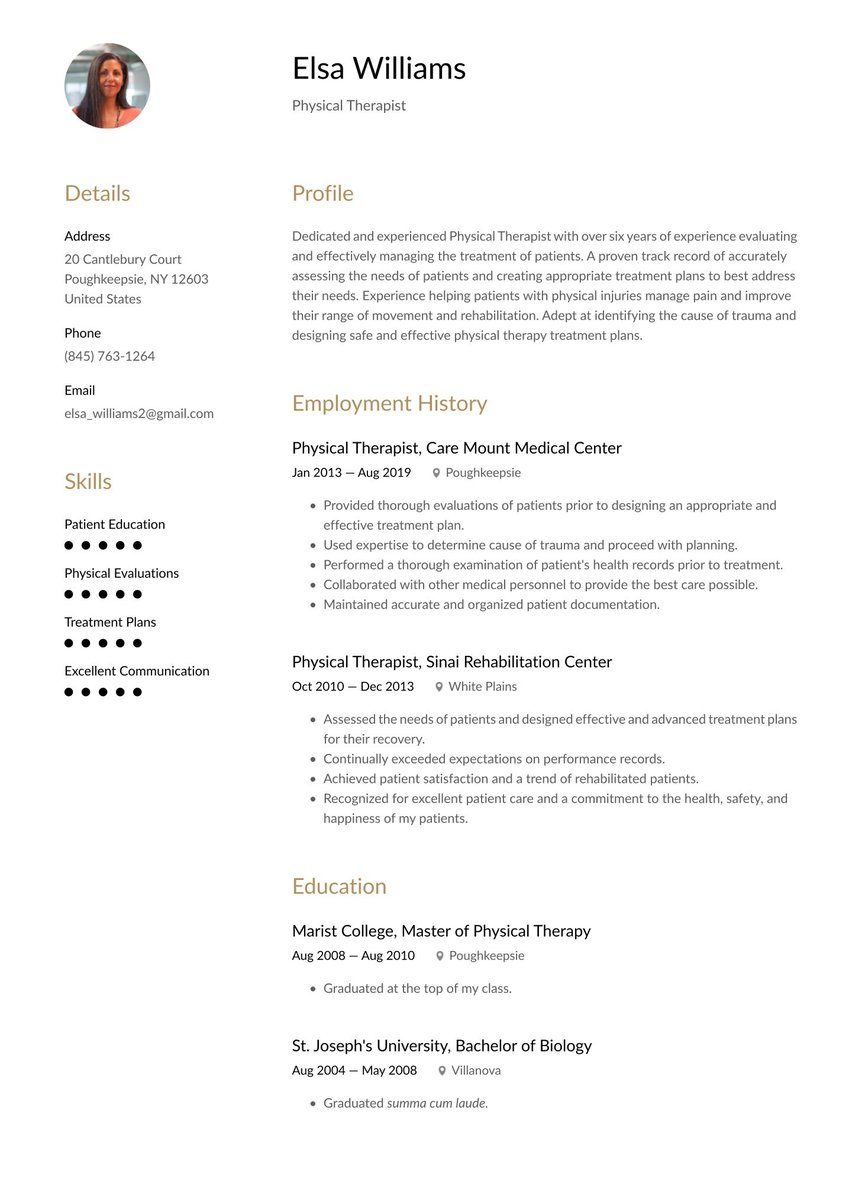

Detail-oriented Credit Analyst with 3+ years of experience in financial risk assessment and credit underwriting. Skilled in financial analysis, loan evaluation, and relationship management. Proven track record of improving portfolio quality and streamlining credit review processes.

06/2022 - present, Associate Credit Analyst, JPMorgan Chase & Co., Chicago

- Analyze financial statements, business plans, and industry trends to evaluate creditworthiness for middle-market commercial clients

- Prepare comprehensive credit packages for loan approvals ranging from $1-5 million, achieving a 92% approval rate

- Collaborate with relationship managers to structure appropriate loan terms and mitigate identified risks

- Monitor a portfolio of 45+ accounts for covenant compliance and early warning signals

08/2020 - 03/2022, Credit Analyst I, Fifth Third Bank, Chicago

- Performed financial analysis and risk assessment for small business loans up to $1 million

- Reviewed and analyzed client financial statements, tax returns, and cash flow projections

- Assisted in developing credit scoring models that improved risk identification by 10%

- 05/2020, Bachelor of Science in Finance, DePaul University, Chicago

- GPA: 3.7/4.0

- Minor: Economics

- Relevant Coursework: Corporate Finance, Financial Modeling, Credit Risk Management, Financial Statement Analysis

- Financial Statement Analysis

- Credit Risk Assessment

- Loan Underwriting

- Risk Mitigation Strategies

- Microsoft Excel (Advanced)

- SQL

- Bloomberg Terminal

When looking for a new job as a credit analyst, you need a resume that passes inspection. Just as you analyze credit risk, a hiring manager will carefully evaluate your resume to decide whether you’re a worthy investment.

Don’t apply for jobs with a resume that lowers your career credit rating. Turn a weak or generic resume into an impressive overview of your financial skills, industry expertise, and achievements in credit analysis.

Your credit analyst resume should showcase your core abilities, including credit risk evaluation and financial modeling. It also needs to highlight your professionalism, business acumen, and attention to detail.

Feel more comfortable studying complex financial documents than writing a resume? We’re here to help. In this guide, we’ll walk you through the steps to create a credit analyst resume that adds up to success.

Guide for a credit analyst resume example

Make a smart investment in your career with resume.io. Our writing guides and resume examples span over 500 professions. With our resume builder, it’s easy to build a quality resume in no time.

This writing guide, along with our credit analyst resume example, will go over the following:

- How to write a credit analyst resume

- The right format for your credit analyst resume

- Adding your contact information

- How to write a notable resume summary

- How to list your experience in credit analysis

- Including your education and relevant skills

- How to choose the right resume design and layout

- What the financial job market looks like and the salary you can earn

How to write a credit analyst resume

Writing a credit analyst resume starts with knowing what to include. Your resume should have these sections:

- A resume header

- A resume summary or profile

- A work experience section

- A resume skills section

- An education section

Before you land your next job analyzing credit risk, spend some time analyzing your career journey. Your resume should show prospective employers your ability to evaluate risk, assess financial statements, and determine creditworthiness.

These tips can help you build a top-tier credit analyst resume:

- Include measurable results. In the finance industry, numbers speak louder than words. Provide data and metrics throughout your resume to prove your value. For example, your measurable results may include improving processing times or reducing default rates.

- Customize your resume for each application. If you’re applying for multiple jobs, target each resume you send out. For example, a commercial credit analyst resume should highlight your ability to analyze business financials, while a resume for a consumer-facing role should emphasize your knowledge of credit scoring methods.

- Choose a professional template. Your resume should be clearly organized and easy to read. Select a traditional resume format that’s suitable for the financial industry.

- Use resume keywords. Many financial institutions use applicant tracking system (ATS) software to filter out resumes based on keyword usage. Include relevant keywords from the job description to make sure that your resume gets through an ATS.

Beat the ATS

ATS software uses algorithms to parse and rank resumes based on the target keywords they include. If your resume contains too few of these keywords, it may never reach an actual person on the hiring team. Boost your chances of success by incorporating relevant keywords into your resume summary, experience, and skills sections.

For example, pretend you’re applying for a credit analyst position with these requirements:

- Credit risk evaluation

- Financial modeling

- Strong Excel skills

- Attention to detail

In your resume summary, you can include these keywords like so:

Detail-oriented credit analyst with over five years of experience in credit risk evaluation and financial modeling. Strong Excel skills with an impeccable attention to detail for reviewing complex financial reports.

For more information, read our article on resume ATS optimization.

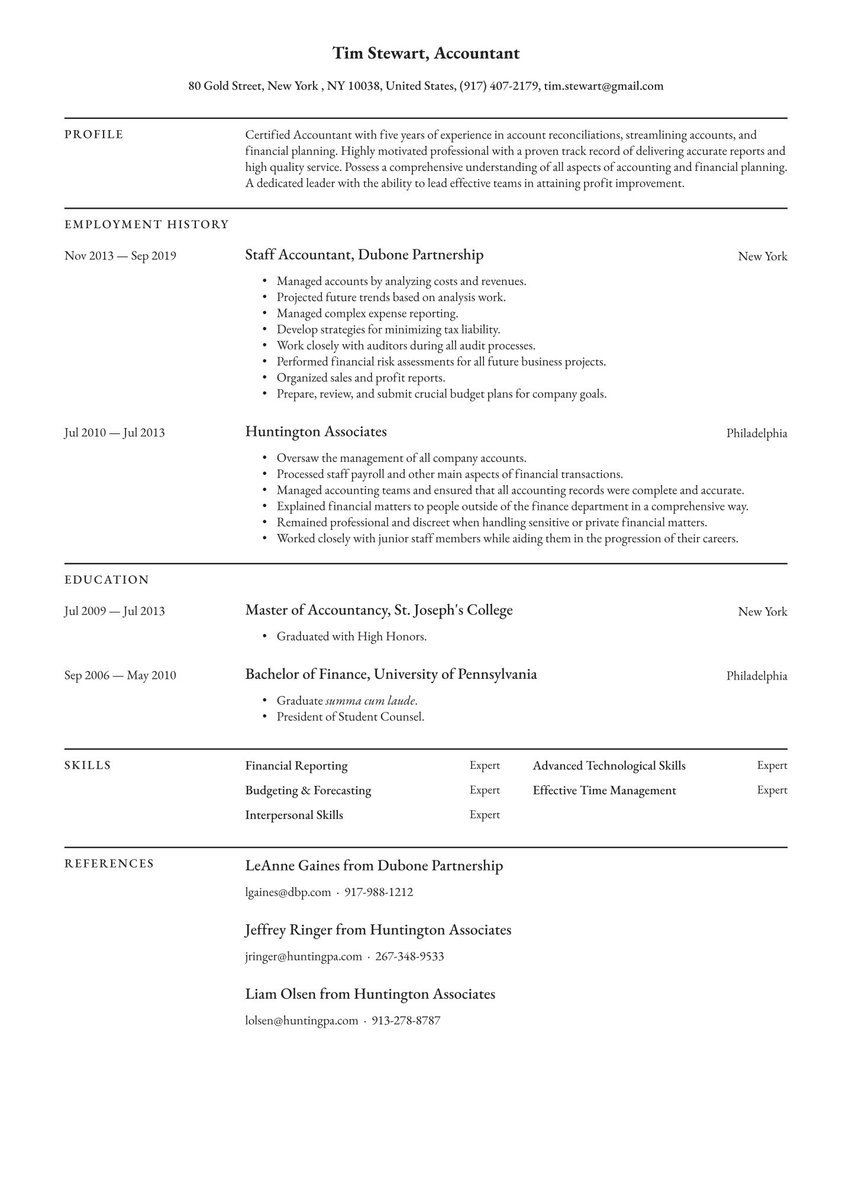

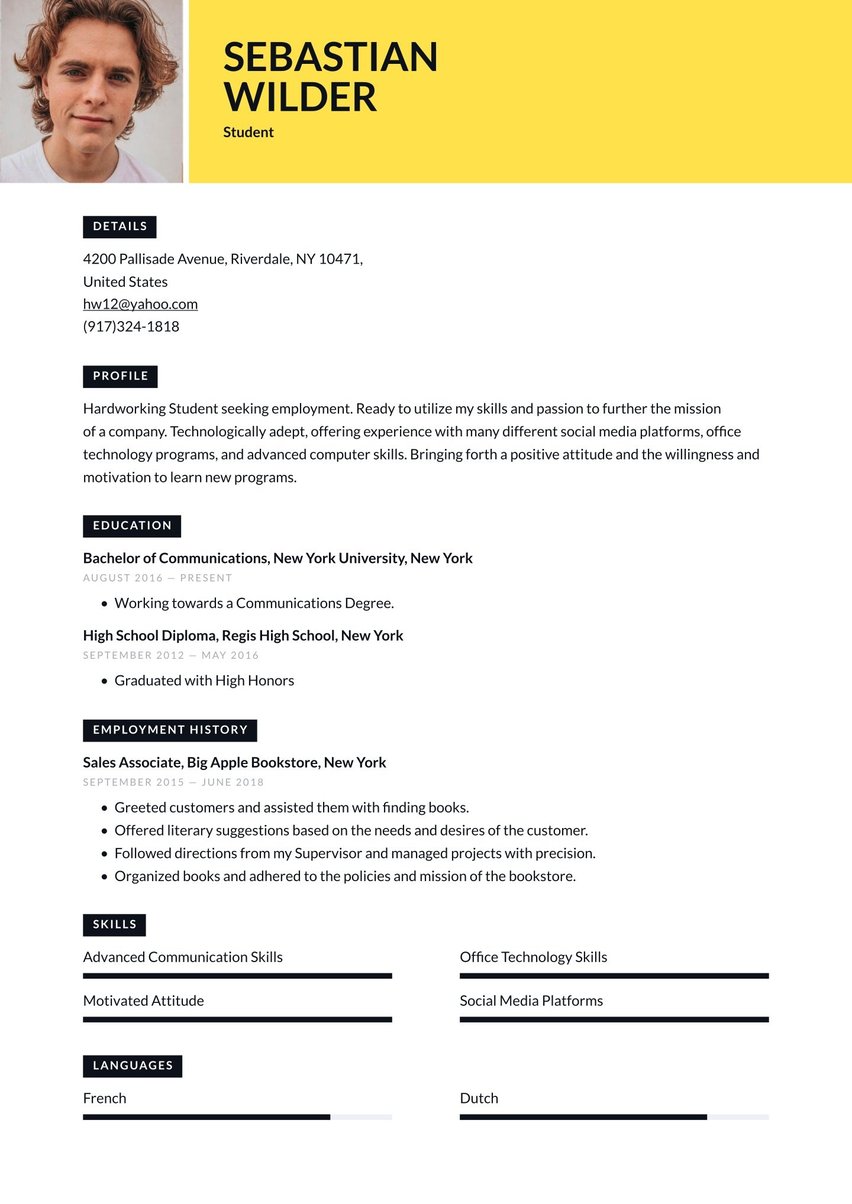

Choosing the right format for a credit analyst resume

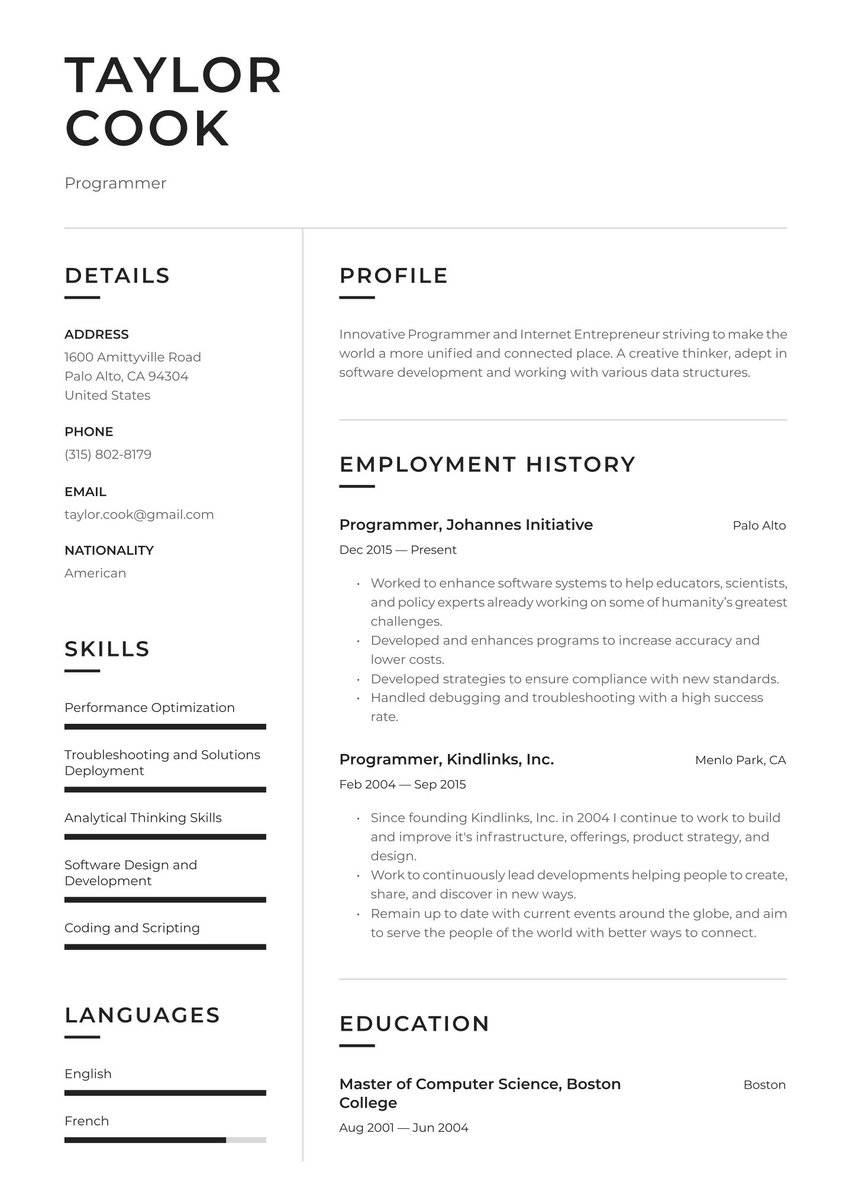

Your resume format should reflect the professionalism and meticulous nature you bring to a credit analyst position. In most cases, you should choose a reverse-chronological format. This resume puts the attention on your work experience. It’s also compatible with ATS software and easy for hiring managers to scan.

If you’re transitioning to credit analysis from another area, a functional resume format may be a better choice for you. A functional resume highlights your relevant skills, such as financial analysis or risk management, even if you have minimal hands-on experience. It’s also a good format if you have gaps in your work history.

Some mid-level professionals may also benefit from a combination, or hybrid, resume. A combination resume spotlights both your work experience and relevant skills. If you have unique skills or achievements, a combination resume can make your qualifications stand out.

If you’re unsure about the right format for you, browse the resume templates in our resume builder. You can also view our resume examples to see all three formats.

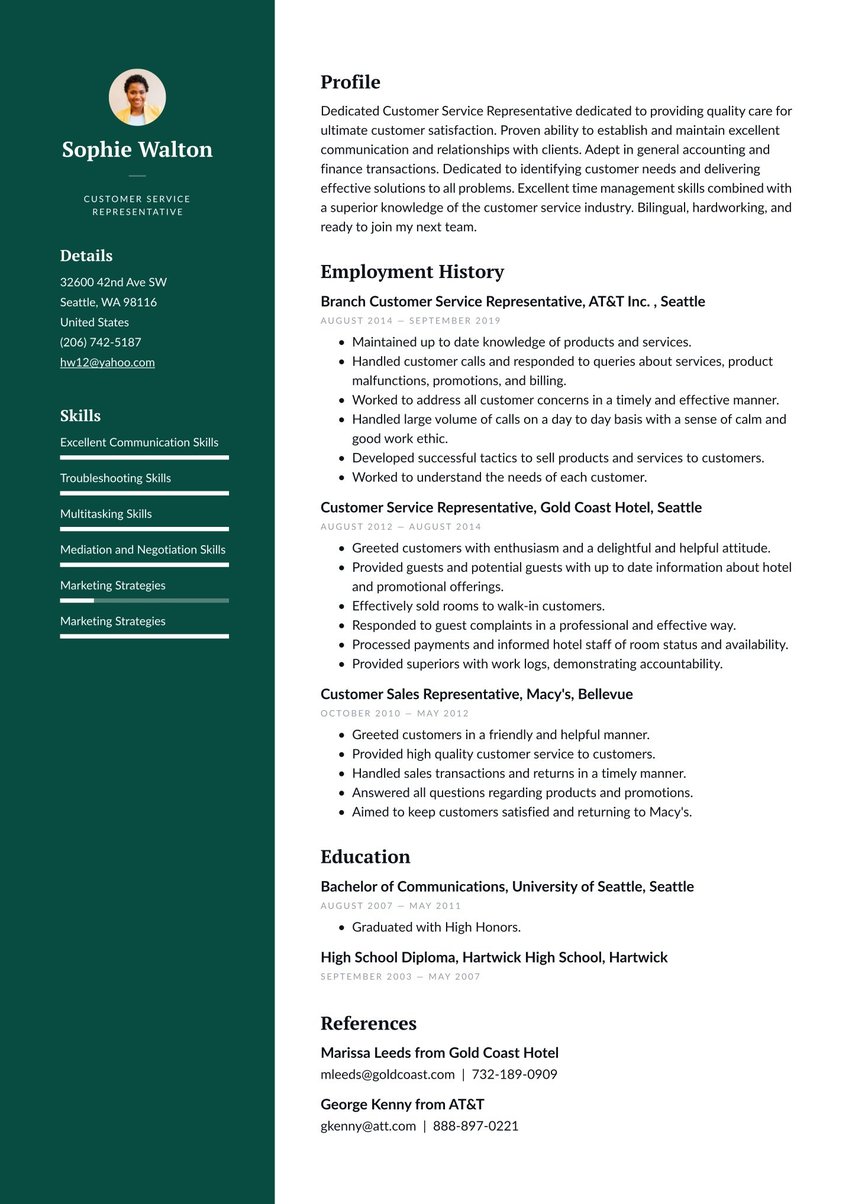

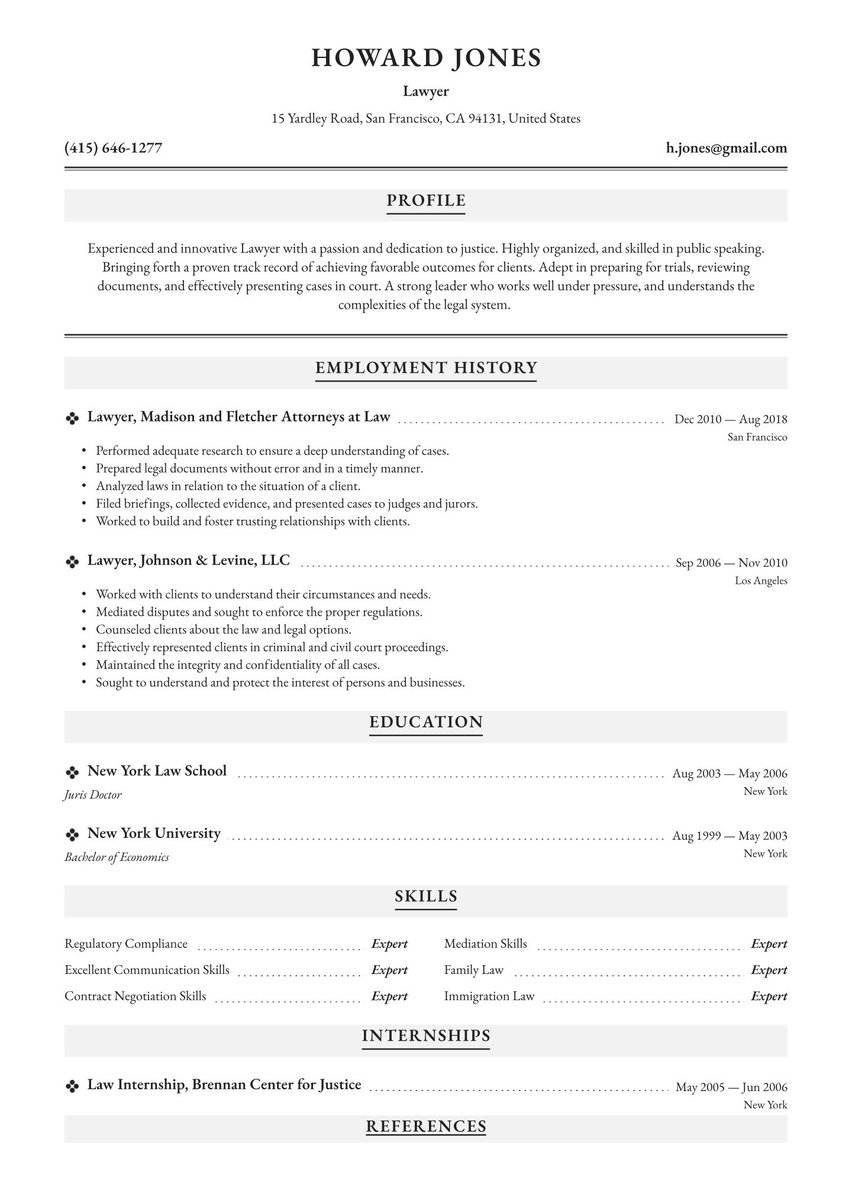

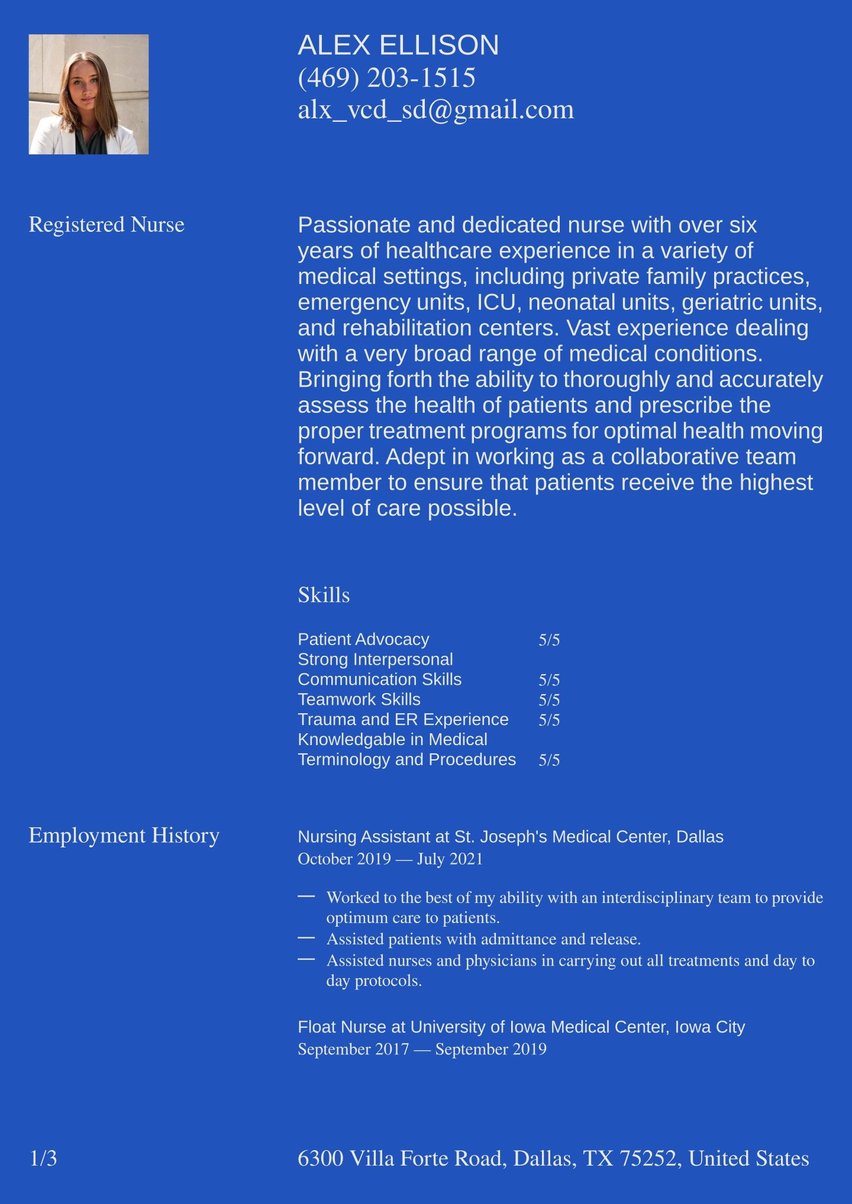

Include your contact information

The header of a financial statement quickly shows whether you’re reviewing a balance sheet, income statement, or cash flow report. In the same way, your resume header should clearly state who you are and how a hiring manager can contact you.

In your header, provide this information:

- Full name and title. List your full name and the title of the target job, such as Credit Analyst or Senior Credit Analyst.

- Professional email. Provide employers with a professional email that uses your name or initials. For example, use the format firstname.lastname@email.com.

- Phone number. Include your phone number and record a professional voicemail greeting.

- Location. List your city and state, but not your full mailing address.

- LinkedIn. Provide your LinkedIn profile if it’s updated with your current experience, skills, and certifications.

You don’t need to provide:

- Age or birthdate. This information can lead to potential age discrimination, so don’t put it on your resume.

- Personal information. Details like your marital status and passport number don’t belong on job application documents.

- Photo or headshot. Skip a photo or headshot, unless you’re applying for international jobs abroad.

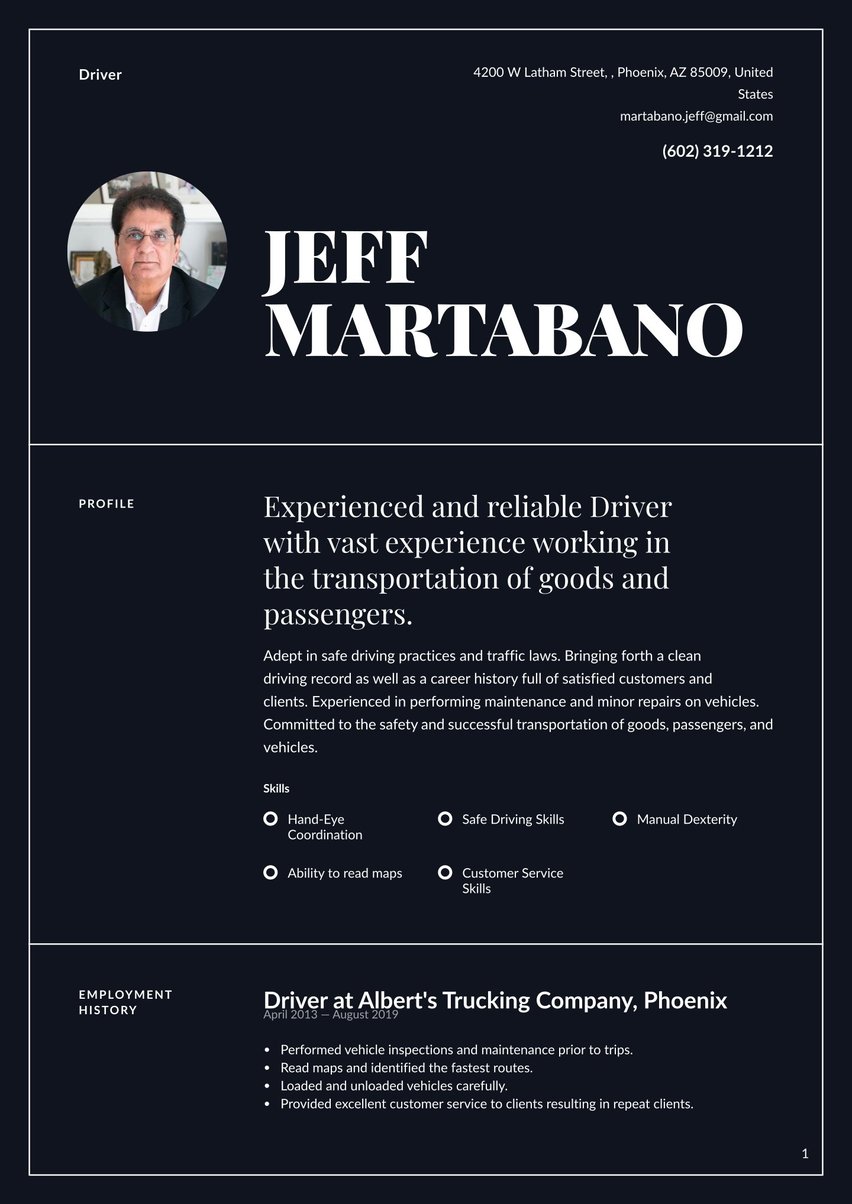

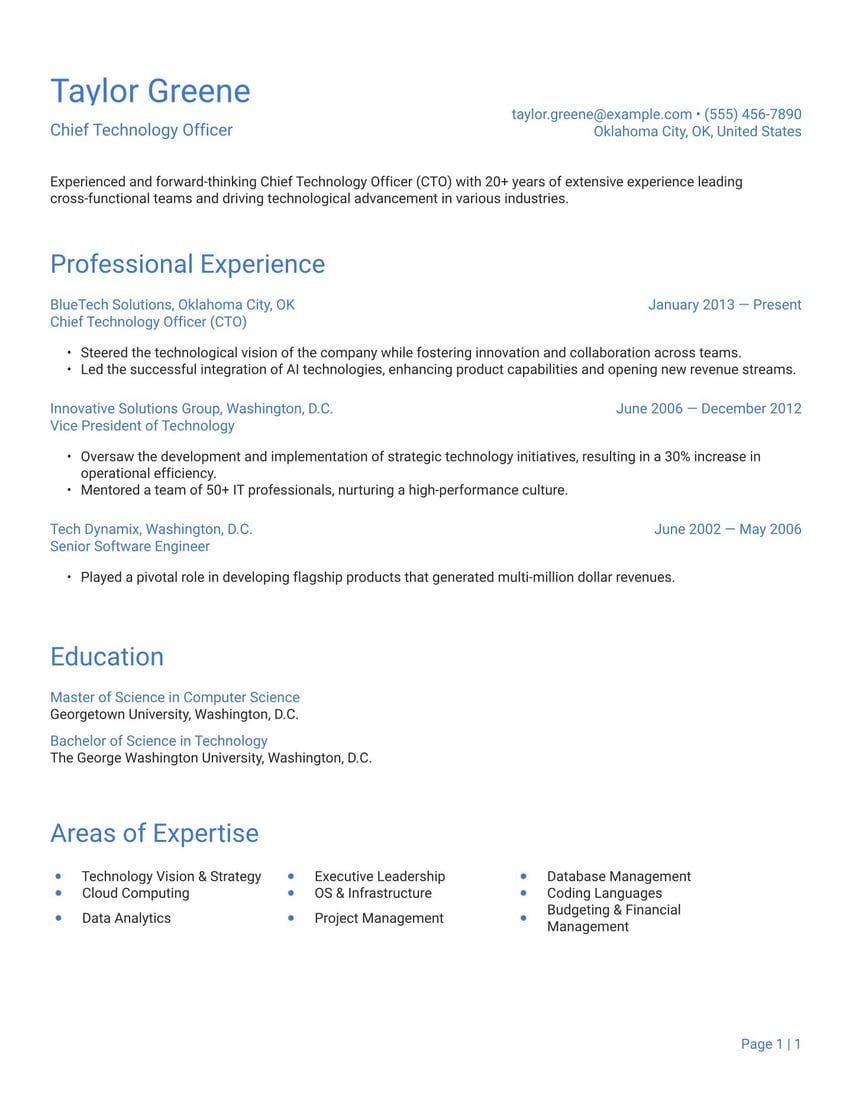

James McAllister

Credit Analyst

james.mcallister@email.com

(103) 555-1930

Portland, OR

linkedin.com/james_mcallister

James McAllister

Excel Wizard and Financial Guru

proud_dad0241@email.com

(103) 555-1930

411 Oak Street, Portland, OR

DOB: 4/29/81

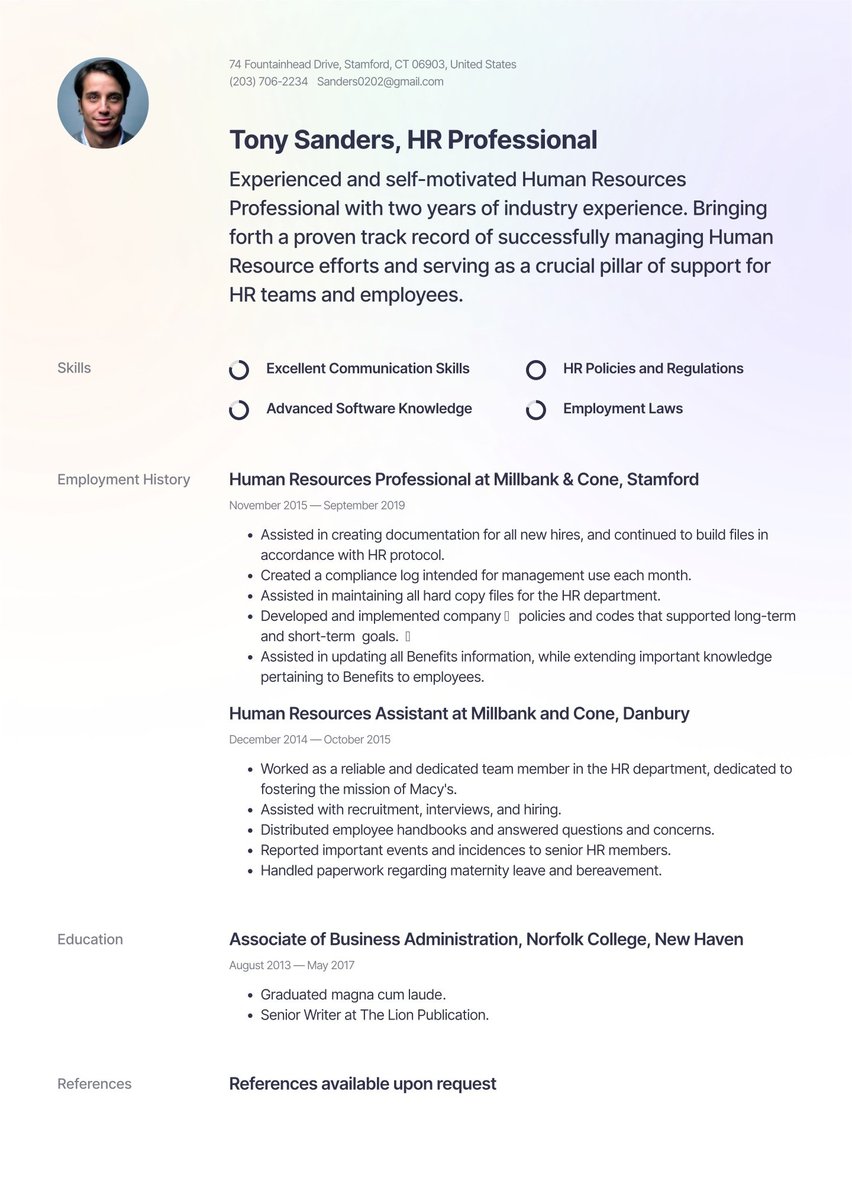

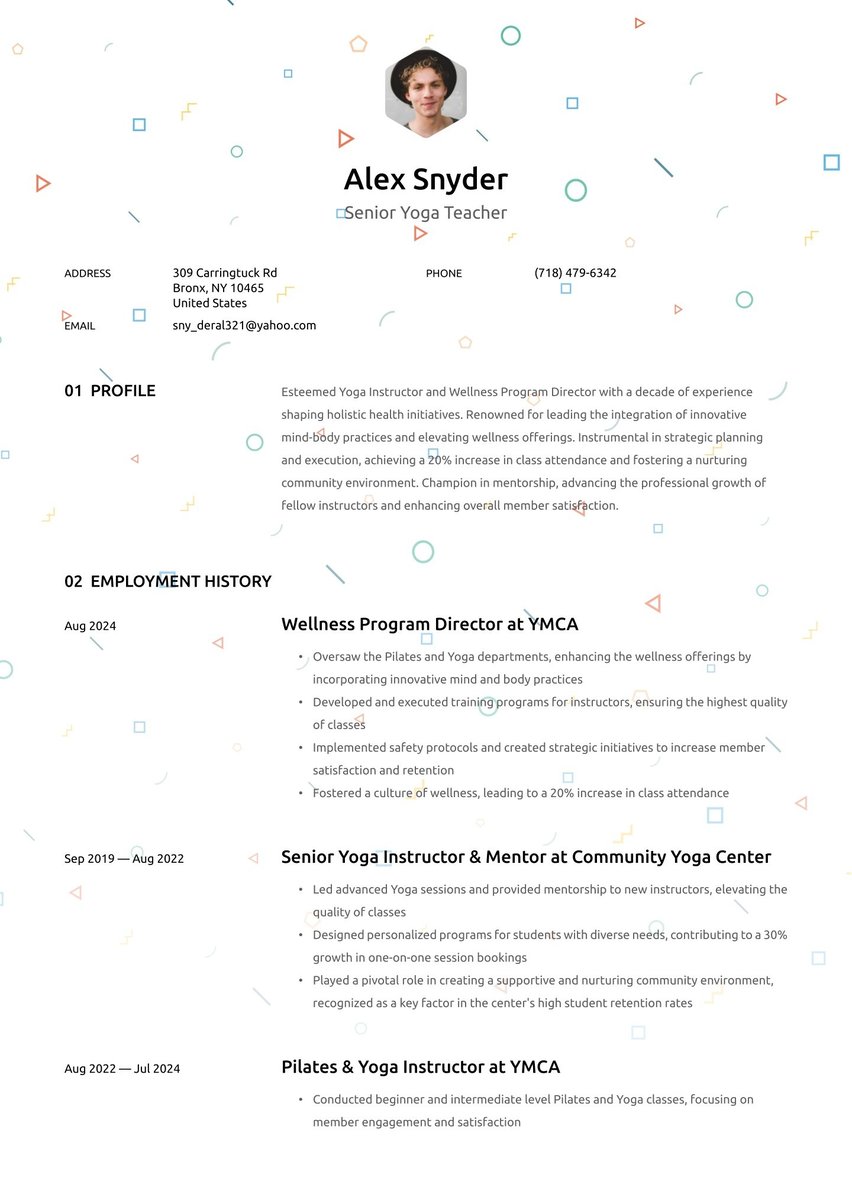

Write a resume summary or profile

A well-written profile statement serves as the executive summary of your credit analyst resume. It should provide employers with an overview of your financial career, analytical skills, and record of managing risk.

While your resume summary should be short (around two to three sentences), it needs to pack a punch. Use this space to highlight the results you’ve delivered for other banks or institutions. What strategic value do you bring to the table? For example, you might showcase your ability to improve risk identification or boost portfolio performance.

Your summary can also discuss the systems or tools you’ve mastered, especially those relevant to the target job. Having advanced skills in SQL, Excel, or financial modeling software can get a hiring manager’s attention. You can also mention a certification you’ve earned or ongoing training you’ve completed to stay up to date in the field.

Avoid using personal pronouns in your summary, such as “I” or “my.” Instead, start your statements with strong action verbs, such as “analyzed,” “monitored,” “performed,” or “calculated.” Remember to include numbers and data wherever possible to show prospective employers the difference you can make in their organization.

A resume summary is your first opportunity to convey your professional image. Think carefully about the impression you want to leave. Are you a detail-oriented analyst capable of complex loan underwriting or a tech-savvy finance professional who can lead credit policy and portfolio performance? Keep your summary focused on the pitch you want to make to potential employers.

Want more ideas for your resume summary? Browse these related resumes:

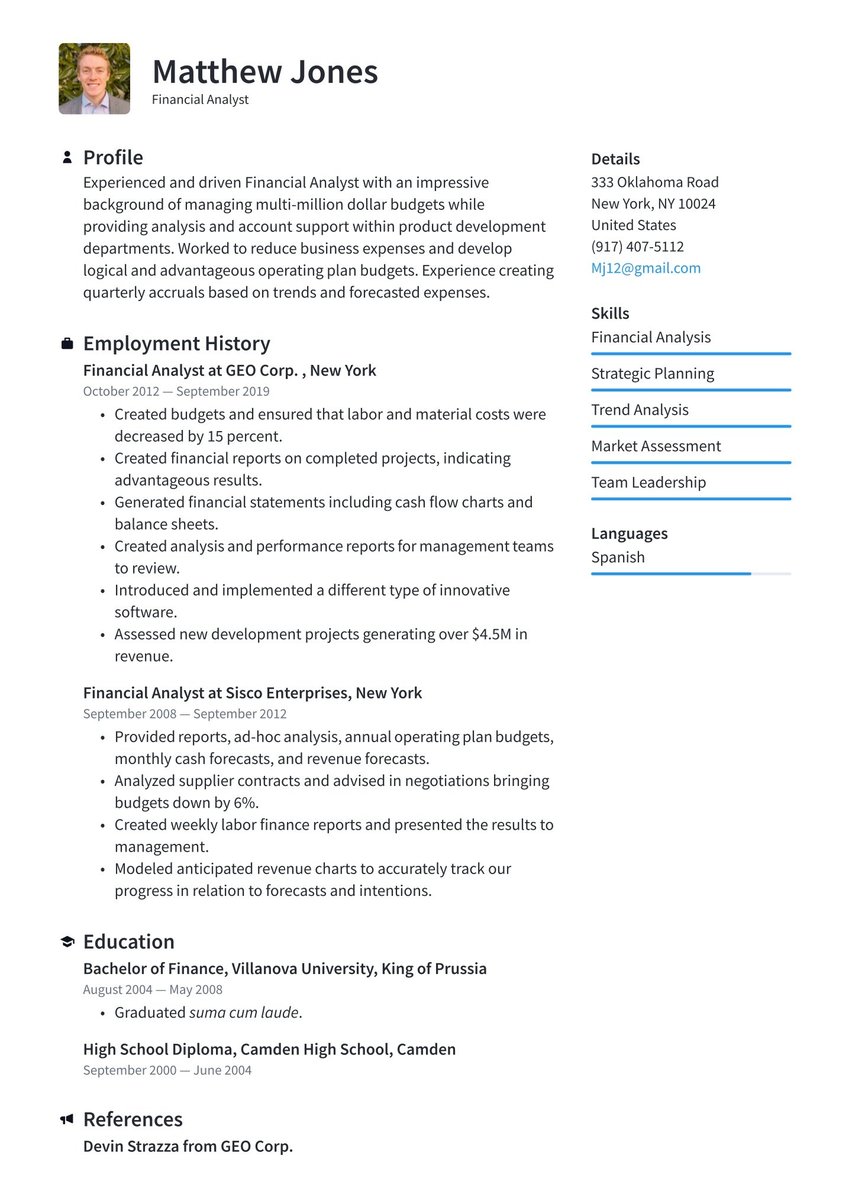

Check out these adaptable summaries from credit analyst resume examples:

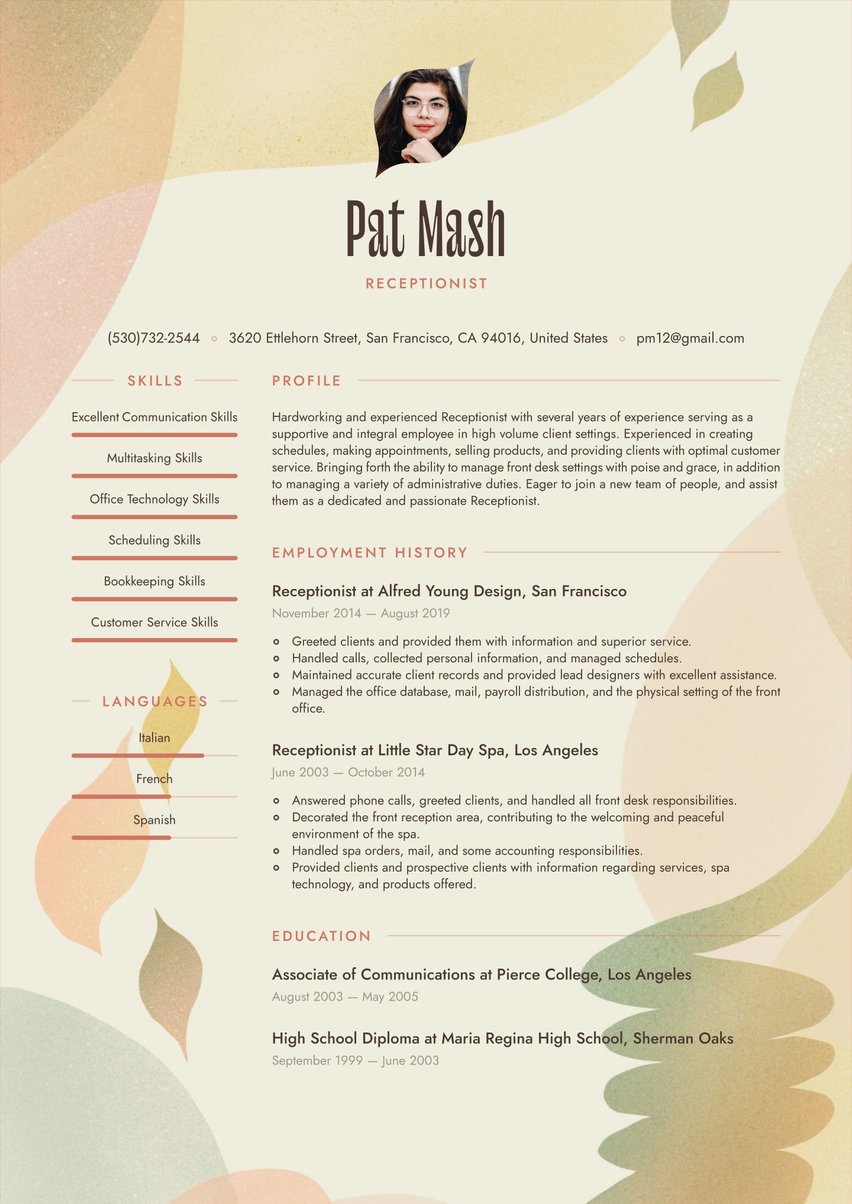

Ambitious accounting professional with a strong foundation in financial reporting and data analysis. Adept at using Excel for analysis and report generation with an excellent attention to detail. Eager to apply analytical skills to support credit risk evaluations and decision making.

Detail-oriented credit analyst with 3+ years of experience in financial risk assessment and credit underwriting. Skilled in financial analysis, loan evaluation, and relationship management. Proven track record of improving portfolio quality and streamlining credit review processes.

Strategic credit analyst with over 10 years of experience leading risk assessment initiatives for corporate portfolios exceeding $25M. Expertise in financial statement analysis, risk mitigation strategies, and regulatory compliance. Proven ability to expedite underwriting workflows and reduce loan default rates by 26%.

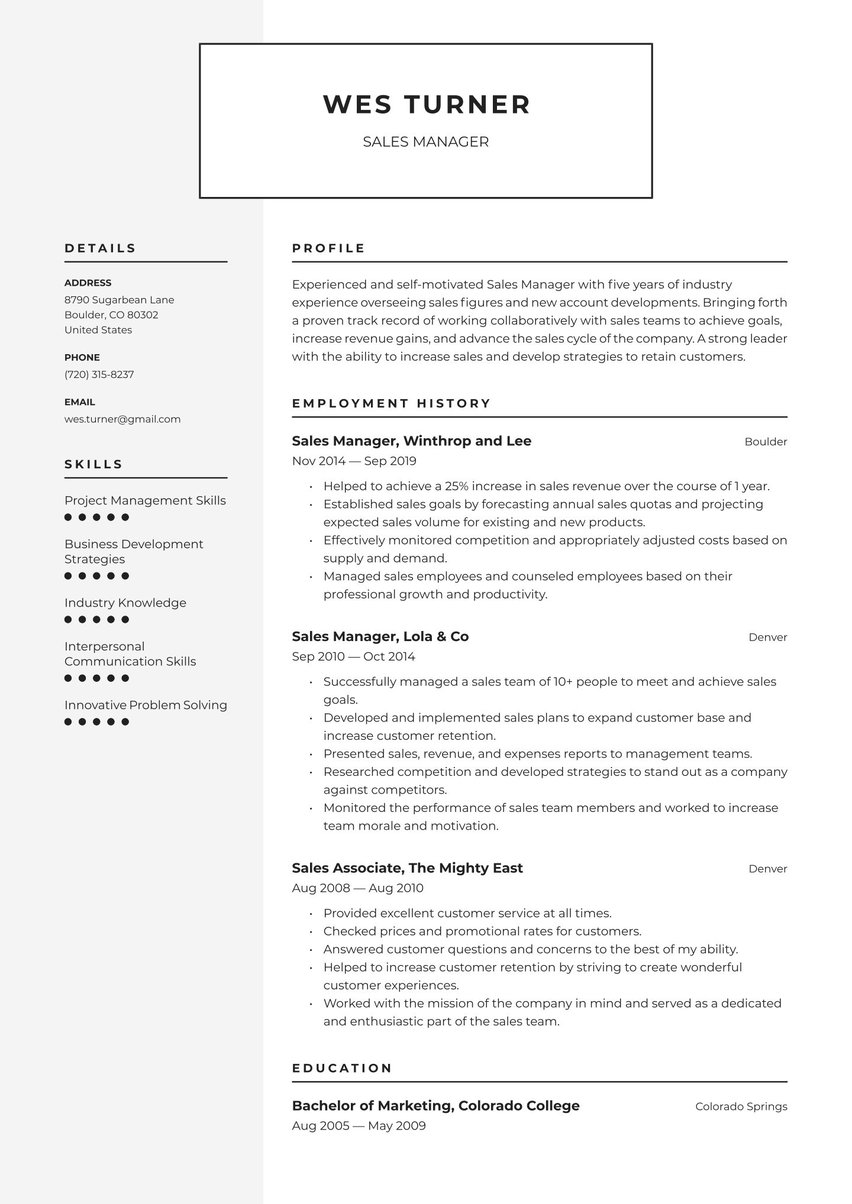

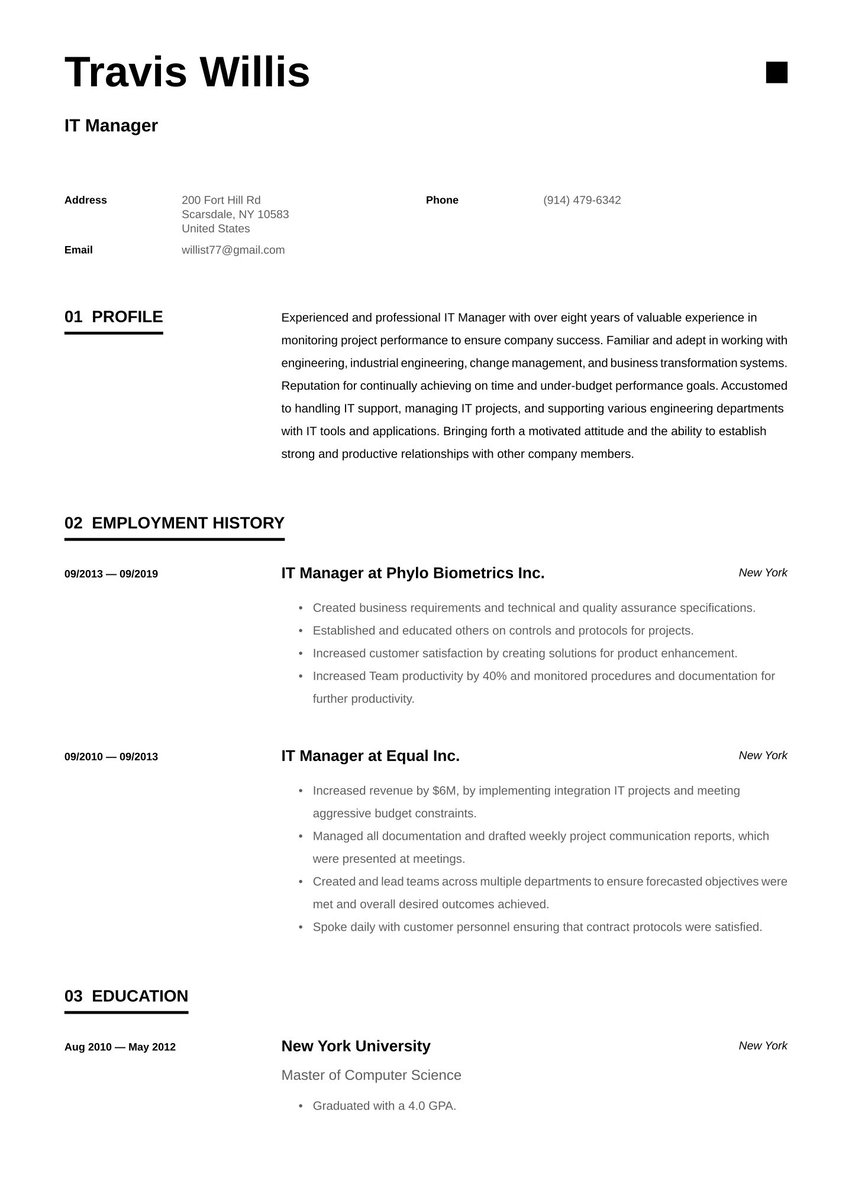

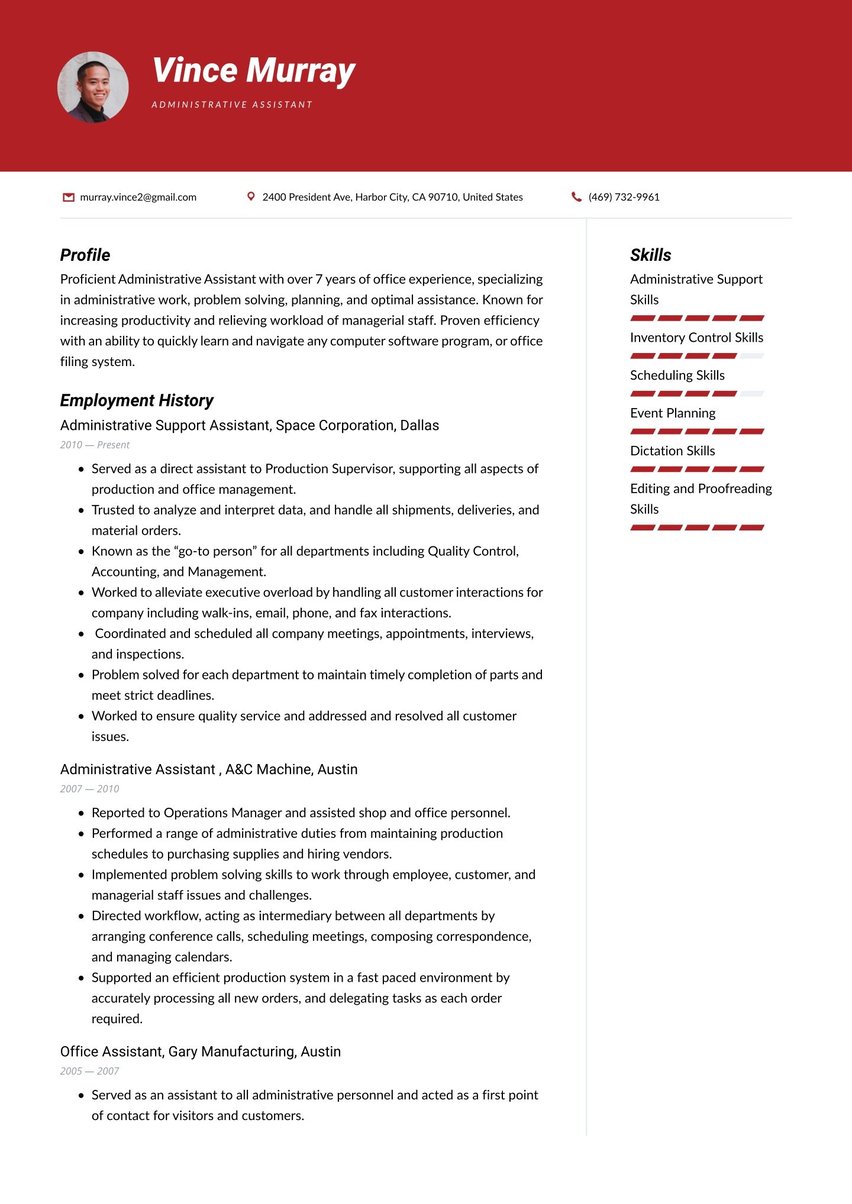

Outline your credit analyst work experience: validate your worthiness

Employers want to hire credit analysts who can minimize risks and inform decision making. Your work experience section should show your career progression in these areas, including the impact you’ve made in past roles.

Outline your employment history in reverse order, beginning with your most recent position. Your work experience should include all of your financial jobs for the past 10 to 15 years. If you have older relevant experience, add it to a separate section titled “Other Experience.”

Provide the basic details about each job you’ve held, including your title, company name, and employment dates. Below this information, write concise bullet points to describe your core duties and achievements in each role. Like your summary, each bullet point should start with a powerful verb to demonstrate your skills in action.

When writing your resume bullet points, don’t just list a bunch of tasks you completed. For example, here are some weak, generic bullet points for a credit analyst resume:

- “Completed risk assessments.”

- “Built financial models.”

- “Evaluated customer creditworthiness.”

These bullet points won’t get an employer’s attention. You need to be more specific and describe the outcomes you achieved. Results-focused bullet points provide more details about your ability to analyze financial data, identify trends, and reduce risks.

Consider these reworked versions of the above bullet points:

- “Performed in-depth credit risk assessments for corporate loan portfolios totaling over $10M, contributing to a 12% decrease in defaults.”

- “Developed detailed financial models to support lending decisions, boosting underwriting efficiency by 24%.”

- “Evaluated customer creditworthiness through data analysis and financial ratios, leading to a 14% increase in loan approval timelines.”

Compared to the previous bullet points, these outcome-oriented statements clearly communicate the value you offer as a credit analyst. Notice how these bullet points also include measurable data to back up each claim. These numbers prove you’re capable of achieving similar results in your next role.

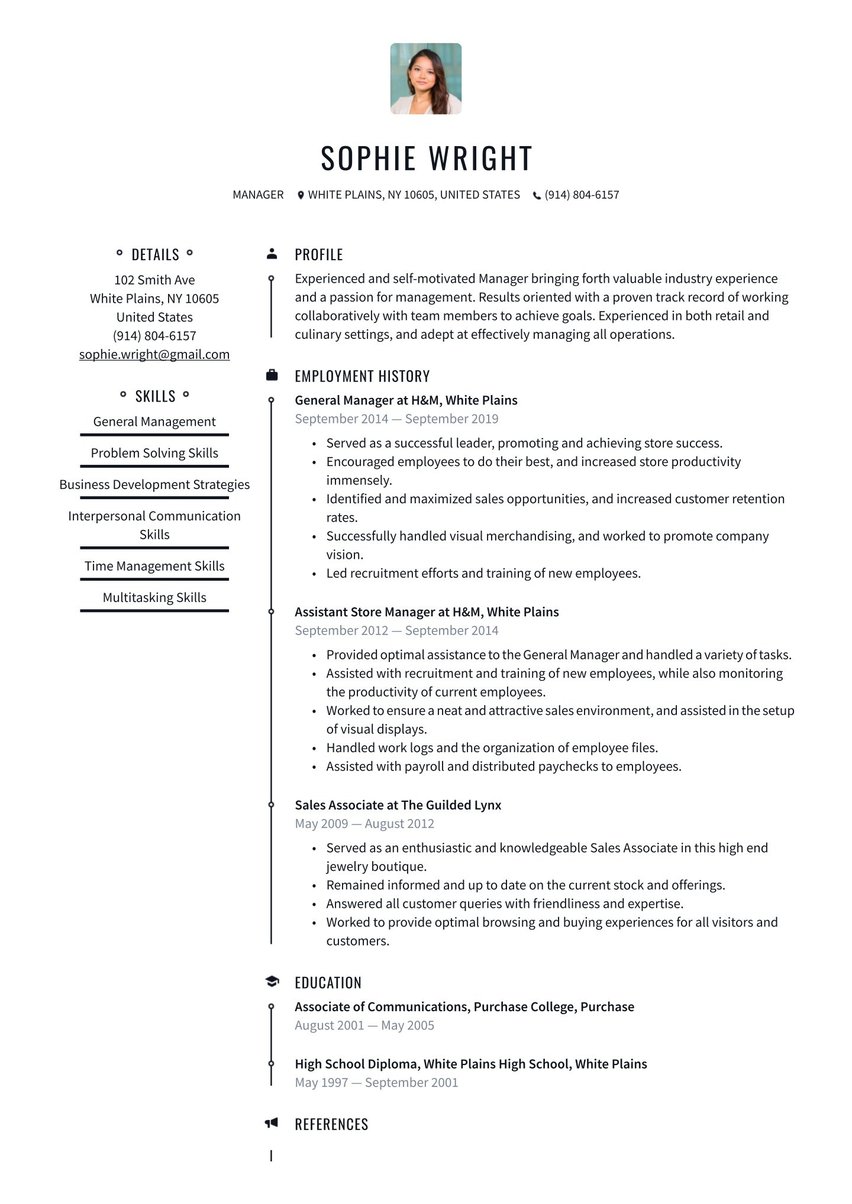

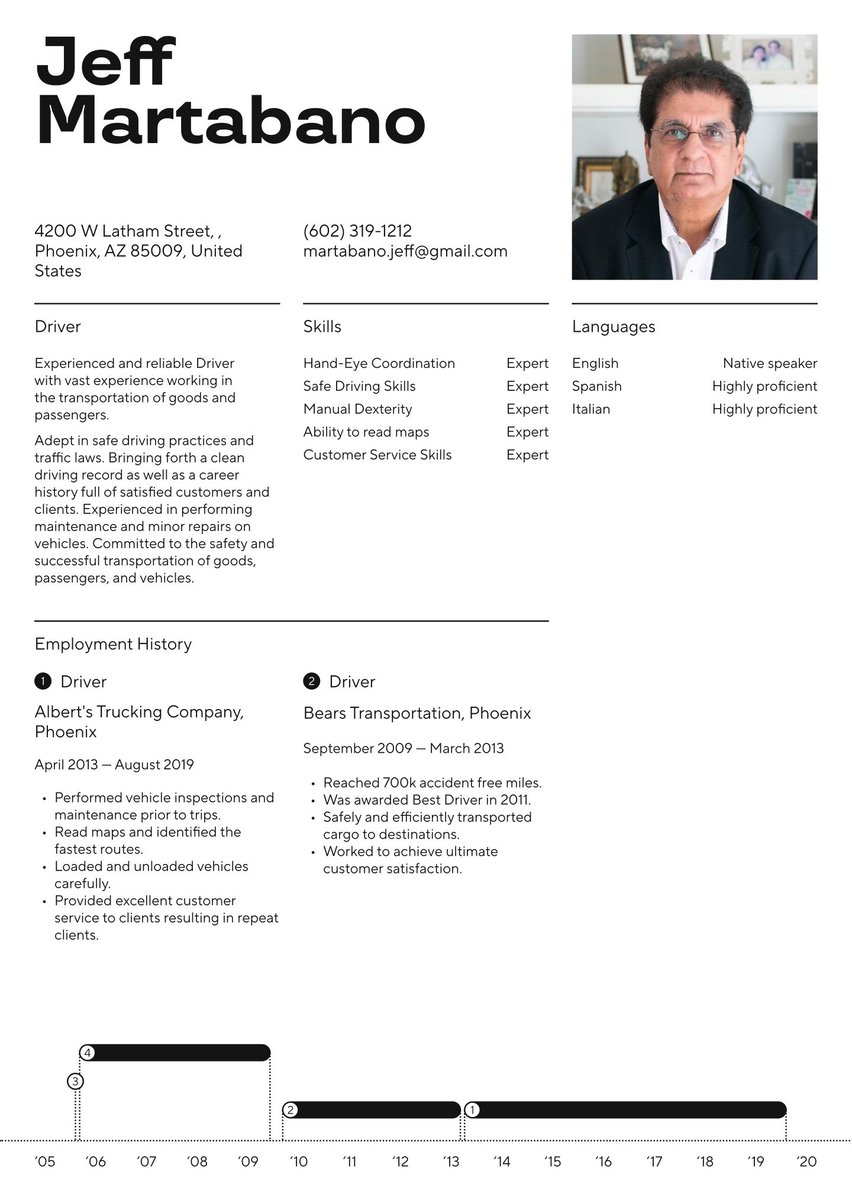

Check out the employment history section of our credit analyst resume example below:

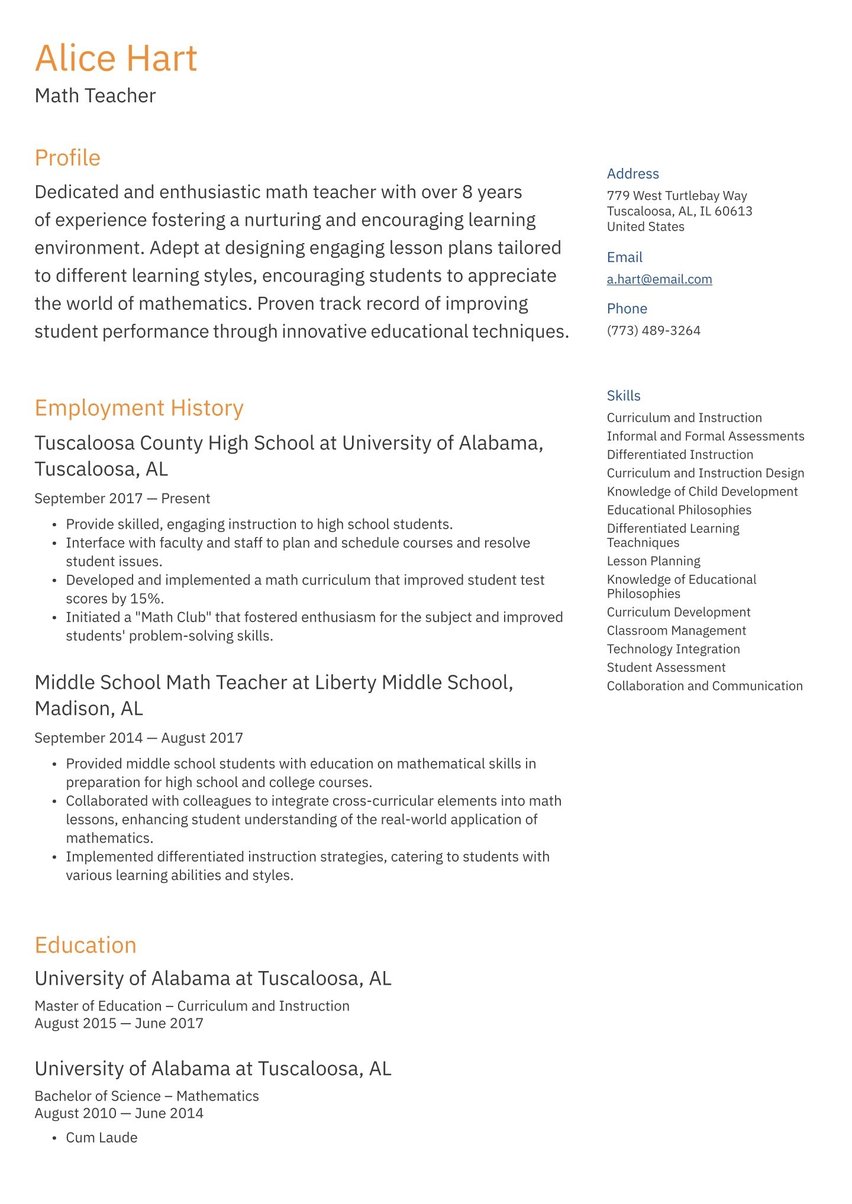

Associate Credit Analyst at JPMorgan Chase & Co., Chicago

June 2022 - Present

- Analyze financial statements, business plans, and industry trends to evaluate creditworthiness for middle-market commercial clients

- Prepare comprehensive credit packages for loan approvals ranging from $1-5 million, achieving a 92% approval rate

- Collaborate with relationship managers to structure appropriate loan terms and mitigate identified risks

- Monitor a portfolio of 45+ accounts for covenant compliance and early warning signals

Credit Analyst I at Fifth Third Bank, Chicago

August 2020 - March 2022

- Performed financial analysis and risk assessment for small business loans up to $1 million

- Reviewed and analyzed client financial statements, tax returns, and cash flow projections

- Assisted in developing credit scoring models that improved risk identification by 10%

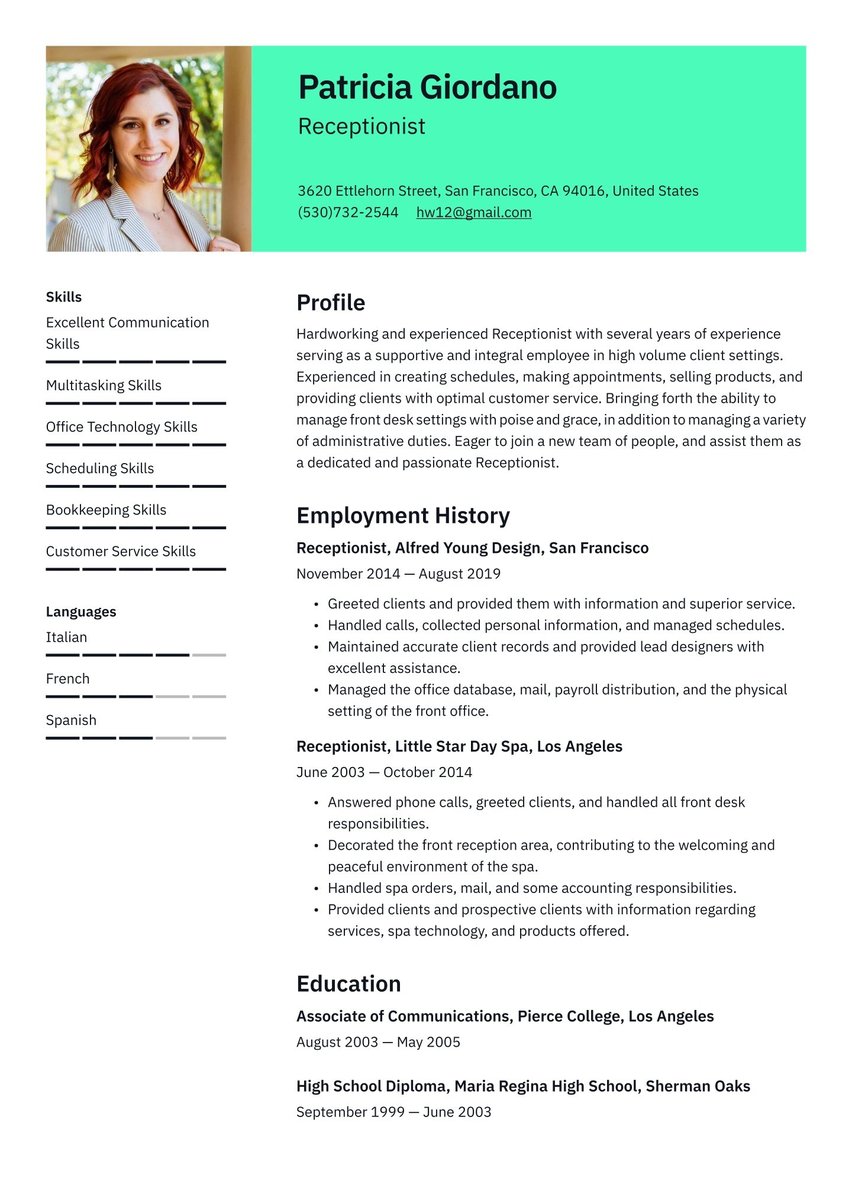

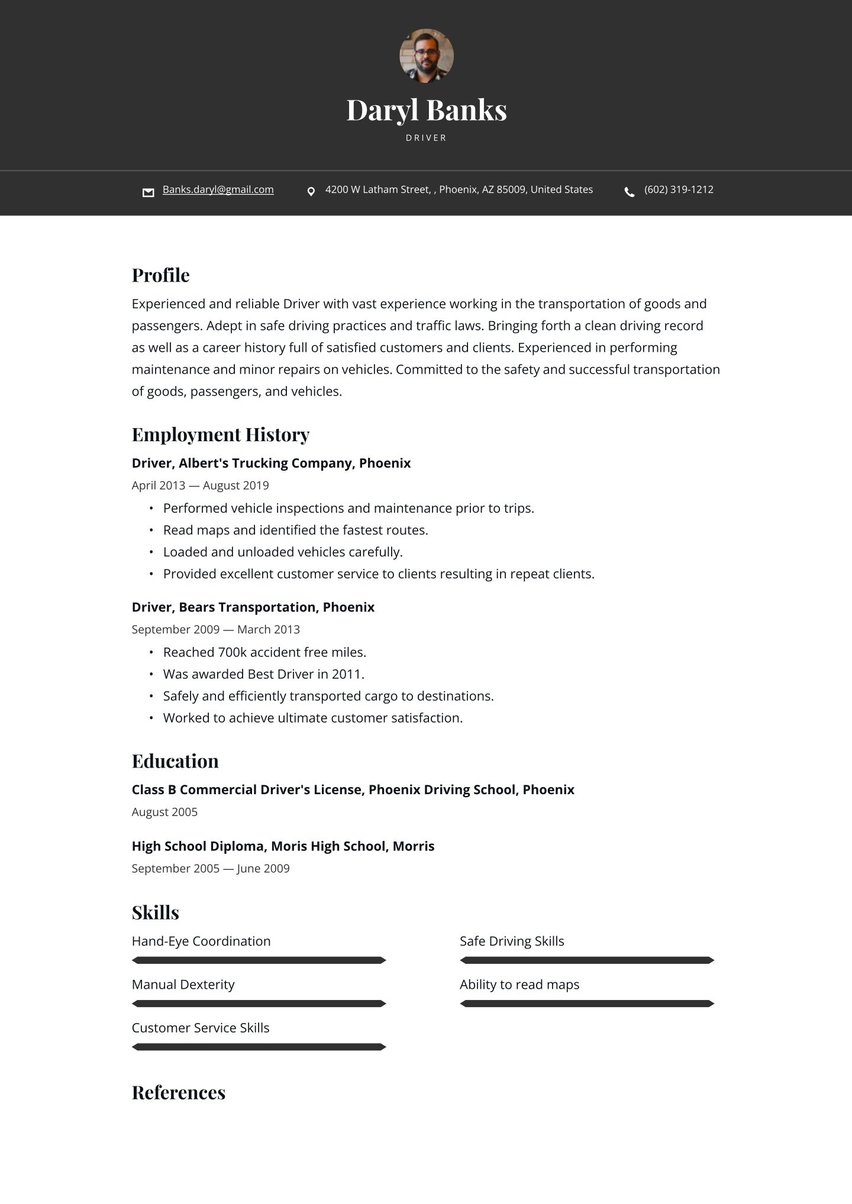

Include your relevant key skills for a credit analyst resume

Credit analysts use both hard and soft skills to do their jobs well. Your resume should have a mix of both, highlighting your financial expertise and interpersonal qualities.

Hard skills are the ones you’ve gained in school or on the job. For credit analysts, these technical abilities can include credit risk evaluation, financial statement analysis, and relevant software, such as Excel.

Your soft skills, on the other hand, are the traits you use to explain financial concepts and collaborate with others, such as customers, loan officers, or sales teams. Some essential soft skills for a credit analyst resume are communication, critical thinking, and teamwork.

In our resume builder, you can choose pre-written skills to add to your credit analyst resume quickly. You can also indicate your proficiency levels or choose your own skills to add.

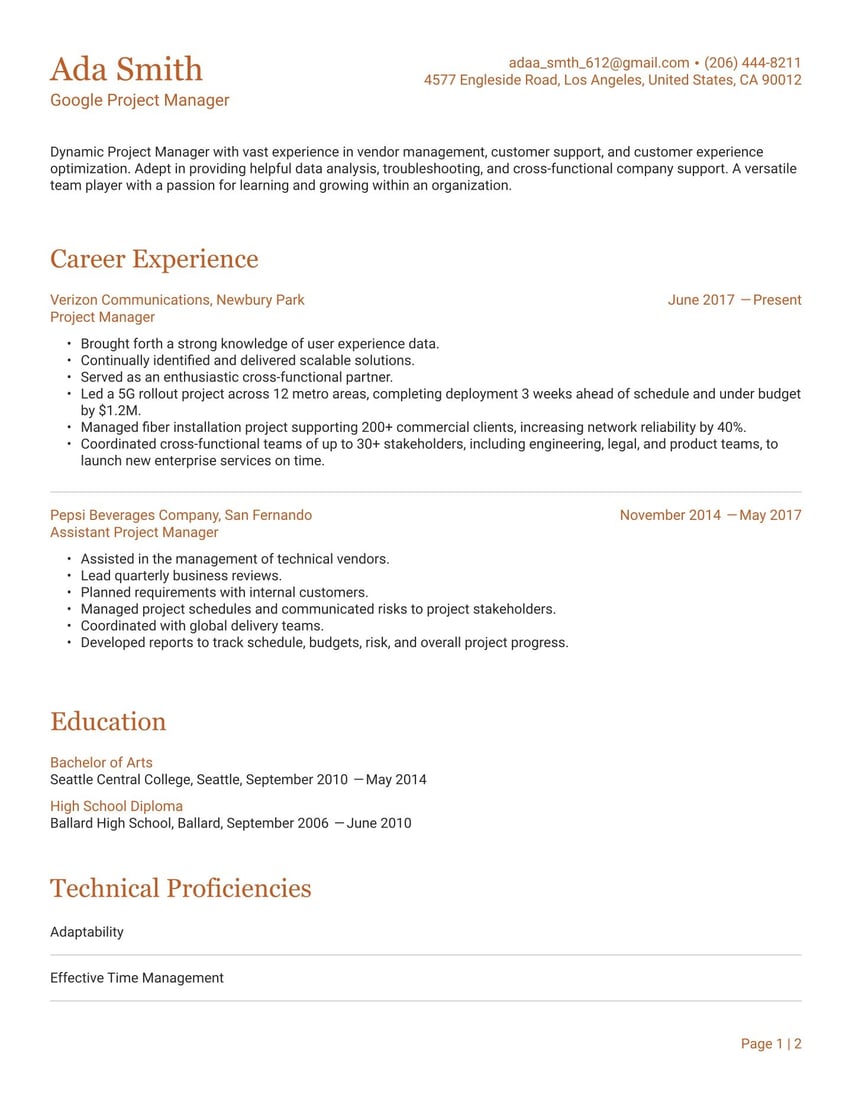

Here’s how the skills section appears in our credit analyst resume sample:

- Financial statement analysis

- Credit risk assessment

- Loan underwriting

- Risk mitigation strategies

- Microsoft Excel (advanced)

- SQL

- Bloomberg Terminal

It’s important to have a skills section on your resume, so that employers can quickly review your top abilities. However, it’s not the only place to highlight your strengths and expertise. Provide examples of your skills in other areas, such as your resume summary and work experience section.

In these areas, you might mention these skills:

- Credit risk evaluation skills. Detail how you evaluate borrower profiles and identify high-risk accounts.

- Financial modeling expertise. Describe how you build and use models to predict creditworthiness.

- Collaboration skills. Outline how you work with others, such as underwriters or relationship managers, to resolve problems or provide support.

Not sure what skills to mention? Review the job description and highlight the skills an employer requires for the role. Make sure that you have some or most of those skills on your credit analyst resume.

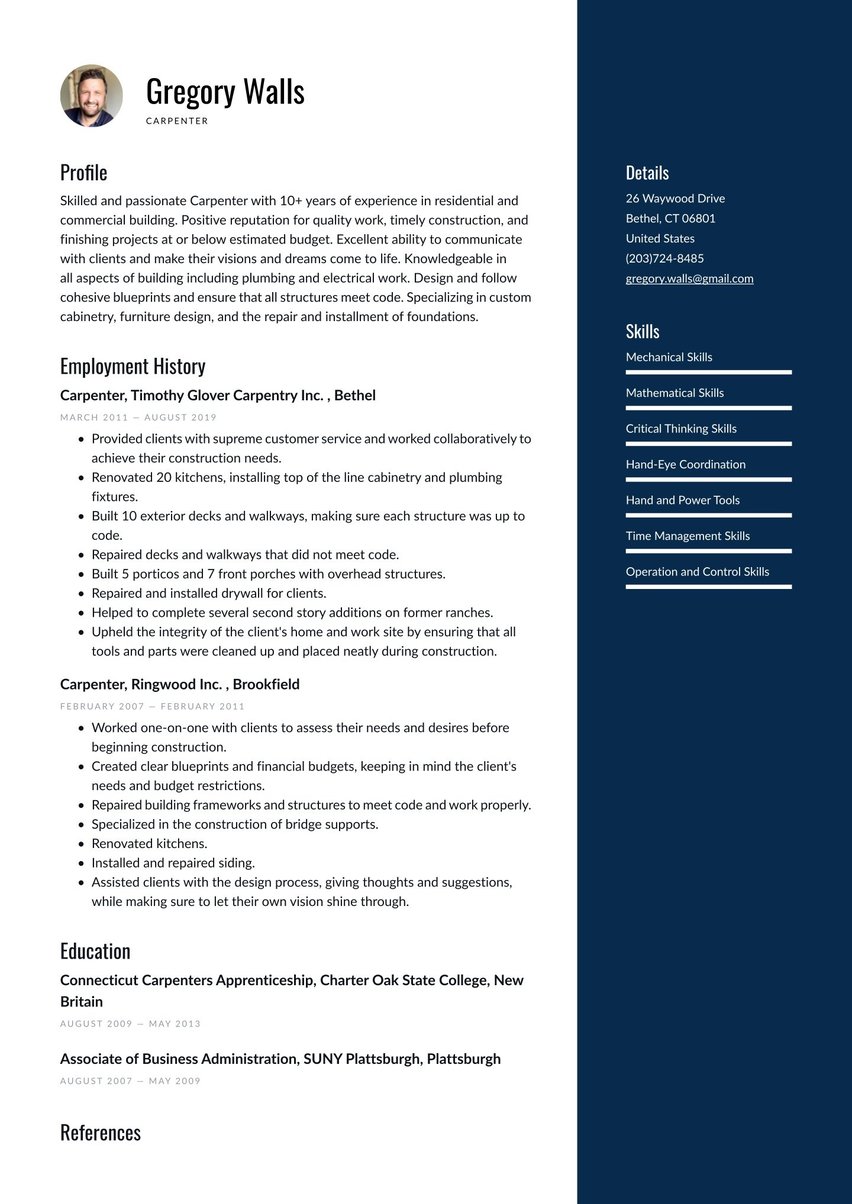

Detail your education & relevant credit analyst certifications

Your education section shows your foundational knowledge in finance, economics, or accounting. Begin with your formal education, listing your bachelor’s degree, school, and field of study. If you have a higher degree, such as a master’s in finance, put it above your undergraduate education.

In this section, you can also list the additional training you’ve completed. A credit analyst resume might include:

- Certifications. Mention the relevant certifications you’ve earned, such as the Certified Credit and Risk Analyst (CCRA) or Chartered Financial Analyst (CFA) credential.

- Courses or training. List any courses, workshops, or training you’ve completed in specific areas, like financial modeling or credit risk evaluation.

- Professional memberships. If you belong to an industry association, such as the National Association of Credit Management (NACM), highlight your membership on your resume. This shows employers your commitment to the field.

In most cases, employers will be more interested in learning about your work experience and skills, so your education should go near the bottom of your resume. However, if you’ve recently graduated with an advanced degree or earned a new certification, you can move your education section to the top of your credit analyst resume.

Bachelor of Science in Finance, DePaul University, Chicago

May 2020

- GPA: 3.7/4.0

- Minor: Economics

- Relevant Coursework: Corporate Finance, Financial Modeling, Credit Risk Management, Financial Statement Analysis

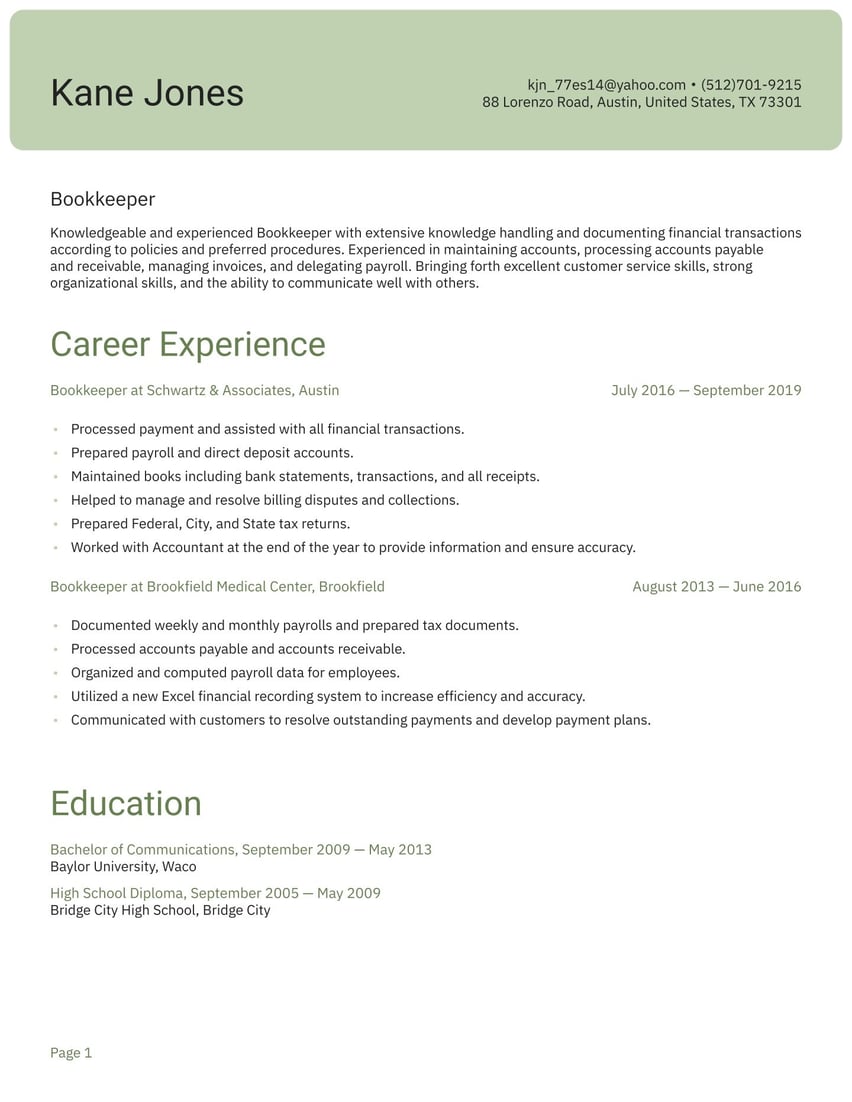

Pick the right layout & design for a credit analyst resume

You wouldn’t dare hand in a cluttered or disorganized financial report. Apply the same level of attention to your resume design and layout. It should be clean, consistent, and professional to make a good first impression on hiring managers and recruiters.

Select a well-organized layout with proper spacing and clear sections for your work experience, skills, and education. Use a simple resume font, such as Helvetica or Calibri, in a 10-point or 12-point size for readability. Leave plenty of white space between sections so that a reader can easily navigate your qualifications.

For jobs in the finance industry, it’s best to avoid bold or nontraditional colors. Stick to a classic color scheme, such as black, gray, or navy. Don’t include additional elements, such as excessive columns or graphics, that can cause problems with ATS software.

Your credit analyst resume should fit onto one page. A second page is acceptable if you have 10 or more years of relevant experience, particularly in credit or financial analysis.

With your analytical eye, your resume needs to look as sharp as the credit reports you compile. If you want to simplify your resume design, use our ATS-optimized resume templates, which take the time-consuming formatting tasks off your hands.

Credit analyst job market & outlook

While economic conditions can affect the job market for credit analysts, the overall outlook looks good for these professionals. Employers will increasingly need to hire analysts who can assess financial data and reduce risks.

- Employment of financial analysts, including credit analysts, is expected to grow 9% by 2033, according to the US Bureau of Labor Statistics. That rate is much faster than the average projected growth of other occupations.

- There will be an average of 30,700 open positions for financial analysts each year between now and 2033.

What type of salary you can earn as a credit analyst

Credit analysts usually earn a yearly salary, as opposed to hourly pay. Depending on the bank, firm, or company where you work, you may also have the potential to earn incentives or bonuses.

In the United States, credit analysts make an average salary of $71,889 per year. You may earn more than this, especially if you have many years of experience or live in an area with a high cost of living, where salaries are generally higher.

Key takeaways for building a credit analyst resume

A quality credit analyst resume can be the key to landing your next job at a bank, agency, or investment firm. Your resume should highlight your analytical skills, technical expertise, and ability to translate data into informed lending decisions.

Tailor your resume to a specific role and highlight the contributions you’ve made to other financial institutions. With these tips, you can write a credit analyst resume that passes a hiring manager’s review.

Your job search begins with our resume builder, but it doesn’t have to stop there. Use our 18 career-advancing tools to search for credit analyst jobs, measure your progress, prepare for interviews, and negotiate salaries with confidence, all within our complete career toolkit.