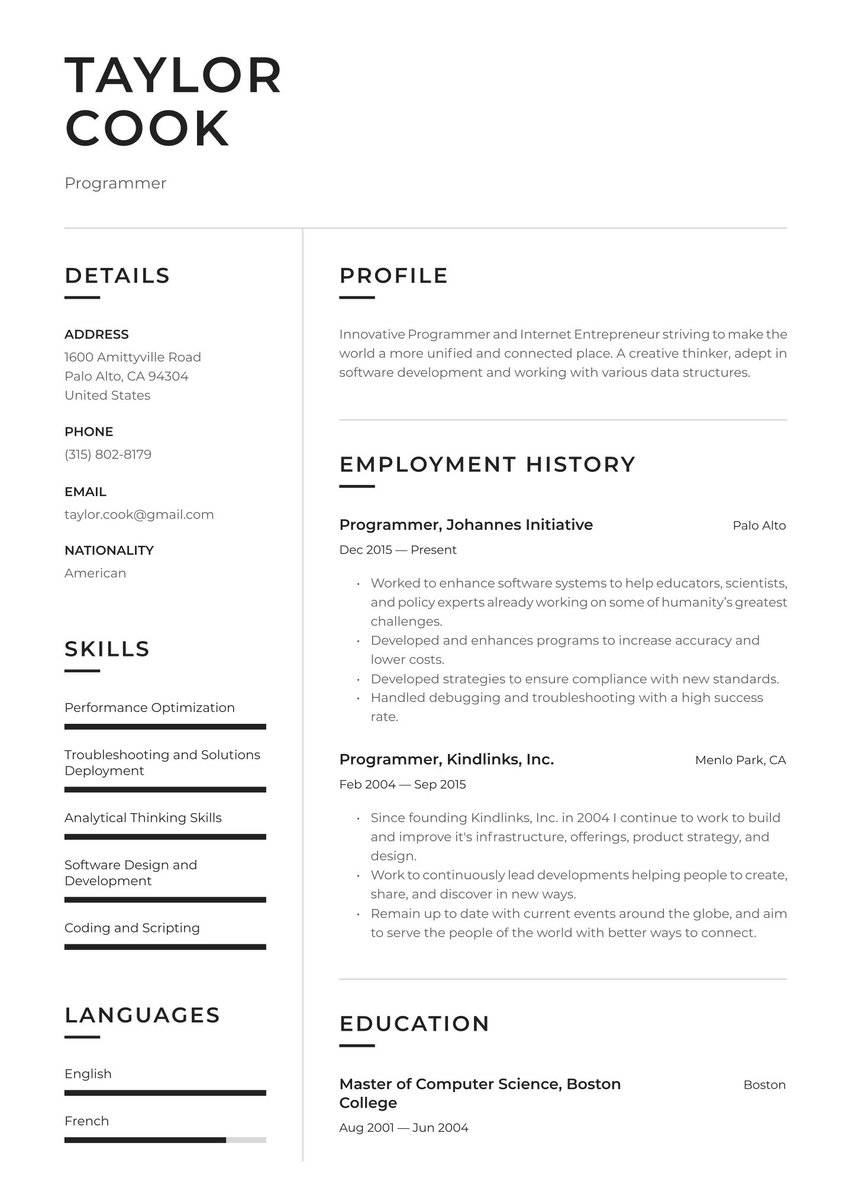

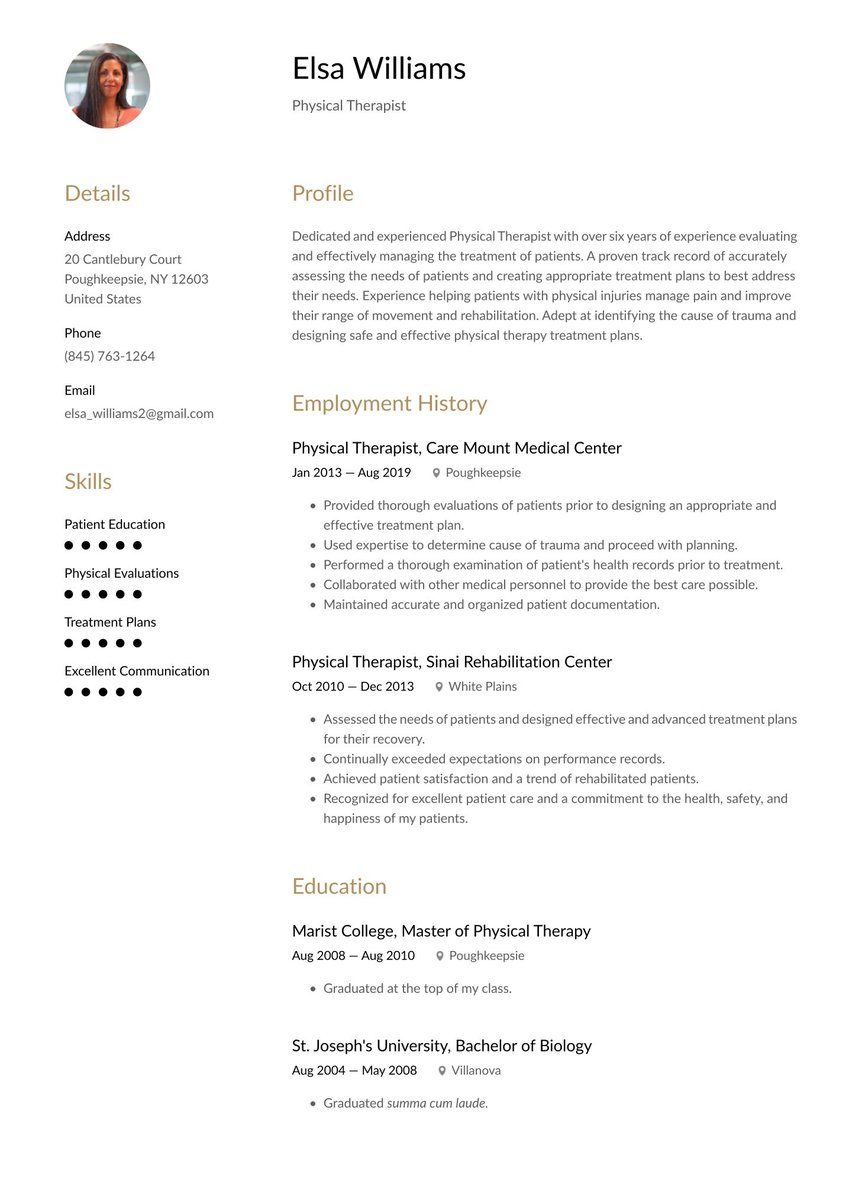

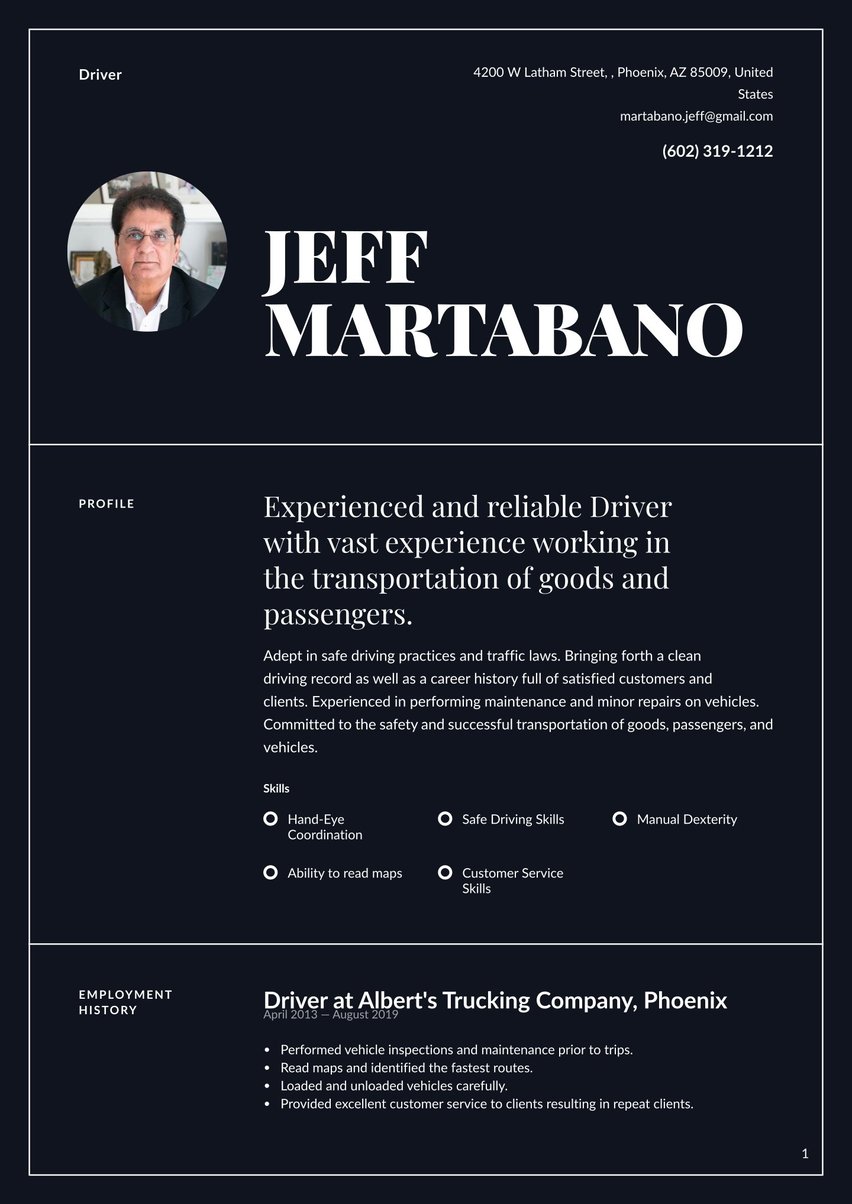

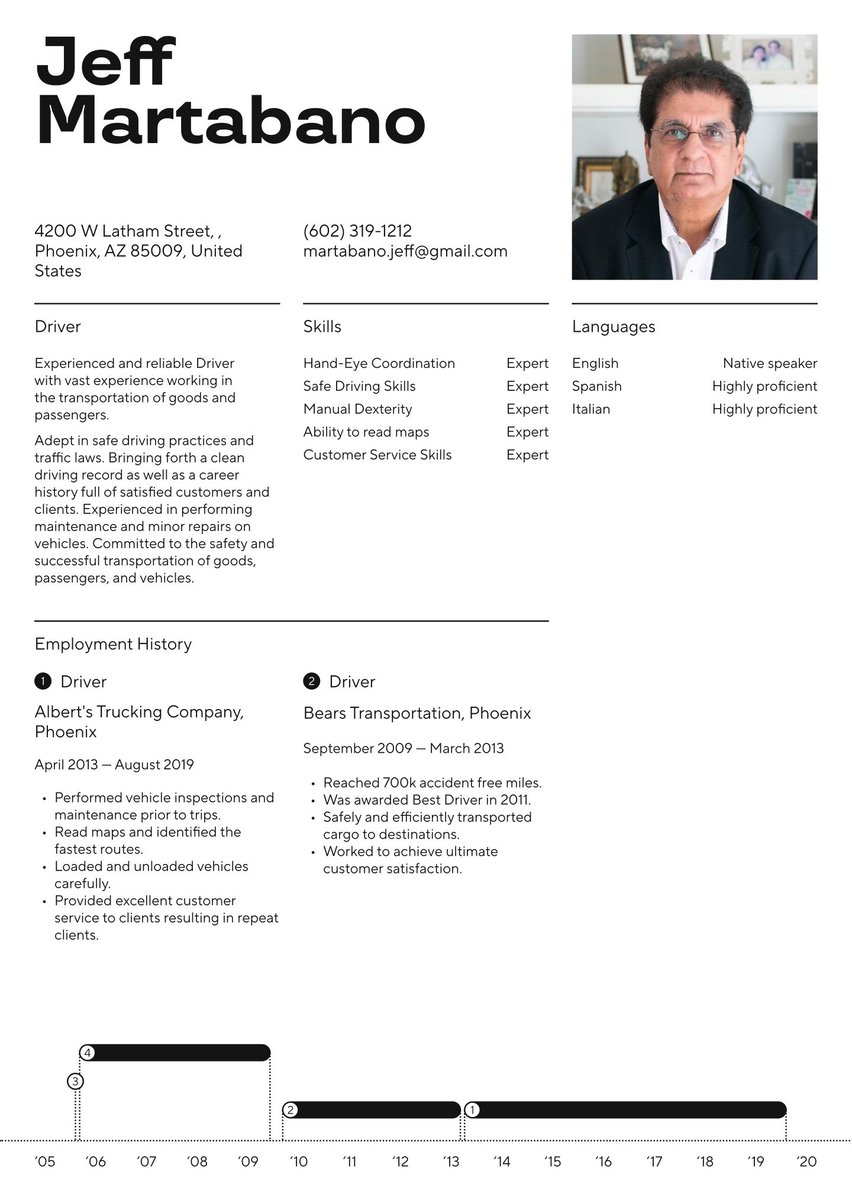

Certified Tax Preparer with 3+ years of experience in preparing individual and small business tax returns. Dedicated to providing accurate and timely tax preparation services while ensuring compliance with federal and state tax laws.

01/2021 - present, Tax Preparer, H&R Block, Houston

- Prepare and file individual and small business tax returns using ProSeries and TaxWise software

- Review and analyze client documents to ensure accurate and complete tax returns

- Provide tax advice and guidance to clients based on their specific financial situations

- Maintain up-to-date knowledge of tax laws and regulations

- Consistently meet or exceed weekly and monthly sales targets

11/2019 - 12/2020, Jackson Hewitt Tax Service, Tax Associate, Houston

- Prepared individual tax returns using ProSeries software

- Reviewed client documents and conducted interviews to gather necessary information

- Ensured accurate calculation of tax liabilities and refunds

- Provided excellent customer service and tax advice to clients

- 05/2019, Associate of Applied Science, Houston Community College, Houston

- Proficient in ProSeries

- Excellent attention to detail

- Effective communication

- Customer service skills

- TaxWise

- TurboTax software

A tax preparer resume is like a perfectly completed 1099 form that nets you a refund. You’ve planned well and now it’s time to reap the rewards: a quicker path to your next job. Without the proper documentation, a tax filing will be delayed and possibly rejected, the same could happen with a resume that isn’t well prepared.

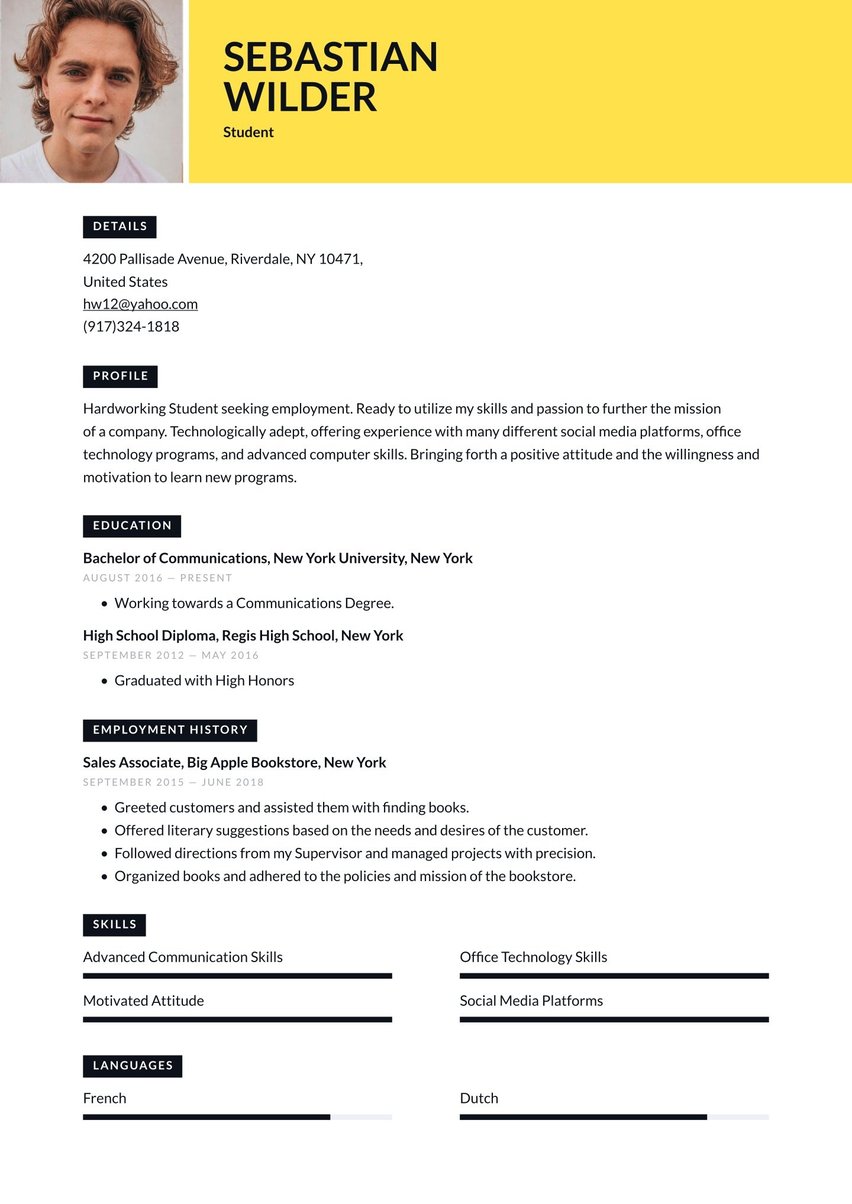

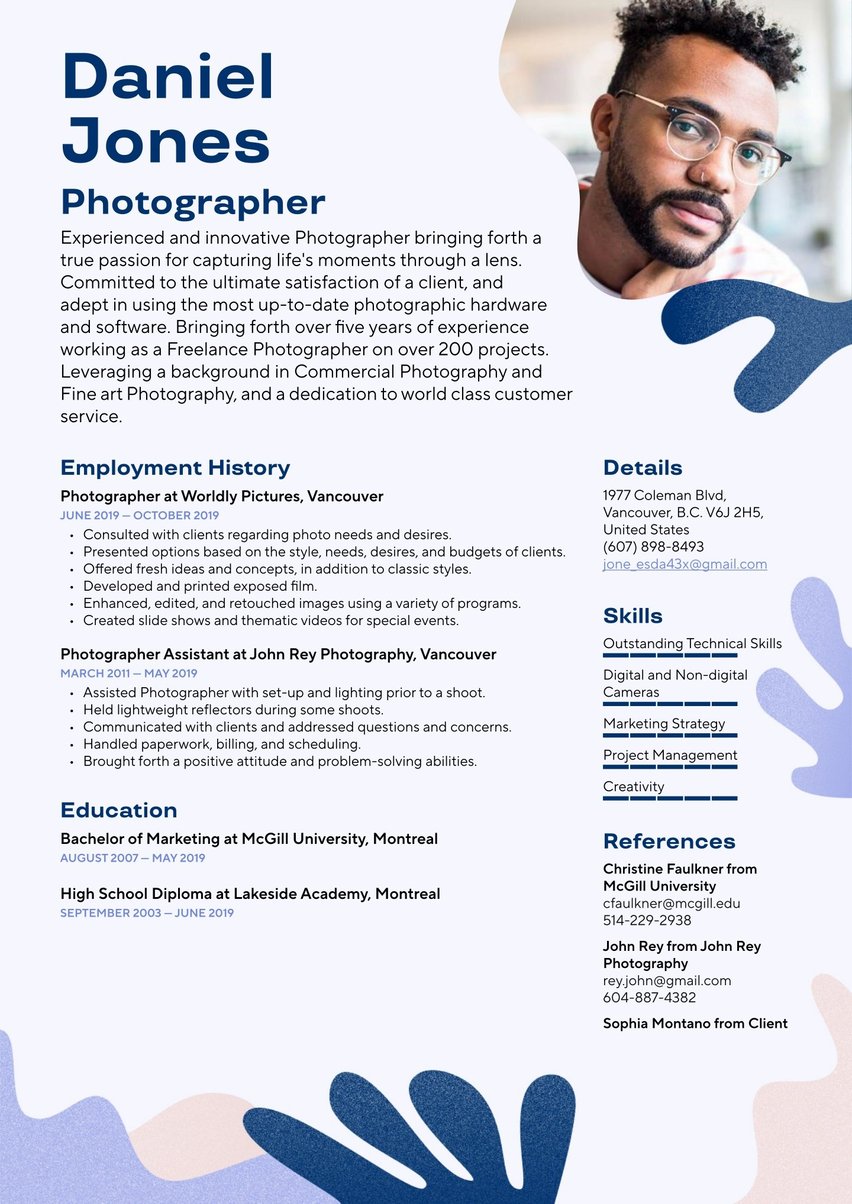

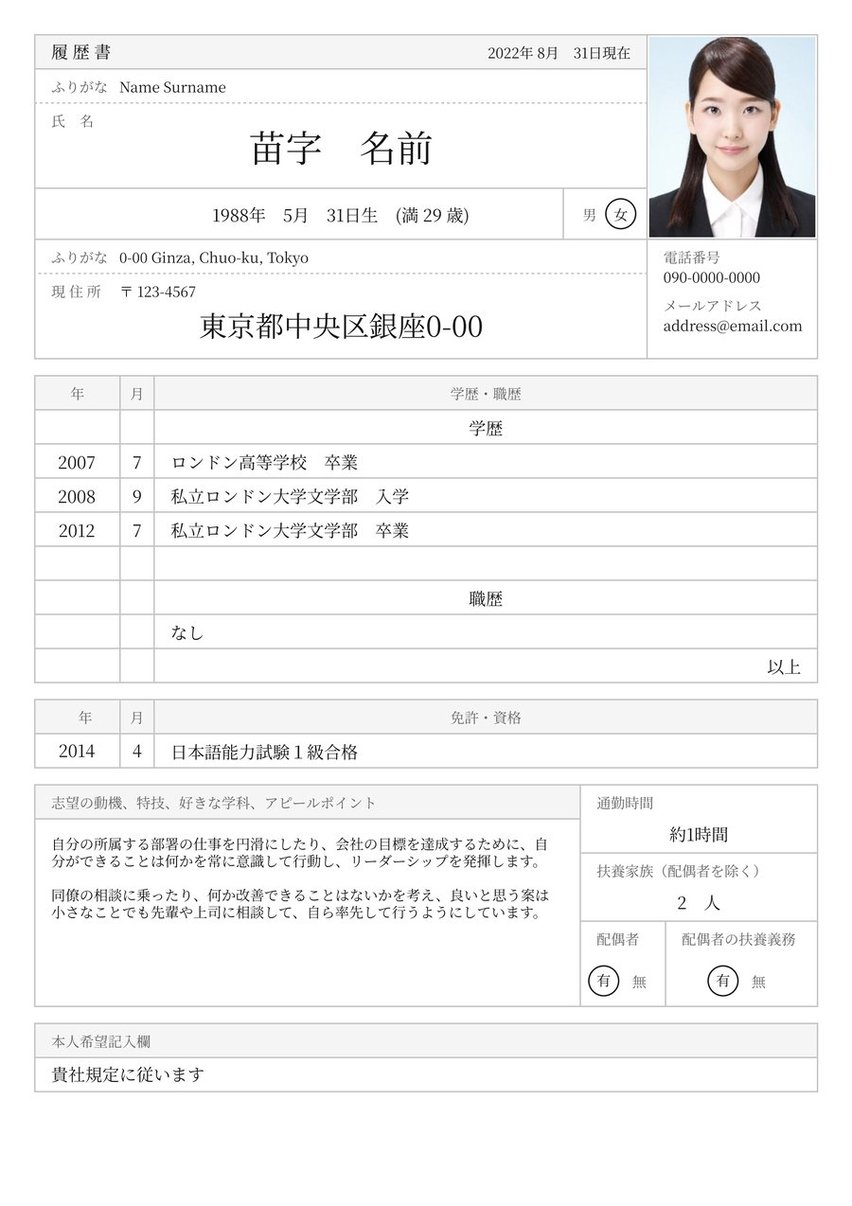

Tax Preparer resume examples by experience level

How can a resume get you there? By stating your case with all the proper calculations.

A resume is your pitch for employment. If one of your clients is audited, you make your best impression with all the necessary documents neatly organized and looking your professional best. You’re ready to make your case. Your resume stands in your stead for that first impression when you seek an interview.

Resume guide for a tax preparer resume

File early with help from Resume.io. Our guides and resume examples cover over 500 professions, and our resume builder makes creating a compelling resume easier than ever.

This resume guide and corresponding car sales resume example will cover the following:

- How to write a tax preparer resume

- Choosing the right resume format for tax preparation

- How to add your contact information

- Using summaries

- Adding your tax preparer experience

- Listing education and relevant experience

- Picking the right resume design/layout

- What the tax preparer market looks like and what salary you can expect

How to write a tax preparer resume

When a client comes to you, you give them a checklist of documents you need to do your best job. This is your outline. A resume for a tax preparer also has an outline. It is the sections you need to include. Your resume should contain the following elements:

- The resume header

- The resume summary (aka profile or personal statement)

- The employment history section

- The resume skills section

- The education section

Tax preparation follows a formula but requires finesse and decision-making. Apply these skills and systems to the creation of your resume. Your goal is to persuade an employer that you are the right tax preparer for the job by developing a narrative of success in a one-page document. But to do that, you need to know what each job entails and what each employer seeks. This formula will help you show that you have what it takes:

- Focus on accomplishments instead of responsibilities. Saying “Responsible for preparing client taxes” doesn’t add very much. That is just a job description. Answer what you did for clients as you prepared their taxes or what value you added to your employer’s accounting firm.

- Personalize your resume. Not all jobs are the same and not all employers are looking for the same talents. Aim your job application at each job by adopting the tone and style as well as putting the emphasis on skills mentioned in the job listing.

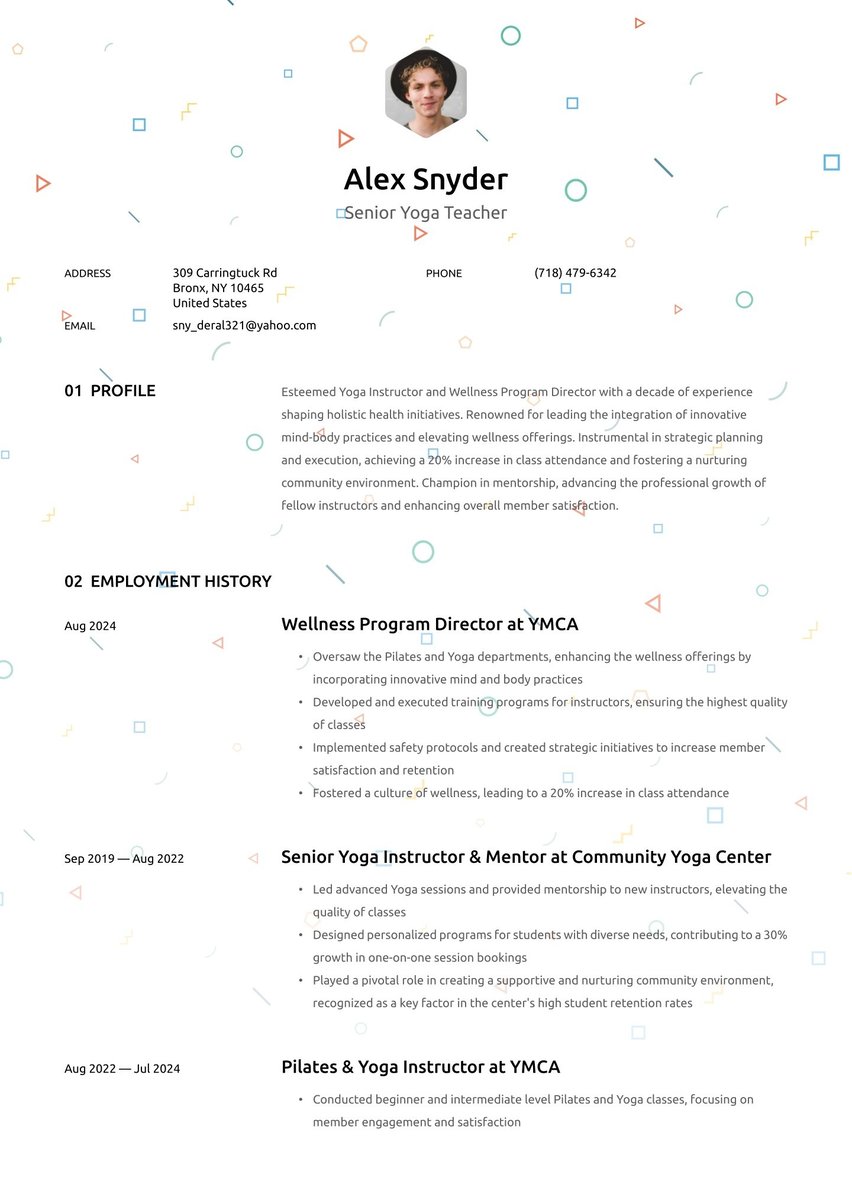

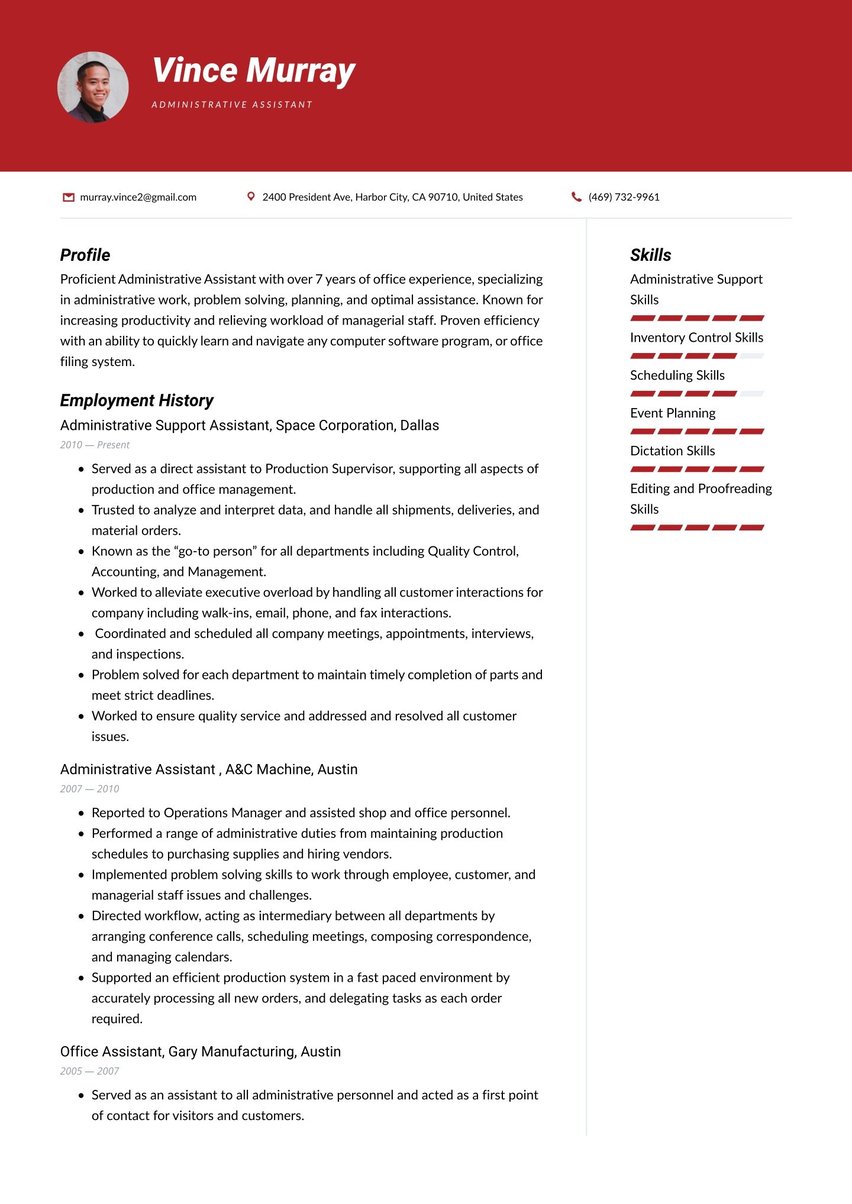

- Choose a resume template that reflects professionalism and detail-orientation without looking stilted.

- Make the most of keywords and phrases to slip through the ATS filter.

Optimize for the ATS

Most employers, except for very small businesses, use some form of applicant tracking system that scans, sorts and ranks resumes. Any time you apply online, you are inputting your data into an ATS. Algorithms based on keywords and phrases the employer pegged to the job rank your resume and decide whether it will get passed on to HR.

The best way to boost your chances is to analyze the job listing and insert those all-important attributes into your tax preparation resume. Here’s an example:

The job description mentions the following:

- Work with clients to gather financial information and assess tax liabilities.

- Prepare individual and business tax returns.

- Understand and stay up-to-date on all tax laws and regulations.

- Identify opportunities for tax planning and recommend strategies to minimize tax liabilities.

Your summary may say:

Tax preparer experienced in working with clients to prepare both individual and business tax returns. Deep knowledge of tax law and regulations adept at assisting clients in gathering financial information and recommending strategies to minimize tax liabilities.

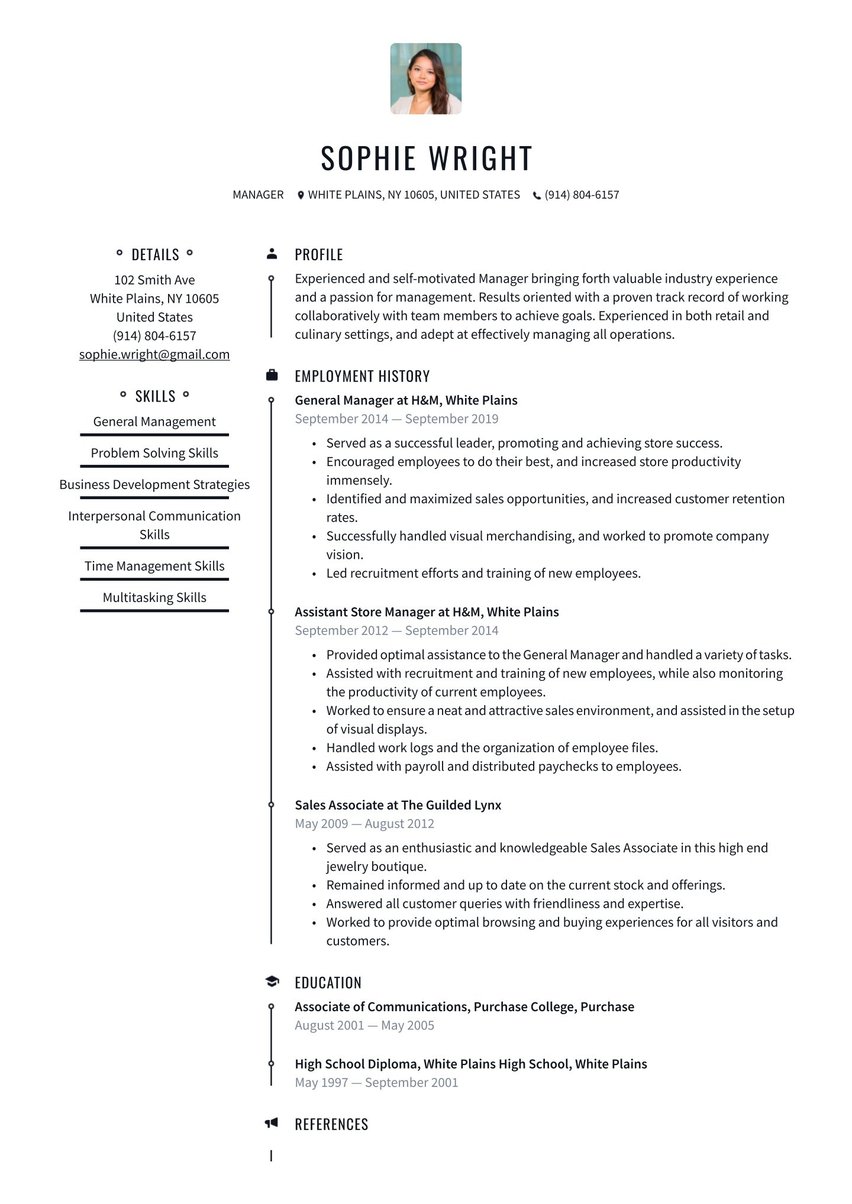

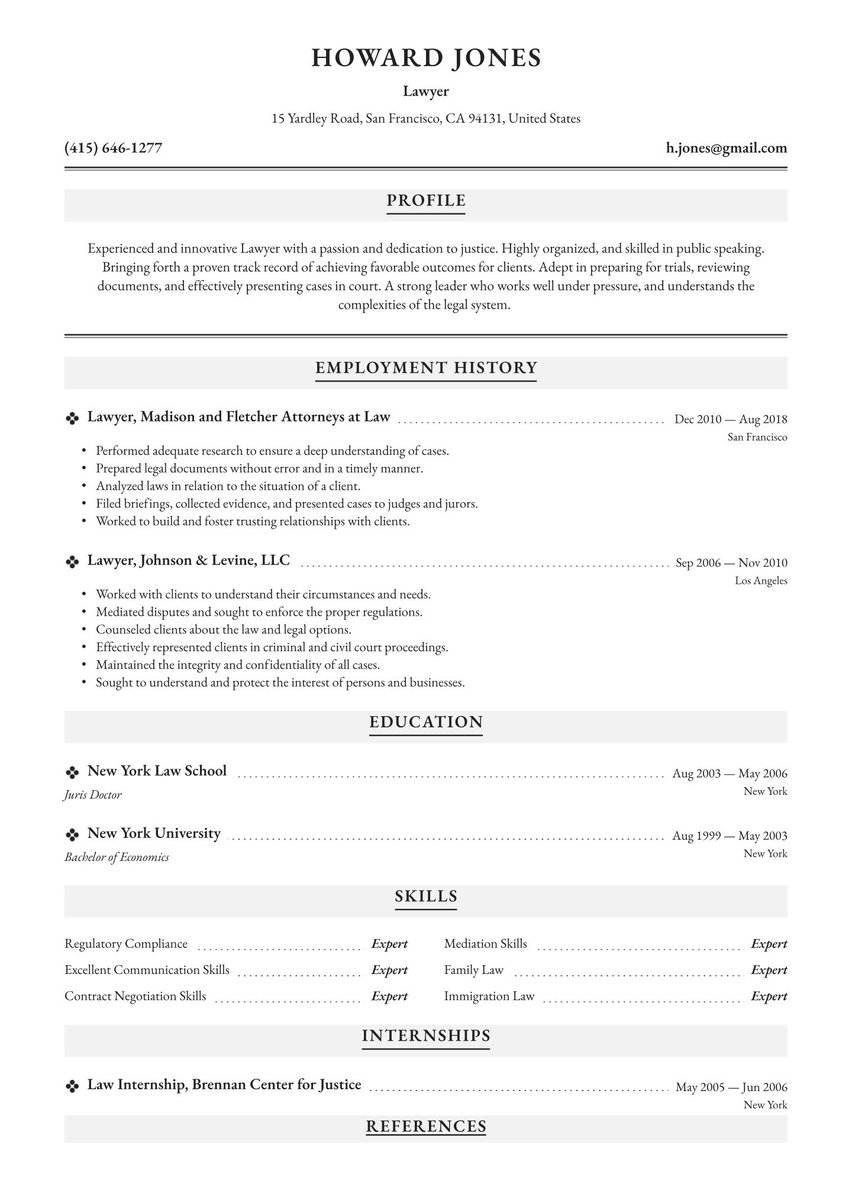

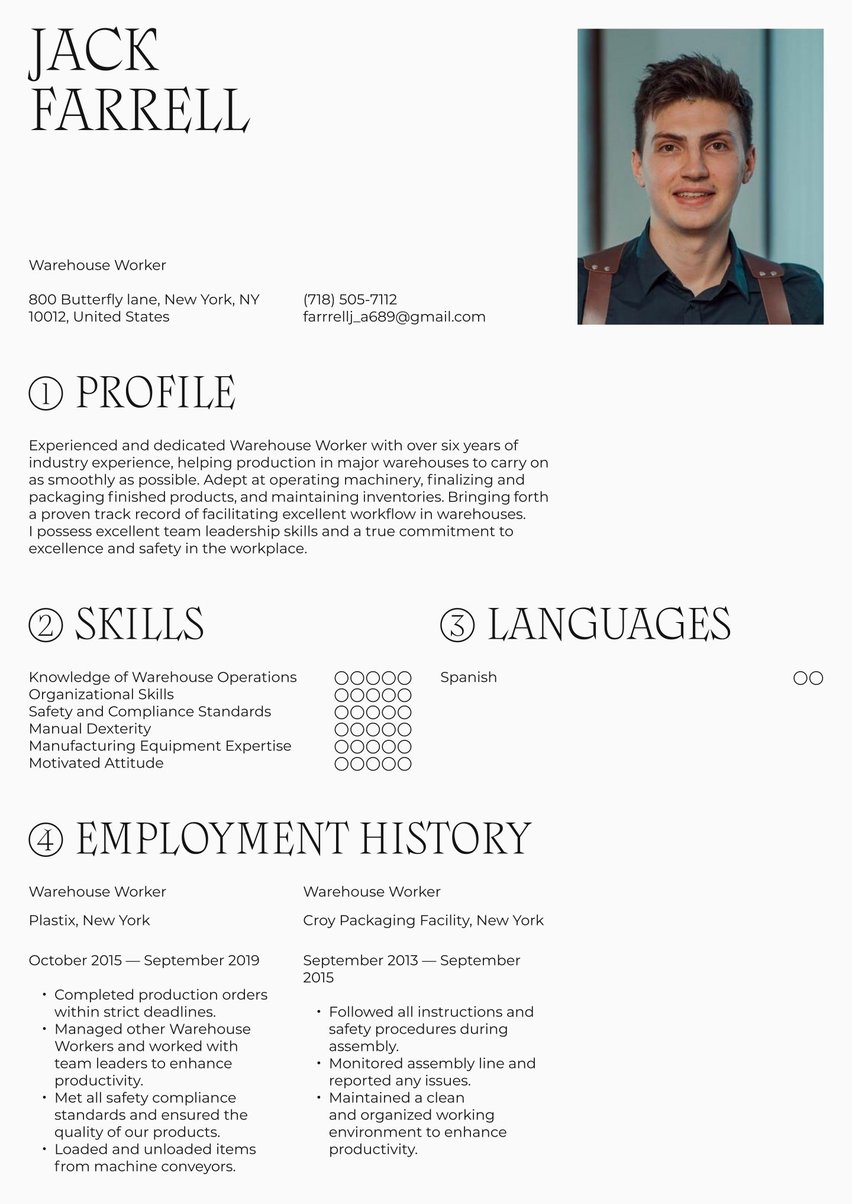

Choosing the right resume format for a tax preparer

Tax preparation is a detail-oriented job that doesn’t allow for error. A resume for a tax preparer needs to echo those traits by being straightforward, professional, and clear.

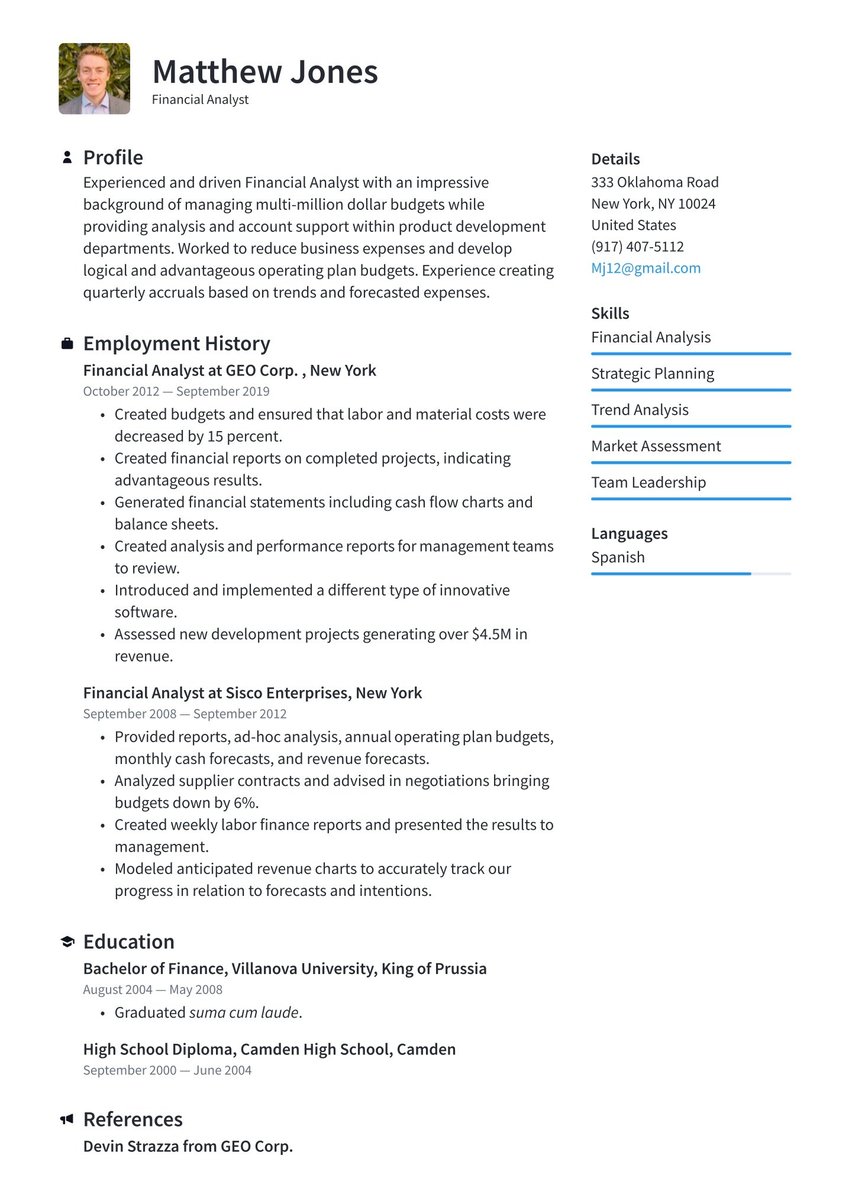

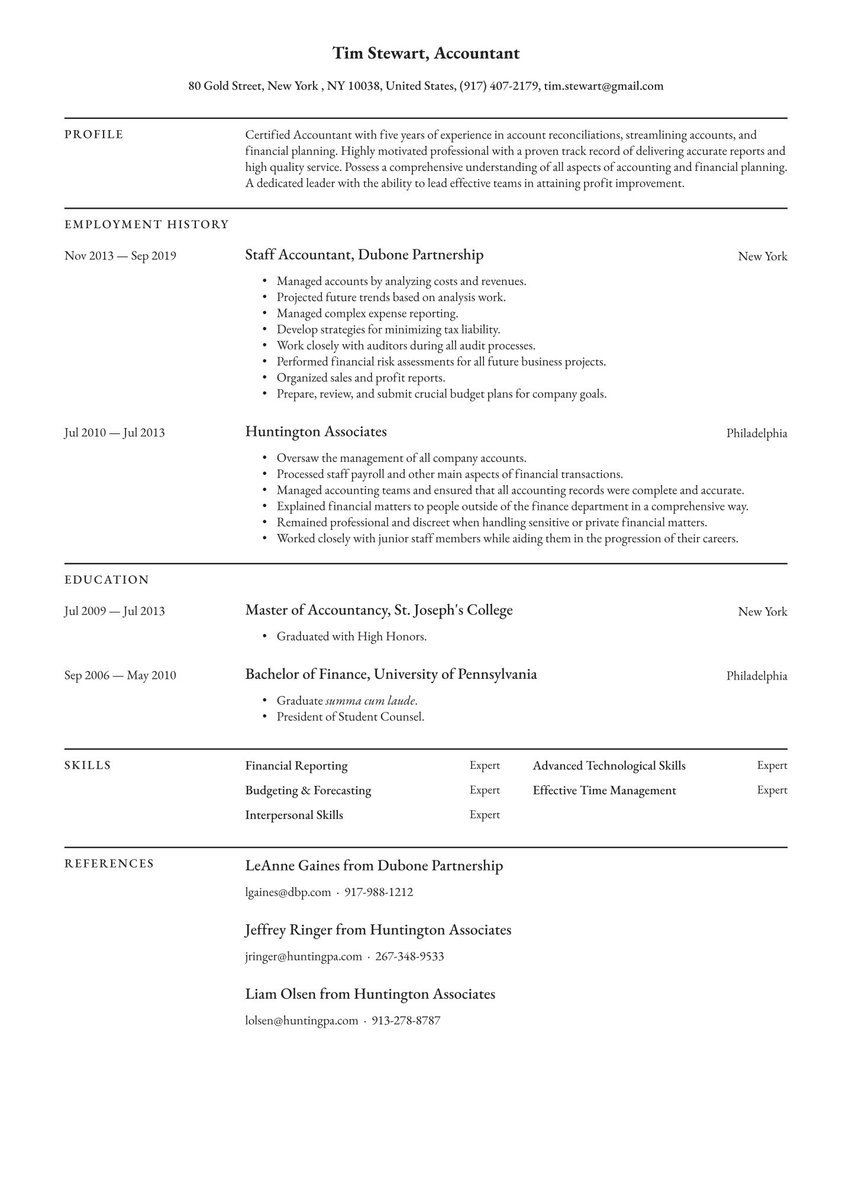

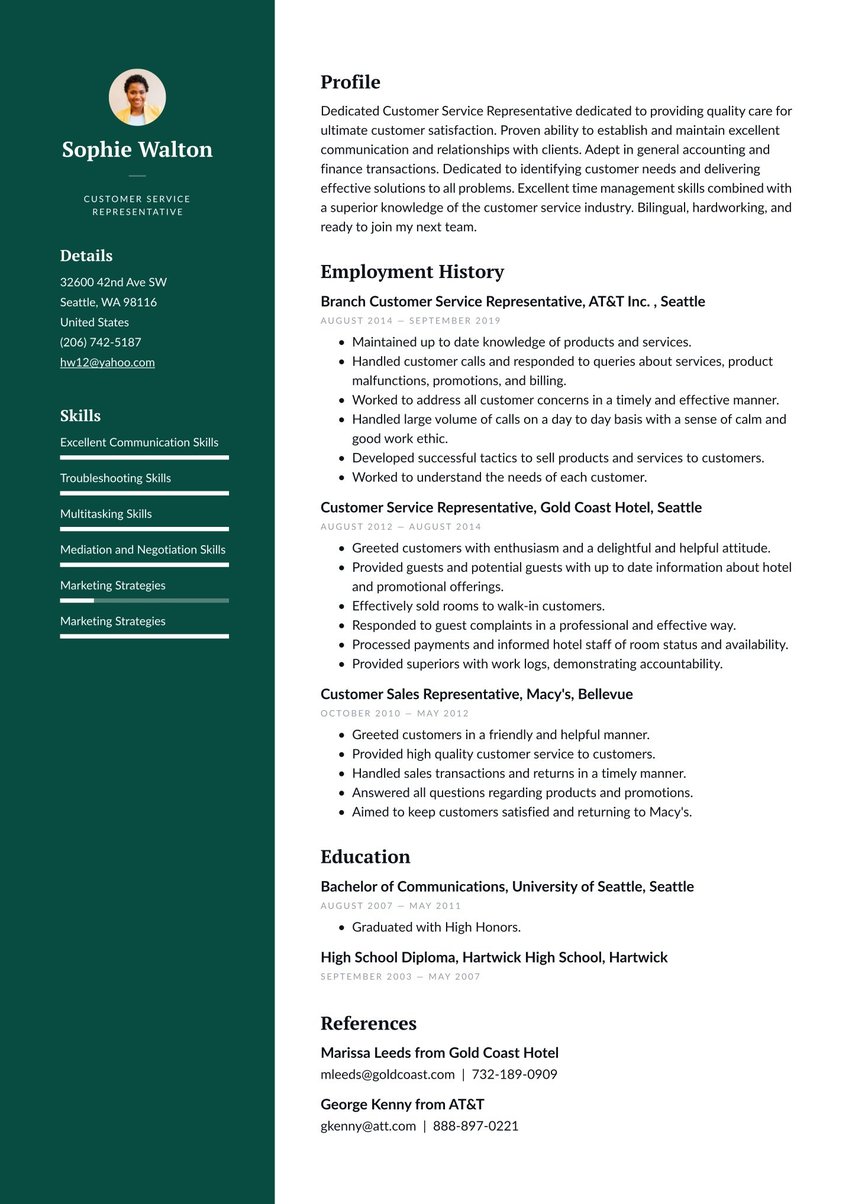

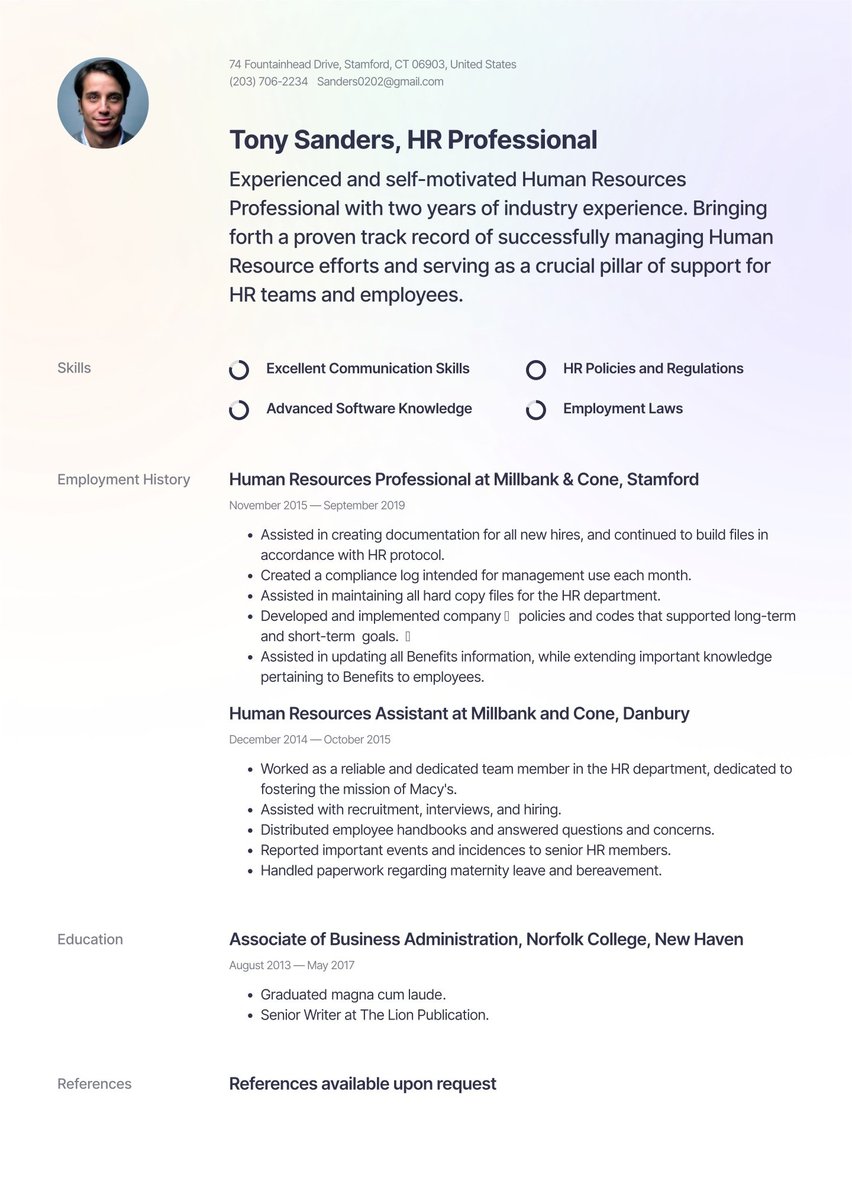

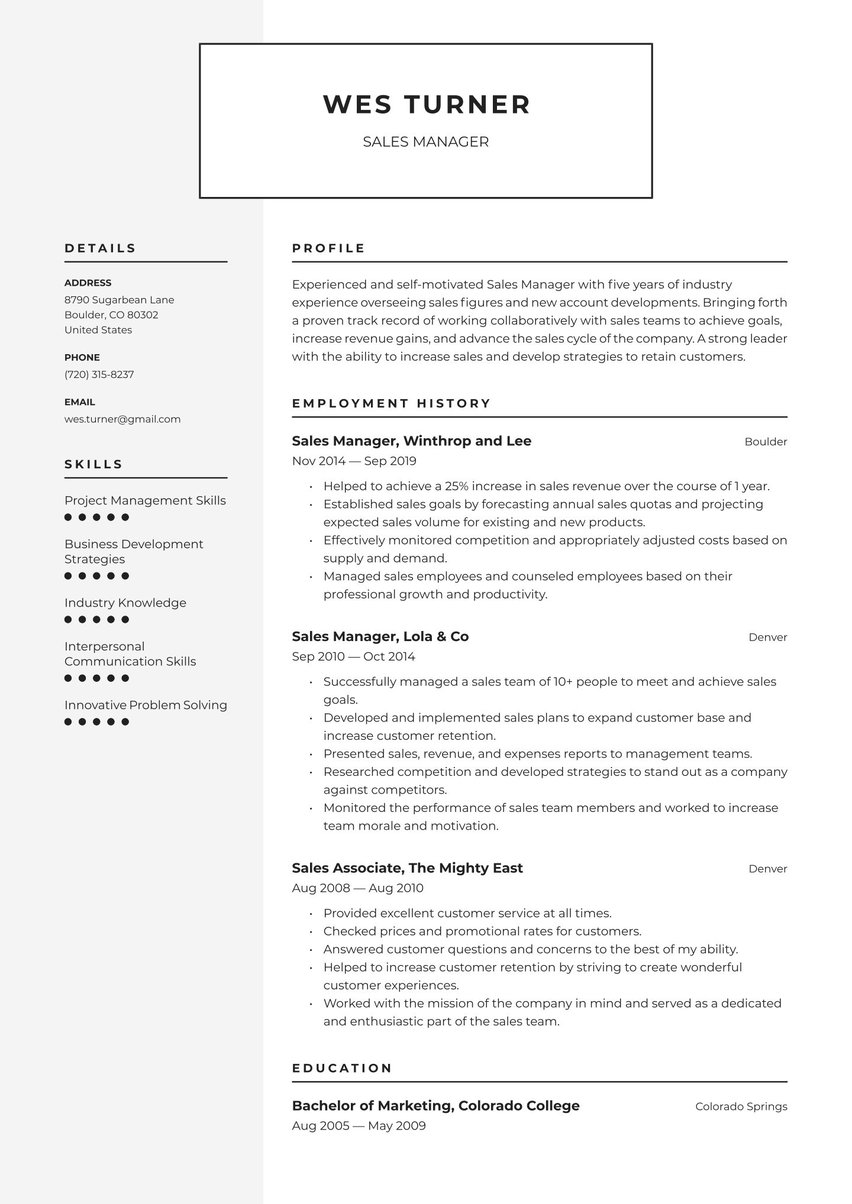

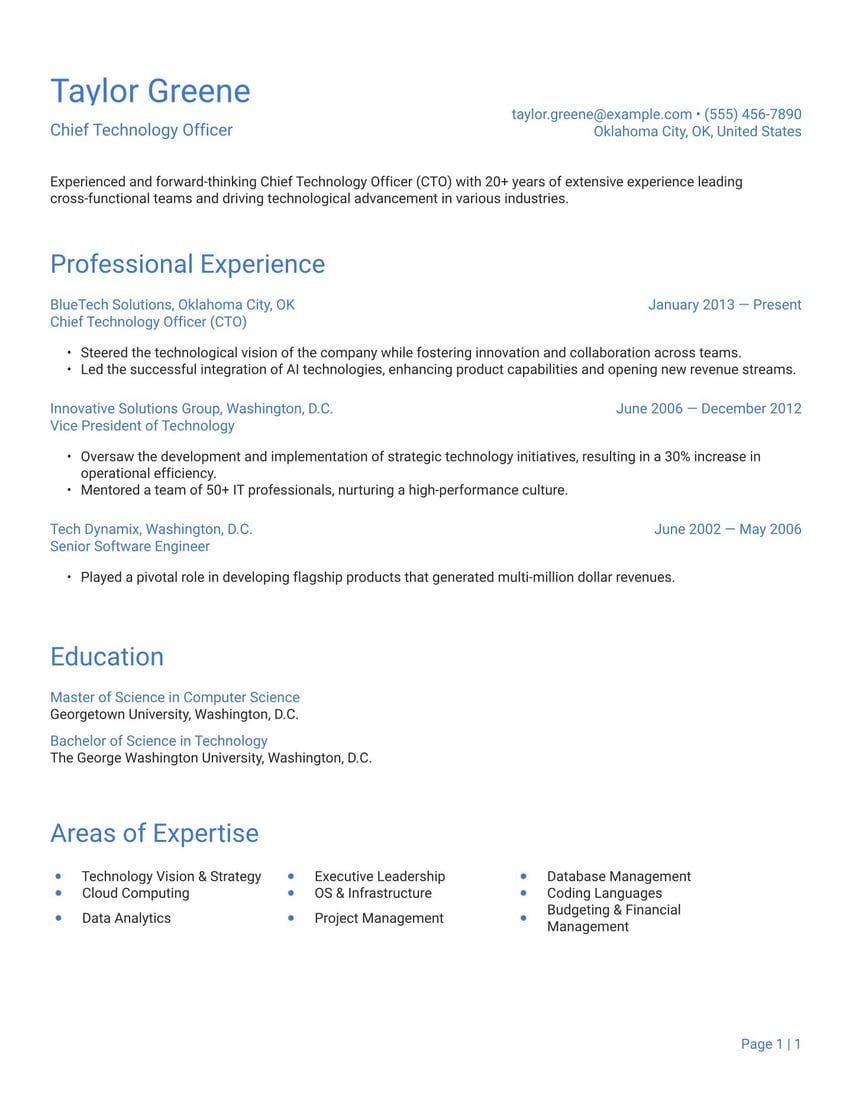

The best format for most resumes, including tax preparation, is reverse chronological order. Within your employment history section, you begin with your most recent position and work your way back, showing a history of your work progression. Below is an example of this format.

If you are beginning your tax preparation career, either right out of training or school, or you have made a career change, you may do better with alternative formats, such as the functional format. This format focuses more on skills and less on employment history.

Our resume builder offers expertly-designed templates in all formats. Choose the format and design that best illustrates your career progression and professional style. Our resume examples will help you decide which works for you.

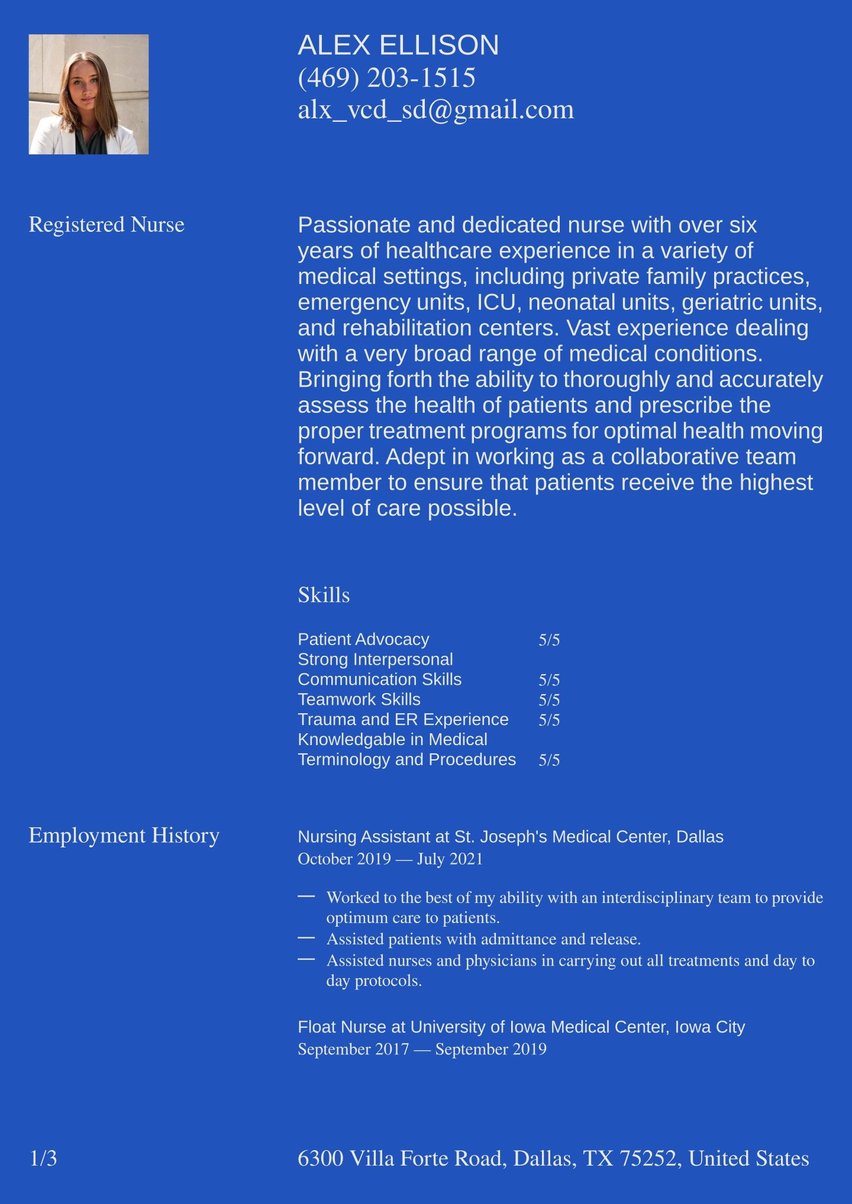

The design for a tax preparer resume should be organized, neat and clean. We suggest a template from either our simple or professional categories.

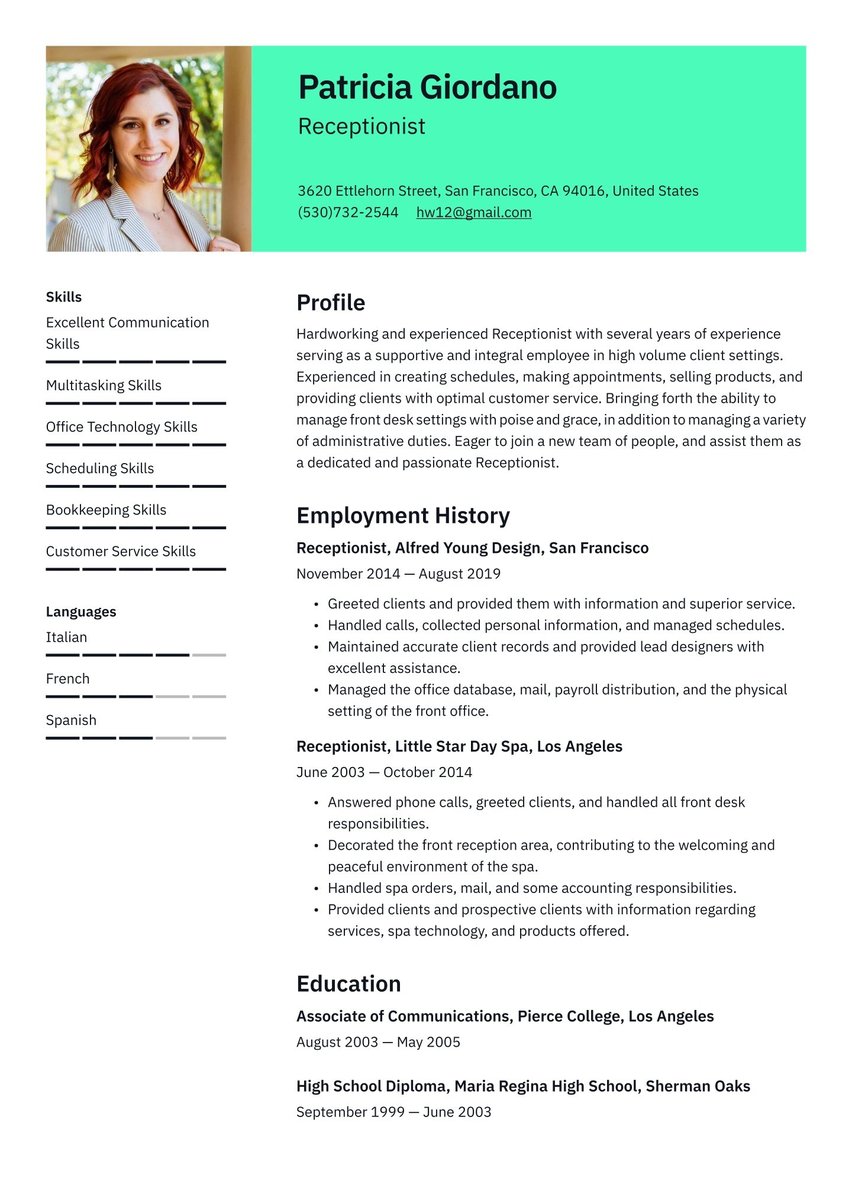

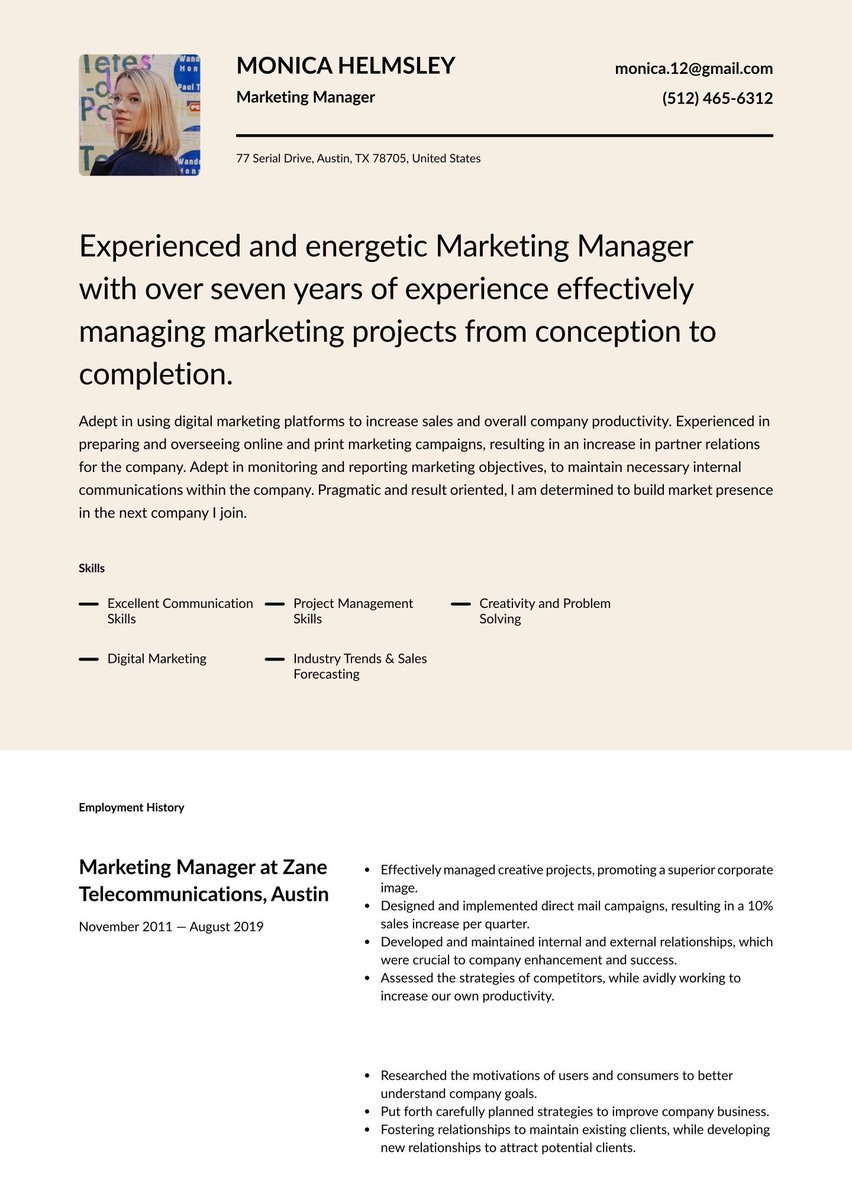

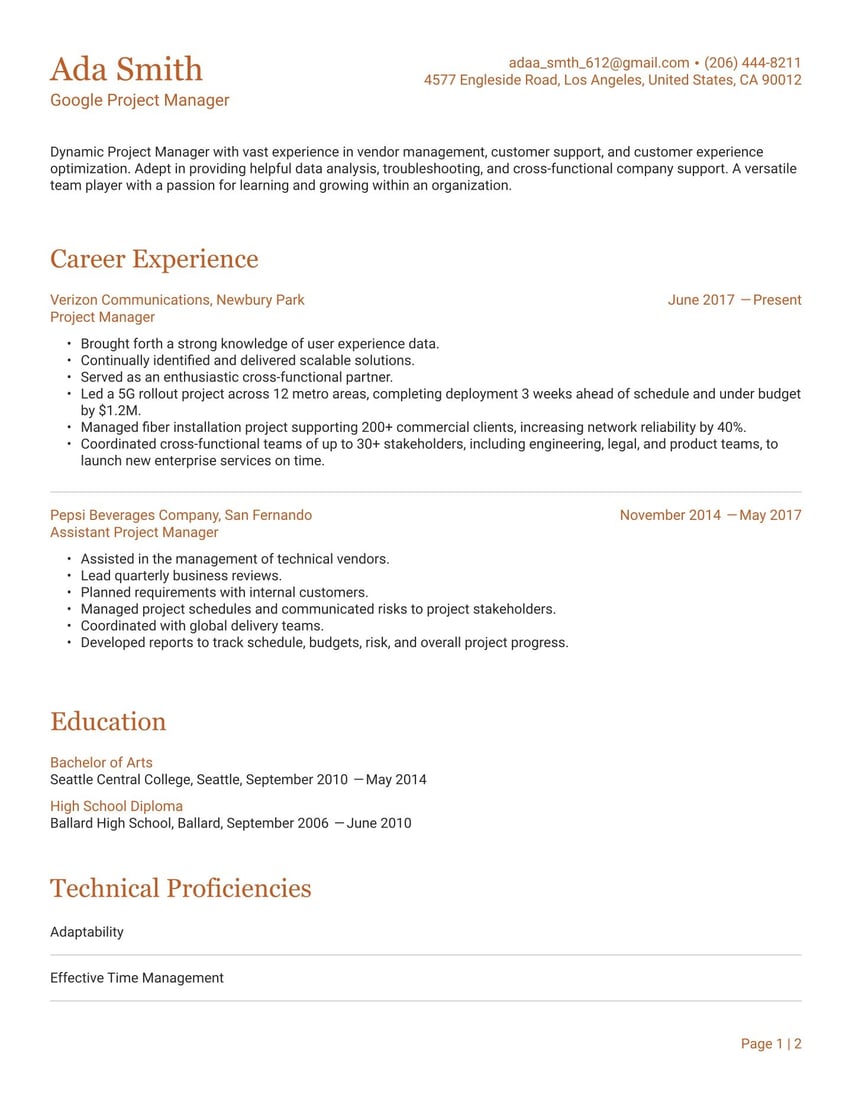

Include your contact information

Data and details reign supreme in the world of the tax filing. One wrong number can throw everything off. Take the same care with your contact information, the key to allowing recruiters to easily reach you to schedule an interview.

The header of your tax preparer resume highlights all your pertinent data. Here’s what we mean by pertinent:

- Full name and desired title. List your first and last name. Use the title of the role you are pursuing.

- Professional email address. Avoid using your work email address unless you want your current employer to know you’re in the hunt for a new job. Instead, use a professional format such as firstname.lastname@gmail.com.

- Phone number. List a number where you can be readily contacted, ensuring you have a professional voicemail greeting.

- Address. By this, we mean only your city and state. Including your street address is outdated and can lead to identity theft in the wrong hands. Note 'Willing to Relocate' here if applicable.

- LinkedIn. If your LinkedIn profile is active, relevant, and shows your client base and professional network, include it here.

Don’t include:

- Date of birth. Not necessary and could potentially lead to age discrimination.

- Personal details. Marital status, social security number, passport number, etc.

- A photo of yourself. The way you look is not relevant and HR personnel are fastidious in avoiding the appearance and bias.

Francisca Menoni

fran.menoni@yahoo.com

404/394-6051

Madison, WI

Francisca “Franni” Menoni

taxinggirl@yahoo.com

404/394-6051

552 Adderbury Lane

Madison, WI 53711

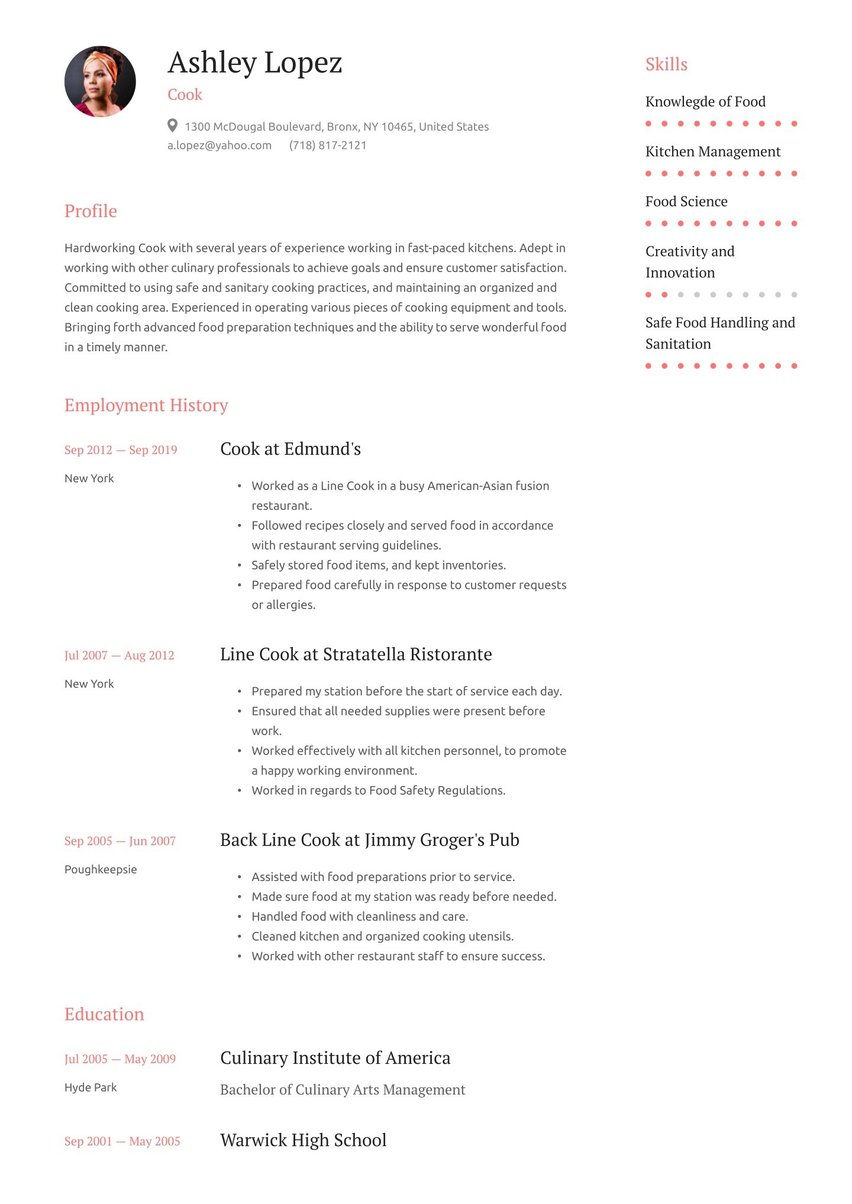

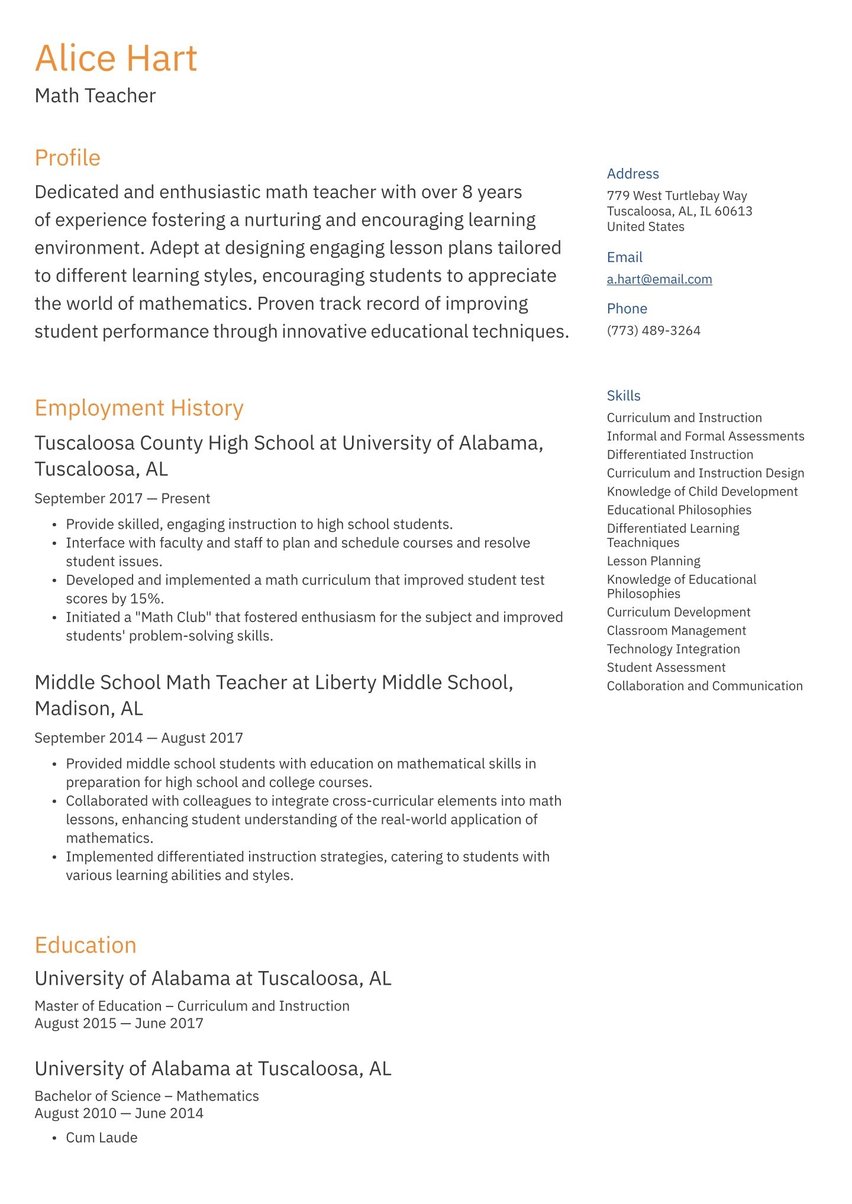

Make use of a summary

Your first task as a tax preparer is to put your clients at ease. You’re about to access their sensitive financial information and advise them in a process that could save them hundreds or thousands of dollars or land them in trouble with the tax man.

A tax preparer resume summary has to radiate confidence, competence and discretion while simultaneously exciting the recruiter about your diligence, depth of knowledge and excellent customer service abilities—all in two or three sentences.

Active language and a confident tone should underlie your entire document, but make use of it here to answer the most important job hunt question: Why should we hire you?

Resorting to repeating information found within your employment history is a waste of space and a less-than-convincing argument. Instead, describe your career as a whole, your professional demeanor or the way you approach difficult clients or situations. Add in your biggest success to intrigue the recruiter.

For example:

- During routine review of past tax filings from former preparer, discovered error that netted client $10,000+.

Need inspiration for your summary? Check out our related resumes:

- Finance-director resume example

- Senior-accountant resume example

- Bank-teller resume example

- Loan-officer resume example

- Loan-processor resume example

- Bookkeeper resume example

- Auditing-clerk resume example

- Banker resume example

- Compliance-officer resume example

- Investment-banker resume example

- Financial-analyst resume example

- Financial-advisor resume example

You can find adaptable tax preparer resume example summaries below:

Recent graduate with accounting degree, with experience assisting in a tax preparation office during tax season. Theoretical knowledge and additional practical skills gained through coursework and internships. Strong understanding of tax laws, regulations, and compliance requirements.

Seasoned tax preparer with proven ability to provide strategic tax planning advice to clients, identify opportunities for tax savings and ensure adherence to regulatory requirements. Adept at navigating complex tax codes, regulations, and compliance requirements. Reduced client audits by 15% with streamlined review process.

Accomplished tax preparer with demonstrated leadership in managing complex tax scenarios, fostering team collaboration, and delivering superior client satisfaction. Client retention rate of 99% over 10 years’ experience. Ability to navigate intricate tax regulations, optimize financial strategies, and provide valuable insights to enhance overall financial performance.

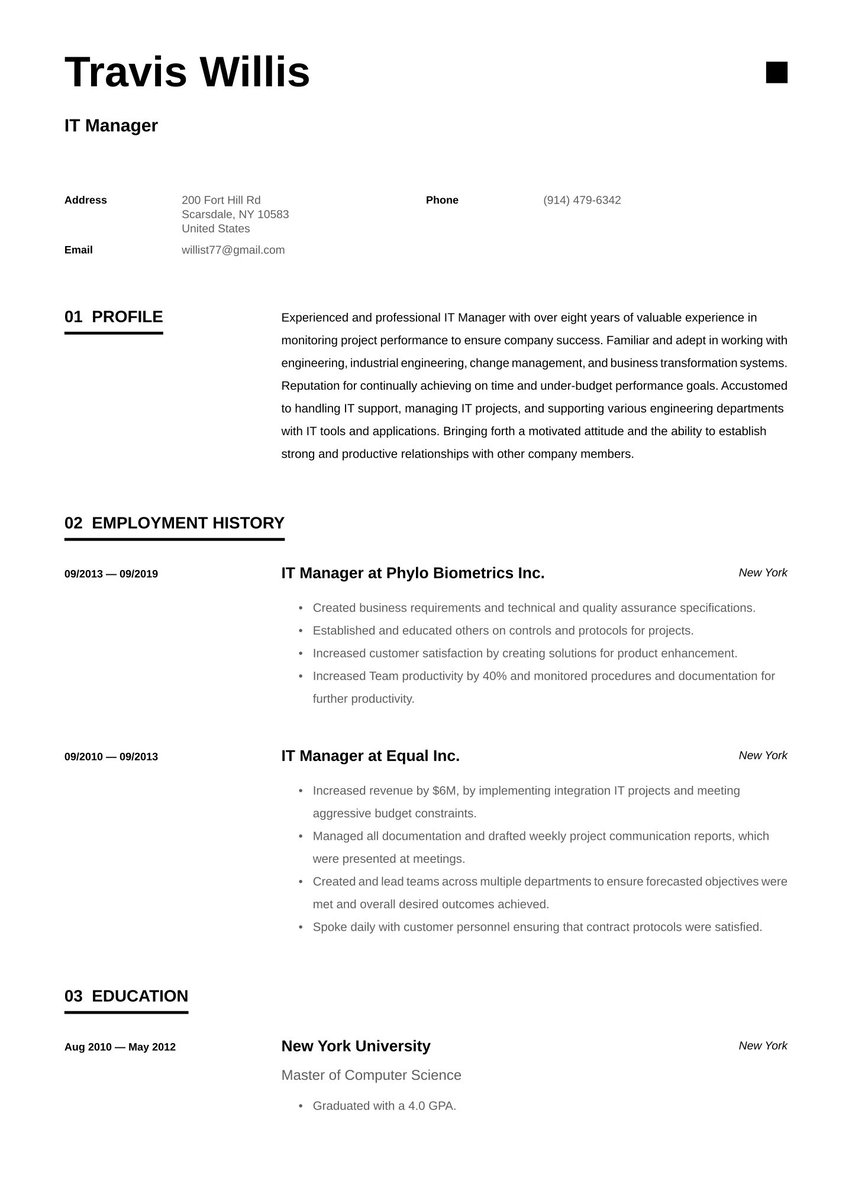

Outline your tax preparer work experience: highlight your capital gains

Start here with your most recent position. Why? HR personnel are most interested in the heights you have reached so far when they look through your tax preparer resume. Work your way back about 10-15 years including relevant work history.

Each bullet point describes a career accomplishment beginning with an action verbs such as prepared, organized, calculated, advised, managed, reviewed, audited or filed. Follow that with how you did it and what you accomplished. Try the STAR method: Situation, Task, Action, Result as a structure for your entries.

To create an impressive case, quantify and use detail whenever possible. An uninspired tax preparer employment listing may look like this:

- Gathered documents and information.

- Prepared tax returns for clients.

- Reviewed each year’s new tax laws and regulations.

- Met with clients to review taxes.

These basic statements don’t give recruiters any idea of what you can do to ease the burden on the tax accountancy firm as April 15 approaches. They are too generic and don’t address the needs of the company.

Instead, consider your overall performance in each job and any specific, noteworthy achievements. If the job listing calls for a specialist in customer service, for example, make sure at least one of your bullet items describes your customer service success.

There’s a much better way to illustrate that you performed those basic tax preparation duties. Here’s how to include those responsibilities in an achievement-based list:

- Requested, input and reviewed all documents and information necessary for 250 clients per tax season.

- Ensured timely and accurate filing of all client tax returns without missing deadline for 4 years running.

- Advised clients on tax savings strategies, leading to an average of 10% reduction in tax liability.

Take a look at the tax preparer employment history resume sample below:

Tax Preparer at H&R Block, Houston

January 2021 - Present

- Prepare and file individual and small business tax returns using ProSeries and TaxWise software

- Review and analyze client documents to ensure accurate and complete tax returns

- Provide tax advice and guidance to clients based on their specific financial situations

- Maintain up-to-date knowledge of tax laws and regulations

- Consistently meet or exceed weekly and monthly sales targets

Jackson Hewitt Tax Service at Tax Associate, Houston

November 2019 - December 2020

- Prepared individual tax returns using ProSeries software

- Reviewed client documents and conducted interviews to gather necessary information

- Ensured accurate calculation of tax liabilities and refunds

- Provided excellent customer service and tax advice to clients

How to write a tax preparer resume with no experience

What skills do you have that make you a candidate for a tax preparation job? Focus on these as you create your first resume for a tax preparer.

A hybrid format allows you to emphasize that bachelor’s degree in tax accountancy that you just earned (or your certification in tax preparation). Include specific classes and any advanced work you have completed.

Although these jobs may not be related, if you are entering the full-time job market for the first time, you should include any summer, part-time, internship or volunteer jobs that show you are responsible, understand time management and can function in a work environment.

Keep in mind that recruiters understand that everyone starts somewhere, so present yourself as a quick learner eager to begin your career who has basic skills and knowledge of tax preparation.

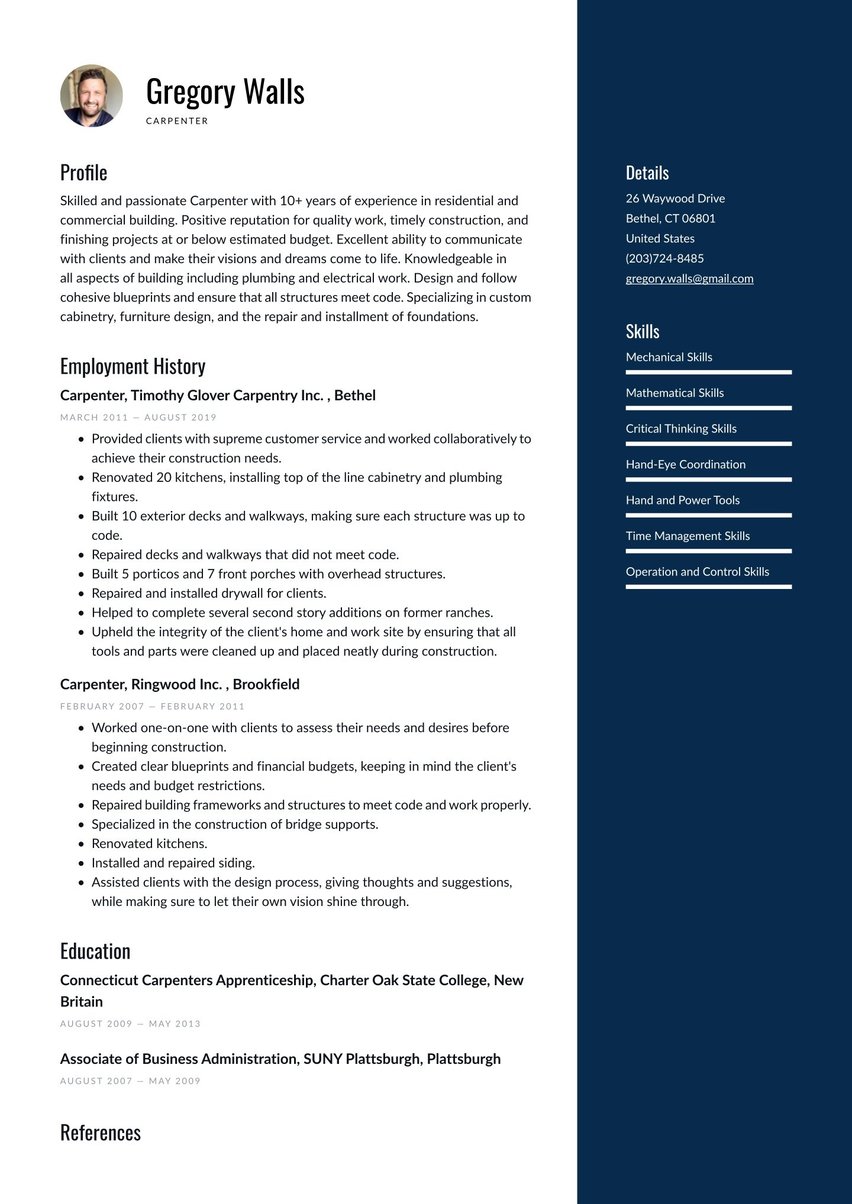

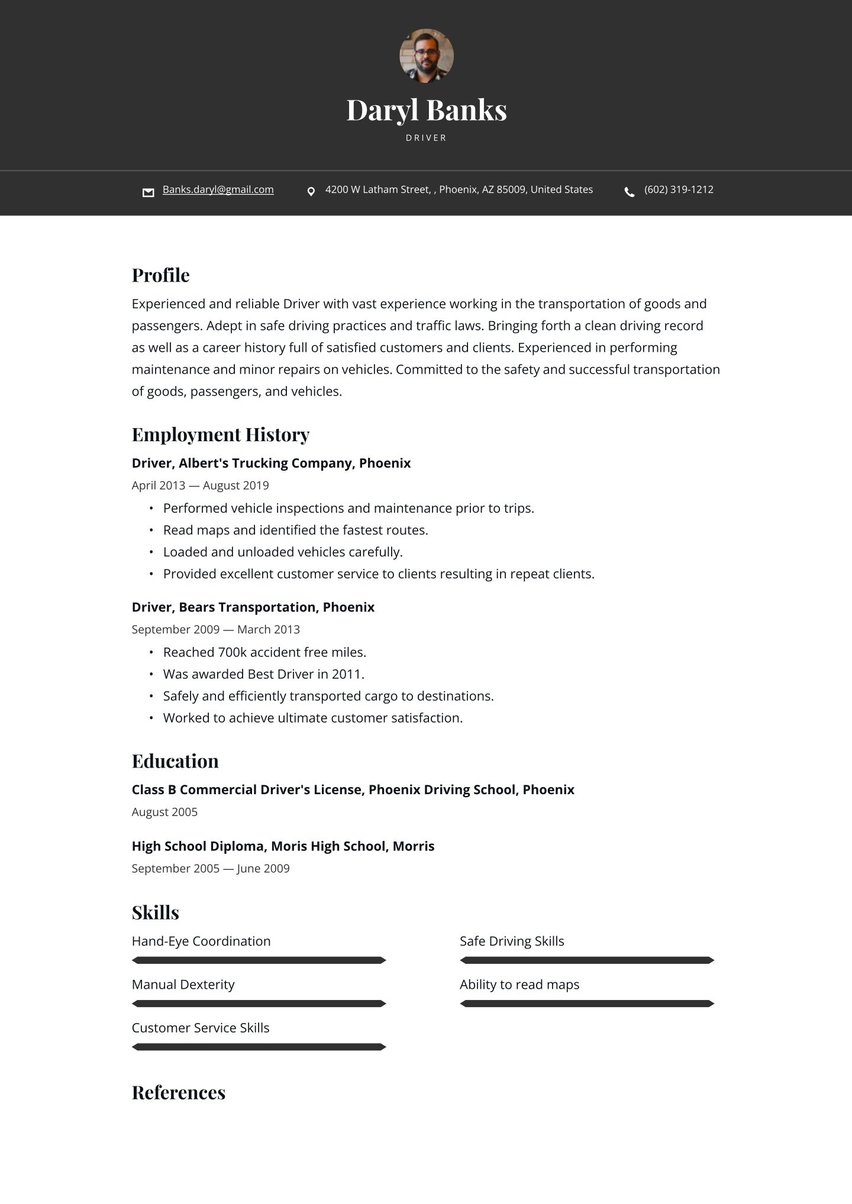

Include the relevant key skills that make you a great tax preparer

The skills section of your tax preparer resume is a carefully curated combination of the hard and soft skills highlight your talents for the job. Hard skills are those you learned in school or in a tax preparation certification course.

Don’t neglect abilities such as accounting and math skills, knowledge of tax law, accounting software such as TaxSlayer Pro, Intuit ProConnect Tax, or any others you are proficient in, especially if mentioned in the job listing.

Tax preparers deal directly with customers, so your soft skills are important. Aside from customer service, you need communication skills, discretion and diplomacy.

The resume builder offers several pre-written key skills to choose from with proficiency ranges you can set. You can also write in your skills.

Here’s what the skills box looks like in our car sales resume template.

Key Skills and Proficiencies

Simply listing your skills in this section without backing them up with more detailed resume examples and descriptions is not enough. As you write your work history and summary, consider how best to include skills such as:

- Attention to detail by describing a time that you caught an error or noticed a subtle change in the law

- Client services by detailing your rate of referrals from current clients

- Tax planning advice by explaining how you assist clients in limiting their tax liability by making sound financial decisions.

Get specific

The summary section is an easy place to swap out one skill for the other to focus on what each employer seeks. Review the job listing and match attributes to the keywords and phrases with it. This will also improve your chances against the ATS and show the recruiter that you understand the job requirements and have what it takes to make a contribution.

Detail your education & relevant tax preparer certifications

Tax preparers do not need a college degree; a high school diploma, but they do need to complete a tax preparer course; however, a bachelor’s degree in accounting will open more doors. List any degrees in the education section of your tax preparer resume.

If you want to work in California, Connecticut, Maryland, Nevada, New York or Oregon, you also need a license from the state. That license should also be listed here.

Many tax preparers are CPAs (certified public accountants). They have at least a bachelor’s degree and have passed the Uniform CPA Exam.

Other options for this section include:

- Professional development. Tax preparers must stay current with all changes in tax law and regulations. Taking a class or seminar is one way to show that you’re dedicated to this task.

- Certifications. If you are an IRS enrolled agent of a CPA list that credential.

- PTIN. Include your IRS-issued preparer tax identification number.

If you are applying for your first tax preparer position, consider moving your education above your employment history since it will better demonstrate your qualifications for the job.

Associate of Applied Science, Houston Community College, Houston

May 2019

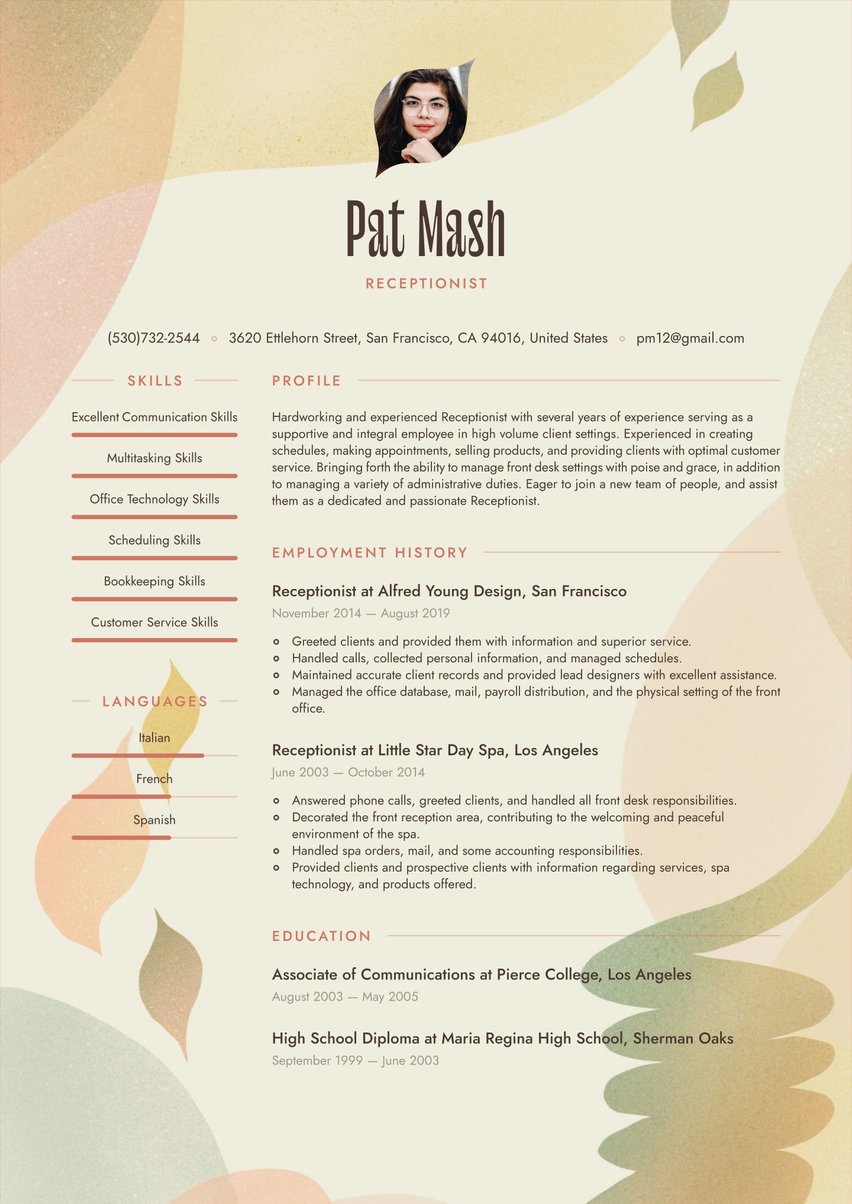

Pick the right resume layout and design for a tax preparer resume

If a client comes to your office, you want to make sure they are entering an environment of competent professionalism. No files piled high on your desk or confidential information open on your computer. Attention to the task at hand without any distraction.

The layout and design for your tax preparer resume needs to present the same quiet confidence and attention to detail. That means no formatting errors, spelling or grammatical mistakes or a too casual or stilted tone or style.

Clean lines, legible fonts and bold section headings will serve you well. A bit of a design flourish in your header will get the attention of the hiring manager without signaling that you are a bit too frivolous for this serious and detail-oriented position. If you want to add a splash of color, keep it to a minimum and avoid any hue that’s too bright. Tax law is serious business.

For tax preparers, we recommend one of our resume templates in the professional or modern category. These field-tested designs will accelerate your entry into the job market by providing the formatting (and a built-in spell checker) for you while offering the flexibility of personalization.

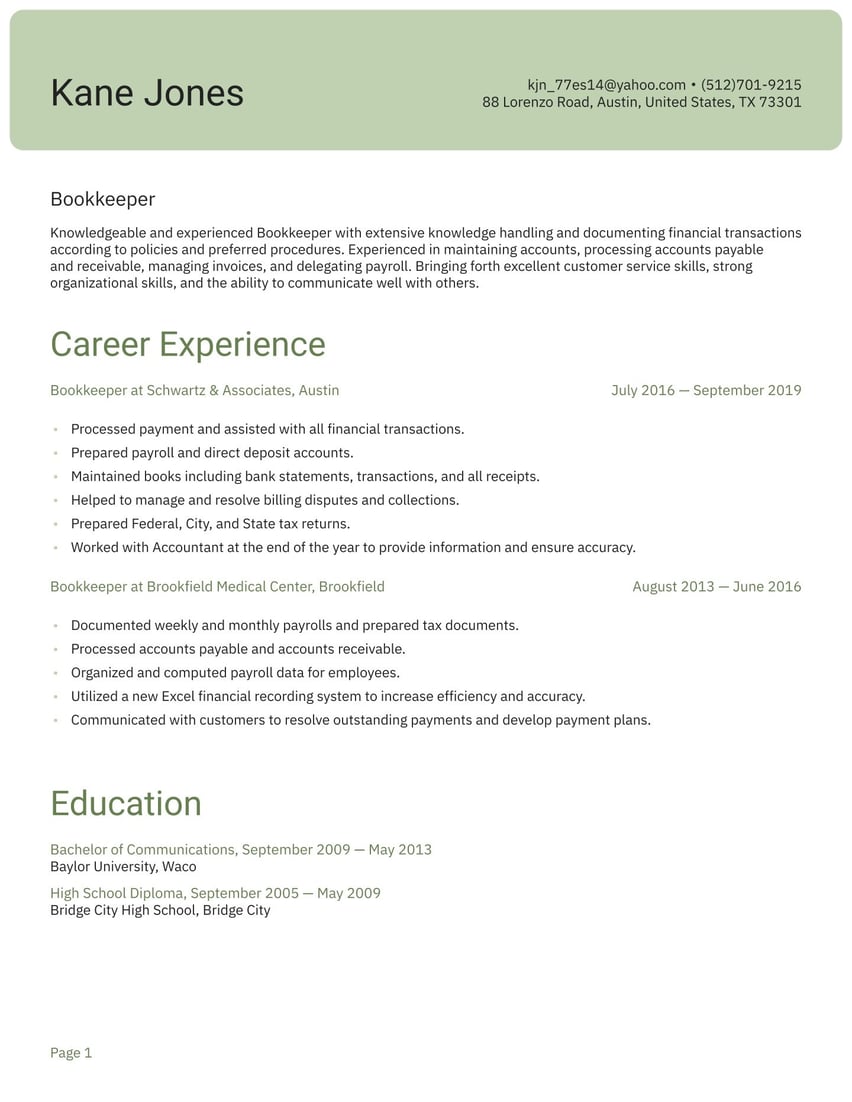

Tax preparer text-only resume example

Profile

Certified Tax Preparer with 3+ years of experience in preparing individual and small business tax returns. Dedicated to providing accurate and timely tax preparation services while ensuring compliance with federal and state tax laws.

Employment history

Tax Preparer at H&R Block, Houston

January 2021 - Present

- Prepare and file individual and small business tax returns using ProSeries and TaxWise software

- Review and analyze client documents to ensure accurate and complete tax returns

- Provide tax advice and guidance to clients based on their specific financial situations

- Maintain up-to-date knowledge of tax laws and regulations

- Consistently meet or exceed weekly and monthly sales targets

Jackson Hewitt Tax Service at Tax Associate, Houston

November 2019 - December 2020

- Prepared individual tax returns using ProSeries software

- Reviewed client documents and conducted interviews to gather necessary information

- Ensured accurate calculation of tax liabilities and refunds

- Provided excellent customer service and tax advice to clients

Skills

- Proficient in ProSeries

- Excellent attention to detail

- Effective communication

- Customer service skills

- TaxWise

- TurboTax software

Education

Associate of Applied Science, Houston Community College, Houston

May 2019

What type of salary you can expect in tax preparation

Tax preparers earn a median hourly wage of $26.85, or $55,840 annually. The bottom 10% earn $13.31 or $27,680, while the top 10% earn $46.45, or $96,610, according to U.S. labor bureau statistics. These numbers exclude accountants and auditors.

Key takeaways for building a tax preparer resume

The best resumes for a tax preparer will present confidence, knowledge and customer service ability throughout each section.

Enhance your employment history section by creating bullet items that tout your successes instead of listing your responsibilities.

The skills section is an easy opportunity for personalization, but it is far from the only section in which you should focus on your skills.

Put the whole thing together with the online resume builder to make your life easier and the job application process faster!

.jpg)

.jpg)