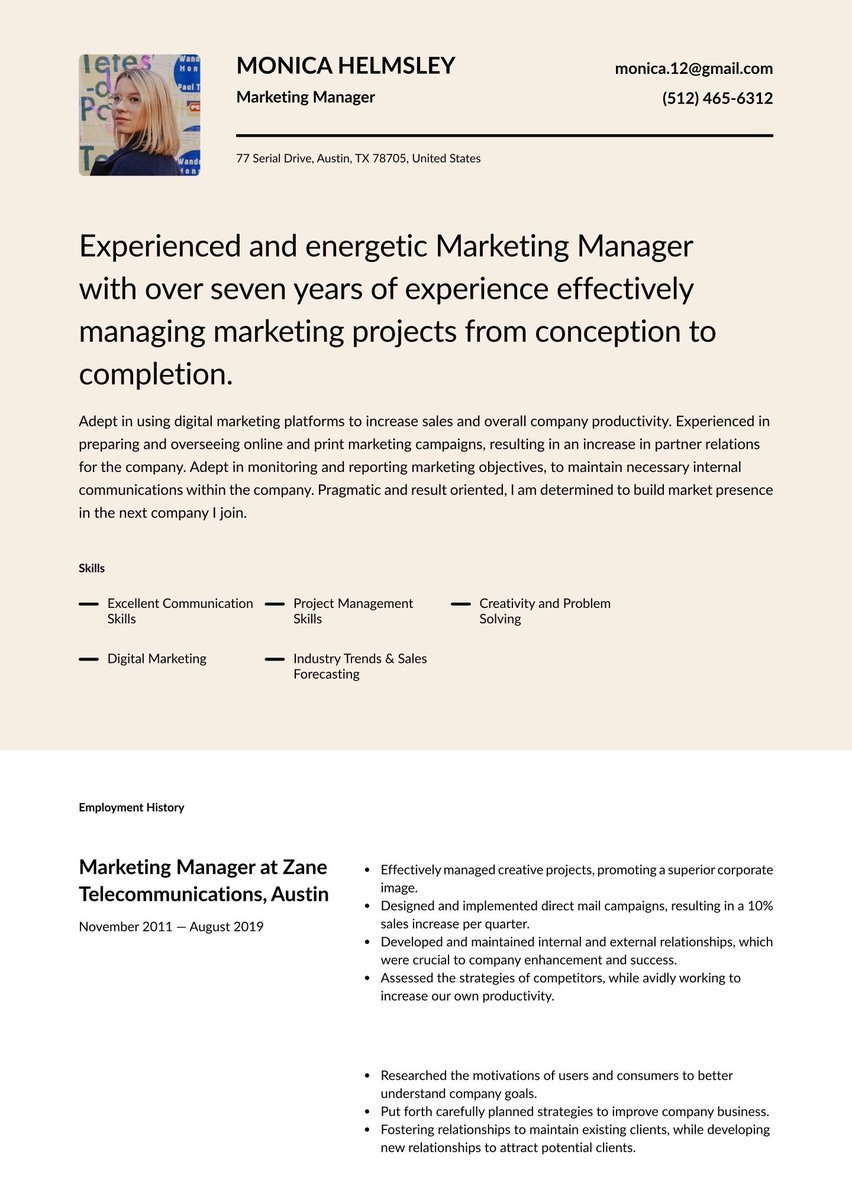

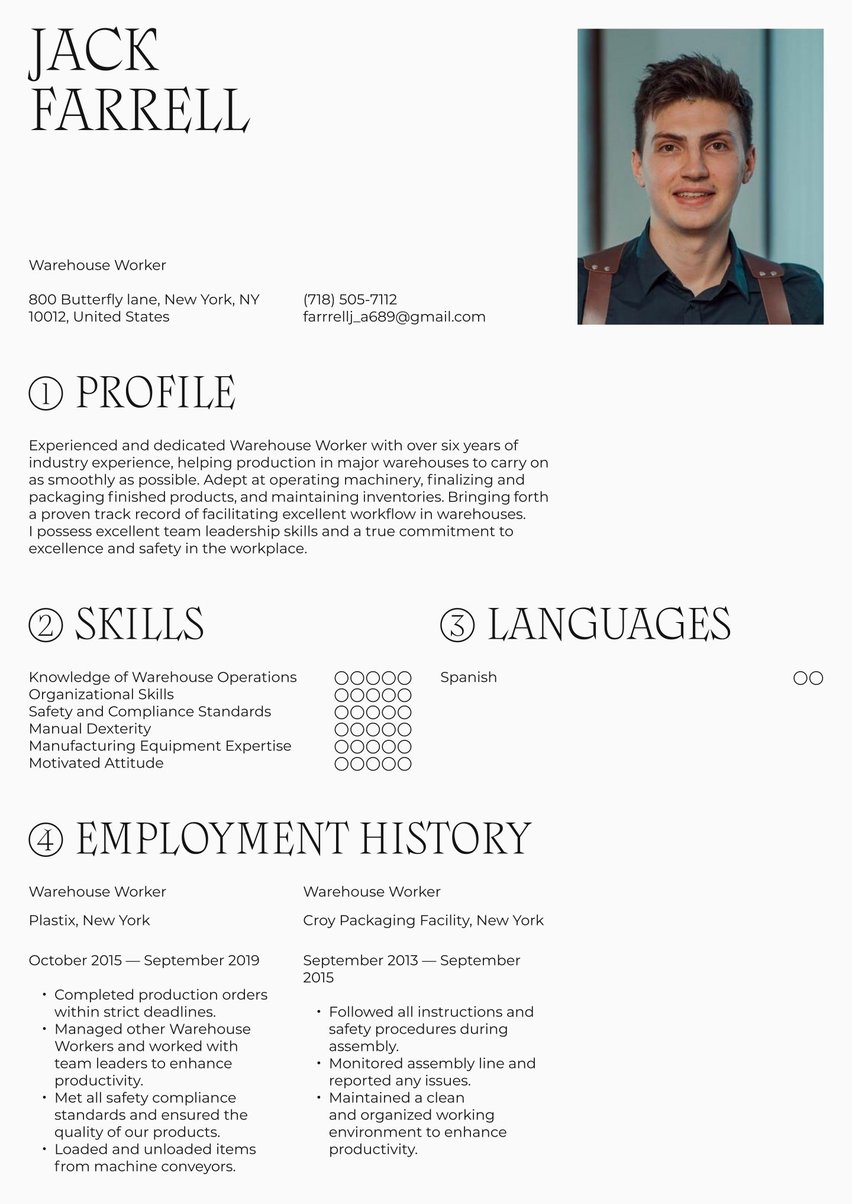

Resume layout, design and formatting

Most candidates agonize over every word of their resume, but fewer realize the importance of carefully choosing each visual element on the page. Resume layout, design and formatting can often say just as much about you as the words on the page — everything from your resume’s color palette to your font styles and size build an image of you as a candidate.

When choosing a design appropriate for the finance industry, professionalism is key. Since this is a formal industry, you’ll want to convey a polished persona. Clean lines, muted colors (or no colors), and traditional font styles like Georgia, Helvetica or Arial are the best options for a bank teller resume.

- Make sure your resume layout contains the right balance of white space to text.

- Create a header that is both professional and eye-catching.

- Stick to a maximum of 2 fonts on your resume.

- Use a font size between 10-12 points for the body of your resume.

- Overwhelm your resume with bright and eccentric colors.

- Overload your resume with too much text — readability is key.

- Forget to customize your CV for each role you apply to.

- Save your resume in a format that might not stay intact between computers; PDF is best.

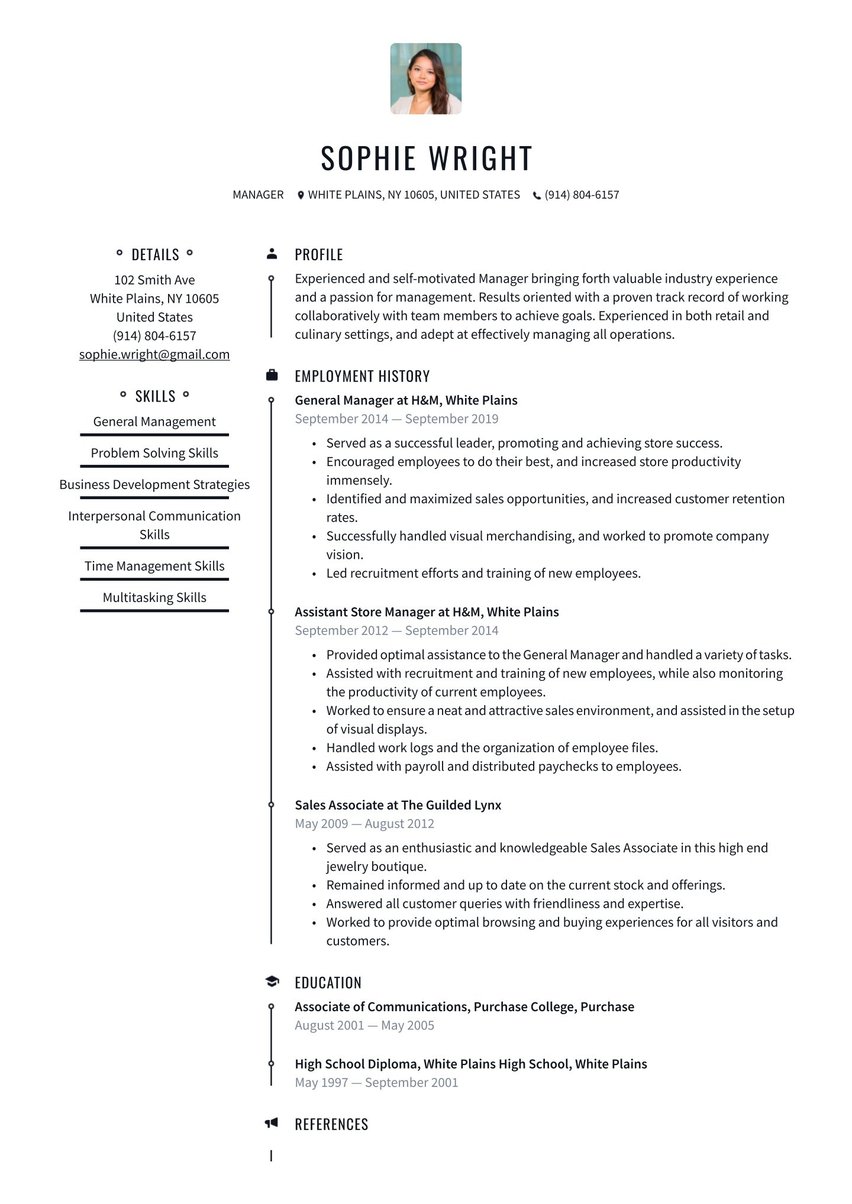

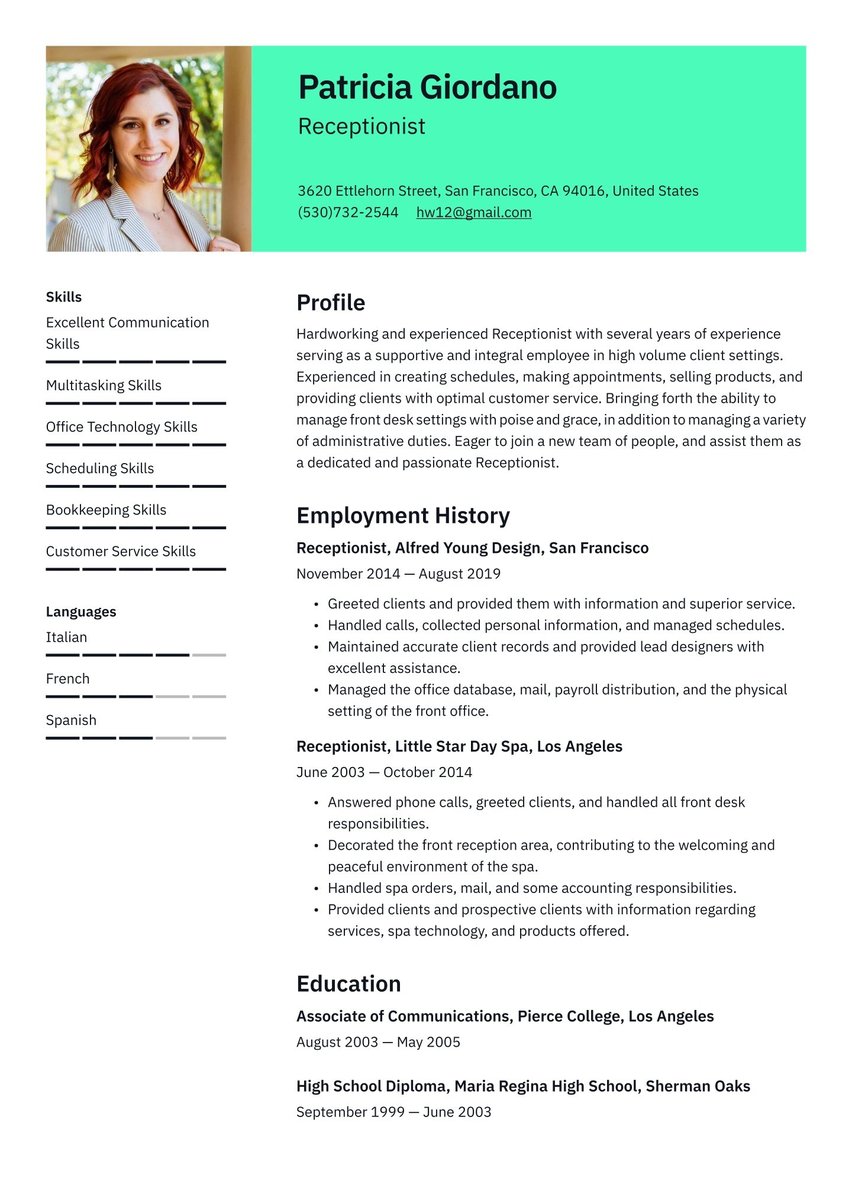

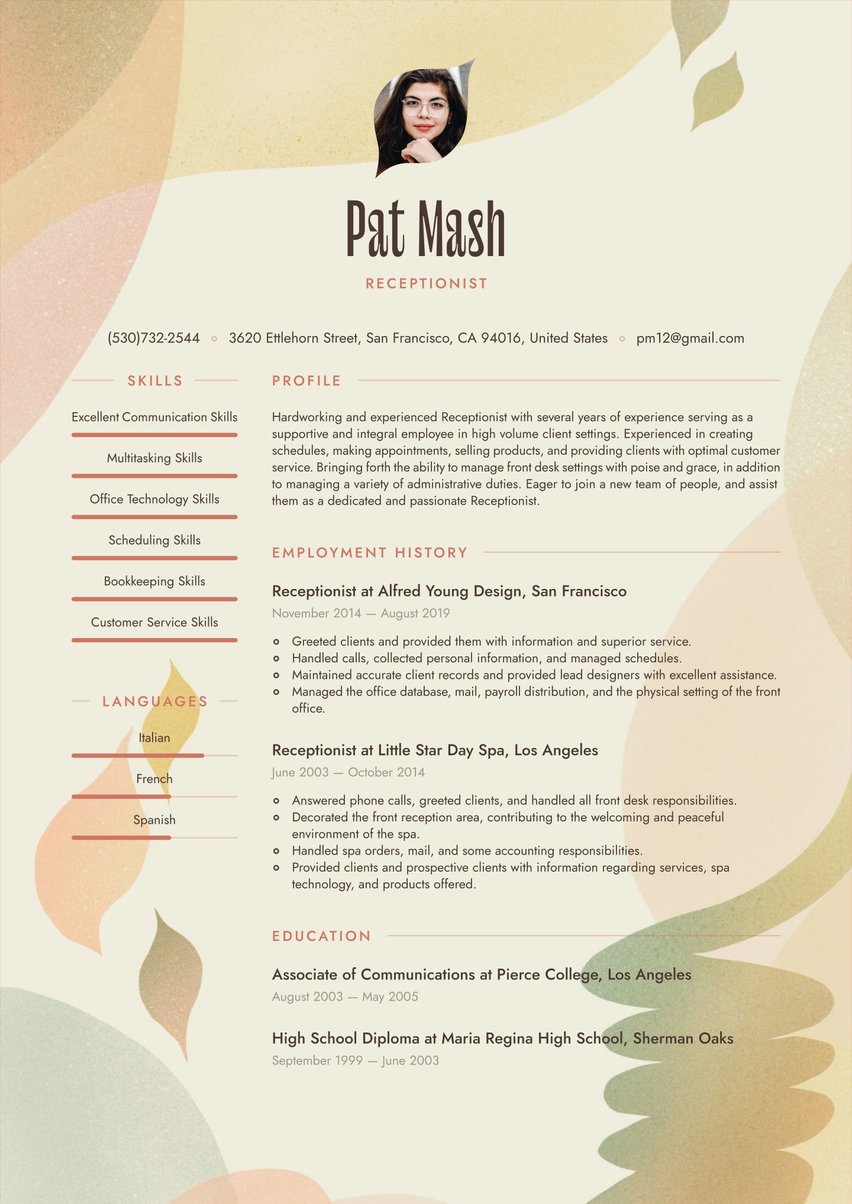

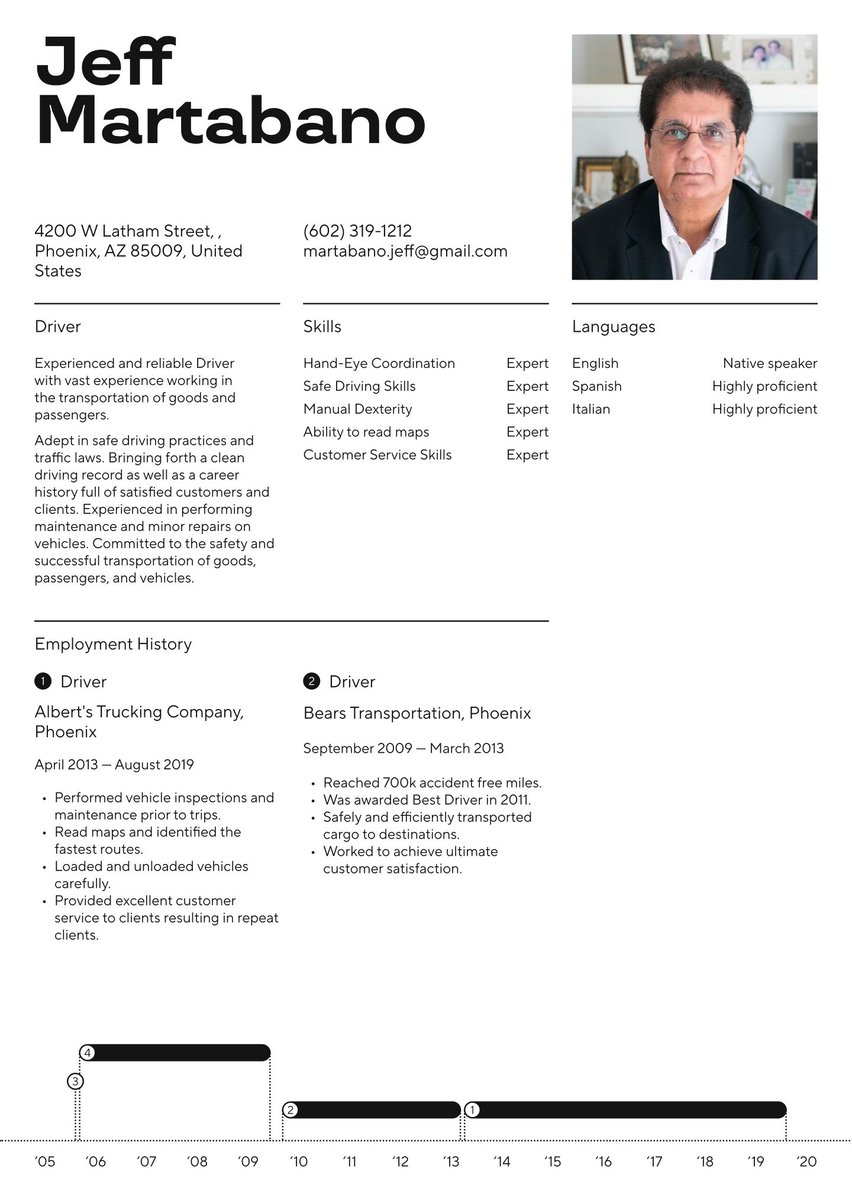

The best resume template for a bank teller

Creating a resume layout from scratch can be frustrating, especially when using traditional word processing software which is too rigid to handle all the sections required in a resume.

Our resume templates make for easy alternatives, providing moveable sections and clean formatting right from the start. They come with pre-filled sample sentences designed to help simplify the writing process.

Before choosing a template for a bank teller resume, make sure to consider your needs as well as the preferences of the employer. For example, will your employment history be the main focus or will you need additional space for your educational background? Does the bank’s branding align with bold fonts and bright colors? Or is a traditional, more subdued approach the way to go?

With Resume.io’s resume builder, you can easily try out one of our professional or simple resume templates and customize it to your taste. Quickly change between styles and save as a new version when applying to multiple openings.

Once you’ve crafted your resume and chosen a template with care, you’ll want to make sure your resume looks the same on the hiring manager’s computer as it does your own. That’s why we recommend downloading your resume as a PDF — the best format for emailing, printing and uploading. PDFs are also commonly accepted and easily readable by ATS systems.

Bank teller text-only resume example

Profile

Experienced Bank Teller seeking to fill a full-time or part-time position. Adept in providing fast and efficient banking services to customers, while helping them to successfully complete desired transactions. Skilled in performing routine and complex banking transactions, while complying with all rules and regulations.

Employment history

Bank Teller, Citibank, New York

July 2018 - December 2022

- Successfully performed a full range of teller duties, averaging 140 customer transactions per shift.

- Fostered a welcoming and friendly customer environment.

- Provided prompt and courteous services to all customers.

- Utilized banking knowledge to recognize customer needs and suggested appropriate banking services.

- Worked as an enthusiastic and cooperative team member, recognized five times as employee of the month.

Bank Teller, Walden Savings Bank, Montgomery

June 2015 - June 2018

- Provided exceptional service and basic product information to customers.

- Ensured the accurate processing of customer transactions, averaging 125 per shift.

- Assisted customers with account maintenance questions and procedures, improving efficiency when referrals to other staff were unnecessary.

- Promoted bank products and services by referring customers to appropriate business partners as necessary.

- Assisted supervisors in daily branch operations.

Skills

- Time Management

- Ability to Multitask

- Adaptability

- Customer Service

- Advanced Banking Knowledge

Education

University at Albany , Associate of Communications, Albany

September 2010 - May 2015

Academy of the Holy Names, High School Diploma, Albany

September 2006 - June 2010

Key takeaways for a bank teller resume

- A bank teller resume needs to convey a variety of banking and people skills.

- The summary section gives an overview of your professional demeanor, plus your most notable accomplishments.

- Your employment history section should follow reverse chronological order with your most recent position listed first.

- Although bank tellers aren’t required to have a college degree, including relevant coursework or achievements can help bolster your education section

- Formatting for a bank teller resume should be formal and professional. Use a template that aligns with the company image and branding.

.jpg)

.jpg)